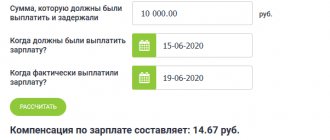

How is the amount calculated? In case of late payment of wages or other amounts established by the payment system

Valuation of intangible assets is a comprehensive assessment of assets that do not have physical expression, but

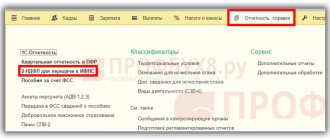

The register of 2-NDFL certificates and a set of certificates on the income of individuals are formed by employers when compiling the annual

Why is a supplementary SZV-M needed? A supplementary SZV-M allows the employer to clarify and supplement previously transmitted

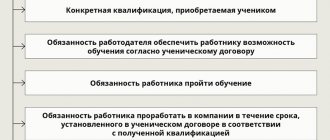

Training an employee at the expense of the employer according to the Labor Code of the Russian Federation. Article 196 of the Labor Code states that

Who grants the right to property tax exemption? Certain categories of taxpayers are given the right

Simply and with examples of why VAT is not a business expense, with

Correspondence 20 accounting accounts Let's consider typical entries: DT20 KT10 - materials written off. DT10

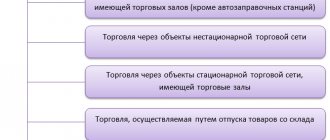

Form TS-2 is used by those who pay the trade tax (TC) if they cease to be his

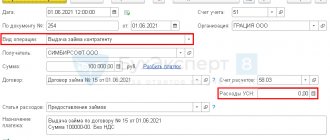

Step-by-step instructions June 01 The organization transferred a loan in the amount of 100,000 rubles to the counterparty. By