VAT is the most insidious Russian tax. With its own characteristics, strict requirements for supporting documents and endlessly changing rules for reflection in accounting registers and books of accounts.

With a special fiscal tracking system ASK VAT-2. And with large additional charges if something was overlooked, made a mistake or not taken into account.

In addition, like no other existing tax, it has a specific feature: after VAT is recognized as deductible - upon the occurrence of circumstances specified by law - VAT must be restored.

We need to remember this. And keep track of dynamically changing legal norms.

Let's discuss what we have on this topic today: when you should not forget about VAT restoration, and when this is not required. Risks and consequences. What is prescribed in the legislation and how practice has developed.

All cases of VAT recovery are given in the Tax Code. In paragraph 3 of Article 170 and Article 171.1. But in practice, everything is not so clear. Tax authorities interpret tax legislation broadly and often require the restoration of VAT in cases that are not even mentioned in the Code.

VAT on advances

According to the existing methodology, when accepting assets (goods, works, services) for accounting, or when returning an advance due to termination of a contract, VAT must be restored, previously accepted for deduction from the prepayment. These are more technical manipulations, understandable and not controversial.

Letter of the Ministry of Finance dated February 8, 2022 No. 03-07-11/7650 clarified the situation when an advance was issued for one product, but in fact, by agreement of the parties, another product was received as an advance payment. According to the Ministry of Finance, when replacing one product with another within the same transaction, the advance payment does not return. And despite the fact that a different product is indicated in the invoice for the advance payment, there is no need to restore VAT - which the tax authorities previously insisted on.

But do not confuse the replacement of goods with offset. In case of offset, the transaction is terminated. And the advance is considered returned. With all the ensuing consequences: 1) the seller on the date of offset can deduct the VAT that was accrued on the advances received and 2) the buyer, during offset, must restore the VAT if he accepted it for deduction upon prepayment. Letter of the Ministry of Finance dated April 1, 2014 No. 03-07-R3/14444 is about this.

Conditions for deducting tax on advances issued

When calculating the tax on the advance payment received, the seller issues an invoice for it and sends 1 copy of it to the buyer. Based on this document, the buyer has the right to take into account the amount of tax allocated in it as deductions (clause 12 of article 171 of the Tax Code of the Russian Federation). Although he may not do this, since deductions are not an obligation, but are made voluntarily (clause 1 of Article 171 of the Tax Code of the Russian Federation). It is better to consolidate the taxpayer’s position regarding deductions for advances issued (whether they will be applied or not) in some document (for example, in the VAT accounting policy).

However, these 2 circumstances (payment and invoice) are not enough for the buyer to deduct it. Additional conditions for carrying out such an operation follow from other provisions of the Tax Code of the Russian Federation:

- a condition on the possibility of transferring an advance payment must be included in the supply agreement (clause 9 of Article 172 of the Tax Code of the Russian Federation);

- The invoice for the advance payment must be dated within the 5-day period allotted for issuing such documents (clause 3 of Article 168 of the Tax Code of the Russian Federation), and have all the required details for it (clause 5.1 of Article 169 of the Tax Code of the Russian Federation).

Acceptance of deductions from the buyer will be reflected in the following posting (for each individual document):

Dt 68/2 Kt 76/VA,

Where:

68/2 - subaccount for accounting for settlements with the budget for VAT on account 68;

76/VA - subaccount for accounting for VAT on advances issued in account 76.

When is VAT required to be restored by law?

The situations are listed in paragraph 3 of Article 170 of the Tax Code. This:

1) Transfer of property (intangible assets and property rights) as a contribution to the authorized capital (or contribution to an investment partnership, share contribution of a cooperative or when replenishing the target capital of an NPO).

The company that received the assets has the right to deduct VAT recovered by the transferring party. Based on documents on the transfer of assets (with the allocation of the VAT amount).

VAT must be restored in the quarter in which the property is actually transferred.

2) The company switches to a special regime: simplified tax system, UTII or PSN (IP)

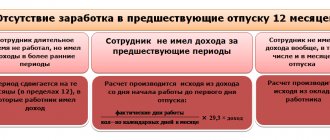

VAT should be restored in the quarter preceding the transition to the special regime. The restored amount of VAT can be recognized as part of other expenses when calculating income tax.

3) The company decided to apply the VAT exemption under Article 145 of the Tax Code.

The procedure for VAT recovery depends on the date of application of such exemption:

If the company applies the exemption from the first month of the quarter, VAT is restored in the previous quarter (before the start of the exemption). If the transition to the exemption is from the second or third month of the quarter, VAT should be restored from the current quarter.

The restored amount of VAT can be recognized as part of other expenses when calculating income tax.

4) The company received budget investments or subsidies to compensate for previously incurred expenses for the acquisition of assets and payment for work (or services).

5) The company's assets began to be used for transactions that are not subject to VAT - not subject to taxation, exempt from taxation, not recognized as sales for VAT purposes.

Non-VAT-taxable transactions and conditions are listed in Article 149, paragraph 2 of Article 146 of the Tax Code.

VAT is reinstated in the quarter in which assets began to be used in non-VAT-taxable transactions. The restored amount of VAT can be recognized as part of other expenses when calculating income tax.

In general, the amount of “input” VAT that the company previously declared for deduction is restored in proportion to the book value of the assets. Which is determined according to accounting data - taking into account accrued depreciation at the time of transition. Without taking into account revaluation.

A special procedure has been established for real estate and for adjusting VAT when receiving budget funds.

VAT accounting for the supplier

Let's consider an example of how the 1C:Accounting 8 program, edition 3.0, reflects operations for accounting for VAT from a supplier when returning advances received to the buyer.

Please note that in accordance with Federal Law No. 303-FZ dated 08/03/2018, VAT tax rates changed from 01/01/2019: from 18% to 20%; from 18/118 to 20/120 and from 15.25% to 16.67%.

Example 1

| Trading House LLC (seller) entered into an agreement for the supply of goods with Clothes and Shoes LLC (buyer) for a total amount of RUB 180,000.00. (including VAT 20% - RUB 30,000.00) on the terms of full advance payment. After receiving the advance payment, the supply contract was terminated and the advance payment amount was returned to the buyer. The sequence of operations is given in Table 1. |

Table 1

Issuing an invoice for payment to the buyer

To perform operation 1.1 “Issuing an invoice to the buyer” (section Sales - subsection Sales), you need to use the Create button to create a new document Invoice to the buyer.

Receiving advance payment from the buyer

To perform operation 2.1 “Receiving advance payment from the buyer”, you need to create a document Receipt to the current account based on the document Invoice to buyer by clicking the Create based button.

The indicators of the document Receipt to the current account are filled in automatically based on the information in the document Invoice to the buyer.

In addition, in the document Receipt to the current account you must indicate:

- in the fields According to document No. and from - the number and date of the buyer’s payment order;

- in the Amount field - the actual amount of the prepayment received.

As a result of posting the document Receipt to the current account, the following accounting entry is generated:

Debit 51 Credit 62.02 - for the amount of money received by the seller from the buyer.

In accordance with paragraphs 1, 3 of Article 168 of the Tax Code of the Russian Federation, the buyer of goods who has transferred the prepayment amount must be issued an invoice no later than 5 calendar days, counting from the date of receipt of the prepayment.

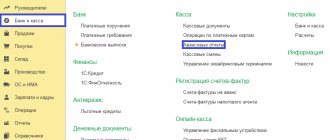

An invoice for the received prepayment amount (operations 2.2 “Creating an invoice for the amount of prepayment”, 2.3 “Calculation of VAT on the received prepayment”) in the program is generated on the basis of the document Receipt to the current account using the Create based button. Automatic generation of invoices for advances received from customers can also be done using the processing Registration of invoices for advance payments (section Banks and cash desk - subsection Registration of invoices).

In the new document Invoice issued

basic information will be filled in automatically according to the base document:

- in the from field - the date of preparation of the invoice, which by default is set to the same date as the date of generation of the document Receipt to the current account;

- in the Counterparty, Payment document No. and from fields - the relevant information from the basis document;

- in the Invoice type field – the value For advance;

- in the tabular part of the document - the amount of the received prepayment in the amount of 180,000.00 rubles, the VAT rate in the amount of 20/120 and the amount of VAT in the amount of 30,000.00 rubles.

In addition, the following will be automatically entered:

- in the Transaction type code field - value 02, which corresponds to payment, partial payment (received or transferred) on account of upcoming deliveries of goods (work, services), property rights (Appendix to the order of the Federal Tax Service of Russia dated March 14, 2016 No. ММВ-7-3/ [email protected] );

- the Compiled switch is moved to the position On paper, if there is no valid agreement on the exchange of electronic invoices, or In electronic form, if such an agreement has been concluded;

- flag Issued (transferred to the counterparty) indicating the date - if the invoice is transferred to the buyer and is subject to registration. If there is an agreement on the exchange of electronic invoices before receiving confirmation from the EDI operator, the checkbox and date of issue will be absent. If the date of transfer of a paper invoice to the buyer is different from the date of preparation, then it must be adjusted;

- The Manager and Chief Accountant fields are data from the Responsible Persons information register. If the document is signed by other responsible persons, for example, on the basis of a power of attorney, then it is necessary to enter the relevant information from the directory Individuals.

For the correct preparation of an invoice, as well as the correct reflection of the document in the accounting system, it is necessary that in the Nomenclature field of the tabular part of the document the name (or generic name) of the goods supplied is indicated in accordance with the terms of the contract with the buyer.

This information is filled in automatically indicating:

- names of specific product items from the document Invoice to the buyer, if such an invoice was previously issued;

- a generic name, if such a generic name was defined in the agreement with the buyer.

By clicking the Print document Invoice issued button, you can go to view the invoice form and then print it in two copies (Fig. 1).

Rice. 1. Invoice for prepayment issued to the seller

The invoice for the prepayment amount received shall indicate:

- in line 5 - details (number and date of preparation) of the payment and settlement document (clause “h” of clause 1 of the Rules for filling out an invoice, approved by Resolution No. 1137);

- in column 1 - the name of the goods supplied (description of work, services), property rights (clause “a”, clause 2 of the Rules for filling out an invoice, approved by Resolution No. 1137);

- in column 8 - the amount of tax calculated on the basis of the tax rate determined in accordance with paragraph 4 of Article 164 of the Tax Code of the Russian Federation (clause “z” of paragraph 2 of the Rules for filling out an invoice, approved by Resolution No. 1137);

- in column 9 - the amount of advance payment received (clauses “and” clause 2 of the Rules for filling out an invoice, approved by Resolution No. 1137);

- in lines 3 and 4 and columns 2–6, 10–11 - dashes (clause 4 of the Rules for filling out an invoice, approved by Resolution No. 1137).

As a result of posting the document Invoice issued, an accounting entry is generated:

Debit 76.AB Credit 68.02 - for the amount of VAT calculated on the amount of advance payment received from the buyer in the amount of RUB 30,000.00. (RUB 180,000.00 x 20/120).

Based on the issued Invoice document, an entry is made in the information register of the Invoice Log.

Despite the fact that since 01/01/2015, taxpayers who are not intermediaries (forwarders, developers) do not keep a log of received and issued invoices, register entries in the Invoice Log are used to store the necessary information about the issued invoice.

Based on the document Invoice issued, a registration entry is made in the Sales VAT

.

Based on the entries in the VAT Sales register, a sales book is generated for the first quarter of 2022 (section Reports - VAT subsection), Fig. 2.

Rice. 2. Sales book for the first quarter of 2022 from the seller

The amount of VAT accrued from the prepayment received is reflected in line 070 of Section 3 of the VAT tax return for the first quarter of 2019 (approved by order of the Ministry of Finance of Russia dated October 29, 2014 No. ММВ-7-3/ [email protected] as amended by the order of the Federal Tax Service of Russia dated December 28, 2014 .2018 No. CA-7-3/ [email protected] ) (section Reports - subsection 1C-Reporting - hyperlink Regulated reports).

Refund of received advance payment

To perform operation 3.1 “Return of advance payment to the buyer”, you must create a document Write-off from the current account.

You can create this document based on the document Receipt to current account by clicking the Create based on button.

The document Write-off from a current account can also be created based on downloading from other external programs (for example, “Client-Bank”). If payment orders are created in the Client-Bank program, then it is not necessary to create them in the 1C: Accounting 8 program. In this case, only the document Write-off from the current account is entered, which generates the necessary transactions.

As a result of posting the document Write-off from the current account, the following accounting entry will be generated:

Debit 62.02 Credit 51 - for the amount of advance payment returned to the buyer in connection with termination of the supply agreement.

Amounts of VAT calculated by the seller and paid to the budget from payment amounts, partial payment for upcoming deliveries of goods (work, provision of services) sold in the Russian Federation are accepted for tax deduction in the event of a change in conditions or termination of the contract and the return of the corresponding amounts of advance payments (Clause 5 of Article 171 of the Tax Code of the Russian Federation).

Deductions of VAT amounts are made in full after the corresponding adjustment operations in connection with the return of goods or refusal of goods (work, services) are reflected in the accounting records, but no later than one year from the date of return or refusal (clause 4 of Article 172 of the Tax Code of the Russian Federation) .

Submitting for tax deduction the amount of VAT calculated on the received advance payment (operation 3.2 “Deduction of VAT calculated on the received advance payment”) is carried out using the document Generating purchase ledger entries (section Operations - subsection Closing the period - hyperlink Regular VAT operations) using the Create command .

Data for the purchase book on tax amounts to be deducted in the current tax period are reflected on the Advances received tab.

To fill out a document using accounting system data, it is advisable to use the Fill command.

As a result of posting the document Formation of purchase ledger entries, an accounting entry is generated:

Debit 68.02 Credit 76.AB - for the amount of VAT claimed for tax deduction in connection with the termination of the supply agreement and the return of advance payment.

To create a purchase book, an entry is made in the Purchase VAT accumulation register.

Based on the entries in the VAT Purchases register, a purchase book is generated for the tax period in which the contract was terminated and the amount of advance payment was returned to the buyer, i.e. for the second quarter of 2022 (section Reports - VAT subsection), fig. 3.

Rice. 3. Purchase book for the second quarter of 2022 from the seller

When registering the advance invoice in the purchase book, the following will be indicated:

- in column 2 - transaction type code 22, which corresponds to the operation for the return of advance payments in the cases listed in paragraph 2 of paragraph 5 of Article 171 of the Tax Code of the Russian Federation (Appendix to the order of the Federal Tax Service of Russia dated March 14, 2016 No. ММВ-7-3 / [email protected] );

- in column 7 - details of the document confirming the return of the advance payment to the buyer (clause “k”, clause 6 of the Rules for maintaining a purchase ledger, approved by Resolution No. 1137);

- in column 15 - the entire amount of the invoice from column 9 on the line “Total payable” (clause “t”, paragraph 6 of the Rules for maintaining a purchase ledger, approved by Resolution No. 1137);

- in column 16 - the amount of VAT that the seller claims for tax deduction (clause “y” of clause 6 of the Rules for maintaining a purchase ledger, approved by Resolution No. 1137).

The amount of the tax deduction will be reflected on line 120 of Section 3 of the VAT return for the second quarter of 2022 (approved by order of the Ministry of Finance of Russia dated October 29, 2014 No. ММВ-7-3 / [email protected] as amended by order of the Federal Tax Service of Russia dated December 28, 2018 No. SA-7-3/ [email protected] ) (section Reports - subsection 1C-Reporting - hyperlink Regulated reports).

Restoration of VAT on real estate

On real estate, VAT is restored not at once, but in equal shares over 10 years.

The 10-year period is counted from the year in which real estate depreciation began. And VAT needs to be restored only in those years when the property was used in non-VAT-taxable transactions. For other years (when the object was used in VAT-taxable activities), it is not possible to recover VAT. The technique is simple. Once you understand the examples, there will be no difficulties in the calculations.

If the property is fully depreciated or more than 15 years have passed since it was put into operation, there is no need to restore VAT on it.

Restoration of VAT previously accepted for deduction in 1C 8.3

Let's consider an example of VAT restoration in 1C 8.3 on goods that were used for non-productive needs of the enterprise.

Let's say an organization held a gala evening. For these purposes, utensils purchased earlier were used. When purchasing tableware with VAT, the goods were entered into the warehouse, paid, an invoice was received from the supplier and VAT was claimed for deduction in 2015. That is, earlier in 1C 8.3 a VAT posting was generated: Dt 68.02 Kt 19.3.

For the evening, the dishes were written off from the warehouse: Dt 91 Kt 10.3. This means that part of the VAT on previously capitalized dishes should be restored, that is, returned to the budget, since this product was not used for production purposes.

First of all, in 1C 8.3 we make an entry in the VAT recovery operation. Using the Add button, select the supplier of this product:

and the invoice on which this item was received:

In 1C 8.3, a complete list of all invoices received from a given supplier opens. Having selected the desired invoice, add it to the list.

Next, fill in all the details. We set the amount for which VAT was restored manually based on the Write-off Certificate, that is, for what amount the dishes were released from the warehouse. For example, this is 500,000 rubles. Accordingly, VAT for restoration will be 90,000 rubles = 500,000 * 18%:

If there is no invoice, let’s say the storage period has expired, then entries in the Sales Book can be made using an accounting certificate with the calculation of the amount of VAT to be restored.

In 1C 8.3, VAT can be restored for all documents and transactions listed in the list that opens when filling out the document. All operations are written similarly:

The result is a wiring:

It is also necessary to restore VAT on previously acquired or constructed real estate that is used for non-production purposes. The mechanism for filling out the document is similar to the example above.

Subsidies and VAT

The effect of received budget funds on the payment of VAT directly depends on the purpose of these subsidies.

- If subsidies are received to reimburse (finance) expenses: a VAT tax deduction for goods (work, services) purchased through subsidies is not claimed. Or restored if previously accepted.

- If subsidies are received to compensate for lost income: upon receipt they are included in the VAT tax base. VAT deductions for purchased goods (works, services) are recognized in the general manner and cannot be restored.

- If subsidies are received to compensate for lost income when applying state-regulated prices or benefits to individual consumers in accordance with the law : such subsidies are not included in the tax base, VAT deductions for purchased goods (works, services) are recognized in the general manner and cannot be restored.

When adjusting (restoring) VAT upon receipt of budget funds, the calculation takes into account the type of reimbursed expenses (taxable or non-taxable), their volumes, the period of receipt, and the share of reimbursement of expenses through subsidies is calculated. Also a simple formula.

Pros and cons of deducting VAT on advances issued

The positive aspects of the use of such deductions occur with significant amounts of advances issued and manifest themselves as follows:

- A large deduction amount can not only significantly reduce the total of the declaration drawn up for the period of its application, but also make it result in the amount of tax reimbursement from the budget.

- A deduction for an advance on account of several deliveries for it is made one-time, ahead of time and in a larger amount than deductions would be made for each of the deliveries separately. At the same time, VAT restoration occurs in parts and can be extended over several tax periods.

On the plus side, there are also conditions for payment of only part of the delivery using the transferred advance payment. In this case, deductions for the advance payment issued and for the delivery document will occur earlier and will be taken in full, and the VAT restoration will be made only in part of these amounts and will be extended over time.

The following points will be negative:

- increasing the volume of accounting operations and document flow;

- there is no point in using deductions for advances if we are talking about small amounts and the period for transferring the advance often coincides with the period of shipment for it.

Read about the rules for issuing invoices for advance payments here.

Write-off of assets: fixed assets, goods, materials

Until 2022, the issue of restoring VAT when writing off fixed assets, goods, and materials remained acute and controversial. But under the pressure of court decisions - most of them taken in favor of business - the regulatory authorities sharply changed their position to the opposite. (Bravo!). And they secured it with letters: Ministry of Finance dated March 2, 2022 No. 03-03-06/1/13389 and Federal Tax Service dated April 16, 2022 No. SD-4-3 / [email protected]

Arbitration practice over the years has clearly confirmed that when fixed assets are liquidated before the end of their useful life due to physical or moral wear and tear, or when goods or materials are written off, there are no grounds for VAT recovery. Since this is not provided for in paragraph 3 of Article 170 of the Tax Code.

The controllers butted heads for a long time, but finally agreed to this: Paragraph 3 of Article 170 of the Tax Code establishes cases in which tax amounts are subject to restoration. In cases not listed in paragraph 3 of Article 170, VAT amounts are not subject to recovery. (Quote from a letter from the Ministry of Finance)

You will not have to recover VAT in the event of an accident, fire, natural disaster or other loss of property due to circumstances beyond the control of the company. And also when the shelf life expires or due to natural loss.

It does not matter on what basis the assets were written off. The main thing is that they were purchased for VAT-taxable activities.

Also catch current letters from the Ministry of Finance of Russia dated May 15, 2022 No. 03-07-11/34572, dated March 15, 2022 No. 03-03-06/1/15834 and the Federal Tax Service dated May 21, 2015 No. GD-4- 3/ [email protected] /.

This is the general case, but the specifics may be different.

In the recent ruling of the Supreme Court dated December 21, 2022 No. 306-KG18-13567, a special clause was noted that the company does not lose the right to deduct VAT if the inability to use fixed assets is due to the occurrence of unfavorable events, and not the taxpayer’s refusal to conduct business.

For example, if fixed assets were liquidated voluntarily - for example, in connection with the cessation of any type of activity, or in connection with the liquidation of a company - the tax office may require VAT restoration.

Recovered VAT - what is it?

The question of VAT restoration arises in relation to tax previously taken into account in deductions. This needs to be done in several situations (clause 3 of Article 170 of the Tax Code of the Russian Federation), the most common of which are:

- changes in tax conditions;

- change in the situation with the advance payment.

The main condition for the restoration of VAT: first, the tax is accepted for deduction, and then, due to some circumstances, it turns out that all of it (or part of it) must be paid to the budget. In this case, the required amount of tax is restored (accrued for payment) and reflected in section 3 of the declaration either in 1 line (080) or in two lines (090 or 100 and in the final 080). The recovery of VAT on advances issued is recorded in two of its lines: 080 and 090.

For information on tax recovery situations not related to advances issued, read the material “The nuances of VAT recovery and what entries are used?” .

And again the focus is on tax benefits

In their letters, the Ministry of Finance and the Federal Tax Service, including on issues of VAT restoration, refer to the position of the arbitrators given in paragraph 10 of the Resolution of the Plenum of the Supreme Arbitration Court dated May 30, 2014 N 33 “On some issues that arise in arbitration courts when considering cases related to the collection of tax for added value."

Controllers have changed tactics: all cases of asset write-off are now closely studied through the prism of unjustified tax benefits.

Now, for each fact of write-off of property, companies themselves have to prove that the disposal of assets was facilitated by circumstances beyond its control. And stock up on relevant documents and confirmations.

Tax authorities and courts are ordered to:

- evaluate the accuracy and completeness of the submitted documents on the disposal of property,

- investigate and take into account the circumstances of disposal, the nature of the taxpayer’s activities and the conditions of its business,

- take into account the compliance of the volume and frequency of disposal of property with the level usual for such activities,

- assess the likelihood of disposal of property for reasons specified by the company,

- evaluate the excessiveness of losses and the validity of the arguments presented.

All this must be taken into account and documents must be prepared to defend your position. If the tax authorities cannot prove that the company’s actions are aimed at obtaining an unjustified tax benefit, there will be no need to restore VAT when writing off assets.

And further. When writing off assets, courts pay attention to the completeness and correctness of supporting primary documents. Reliable evidence of damage, loss, evidence of their disposal. The bigger, the better.

What are these: orders to create commissions and conduct an inventory in connection with an event that resulted in damage or loss, acts of write-off, acts of damage, of combat, of breakdowns, of the occurrence of events, orders of approval of acts, inventory sheets, documents of disposal.

For write-off acts, you can use both unified forms, and you can develop and approve your own forms of primary documents in the order on accounting policies. From January 1, 2013, the use of unified forms is not mandatory, but the documents developed by the company - to be recognized as full-fledged primary ones - must contain the necessary details and information.

Write-off of accounts receivable

As a general rule, if the contractor returns the advance payment to the customer, he must restore VAT from the advance payment previously accepted for deduction.

But there are situations when the company paid an advance, but the contract was not fulfilled for various reasons and the advance was not returned. Accounts receivable are stuck.

So, the Ministry of Finance believes that when such a “debt” is written off, the VAT on the advance payment, previously accepted for deduction, must be restored. And he even issued a number of categorical letters on this topic: dated 06/05/2018 N 03-07-11/38251 and dated 06/23/2016 N 03-07-11/36478. The motive is this: the services were not provided and there is no right to a deduction for them.

Courts take a business position: The Tax Code does not contain provisions according to which, in the event of termination of a contract or non-fulfillment, the taxpayer is obliged to restore VAT on the amounts of a previously issued advance.

If you find yourself in such a situation, check out the useful resolutions: AS of the Volga District dated November 16, 2016 No. A65-27794/2015 and AS of the West Siberian District dated March 12, 2022 No. A27-27184/2016.

Accounting

How to reflect the operation “VAT previously accepted for deduction has been restored” - the posting depends on the circumstances.

Option #1

In general, record the following entries in your accounting records:

- Dt 19 Kt 68-02 - VAT on property, property rights, intangible assets used in non-taxable transactions has been restored;

- Dt 20, 26, 44, 91-2 Kt 19 - the restored tax is included in the expenses of the corresponding category.

Prepare these postings if:

- the asset is used in non-taxable transactions;

- tax exemption received;

- a transition to simplified (special) tax regimes was carried out;

- budget subsidies and investments have been received.

Option No. 2

If the restoration needs to be carried out from the amount of the advance (prepayment), make the following entries:

- Dt 60, 70 Kt 68 - the tax on the advance amount has been restored.

Reflect this entry if input VAT was taken into account in full, forgetting about the deduction for the advance payment. And also if the counterparties returned the advance to you due to termination of the contract or change in its terms.

Option No. 3

If the cost of a product, work, or service was reduced as a result of receiving a discount from the seller, reflect:

- Dt 19 Kt 60 REVERSE - reflects the tax related to the discount;

- Dt 68-02 Kt 19 REVERSE - the amount of the declared deduction in the amount of tax related to the discount from the seller (supplier, contractor, performer) has been reduced.

If the decrease in value arose as a result of an accepted claim, reflect:

- Dt 76-2 Kt 68-02 - the tax was restored to satisfy the claim against the supplier, contractor, seller.

And if the reorganization

Who must pay VAT in the case when a legal entity created by separation (successor) receives assets from its predecessor upon creation under a transfer deed, and subsequently uses them in VAT-free activities.

According to the current legislation - the Tax Code - no one. The legal predecessor does not have to “restore” VAT. When transferring property, there is no obligation to restore VAT. And such a transfer itself is not recognized as an object of VAT taxation.

The legal successor also has no obligation to charge VAT or restore VAT: VAT is restored by the one who applied the deduction.

There are no legal opportunities to get hold of VAT restoration. But everyone knows that business willingly uses this legislative gap to optimize taxation, including in the well-known scheme for transferring property: when you need to sell property, but don’t want to pay taxes: you “transfer” the property to a new legal entity and sell a share in the authorized capital .

But the controllers have a different opinion. The position of the Ministry of Finance is expressed in letters dated May 3, 2022. No. 03-07-11/29894 and dated April 05, 2022 No. 03-07-11/20201. And it is categorical: if the legal successor uses the received assets for VAT-free transactions, he must restore the VAT accepted for deduction by the legal predecessor.

And the Supreme Court (determination dated October 17, 2014 N 307-KG14-1534, and regional courts on the side of taxpayers: Resolution of the Arbitration Court of the East Siberian District dated March 23, 2016 N F02-1379/2016, Resolution of the Volga-Vyatka District Arbitration Court dated 27 February 2015 N A17-3124/2014, FAS of the North-Western District dated April 30, 2014 N A52-1617/2013, West Siberian District dated March 14, 2014 N A81-2538/2013, dated June 20, 2022 N A27 -15970/2016, Ural District dated February 25, 2014 N F09-495/14).

The courts' conclusion: the assignee should not restore VAT, since he did not claim the deduction. The obligation to restore VAT in the cases specified in paragraph 3 of Article 170 lies with taxpayers who previously accepted the tax as a deduction. Yes, that's logical.

But if the tax authorities prove the receipt of an unjustified tax benefit for the purpose of non-payment of VAT, reveal the control and interdependence of companies, establish the formality or absence of a business purpose for the reorganization, the judges will support the auditors. There is also such a ruling of the Supreme Court of the Russian Federation dated October 9, 2022. N 305-KG16-7109.

How to recover VAT during reorganization, and who should do it, is still a controversial issue. There is a strange opinion of the court, which, having assigned the obligation to restore VAT to the successor, motivated this by the fact that “ not a single norm of Ch. 21 of the Tax Code of the Russian Federation does not exempt an organization from VAT restoration when switching to a special regime solely on the grounds that before the transition the legal entity carried out a reorganization. A different interpretation of the legal norms would mean that in order to avoid the restoration of VAT when switching to a special regime, the taxpayer would only need to carry out a reorganization.” Yes, a strange interpretation of legal norms... Fortunately, I have found one such “original” solution...

It is possible that the issue of restoring VAT in connection with the reorganization will be resolved in the near future. Bill No. 720839-7 with large-scale changes to the Tax Code is currently under consideration in the State Duma. Among others, it is proposed to define a special procedure for the restoration of VAT amounts accepted for deduction by the reorganized organization: to assign the obligation to restore VAT to the successor in the event of a transition to special taxation regimes.

Or maybe this bill will not pass? Or will it be returned for revision? We keep it under control. Autumn session of legislators.