When new material assets begin to operate at an enterprise, their receipt must be properly documented, since the value of property assets added to the balance sheet directly affects many other production factors. The procedure for capitalization of fixed assets must comply with regulatory requirements, be documented and be correctly recorded in accounting accounts.

Let's consider the ways in which fixed property assets can reach an enterprise, how to correctly carry them out according to the accounting procedure, and in what documents to display them.

Primary documents - grounds for accounting for introduced fixed assets

No property asset can appear in an enterprise “out of nowhere”: its introduction is necessarily accompanied by a number of documentary evidence. Based on the primary documentation corresponding to a specific group of production assets, each object or their group is registered on the balance sheet. Depending on whether they belong to a group of objects, the introduction of an asset may be accompanied by the following “primary”:

- acceptance certificate - for the acceptance of various objects, a certain form is provided (OS-1a - provided for structures and buildings; OS-1 - for other single objects; OS-1b - for groups of fixed assets, excluding structures and buildings);

- invoice (act) for acceptance of equipment - for equipment that does not require preliminary installation (form OS-14);

- act (invoice) of acceptance and transfer of equipment for the purpose of carrying out installation work - form OS-15.

For each new object from the fixed assets put into operation, it is necessary to create a special inventory card according to the established model:

- for a single OS object - according to the OS-6 form;

- for several grouped objects - according to the OS-6a form.

In it, the asset is assigned a unique inventory number , constant for the entire life of the asset (usually this is a serial number in a certain series).

These cards will subsequently reflect the entire “life” of the main asset in the enterprise:

- admission;

- depreciation;

- revaluation;

- modernization;

- conservation-depreservation;

- recovery;

- disposal (write-off).

The results are compiled into a single inventory book , where the final accounting of fixed assets is carried out, which must be drawn up in the OS-6b form.

statement of the dynamics of fixed assets is compiled using inventory cards .

How to register a fixed asset in 1C: Accounting

Published 06/06/2014 15:22 While working in 1C programs, users have a lot of questions about the acceptance of fixed assets for accounting. Indeed, it is very important to do everything correctly at the initial stage, so that later there are no problems with calculating depreciation. Let's consider an example of acquiring a fixed asset and accepting it for accounting in the 1C: Enterprise Accounting 8 edition 3.0 program.

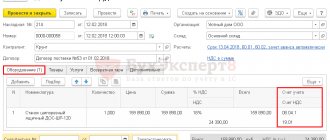

The first step is to capitalize the fixed asset to the account 08.04. To do this, we create a document “Receipt of equipment”.

Click on the “Create” button

We fill in the “Counterparty” and “Agreement” fields, indicating there the details of the seller of our fixed asset, then select the warehouse to which we will register the receipt. We add a new line to the tabular part, indicate the name of the fixed asset in the nomenclature field (add a new element to the “Nomenclature” directory in the “Equipment ...” folder), fill in information about the price and VAT, the accounting account is 08.04.

We post the document, then indicate the invoice details in the lower left corner and click on the “Register” link.

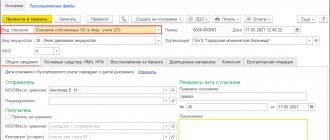

Now you need to accept the fixed asset for accounting. To do this, go to the “Directories” tab, section “OSiNMA”, “Fixed Assets” and open the fixed assets directory. We add a new element to the directory, filling in only the name and accounting group of the fixed asset, the remaining fields will be filled in automatically when posting the acceptance document for accounting. We save the entered information with the “Record” button and go to the “OSiNMA” tab - “Acceptance for accounting of fixed assets” and click the “Create” button.

Fill out the created document. In the “Equipment” field we indicate an element from the “Nomenclature” directory, which we added when we generated the receipt document from the supplier. Fill in the fields “Warehouse” and “Account” - 08.04.

On the “Fixed assets” tab, we add the previously created directory element to the tabular part, the inventory number is filled in automatically.

On the “Accounting” tab, the main thing is to remember to check the “Calculate depreciation” checkbox. Be sure to indicate the depreciation account and useful life in months. The field “Depreciation schedule by year” can be left blank.

In the “Method of reflecting depreciation expenses” field, information is added about which account to assign depreciation expenses to. Here you can select from existing directory elements or add a new one by specifying the desired account and subaccount.

If your organization is on the OSN, then you will also need to fill out the “Tax Accounting” tab.

Now you can post the document. If errors occur during processing, the first step is to check whether the warehouse in the receipt and acceptance documents matches. As well as the time and date of the documents - receipt should be at least a couple of seconds earlier.

If you need more information about working in 1C: Enterprise Accounting 8, then you can get our book for free using the link.

Author of the article: Olga Shulova

Let's be friends on Facebook

Did you like the article? Subscribe to the newsletter for new materials

Add a comment

Comments

0 #36 Irina Plotnikova 04/29/2021 01:06 I quote Natalya:

Hello, please tell me if, on the basis of a leasing agreement, I can carry out the “Receipt of Equipment” to calculate depreciation??? Thank you for your reply

Natalya, good afternoon.

Leasing operations are formalized completely differently. The entry of leased property is carried out, at a minimum, on the basis of “Receipt for leasing”. We have a detailed master class on leasing that might interest you. Quote 0 #35 Natalya 04/27/2021 21:56 Hello, please tell me if, on the basis of a leasing agreement, I can carry out “Receipt of equipment” to calculate depreciation??? Thank you for your reply

Quote

0 #34 Atakanavratarya 12/01/2018 13:20 Modernization and reconstruction must be recorded on the card. The company has the right to use a unified form in form OS-6, or develop its own form. If the characteristics and purpose of a fixed asset have changed significantly, it is permissible to create a new card and store the old one as a source of information.

Quote

0 #33 Tatyana Ostapenko 11/25/2016 09:58 hello, help me create in 1c OS in an economic way, 1. Bought materials 2. REQUIREMENT - INVOICE WRITTEN TO 08 ACCOUNT + THE SAME SALARY, TAXES. then NEED TO BE WRITTEN OFF ON 01 THE COST IS NOT WRITTEN OUT WHY?

Quote

0 #32 Tatyana Ostapenko 11/25/2016 09:53 Hello, help me register in 1C accounting 3.0 the construction of OS in an economic way 1. We purchase materials, 2. We write off the invoice request to account 08, 3. Next you need to write off from 08 to 01 but the cost is not written off

Quote

0 #31 Olga Shulova 10.28.2016 19:42 I quote Elena Sh:

Good afternoon, Olga! the document “Acceptance for accounting of fixed assets” is less than the receipt document in amount. and, accordingly, according to D08.04 the difference in amount. What to do?

Hello!

In what period was the document “Acceptance for accounting of fixed assets” introduced? Quote 0 #30 Elena Sh 10.28.2016 13:21 Good afternoon, Olga! the document “Acceptance for accounting of fixed assets” is less than the receipt document in amount. and, accordingly, according to D08.04 the difference in amount. What to do?

Quote

0 #29 Natalya 05/12/2016 03:15 Thank you very much, I’ll try)

Quote

0 #28 Olga Shulova 05/10/2016 19:56 I quote Natalya:

Thanks for the advice. It only confuses me that the period is already closed and if I make such changes now, will it mean I will have to re-close the months, years? And won't this affect any data?

If the balances were introduced a long time ago, then I would not risk it.

Then the advice was more for the future. I missed that the year there is 2013, not 2015. And in the current situation, you can try to enter the document “Receipt of goods” on the date that is possible (before the document transfer of equipment for installation). After this, make the document “Adjusting register entries” (I told you how to work with it in KA in the article “How to reverse a document in 1C” in the “First steps in the new program” section). But in this document, only reverse the accounting entry and clear all other tabs in the debt adjustment. After this, information about this equipment will be in all the necessary registers, because the posting document will include it, and you can try to transfer it to installation. Quote 0 #27 Natalya 05/09/2016 03:04 Thank you for the advice. It only confuses me that the period is already closed and if I make such changes now, will it mean I will have to re-close the months, years? And won't this affect any data?

Quote

0 #26 Olga Shulova 05/05/2016 09:24 I quote Natalya:

Yes, 1s KA 8.3.5.1517

In Integrated Automation, initial balances of inventory items must be entered using the document “Receipt of goods” with the type of operation “Entering initial balances”.

Indicate the account in the tabular section as 07 in this case Quote 0 #25 Natalya 05/05/2016 02:16 Yes, 1s KA 8.3.5.1517

Quote

0 #24 Olga Shulova 05/04/2016 08:03 I quote Natalya:

12/31/13 Entering the initial balances (manual posting) d07k000 1000000rub, 01/01/2016 transfer of equipment for installation, the top part is set to account 08.04, at the bottom in the table I select OS account 07, post and the message appears “for the item printing machine new movements were formed without a total assessment according to the regulations .accounting". Please tell me what am I doing wrong?(((

I think you entered the balance incorrectly.

Which 1C configuration are you working in? Judging by the description of the error, is this complex automation or UPP? Quote 0 #23 Natalya 04/30/2016 17:13 12/31/13 Entering initial balances (manual entry) d07k00 0 1000000rub, 01/01/2016 transfer of equipment for installation, the top part is set to account 08.04, at the bottom of the table I select OS account 07, I enter and the message appears “for the item printing machine, new movements were formed without a total estimate for accounting regulations." Please tell me what am I doing wrong?(((

Quote

0 #22 Olga Shulova 04/25/2016 20:47 I quote Natalya:

For some reason, I can’t generate amounts for regulated accounting. I'm trying to put prices in the OS cards, the program does not allow me to fill out these columns. Tell me what to do?

What documents do you use to reflect the entire chain?

Describe in more detail: date - document - amount - transaction. And at what stage do problems begin? Quote 0 #21 Natalya 04/24/2016 19:44 First you need to enter the document “Transfer of equipment for installation”, moving the OS to account 08.04. And then the document “Acceptance for accounting of fixed assets”, which will generate a posting to account 01. For some reason, I am not generating amounts for regulated accounting. I'm trying to put prices in the OS cards, the program does not allow me to fill out these columns. Tell me what to do?

Quote

0 #20 Olga Shulova 04/21/2016 20:36 I quote Natalya:

Good afternoon, Olga! Please tell me how can I transfer equipment from account 07 to account 01 so that depreciation is calculated?

Hello!

First you need to enter the document “Transfer of equipment for installation”, moving the OS to account 08.04. And then the document “Acceptance for accounting of fixed assets”, which will generate a posting to account 01 Quote 0 #19 Natalya 04/20/2016 17:12 Good afternoon, Olga! Please tell me how can I transfer equipment from account 07 to account 01 so that depreciation is calculated?

Quote

0 #18 Olga Shulova 03/21/2016 15:20 I quote Elena Lesnikova:

Hello! Help me please! We started working in 1C: Accounting in January of this year. Depreciation is not charged for some fixed assets with a residual value! Is it necessary to enter OS balances through 08 account? And why, when taking fixed assets into account, are there only equipment, and buildings included?

Hello!

Were fixed asset balances entered using special documents “Entering initial balances”? If they are entered manually, then depreciation will not be charged. There is no need to make an invoice after 08, the posting will be Dt 01 Kt 000, but it must be formed with the correct document. When accepting fixed assets for accounting, do you select an item from the directory and see only one suitable folder there, Equipment? If this is the case, then you can add another folder with a different name, but you can store everything in the Equipment folder. Quote 0 #17 Elena Lesnikova 03/18/2016 20:41 Hello! Help me please! We started working in 1C: Accounting in January of this year. Depreciation is not charged for some fixed assets with a residual value! Is it necessary to enter OS balances through 08 account? And why, when taking fixed assets into account, are there only equipment, and buildings included?

Quote

0 #16 Alina Goncharova 02/16/2016 18:28 Thank you!

Quote

0 #15 Olga Shulova 02/16/2016 09:23 I quote Alina Goncharova:

Olga, good afternoon! Please help me understand the new OS accounting rules in the 1C program. An organization on OSNO purchased a laptop worth 44,000 rubles in January 2016. and a projector worth 48,000 rubles. Tell me how to take this property into account in the program? Do I understand correctly that in accounting these will be fixed assets, and in tax accounting this property will be capitalized as part of the inventory, since the cost is less than 100 thousand rubles? How, in this case, to correctly accept this property for accounting and put the operating system into operation in accounting? Thank you very much in advance!

Hello, Alina!

Yes, that’s how I understand the new rules too. I think the simplest option would be simply in the document “Acceptance for accounting of fixed assets” on the “Tax accounting” tab, select the procedure for including the cost in expenses “Inclusion in expenses upon acceptance for accounting.” And leave the depreciation charge in accounting; in this case, expenses will be reflected correctly: in accounting at a time, and in accounting as usual, through depreciation. Quote 0 #14 Alina Goncharova 02/15/2016 14:25 Olga, good afternoon! Please help me understand the new OS accounting rules in the 1C program. An organization on OSNO purchased a laptop worth 44,000 rubles in January 2016. and a projector worth 48,000 rubles. Tell me how to take this property into account in the program? Do I understand correctly that in accounting these will be fixed assets, and in tax accounting this property will be capitalized as part of the inventory, since the cost is less than 100 thousand rubles? How, in this case, to correctly accept this property for accounting and put the operating system into operation in accounting? Thank you very much in advance!

Quote

-1 #13 Ellie 11/13/2015 01:36 Thank you very much for your answer. I would also bet on 97. We have an LLC on OSN.

Quote

0 #12 Olga Shulova 11/12/2015 20:51 I quote Ellie:

Hello. The cell phone was purchased using a check for cash. And on the receipt, in a separate line, it says “Warranty from the 2nd year 500 rubles.” There are no other documents.

Then an interesting situation arises.

In this case, the paid guarantee can be considered as a kind of guarantee-insurance. As a general rule, insurance costs associated with the acquisition of fixed assets in accounting are included in the initial cost. But in our case, they are not associated with the acquisition of a fixed asset, but with the subsequent period of its actual use. Consequently, in accounting they are recognized as deferred expenses, accounted for in account 97 and they must be written off during the period for which they were paid (fix the period with an order for the enterprise). Are you on OSN or USN? The amount is not large, so I’m not even sure if you want such difficulties in the design. Quote 0 #11 Ellie 11/12/2015 10:54 Hello. The cell phone was purchased using a check for cash. And on the receipt, in a separate line, it says “Warranty from the 2nd year 500 rubles.” There are no other documents.

Quote

0 #10 Olga Shulova 11/12/2015 10:31 I quote Ellie:

Good evening. Olga, how to properly register a PC if you have purchased a network card, processor, mouse, keyboard, monitor, etc. separately for cash the cost is up to 40,000 rubles. There are no documents for assembly. What documents and postings? And how to take into account cell phones up to 40,000 rubles. Do we put it on account 10 and write it off? But do they have a warranty and SPI? Thank you.

Hello!

The PC can be assembled from components using the “Item Contents” document. But if the cost is less than 40 thousand, then we put it at 10 and can immediately attribute it to expenses. Same with cell phones. Tell us more about the guarantee, what documents are used to document it and what confuses you? Quote 0 Ellie 11/11/2015 00:52 Good evening. Olga, how to properly register a PC if you have purchased a network card, processor, mouse, keyboard, monitor, etc. separately for cash the cost is up to 40,000 rubles. There are no documents for assembly. What documents and postings? And how to take into account cell phones up to 40,000 rubles. Do we put it on account 10 and write it off? But do they have a warranty and SPI? Thank you.

Quote

0 Olga Shulova 07/21/2015 21:59 Quoting Oksana gt:

We entered the balances of fixed assets. further how to take them into account? Are there any entries in the OS inventory book?

Hello!

What program do you work in (1C: Enterprise Accounting, 1C: Integrated Automation, etc.)? What document was used to enter the opening balances? Usually, if the balances are entered correctly, nothing else needs to be done. Quote 0 Oksana gt 07/21/2015 17:07 Fixed asset balances have been entered. further how to take them into account? Are there any entries in the OS inventory book?

Quote

0 Olga Shulova 05/24/2015 21:58 I quote Natalya:

Sorry, Olga. I meant account 000(((

Then you need to look for the reason in entering the initial balances.

Maybe you haven’t corrected all the columns (there are still hidden fields that appear when you right-click and select “Customize List”)? Is the period for entering balances for editing open? Quote 0 Natalya 05/23/2015 02:49 Sorry, Olga. I meant account 000(((

Quote

0 Olga Shulova 05/22/2015 15:56 I quote Natalya:

1s KA 8.3 the difference between the original cost and accrued depreciation was reflected in this account

A very strange situation.

Are you sure that the posting to this account was made by the balance entry document? If you directly generate an account card for 001 for the entire period of work in the program, then with what document is the turnover registered? Quote +1 Natalya 05/22/2015 02:27 1s KA 8.3 the difference between the original cost and accrued depreciation was reflected in this account

Quote

0 Olga Shulova 05/21/2015 17:57 I quote Natalya:

Good afternoon, Olga! And if balances were entered and the accountant entered the amounts incorrectly, it turned out that the initial cost is less than the accrued depreciation, the amount is stuck on account 001, how can I remove it? I corrected the amounts in the document for which balances were entered, but the amount does not disappear.

Hello!

Which 1C program are you working in? (name and version of the configuration) Is the OS on the balance sheet (account 001)? Quote 0 Natalya 05/21/2015 16:31 Good afternoon, Olga! And if balances were entered and the accountant entered the amounts incorrectly, it turned out that the initial cost is less than the accrued depreciation, the amount is stuck on account 001, how can I remove it? I corrected the amounts in the document for which balances were entered, but the amount does not disappear.

Quote

Update list of comments

JComments

Primary cost of OS

These accounting documents must include the primary cost of fixed production assets; it consists of the costs that the enterprise actually incurred for:

- acquisition;

- delivery;

- installation;

- construction;

- acquisition of raw materials for creation;

- payment of state duty to obtain a license, etc.

IMPORTANT! The primary cost of received fixed assets does not include the amount of VAT and other fees subject to reimbursement.

Analytical and synthetic accounting of fixed assets

Accounting for fixed assets is carried out on the basis of the Chart of Accounts on the following synthetic accounts:

- Account 01 “Fixed Assets”—shows fixed asset objects broken down by their types at original cost. Analytical accounting is carried out according to the following types: buildings, structures, transmission devices, machinery and equipment, vehicles, inventory, and others. There is also an analytical account to reflect the write-off of fixed assets (01/9).

- Account 02 “Depreciation of fixed assets” - fixed assets are shown in the amount of accumulated depreciation (that is, part of the price of the object transferred to expenses). Analytical accounting is performed in the same way as for account 01

- Account 03 “Income Investments” - is used to account for fixed assets acquired to generate income by renting them out. Analytical accounting is performed either by type of operating system or by tenant.

- Account 07 “Equipment for installation” - takes into account OS objects for which installation needs to be carried out. Analytical accounting is carried out by type of object.

- Account 08 “Investments in non-current assets” - is used to accumulate the initial price of incoming objects. All costs associated with the purchase of the OS are accumulated here. Analytical accounting is performed by type of investment.

You might be interested in:

08 accounting account - “Investments in non-current assets”

Accounting depending on the methods of receipt of fixed assets

Accounting for each fixed asset occurs differently; the method depends on the official source from where the fixed asset came to the enterprise. Different paths not only lead to different initial costs, but also different accounting nuances.

- Purchasing from a supplier. It is necessary to take into account all costs, including transport and installation, excluding VAT. According to accounting, this will be done in this way:

- the cost of the acquired asset excluding VAT (debit 08, credit 60);

- additional costs for delivery, installation, setup, etc. (debit 08, credit 60 or 76);

- allocation of VAT (debit 19, credit 60 or 76);

- putting the main asset into operation (debit 01, credit 08).

- Acceptance under a gift agreement. It is necessary to take into account the market price of the object, current at the time of donation (the amount must be documented).

ATTENTION! Entrepreneurs and organizations cannot make “gifts” to each other in amounts exceeding 5 minimum wages.Accounting entries:

- D08 K98/2 - the main asset was received free of charge and accepted for accounting;

D01 K08 - this material asset is put into operation;

- D98/2 K91 - writing off depreciation from account 98 to “other income”.

- Contributing your share to the authorized capital. The cost of the OS is agreed upon by the founders and regulated in the constituent documents.

NOTE! If funds are deposited for a significant amount exceeding 200 times the minimum wage, then it must be additionally assessed by an independent specialist.Accounting data:

- the property asset is introduced as a contribution to the authorized capital (debit 08, credit 75);

the main asset is put into operation (debit 01, credit 08).

- Creating an OS in-house (economic method, construction, etc.) - all costs for raw materials, the work itself (if necessary, then under contracts), transportation costs, installation, etc. are subject to accounting. Accounting:

- wages for contractors (debit 08, credit 60 or 76);

- cost of raw materials (debit 08, credit 10);

- all other costs incurred in creating the operating system (debit 08, credit 60 or 23, 25, 26, 76);

- allocation of VAT for all types of expenses (debit 19, credit 60 or 23, 25, 26, 76);

- putting a new asset into operation (debit 01, credit 08).

- Receipt under contracts where the remuneration provides for obligations other than monetary – the cost is determined in the same way as when transferring an object as a gift (based on the current market price for similar goods or services). Accounting entry:

- acceptance of funds for accounting (debit 01, credit 08);

- the asset is accounted for and put into operation (debit 01, credit 08).

Accounting for valuation and revaluation of fixed assets

Accounting for the valuation of fixed assets

carried out according to three types of cost: initial, residual and replacement.

The initial cost is determined by the amount of actual costs for the acquisition, construction and production of fixed assets, with the exception of value added tax and other refundable taxes (except for cases provided for by the legislation of the Russian Federation).

The residual value of fixed assets is considered as the original cost reflected in the balance sheet, minus depreciation in monetary terms.

Replacement cost is the cost of fixed assets at market prices valid on a certain date. It is usually used during revaluation or when calculating the purchase price for long-term leases (leasing) and is determined by independent experts (appraisers).

Accounting for revaluation of fixed assets

allowed in cases of retrofitting, completion, reconstruction and partial removal of existing facilities. The organization has the right, no more than once a year (at the beginning of the reporting period), to revaluate fixed assets at replacement cost using indexation or direct recalculation at documented market prices. If differences arise, they should be classified as additional capital.

Unaccounted for fixed assets

Periodically, all enterprises carry out an inventory - an additional, intermediate accounting of all property assets. Sometimes the result of an inventory may be the discovery of one or more fixed assets that were not previously registered.

Such funds are subject to mandatory capitalization.

To do this, you need to find out their market value, which will be valid at the time of discovery (this moment will determine the date of entry on the balance sheet). Accounting should be made on the account “Fixed Assets” (debit 01, credit 91).

On the basis of what documents is the receipt of fixed assets regulated?

Regulatory documents that are used as the basis for reflecting fixed assets in accounting and tax accounting at an enterprise include:

- Law “On Accounting” No. 402 FZ - this act defines the principles of accounting and basic concepts.

- Tax Code of the Russian Federation - this act establishes the general concepts of OS and the procedure for accounting for such objects in tax accounting.

- Regulations on accounting and accounting in Russia No. 34 - this act defines the concept of OS, and also provides a classification of these objects.

- PBU 61 is a leading regulatory act that defines not only what fixed assets are, but also establishes the rules for their assessment, accounting, execution using documents, etc.

- Guidelines for maintaining fixed assets accounting No. 91 - this act establishes the main methods for recording fixed assets, and also discusses the features of individual operations for accounting for fixed assets.

- Chart of accounts and instructions for its use No. 94n - defines the accounts on which fixed assets are recorded, and also establishes standard correspondence of these accounts with other accounting accounts.

Attention! When reflecting the receipt of fixed assets, other regulations can be used, for example, PBU 9/99 and PBU 10/99 regarding the occurrence of income and expenses that arise when purchasing fixed assets, as well as guidelines for conducting an inventory.