Who and when is obliged to create a reserve for warranty repairs in accounting? The company is obliged to recognize

As it was before Until 2022, all insurers were required to issue all their employees

What social benefits for children are there in the Russian Federation? Types of social assistance for parents are listed in

VAT is the most insidious Russian tax. With its own characteristics, strict requirements for supporting documents

The economic activities of organizations are based on the use of property owned by it, which is reflected in accounting. From 1.01.19

A letter about excessively transferred funds is a document that is necessary for the return of illegally made

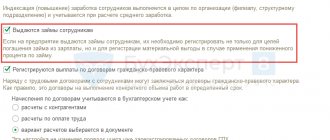

In practice, an accountant often has to deal with the registration of transactions for the issuance of interest-free or interest-bearing

Fixed assets in budget accounting - 2020-2021: introductory information In accordance with clause 21

Adjustment of 6-NDFL may be necessary if the tax agent makes errors in the Calculation. Responsibility for defects

Grounds for withholding alimony from earnings Alimony is payments made from the income of adults