A letter about excessively transferred funds is a document that is necessary to return payments made unlawfully to a third party. In some cases, the accountant may make mistakes in making calculations. As a result, the company may lose money and there will be a shortage. One of the pre-trial ways to return overpaid amounts is to contact third parties with a letter of return.

- Form and sample

- Online viewing

- Free download

- Safely

FILES

Legal regulation

When making payments, an organization may allow an overpayment due to:

- inattentiveness of employees filling out documents;

- unreliability of information from the accounting service about the amount of payment.

Transfer of excess funds can be carried out:

- employee of the organization;

- to the counterparty;

- government agencies (treasury, tax service, inspectorate, etc.).

The obligation of a person who unreasonably receives any property from another entity to return it is provided for in Article 1102 of the Civil Code of the Russian Federation. When an organization transfers excess funds, the person who receives such amounts receives an illegal material benefit.

Even if funds in excess of the norm are transferred by the organization independently, the receipt of such a benefit by another entity is unreasonable and on the basis of Art. 309 of the Civil Code of the Russian Federation creates an obligation to return overpaid amounts.

Unilateral refusal to fulfill obligations and unilateral changes in its conditions under current legislation are not allowed, regardless of who receives these sums of money. Therefore, when an error is identified, the affected company may resort to various methods to protect its interests. And first, on behalf of the organization, a notice must be sent to the enriched entity.

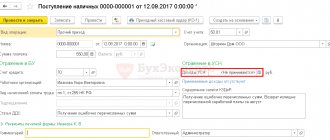

Postings when returning an erroneously transferred payment from a counterparty

For the payer, the amount transferred to the wrong counterparty or transferred in a larger volume also goes to account 76: Dt 76 Kt 51 (52) or Dt 76 Kt 60 (if it is no longer possible to correct the posting made on the payment order).

The return of incorrectly transferred funds from the counterparty in the postings will be expressed as Dt 51 (52) Kt 76. For currency payments, here you will also need to take into account the exchange rate difference, the amount of which will be charged either to the debit or credit of account 91 (Dt 91 Kt 76 or Dt 76 Kt 91).

If, in relation to an erroneous payment, a decision is made to offset it against payment for a delivery within the framework of an existing relationship with the counterparty, then the payment recorded on account 60 will simply change the analytics due to internal posting. In this case, it will be possible to take into account VAT in deductions for both advance payment and delivery.

Document structure

A letter (notice or notification) about excessively transferred funds is drawn up in any form. The legislation of the Russian Federation does not determine the structure of this document. However, in order for the unjustly enriched person to be provided with the most complete information, the text of the letter should indicate:

- business name of the company sending the letter;

- outgoing document number and date of its preparation;

- full name of the addressee (name of the enterprise, address, full name of the manager);

- address to the manager (for example, “Dear Pyotr Petrovich!”);

- actual data (date, time of transfer of funds, payment order number, amount, how much it exceeds the required payments);

- reasons for the overpayment (calculator error, late submission of information to a specialist, etc.);

- a request to return amounts paid in excess of the norm;

- the exact amount of funds to be refunded;

- bank details to make a refund;

- initials and position of the person signing the document.

The letter can indicate legislative acts that establish obligations to return unjustifiably received amounts, as well as notify the counterparty of the negative consequences that will result from ignoring the request for a return.

The return notice may be signed:

- the head of the organization or his deputy (subject to confirmation of his authority);

- chief accountant;

- by any employee of the enterprise, provided that the signature is affixed with the official seal of the company.

To return funds, some organizations (banks, government settlement authorities) ask you to fill out an application using a special form. In this case, the sample or form is issued by the organization itself.

Documents confirming unjust enrichment can be attached to the letter requesting the return of funds, namely:

- money orders;

- bank account statements;

- acts of reconciliation of mutual settlements.

Letter for refund: sample and form of document in specific situations

In the nomenclature grid of internal documents, a letter of refund is a petition, the essence of which is the payer’s request to return to the sender the money transferred excessively or erroneously.

There is no standard form for such a letter approved by law. However, in business financial correspondence, samples are used, the content and form of which have been developed taking into account many years of practice. In addition, forms recommended by specific banks whose clients are the payer can be used.

Use our letter form. How to fill it out correctly depends on the situation in which you need to return the money: we will show examples of filling it out below.

How to write a letter about a refund? The principle of forming the information contained in the letter and its sequence is identical to the requirements for the formation of business documents:

- a letter to the bank about the return of funds is drawn up on the payer’s letterhead; if there is none, the standard registration data and bank details of the applicant are indicated at the top of the sheet;

- a cap:

- Full name and position of the head of the counterparty company,

- the name of the organization he heads;

- document title

- the essence of the petition, set out in the following sequence:

- information about the payment made - when, on what basis (for example, an agreement, claim, clause or other documents) and in what amount the funds were transferred,

- reasons for the return,

- amount to be refunded

- the time frame within which a refund must be made;

- information in the signatory and the date the document was generated.

Please pay attention! If a letter of claim for the return of funds is sent to the counterparty (as a rule, the claim is sent if the recipient has not responded to the initial appeal), it includes an additional paragraph - information about the consideration of the claim through the court, the submission of demands for the accrual of penalties for illegal use of finances, liability in accordance with current legislation.

Compilation deadlines

The Civil Code of the Russian Federation does not contain any mention of the maximum time limit for sending an appeal with a demand for the return of unjustifiably received amounts of money. Based on the general statute of limitations, an application to a person who has unjustifiably enriched himself can be filed within three years from the moment the organization learned or should have learned about the excessive payments made.

However, it is considered in good faith to notify the counterparty within a reasonable time after identifying an accounting error. In civil law, this period usually does not exceed 7-10 days.

To whom is it sent and how is it transmitted?

A letter about excessively transferred funds must be sent to the manager, even if it is signed by an accountant or other specialist of the affected organization. No one other than the manager can give orders for the payment of funds to third parties. And it is better for the chief accountant not to take on such responsibility.

The person who has received unjust enrichment may not satisfy the request stated in the document. In this case, the organization sending the letter must take care of evidence that the addressee received the request. Therefore, it is better to send a refund notification:

- through the office or reception of the head, provided that the second copy of the letter is affixed with a company stamp, date and signature of the employee who received the document;

- according to the acceptance certificate, which will indicate the signature of the official who received the letter;

- by a valuable letter with a description of the addition, if the counterparty refuses to independently accept the notice.

If the funds are not returned voluntarily by the counterparty, the refund of overpaid amounts must be made in court.

Letter of return of transferred funds: sample of options and nuances of formation

The principle of writing the information part of the application for a refund has a general concept, but its content varies depending on the reason for filing the application. Let's look at three options and nuances of writing letters.

First letter: return of erroneously transferred funds

This application option is relevant for cases where the payer sent funds to the settlement account of a counterparty for whom they were not intended. For example, for the return of erroneously transferred funds, a letter, a sample of which we are considering in this part, must be submitted if:

- the sender of the payment made an error when automatically selecting a recipient in the electronic form of the payment order;

- the payment was sent to the counterparty with whom the cooperation was completed;

- The bank transferred money using erroneous details.

- and in other similar cases.

In the first and second cases given, the refund claim is made in the name of the payee. In the third case, the claim is addressed to the bank, which in the above situation actually violated the rules for the bank to carry out payment transactions and is liable in accordance with Art. 866 of the Civil Code of the Russian Federation.

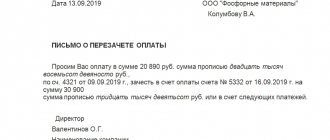

Second letter: return of excessively transferred funds

This version of the letter is relevant in cases where the sender of the payment incorrectly indicated, and in particular, unlawfully inflated the amount of funds transferred, making an error in calculations or a mechanical error.

We give an example of how a letter for the return of overpaid funds should be written, a sample of which contains an indication of the type of error, and additional documents - a reconciliation report confirming the overpayment.

Third letter: for a refund from the supplier

A letter requesting a refund for a product is no longer so much an application for a refund as a full-fledged financial and legal claim, which must be formalized accordingly.

The content of this letter, which in turn can subsequently become a documentary argument when considering a claim in economic arbitration, must necessarily include:

- a footnote to the provisions of the Goods Supply Agreement,

- indication of non-arrival or inadequate quality of goods;

- failure to fulfill obligations by the supplier regarding compliance with delivery deadlines.

This type of claim for a refund implies the mandatory availability and provision of supporting documents to the bank - a supply agreement and a reconciliation report.

Read also: Purpose of payment when returning funds to the buyer

Errors

Among the possible errors encountered when drawing up a notice of overpaid amounts of money, it is worth highlighting:

- incorrect filling of bank details for return;

- absence of the official seal of the organization (if the letter is not written on company letterhead and signed not by the head, but by another official);

- unreasonable demand (lack of data on payment and amount of overpayment).

If there are such errors, the refusal to refund will be lawful.

How to return the money transferred by mistake?

If you transferred money by mistake, how to return it, don’t just leave it like that.

In order to make a refund of money that was transferred to the wrong recipient, follow these steps:

- Contact the bank and write an application for a refund, indicating your account information and the reason why you are canceling the transfer, it is also advisable to attach a copy of the receipt for the money transfer. If it is not possible to drive to the bank, then write to the bank via chat or call

- Wait for the money transferred by mistake to be returned to you

When money is transferred to your account, it takes several hours, and sometimes several days, so the sooner you contact the bank, the sooner the transfer operation will be stopped and the money will be returned to you.

You can directly contact the person to whom the money was transferred by mistake and ask to return it, especially since not in all cases the bank can refund the money.

If for some reason it is not possible to return the money, then the only option left is to file a lawsuit against the person to whom the money was transferred erroneously, demanding the recovery of unjust enrichment.

If the court makes a decision to collect funds, you must wait until it comes into force and then apply with a writ of execution to the bailiffs to initiate enforcement proceedings.

Return to the debtor of what was overpaid in enforcement proceedings

General conditions for the return of overpaid funds to the debtor

The procedure and procedure for returning funds to the debtor is a fairly simple and clearly regulated aspect in the enforcement procedure.

The funds remaining after distribution are transferred (issued) to the debtor. If the bailiff does not have the opportunity to do this, they are kept in the account of the enforcement agency for three years, and then transferred to the republican budget <*>.

The distribution of collected funds within the framework of enforcement proceedings is the final stage of enforcement proceedings, during which the bailiff may discover excess funds. In this case, the bailiff is obliged to transfer (issue) the remaining amount to the debtor.

When his current account is out of date or closed, or when there is no information about the current account, the bailiff is obliged to notify the debtor of overpaid funds.

The debtor is considered to be properly notified if the bailiff has information that the addressee received the correspondence sent to him <*>.

The bailiff is obliged to notify the debtor by letter with a return notification or through the use of electronic and other types of communication that ensure recording of the fact of receipt <*>.

The practice is that SMS is considered an appropriate form of notification. The proper form of notification will also be a letter with return notification to the legal address of the debtor, regardless of its actual location.

Neither the Law on Enforcement Proceedings nor the Instructions on Enforcement Proceedings contain any time limits within which the bailiff must send a notification of the availability of funds or transfer the overpaid amount.

If the debtor has received proper notification of the return of excessively collected funds, but has not informed the bailiff about the method of their return, these funds may be sent to the republican budget within three years from the date of receipt of the notification.

If, before the transfer (issuance) of funds, new enforcement proceedings are initiated against the debtor or suspended ones are resumed, or the grounds for postponing the enforcement action no longer exist, the remaining funds are used to pay off the debt under these enforcement proceedings <*>. Moreover, the amounts of overpayment located in the account of the enforcement agency may be transferred to other collectors even at the stage of voluntary execution <*>.

Specifics of the return of overpayment to a debtor - an individual

The bailiff must always notify the debtor - an individual - about such funds, since individuals do not have current accounts. Refunds are made in cash at the cash desk of the bank branch servicing the current account of the enforcement agency.

However, neither the Instructions for Enforcement Proceedings nor the Law on Enforcement Proceedings prohibit the return of funds to an individual’s card account. Therefore, we recommend that the debtor - an individual who has received notification of the remaining amounts - apply for their return to his card account.

Specifics of the return of overpayment to a debtor - a legal entity

In practice, sometimes the bailiff forecloses on the debtor's funds by sending orders with payment demands to all of his current accounts <*>.

Banks are required to comply with these requirements.

For the debtor, this means that if funds are available, they can be written off from current accounts at a time in an amount exceeding the amount of the debt.

It is necessary to understand that in such a situation there are no violations either on the part of the banks or on the part of the bailiff.

At the same time, the bailiff must act according to the general mechanism: notify the debtor and return the overpaid amounts.

Specifics of the return of overpayments by the debtor directly to the claimant

In practice, the debtor can repay the debt directly to the collector, which, in turn, does not exclude cases of overpayment for various reasons.

The Law on Enforcement Proceedings does not prohibit making payments directly, but obliges the debtor to notify the bailiff about this by submitting supporting documents <*>.

In such a situation, the Law on Enforcement Proceedings does not oblige the bailiff to take any measures to return the overpayment. Therefore, the debtor needs to act independently.

If it was not possible to reach an agreement with the claimant on the voluntary return of the overpaid amount, the debtor has the right to file a claim in court for the recovery of amounts of unjust enrichment <*>.

For such claims, the statute of limitations is three years from the moment the debtor learned or should have learned about his violated right <*>.

Judicial practice proceeds from the fact that the debtor, as a legal entity, is obliged to know about all its financial transactions. In other words, in the event of an overpayment by the debtor to the collector directly, the statute of limitations for filing a claim for the return of amounts of unjust enrichment will begin to run from the moment of payment, and not from the moment when the collector notified the debtor or refused to return the overpaid amount.

General recommendations for debtors on the return of overpaid amounts

1. The debtor may independently, before distributing the collected funds, contact the bailiff with an application for their return, if there is reliable information about the overpayment (documents confirming the fact of the overpayment).

This method will in no way oblige the bailiff to return the overpaid funds until the funds are distributed. But this will help the bailiff to promptly return them.

2. Both the claimant and the debtor are sent a decree on the distribution of funds, from which the received amount and the amount of debt under the writ of execution <*> are visible.

The debtor, having concluded that there has been an overpayment, has the right to contact the bailiff with an application for the return of the overpaid amounts, in which it is necessary to indicate the bank details of the current account for the transfer.

This will also help the bailiff to promptly return the funds.

Please note that the bailiff is obliged to respond to the application within 10 working days <*>.

Refund of overpaid amounts of money from the republican budget

It is theoretically possible that the bailiff not only did not notify the debtor and did not return the overpaid amounts, but also transferred them to the republican budget.

The only way out in this situation is to file a claim to recover amounts of unjust enrichment from the republican budget.

However, there is difficulty in determining the moment when the debtor learned or should have learned about his violated right. The establishment of such a moment directly affects the statute of limitations for filing a claim.

Thus, there is a point of view that the statute of limitations does not begin to run for the debtor if the bailiff has not complied with the requirement for proper notification in accordance with paragraph 187 of the Instructions for Enforcement Proceedings.

There is logic in this position: The instructions for enforcement proceedings oblige the bailiff to notify the debtor and return the overpaid amounts, but does not establish a period within which this must be done. In the case where the debtor has no idea about the overpayment, the fact of a violation of his right does not exist until due notification. Accordingly, the statute of limitations does not begin to run.

According to another point of view, the moment when the debtor learned or should have learned about his violated right can be considered the moment of overpayment.

In other words, the debtor in any case must know for sure how much and to whom he pays. Therefore, it is at the moment of an erroneous payment that the debtor must learn about his violated right.

conclusions

1. The procedure for returning amounts overpaid to the debtor is regulated by the Law on Enforcement Proceedings and the Instructions on Enforcement Proceedings

2. The bailiff is obliged to return the amount of the overpayment, and in the absence of information on where to make the transfers, send the debtor a notice of the need to submit them.

3. The debtor should take an active position and independently take measures to return the overpaid amounts.

4. The debtor has the right to file a claim in court for the return of amounts of unjust enrichment in a situation where he believes that the bailiff unjustifiably transferred funds to the republican budget.