The concept of loss in tax accounting

The concept of loss is given in Art.

274 Tax Code of the Russian Federation. Lesion

- this is the negative difference between income determined in accordance with Chapter 25 of the Tax Code of the Russian Federation and expenses taken into account for tax purposes in the manner prescribed by this chapter in a given reporting (tax) period.

If in the reporting (tax) period the taxpayer incurred a loss, then the tax base in this period is recognized as zero.

Losses received by the taxpayer in the reporting (tax) period are accepted for tax purposes in the manner and under the conditions established by Art. 283 Tax Code of the Russian Federation.

Carry forward of losses from 2022

From January 1, 2022, new rules for the transfer of losses from previous years are in effect, in accordance with the new Federal Law of November 30, 2016 No. 401-FZ.

According to changes in legislation, it will be possible to carry forward a loss in an amount not exceeding 50% of the tax base of the current period.

In addition, the new law abolished the previous ten-year limitation on carry forward of losses.

It is worth adding that the limit on the amount of transferred losses is currently set by legislators for the period from January 1, 2022 to December 31, 2022.

conclusions

Any organization is created for the purpose of making a profit. But in market conditions, some make losses at the end of the year. Often such losses are covered by profits not distributed among participants or by reserve and additional funds. If losses exceed income, then the negative balance can be carried forward to later periods. You can reduce the tax base for income tax by the amount of losses that were received in previous tax periods. There is no time limit; losses can be carried forward until the resulting loss for all previous years is completely written off. Losses must be transferred in chronological order based on the fact of occurrence. It must be remembered that before reducing the tax base of the current year by the amount of losses from previous years, check the availability of documents that confirm the amount and period of occurrence of losses.

Firmmaker, April 2018 (updated annually) Anastasia Chizhova (Konatova) When using the material, a link is required

Application of PBU 18/02

The amount of income tax, determined on the basis of accounting profit (loss) and reflected in the accounting records regardless of the amount of taxable profit (loss), is a conditional expense (conditional income) for income tax (clause 20 of the Accounting Regulations “Accounting for calculations for corporate income tax" PBU 18/02, approved by Order of the Ministry of Finance of Russia dated November 19, 2002 No. 114n).

The conditional income tax expense (income) is reflected in the debit of account 99 “Profits and losses” in correspondence with account 68 “Calculations for taxes and fees” (Instructions for the use of the Chart of Accounts for accounting financial and economic activities of organizations, approved by Order of the Ministry of Finance of Russia dated 31.10.2000 No. 94n).

The amount of the loss received according to tax accounting data, subject to carry forward, in accordance with paragraphs 8 - 11, 14 of PBU 18/02, forms a deductible temporary difference, leading to the formation of deferred income tax (deferred tax asset), which should reduce the amount of income tax payable to the budget in the next reporting period or in subsequent reporting periods.

An entity recognizes deferred tax assets in the reporting period in which deductible temporary differences arise to the extent that it is probable that it will generate taxable profit in subsequent reporting periods.

The deferred tax asset is equal to the amount determined as the product of the deductible temporary difference that arose in the reporting period and the income tax rate in effect at the reporting date.

Deferred tax assets are reflected in accounting as the debit of account 09 “Deferred tax assets” in correspondence with the credit of account 68 (clause 17 of PBU 18/02; Instructions for using the Chart of Accounts).

As the deductible temporary difference decreases or is fully settled (as the resulting loss is carried forward), the deferred tax asset will decrease or be fully eliminated.

In this case, an entry is made to the debit of account 68 and the credit of account 09.

Example

An organization in 2022, according to accounting and tax records, received a loss from its operating activities in the amount of 50,000 rubles.

Based on the results of 2022, according to accounting and tax accounting data, a profit from core activities was received in the amount of 100,000 rubles.

The organization decided to carry forward the loss to the future in the amount of 50% of the tax base of the current period.

In accounting, the carry forward of losses should be reflected as follows:

| Contents of operations | Debit | Credit | Amount, rub. | Primary document |

| Accounting entries 2022 | ||||

| Loss from core activities reflected | 99-1 | 90-9 | 50 000 | Accounting certificate-calculation |

| Reflected conditional income tax income | 68 | 99-2 | 10 000 | Accounting certificate-calculation |

| Deferred tax asset recognized | 09 | 68 | 10 000 | Accounting certificate-calculation |

| Accounting entries 2022 | ||||

| Profit from core activities is reflected | 90-9 | 99-1 | 100 000 | Accounting certificate-calculation |

| Reflects the conditional income tax expense | 99-2 | 68 | 20 000 | Accounting certificate-calculation |

| Deferred tax asset settled | 68 | 09 | 10 000 | Accounting certificate-calculation |

How to determine a loss for 2022 that can be carried forward to future profits

tax accounting at the end of the year , then it should determine whether it has a loss that can be carried forward and reflect this loss in Section I of Part II of the declaration for the fourth quarter (clause 5 of letter N 2-2-10 /01017, footnote <8>).

Note! The loss subject to transfer to the profit of subsequent tax periods is determined according to the legislation in force in the year for which the loss subject to transfer is determined (clause 2 of article 183 of the Tax Code, clause 1 of letter N 2-2-10/01017).

The amount of loss to be carried forward for the entire organization in 2022 is determined as follows:

———————————

<1> Indicator of line 1 of section I of the declaration.

<2> Indicator of line 3 of section I of the declaration.

<3> Indicator of line 2 of section I of the declaration.

<4> Indicator of line 2.1 of section I of the declaration.

<5> Indicator of line 4.1.1 of section I of the declaration.

<6> From the indicator of line 4.2 of section I of the declaration, the amount of taxes and fees paid from non-income, specified in subparagraph. 3.18, 3.20 and 3.21 art. 174 NK.

<7> Indicator of line 4.2.1 of section I of the declaration.

Where non-expenses (non-income) are calculated as follows:

Note! When calculating the amount of loss for transfer, the following are not included in the calculation: 1) revenue, costs, non-operating income and expenses for activities taxed (part 1, paragraph 2, article 183 of the Tax Code): - a single tax for producers of agricultural products; - a tax under the simplified tax system; - tax on the gambling business; - tax on income from lottery activities; - tax on income from conducting electronic interactive games; - fee for carrying out activities to provide services in the field of agroecotourism; 2) the amount of loss received (part 2, clause 2 Article 183 of the Tax Code):— from activities outside the Republic of Belarus for which a Belarusian organization is registered as a taxpayer of a foreign state;— based on the results of the tax period (periods, part of the tax period) in which the organization had the right to apply exemption from income tax (the right to non-payment of income tax) for several tax periods determined by this legislation (for example, exemption under Decree No. 6).

After we have determined the loss for transfer for the entire organization, we compare it with the loss received in tax accounting, which is indicated in column 3 of line 10 of the declaration.

If, at the end of a tax period, the amount of loss for carryover purposes exceeds the total amount of loss for the same tax period, the total amount of is taken that can be carried forward .

Example. Determining the amount of loss that can be carried forward

The organization calculated a loss for transfer purposes based on the results of 2021 in the amount of 2,000 rubles. The loss indicated in column 3 of line 10 “Tax base” of section I of part I of the declaration for 2022 amounted to 1,500 rubles. The amount of loss that can be transferred is 1,500 rubles .

of all, the loss for the 1st and 2nd groups of operations is determined (claimed for transfer) (paragraphs 1 and 2, part 4, subclause 3.1 of Article 183 of the Tax Code).

Group 1 includes operations:

— with derivative financial instruments;

— with securities, including derivative securities, which are subject to the taxation features provided for in Art. 179 NK.

Group 2 includes alienation operations:

— fixed assets (including parts of a capital structure (building, structure), which is a fixed asset);

— unfinished construction of objects and their parts;

— uninstalled equipment;

— enterprises as a property complex.

Secondly, the loss that remains after excluding losses from the 1st and 2nd groups of operations (hereinafter referred to as the loss from other operations) is determined to be carried forward.

The amount of loss from other operations is determined by subtracting from the loss that can be carried forward the amounts of losses for the 1st and 2nd groups of operations.

If the amount of losses for the reporting year for each of the groups of operations is less than the total loss that can be carried forward, then the losses for each of the groups must be carried forward based on their actual size (Part 3, Subclause 3.1, Article 183 of the Tax Code).

If the amount of losses for the 1st and 2nd groups of operations is greater than the loss that can be transferred, then the amount of loss for each of the groups subject to transfer is determined as follows:

1) if a loss is received for one group of operations, then the amount of loss to be transferred for this group is accepted within the limits of the loss that can be transferred (paragraph 3, part 4, subclause 3.1 of Article 183 of the Tax Code):

2) if losses are received for two groups of transactions, then the amount of loss subject to transfer for each group is determined by multiplying the amount of loss that can be transferred by the share of the loss for each group of transactions in the amount of losses for them (paragraph 2, part 4, subparagraph 3.1 Article 183 Tax Code):

— the loss subject to transfer to the 1st group is determined as follows:

— the loss subject to transfer to the 2nd group is determined as follows:

Example. Determining the loss for transfer, filling out section I of part II of the income tax return

At the beginning of the year, the organization does not have any uncarried losses from previous years.

All profits are taxed at a rate of 18%.

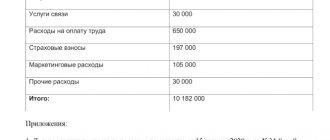

The accounting records for 2022 reflect the following indicators:

| Index | Account turnover | ||

| By debit | By loan | Amount, rub. | |

| Turnover on account 90 “Income and expenses from current activities” | |||

| Revenue from sales of goods | 90-1 | 360000 | |

| VAT calculated on sales | 90-2 | 60000 | |

| Cost of goods, administrative expenses, sales expenses (including expenses in the amount of 100 rubles are not taken into account when taxing profits) | 90-4, 90-5, 90-6 | 230100 | |

| Turnover on account 91 “Other income and expenses” | |||

| Proceeds from the sale of fixed assets | 91-1 | 24000 | |

| Proceeds from the sale of securities | 91-1 | 6000 | |

| Positive exchange rate differences | 91-1 | 25000 | |

| VAT calculated on the sale of fixed assets | 91-2 | 4000 | |

| OS implementation costs | 91-4 | 50000 | |

| Expenses from the sale of securities | 91-4 | 16000 | |

| Negative exchange rate differences | 91-4 | 75000 | |

| Accounts receivable with expired statute of limitations | 91-4 | 700 | |

The total loss in accounting amounted to 20,800 rubles. (360,000 rub. + 24,000 rub. + 6,000 rub. + 25,000 rub. - 230,100 rub. - 60,000 rub. - 4,000 rub. - 50,000 rub. - 16,000 rub. - 75,000 rub. - 700 rub.).

In Section I of Part I of the income tax return, the indicators will be as follows:

Line 1: 390,000 rub. (360,000 rub. + 24,000 rub. + 6,000 rub.).

Line 2: 296,000 rub. (230,100 rub. - 100 rub. + 50,000 rub. + 16,000 rub.).

Line 3: 64,000 rub. (60,000 rub. + 4,000 rub.).

Line 4.1: 25,000 rub.

Line 4.1.1: 25,000 rub.

Line 4.2: 75,700 rub. (75,000 rub. + 700 rub.).

Line 4.2.1: 75,000 rub.

The total loss for transfer purposes is RUB 20,000. (from line 4.2, the amount of 700 rubles is not included in the calculation) - column 2 of section I of part II of the declaration.

We determine the total loss for the purposes of transfer by groups of operations:

— for the 1st group: 10,000 rubles. (6,000 rubles - 16,000 rubles) column 3 of section I of part II of the declaration;

— for the 2nd group: 30,000 rubles. (24,000 rubles - 4,000 rubles - 50,000 rubles) column 5 of section I of part II of the declaration.

The total amount of losses for the 1st and 2nd groups is greater than the loss that can be transferred (10,000 rubles + 30,000 rubles) > 20,000 rubles.

The amount of loss to be carried forward will be:

— for the 1st group — 5000 rub. (20000 x (10000 / 40000)) column 4 of section I of part II of the declaration;

— for the 2nd group — 15,000 rubles. (20000 x (30000 / 40000)) column 6 of section I of part II of the declaration.

At the end of the year, the organization will have an uncarried loss, which is indicated in columns 8 - 10 of Section I of Part II of the declaration.

Section II of Part II of the declaration is not completed.

Note! An organization does not have the right to declare losses for transfer if these losses: - were not declared before the start of the inspection (except for desk audits); - were established and (or) adjusted upward during the inspection (Part 4, Clause 7, Article 183 of the Tax Code).

In accounting , a loss determined to be transferred is not reflected, but only a deferred tax asset (DTA) is accrued by entry D-t 09 - K-t 99. It is defined as the product of the amount of the transferred loss and the income tax rate (clauses 9 and 11, part 1, clause 16 of Instruction No. 113).

Example. Reflection of ONA in accounting when determining a loss that can be transferred

The organization has determined the loss that can be carried forward at the end of 2021 in the amount of 20,000 rubles. This loss is reflected in section I of part II of the declaration. All profits are taxed at a rate of 18%.

In accounting, you should make an entry D-t 09 - K-t 99 - 3600 rubles. (RUB 20,000 x 18%).

Read this material in ilex >>* * following the link you will be taken to the paid content of the ilex service

The order of carrying forward losses to the future

In order to carry forward losses to the future, a “queue” is observed.

According to the provisions of paragraph 3 of Art.

283 of the Tax Code of the Russian Federation, in the case when losses were received not in one, but in several tax periods, when transferring them, the order must be observed: first, the loss received in the earliest year must be transferred, followed by losses received in later years in ascending order periods. Example

At the end of 2012, the organization received a loss in the amount of 300,000 rubles, at the end of 2013 - a loss in the amount of 400,000 rubles.

In all subsequent years, the organization operated with a profit, but did not reduce the tax base for 2014 - 2016. for losses from previous years.

In 2022, she made a profit of RUB 800,000. and decided to carry forward losses from previous years to this year.

When calculating income tax for 2022, she has the right to take into account a loss in the amount of 50% of the profit for 2022 - 400,000 rubles. (RUB 800,000 x 50%).

Therefore, the organization has the right to take into account the loss received in 2012 in the amount of 300,000 rubles, as well as part of the loss for 2013 in the amount of 100,000 rubles. (400,000 - 300,000).

Thus, the tax base of the organization for 2022 will be equal to 400,000 rubles.

The balance of the uncarried loss for 2013 is in the amount of RUB 300,000. (400,000 - 100,000) the company will be able to take into account in subsequent years without the restrictive ten-year period for carrying forward losses.

How to transfer losses from previous years in the accounting database

Currently there is no automatic transfer of losses in the programs. Therefore, we will transfer the loss using manual entries. Please note that the manual loss carry forward operation is carried out on December 31, after the close of the tax period, but before the balance sheet reformation.

2.1 We close the tax period in which the loss was incurred

- We will forward the documents for December;

- We close the month, but skip the “balance sheet reform” operation. D 99.01 – K 90.09 The program must generate the posting independently.

- We create a manual loss transfer operation: D 97.21 – K 99.01 – the amount of loss carried forward to future periods. 97.21 “Other deferred expenses” 99.01 “Profits and losses from activities with the main tax system”

- For account D 97.21, we create the subaccount “Loss ... year” and configure this subaccount correctly. Type for NU - Losses of previous years Type of asset in the balance sheet - Other current assets Amount - Amount of loss Recognition of expenses - In a special order Write-off period - from XX.XX.XXXX

2.2 We carry out the “balance sheet reform” document

D 84.02 – K 99.01 D 90.01 – K 90.09

The program must generate the postings independently. The transfer of losses is carried out after the regulatory operation “Calculation of income tax”.

2.3 Write-off of losses from previous years

Now, in the new tax period, starting from the date specified in Subconto, if an organization makes a profit in tax accounting, it will automatically be reduced by part of the loss of the previous period or the entire amount. The write-off will take place monthly until the entire loss is written off. The operation can be seen in Menu – Closing the month – Write-off of losses from previous years. D 99.01 – K 97.21 – the amount of the written off part of the loss.

2.4 We reflect the transferred loss in the income tax return

On Sheet 02 of Appendix 4, you must indicate the year from which we are transferring the loss and the amount of the loss Total; the amount of the tax base; the amount of loss, but not more than 50% of the profit; the balance of the unwritten loss. We go to Sheet 02; the amount of the transferred loss should be automatically transferred to page 110.

—

Carrying forward a loss using an example

When calculating income tax for 2022, Mega LLC received a loss of 350,000 rubles. This loss can be carried forward to the future, forming from December 31, 2017. manual wiring operation D 97.21 – K 99.01 = 350,000 rub. In the 1st quarter of 2022, when calculating income tax for Mega LLC:

Income 1,200,000 rubles, Expenses 1,000,000 rubles.

The tax base was 200,000 rubles. (1,200,000 – 1,000,000), we can reduce it by the amount of loss, but not more than 50% of the profit. In our case, we reduce by 100,000 rubles. In the income tax return on Sheet 02, Appendix 4, we indicate: - the year from which we transfer the loss = 2022; — amount of loss Total = RUB 350,000; — tax base amount = 200,000 rubles; - amount of loss, but not more than 50% of profit = 100,000 rubles; — balance of unwritten loss = 250,000 rubles (350,000 – 100,000)

—

2.5 Deferred loss carryforward

There are situations when organizations do not want to reduce the tax base for losses from previous years in the current tax period, because carrying forward losses to the future is a right. But then a situation may arise when management needs to reduce the tax base, thereby reducing the tax.

Important! — If you do not apply PBU 18/02 and are sure that you will never carry forward the resulting loss, then you do not have to create a manual “Loss Transfer” operation at the end of the year. — If you apply PBU 18/02, then this operation will have to be created, otherwise the program will not allow you to close the first month of the next year.

In this case, we still recommend creating an operation to transfer the loss, but then without indicating the start date for writing off this loss.

How to do this: In a manual operation to transfer a loss, for account 97.21, we create a subaccount “Loss ... year” Type for NU - Losses of previous years Type of asset in the balance sheet - Other current assets Amount - Amount of loss Recognition of expenses - In a special order Write-off period - LEAVE LINE IS EMPTY Later, when you decide to reduce your tax base by the amount of the loss, you will need to indicate in the “write-off period” field the first date of the tax period from which you want to start writing off.

2.6 We suspend the write-off of losses for a while

It happens that an organization has written off a loss over a certain period of time, but this year does not want to reduce the tax profit for the loss of previous years and needs to stop writing off the loss for a while.

In this case, it is necessary to create a transaction entered manually with the posting: D 97.21 (sub-account “Balance of loss 2017”) - K 97.21 (sub-account “Loss 2017”) - the amount of the balance of the loss not transferred. We set up the subconto “Remaining loss 2017” as described above, i.e. We leave the dates of the write-off period blank.

Then, when write-off is required again, it will be necessary to post back:

D 97.21 (sub-account “Loss 2017”) - K 97.21 (sub-account “Balance of loss 2017”) - the amount of the balance of the loss not transferred.