Hello, Vasily Zhdanov, in this article we will consider the calculation of intangible search assets of an enterprise. Organizations engaged in the development of natural resources and carrying out activities to search for and develop mineral deposits in the course of their activities incur so-called “exploration” expenses. Such costs are associated with the expenditure of fixed assets (tangible assets) and intangible assets. Intangible exploration assets in the balance sheet of the enterprise are reflected in account 08, subaccount “Investments in non-current assets”.

What are intangible exploration assets on the balance sheet: concept, varieties

Exploration assets are funds invested by the company in organizing activities for the search, exploration and development of mineral deposits, in the exploration of mineral resources in the subsoil and in assessing the economic feasibility of mining mineral resources in a certain territory.

Take our proprietary course on choosing stocks on the stock market → training course

The company’s “search” assets are divided into tangible and intangible. The first includes tangible objects - fixed assets and materials. Intangible exploration assets are understood as assets that do not have a tangible form, but are used in carrying out prospecting, exploration and evaluation work at mineral deposits. Non-current assets are non-current assets that are not related to the purchase or independent creation of tangible objects.

The following assets of an enterprise can be classified by an accountant as intangible exploration assets:

- recorded results of fossil sampling;

- results of exploration drilling activities;

- information obtained during topographical, geophysical and geological research (and any other useful geological information about the subsoil);

- the right to carry out activities for exploration of minerals, assessment of their deposits, search for minerals (subject to the company having the appropriate license);

- the results of assessment activities carried out to determine the degree of feasibility of mining in terms of expected commercial benefits or the likelihood of obtaining them.

Important! Reimbursable tax payments, as well as general and similar expenses cannot be taken into account as actual costs incurred for the purchase and creation of intangible exploration assets (except for cases where such costs are directly related to the search and evaluation of mineral deposits and can be attributed to a specific subsoil area where prospecting and appraisal work is being carried out).

Line 1130 may reflect the costs of searching, exploration and evaluation of deposits (costs of purchasing or independently creating exploration assets), the list of which includes the following costs:

- costs of making payments under an agreement with the seller;

- the company’s obligations that arise due to the implementation of activities for the search, exploration and evaluation of deposits related to recognized legal acts (these are obligations for the liquidation of structures, buildings, equipment, as well as for land reclamation, and environmental protection);

- remuneration of contractors and other contractors whose work is paid due to the need to carry out prospecting, exploration and evaluation activities in relation to mineral deposits;

- expenses for remuneration of employees whose work is directly to create legal acts;

- monetary rewards from third parties for mediation in the company’s purchase of legal entities;

- depreciation charges for non-current (including exploration) assets that were used when the enterprise created legal acts;

- payment for specialist consultations and information resources related to the creation or purchase of legal acts;

- duties (patent, government, customs duties and fees), tax deductions that are not refundable;

- other costs that are directly related to the purchase or creation of legal acts or to ensuring proper conditions for its use by the company for the purposes specified by it.

Acceptance of costs in company accounting

The organization independently decides on the distribution of costs incurred between intangible exploration assets and ordinary activities. The decision made must be recorded in the company's accounting policies.

In the accounting of a company, legal acts are accepted at the cost of all actual costs incurred for their creation, namely:

- the cost of goods and services of suppliers according to the contract of sale and purchase of legal acts;

- the cost of work performed under construction contracts and other agreements;

- payment for information and consulting services;

- payment of mandatory customs duties;

- taxes and duties, the further reimbursement of which is not possible;

- the amount of depreciation charges in the company’s non-current assets used in the formation of a new intangible exploration asset;

- remuneration of employees involved in the process of forming legal acts;

- fulfilled obligations of the company in relation to environmental protection, liquidation of buildings and structures related to the implementation of prospecting and exploration activities in the subsoil, as well as mineral exploration;

- funds spent on acquiring a license to perform work on intangible exploration assets.

Line 1130 of the balance sheet contains information about the actual costs of creating intangible assets, taking into account depreciation charges as of December 31 of the reporting year, the previous one and the previous one, i.e. The balance sheet line reflects the residual value of intangible exploration assets as part of the company's non-current assets. An increase in the indicator, as a rule, indicates a positive trend.

Which business entities keep records of intangible exploration assets?

The accounting of an enterprise will include information about intangible exploration assets if it periodically incurs costs for conducting prospecting and exploration work in terms of assessing mineral deposits in a selected subsoil area.

At the same time, companies have the right, at their discretion, to distribute search costs in the balance sheet between their non-current assets (including legal and regulatory assets) and costs for ordinary activities. The decision taken by the management of the enterprise must be properly recorded for accounting purposes in the accounting policies of the company.

Nuances of accounting for search assets

General accounting rules also apply to exploration assets (PBU 24/2011). Tangible search assets are accounted for in the same way as fixed assets, while intangible ones are accounted for in the same way as other non-search intangible assets. For them, the PBU provides special subaccounts of account 08 “Investments in non-current assets”. If there are several plots of land under study, you need to open a separate sub-account for each of them.

Recognition of search assets

These assets are recognized as a separate section of accounting when the organization has a license for this type of activity.

REMINDER! The license itself is an intangible search asset.

The assessment is based on the funds actually spent on a particular asset. The initial accounting of a prospecting asset is maintained using the following entries:

- debit 08 “Investments in non-current assets”, subaccount “Investments in exploration assets”, credit 10 “Materials” (20, 23, 60, 69, 70, etc.) – the initial cost of the exploration asset has been formed;

- debit 08, subaccount “Tangible exploration assets” (or “Intangible”) - this asset is taken onto the balance sheet.

Depreciation of exploration assets

It occurs in the same way as depreciation of fixed assets or intangible assets. It is recommended to open a special subaccount for account 02 “Depreciation”.

FOR YOUR INFORMATION! The useful life of a search asset of any group is determined by the organization itself and fixed in its accounting policies.

The wiring will look like this:

- debit 23 “Auxiliary production”, subaccount “Expenses for ordinary activities”, credit 02 “Depreciation of fixed assets”, subaccount “Depreciation of exploration assets” - depreciation of exploration assets.

IMPORTANT RULE! If an asset was first used on one plot of land and then transferred to another, then depreciation on it must be recorded against the creation of a new asset on the next plot of land. This type of accounting is typical for all cases where one asset was used to create other assets.

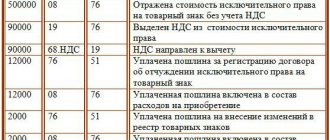

How is the value calculated on line 1130 (intangible exploration assets on the balance sheet): formula

On line 1130 of the Balance Sheet, it is customary to reflect the company’s expenses incurred for prospecting, exploration of minerals in a selected subsoil area, and evaluation of their deposits (taking into account revaluation, depreciation, and depreciation). Information must be provided as of the reporting date and the last day (December 31) of the previous year and the year preceding it.

The value for line 1130 “Intangible exploration assets” can be found using the calculation formula below:

How to reflect intangible search assets in accounting

Accounting for intangible exploration assets is carried out on account 08, subaccount “Investments in non-current assets”. The accountant must reflect the legal acts on line 1130 “Intangible exploration assets” as part of non-current assets at their residual (book) value. Depreciation is calculated in the same way. The “Explanations” column is used by accountants to disclose the indicator on line 1130.

Important! In general, the indicators on line 1130 as of December 31 of the previous and preceding years can be transferred from the balance sheet for the previous period.

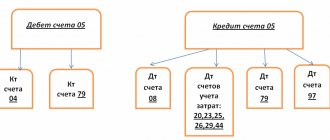

The procedure for accounting for intangible exploration assets is described in the diagram below:

Composition and structure of non-current assets

The composition of the non-current assets of the enterprise is detailed in different ways by different documents of the Ministry of Finance of the Russian Federation:

- by order No. 43n dated 07/06/1999, which approved PBU 4/99, dedicated to the methodology for compiling accounting reports, non-current assets included intangible assets, fixed assets (with the inclusion of non-refundable assets), profitable investments in materiel and financial investments;

- by order No. 94n dated October 31, 2000, which approved the chart of accounts, non-current assets are divided into fixed assets (with the allocation of income-generating investments), intangible assets, depreciation of fixed assets and intangible assets, capital investments in them (with the allocation of equipment requiring installation) and ONA;

- By order No. 66n dated 07/02/2010, containing the latest form of balance sheet recommended for use, these assets are divided into 9 articles: intangible assets, R&D, intangible and tangible exploration assets, fixed assets, profitable investments in materiel, financial investments, non-current assets and other non-current assets .

There are no contradictions between them, but the concept of non-current assets for the purposes of its reflection in the balance sheet still needs to be clarified. Non-current assets on the balance sheet are the company’s own property, which for a long time (more than a year) is used in its main activities in order to generate income. The components of non-current assets are:

- NMA;

- OS;

- unfinished investments in their creation;

- financial investments;

- SHE.

ONA (account 09), which are temporary differences in income tax that arise due to a discrepancy between accounting and tax data, is a rather random phenomenon for non-current assets . They do not correspond to the meaning of a non-current asset either in essence (this is not property, but a certain estimated amount of tax), or in terms of duration of existence (they may not be long-term). Not all organizations use them, and they, as a rule, do not play a significant role in non-current assets , so we will not dwell on them.

To learn how and when temporary differences are formed, read the article “What is deferred income tax and how to account for it?”

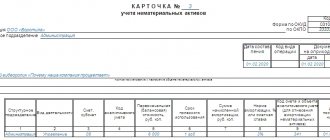

How to fill out line 1130 “Intangible search assets”: example

Let's consider the procedure for filling out line 1130 of the Balance Sheet using the example of the non-existent StarLight LLC, which has a license (obtained in 2012) to conduct prospecting, exploration and appraisal work on mineral deposits.

The company spent a total of 598 million rubles on obtaining a permit, and in 2014 the company transferred it to intangible assets (since, based on the results of the work carried out, a decision was made on the commercial feasibility of mining the mineral).

So, line 1130 of the StarLight enterprise will be filled in as follows:

How to write off intangible exploration assets

Depending on the results of the organization’s work in searching for mineral deposits, their exploration and commercial assessment, write-off of legal acts can be carried out in one of the 3 ways listed in the table:

| Option to write off intangible exploration assets | In what cases is this method of writing off legal acts applied? |

| Formation of the actual cost of the company's fixed assets | If a certain well, based on the results of geological exploration activities, is recognized as a fixed asset of the enterprise, the costs of such work can be taken into account when determining the actual cost of such a well. |

| Write-off as other expenses (account 91, subaccount “Other expenses”) | This write-off method is relevant for cases when the extraction of mineral resources in some subsoil area is considered unpromising by the enterprise. |

| Transfer of legal acts to intangible assets (to account 04) | For cases when the extraction of mineral resources in a certain subsoil area is recognized as commercially feasible. |

Derecognition of exploration assets

You are required to derecognise the search asset and write it off from account 08 if:

- the commercial feasibility of resource extraction in this area has been confirmed;

- Mining of minerals for one reason or another has been recognized as unpromising.

Each of the above decisions must be documented and documented in a corresponding report. If the feasibility of production is recognized as economically justified, make an entry Dt 01 Kt 08 for the amount of costs accumulated for this object. Based on this accounting entry, the amount of search expenses will be allocated to the fixed asset item. If we are talking about intangible assets, then the following entry should be made: Dt 04 Kt 08.

In case of unpromising production and its subsequent cessation, write off the amount of costs accumulated under Dt 08 to other expenses: Dt 91.2 Kt 08.

Example No. 1. Neft Prom JSC received a license to search for oil deposits in the B-34 area. In September 2022, Neft Prom hired a contractor, Techno Global LLC, to drill a well. Cost of services (7,342,500 rubles, VAT 1,120,042 rubles) to the contractor 09/13/17. Based on the results of prospecting work carried out in September-October 2022, the well was declared unproductive and abandoned on 10/22/17. The cost of work to abandon the well was paid in favor of Techno Global LLC (481,300 rubles, VAT 73,419 rubles).

The following entries were made in the Neft Prom accounting:

| date | Debit | Credit | Sum | Description |

| 13.09.17 | 08 | 60 | RUR 6,222,458 | The cost of the work of Techno Global LLC is reflected (RUB 7,342,500 -RUB 1,120,042) |

| 13.09.17 | 19 | 60 | RUB 1,120,042 | The amount of VAT on the cost of drilling a well is taken into account |

| 13.09.17 | 68 VAT | 19 | RUB 1,120,042 | VAT is accepted for deduction |

| 22.10.17 | 91.2 | 08 | RUR 6,222,458 | The exploration asset is written off as expenses in connection with well abandonment |

| 22.10.17 | 91.2 | 60 | RUR 407,881 | The cost of the work of Techno Global LLC to abandon the well is reflected (481,300 rubles - 73,419 rubles). |

| 22.10.17 | 19 | 60 | RUR 73,419 | The amount of VAT on the cost of well abandonment work is taken into account |

| 22.10.17 | 68 VAT | 19 | RUR 73,419 | VAT is accepted for deduction |

| 22.10.17 | 09 | 68 Income tax | RUB 1,326,068 | The tax asset is reflected ((RUB 6,222,458 + RUB 407,881) * 20%) |

| 30.11.17 | 68 VAT | 09 | RUR 22,101 | The tax asset was partially repaid (RUB 1,326,068 / 12 months * 20%) |

The most commonly used entries for accounting for intangible exploration assets

The table below shows the most common entries in the accounting of intangible exploration assets:

| Operation | DEBIT | CREDIT |

| Formation of the initial (actual) cost of intangible exploration assets for accounting purposes | 08.11 | 60 |

| Payment of wages to employees of the organization involved directly in the process of creating a legal regulation object | 08.11 | 70, 69, 02, 96… |

| Transfer of legal acts to the section of intangible assets for the purpose of their further exploitation | 04 | 08.11 |

| Write-off of expenses in connection with a decision about the futility of their operation in the future | 91.2 | 08.11 |

Recognizing the commercial viability of resource extraction

If the analysis of exploration data shows positive results and there is documentary evidence of the economic feasibility of production, the company must perform certain actions:

- Transfer existing intangible exploration assets to intangible assets.

Note! In some situations, the price of an intangible exploration asset may influence the formation of the value of the firm's main assets. For example, the costs of geological work for specific wells may form the actual price of the well itself when it is recognized as part of the company's fixed assets. - Stop accounting for subsequent costs incurred in this subsoil area as part of intangible exploration assets.

Note from the author! The write-off of an intangible exploration asset is carried out in the manner of writing off the company's intangible assets.

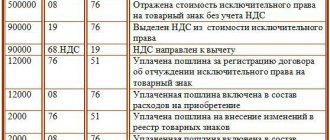

An example of making entries for accounting of legal acts

JSC StarShine acquired the exclusive right to conduct exploration activities in relation to a coal deposit in November of the reporting year at a cost of 350,000 rubles (including the amount of value added tax in the amount of 57,000 rubles). The management of the joint-stock company also paid for consulting services worth 21,000 rubles (excluding VAT). The company's accountant will make the following entries:

| Operation | Amount (rubles) | DEBIT | CREDIT |

| The acquisition of the right to conduct exploration of deposits is reflected | 293 000 | 08.11 | 60 |

| The amount of input VAT is taken into account | 57 000 | 19 | 60 |

| The cost of specialist consultation is taken into account | 21 000 | 08.11 | 76 |

| Accepted for VAT deduction | 57 000 | 68 | 19 |

Answers to frequently asked questions about intangible exploration assets on the balance sheet (line 1130)

Question: Is it possible to take into account on line 1130 expenses for activities to search for mineral deposits, exploration work and evaluation of deposits if the expenses took place before the enterprise received a license to carry out such activities?

Answer: The costs you listed can be attributed to the costs of obtaining a license. However, a condition must be met - the costs must be directly related to obtaining a license. Otherwise, it is not permissible to take into account expenses.

Question: How to determine the amount of expenses actually incurred when purchasing or creating an intangible exploration asset?

Answer: The procedure for determining the amount of actual costs for the purchase/creation of legal acts is described in paragraphs 13-15 of PBU 24/2011.

Intangible and tangible search assets

Search assets (SA): concept

So, enterprises that use subsoil create accounting in accordance with the specifics of the industry, i.e. carrying out search and related work.

Regulates the rules for the formation of such expenses PBU 24/2011 “Accounting for costs for the development of natural resources.”

It applies only to expenses incurred before the likelihood of obtaining economic benefits in excess of the costs incurred has been established and documented.

According to PBU, search assets are divided into:

- material (MPA), i.e. expenses aimed at the manufacture or purchase of an object put into tangible form and used in search activities;

- intangible (IPA), forming similar intangible assets.

All of them are included in non-current assets and are accounted for in separate subaccounts of the same name to the account. 08 “Investments in non-current assets”.

In the balance sheet, PAs are recorded separately from each other: “Intangible exploration assets” in the balance sheet is line 1130, and line 1140 reflects “Tangible exploration assets.”

The costs of forming a PA include:

- Cost of the object, incl. payment for contract work on its creation;

- Remuneration for services (intermediary, information, consulting);

- Customs fees and duties;

- Non-refundable taxes;

- Wear and tear of equipment used in the manufacture of regulatory legal acts;

- Payments to employees directly involved in the process of creating legal acts;

- Costs of restoring the ecological balance in the area where the work is carried out;

- The cost of a license to carry out work on the production of legal acts.

The following are not included in the costs of purchasing or creating legal acts:

- Refundable taxes;

- Expenses incurred before the date of receipt of the permitting license, but they can be included in the cost of obtaining a license (if they are directly related to this);

- General business expenses that are not directly related to search activities.

Tangible prospecting assets: what they include

The MPA category includes property (fixed assets) used during exploration, prospecting and evaluation of deposits:

- engineering structures (for example, overpasses, pipeline systems);

- equipment (drilling stations, etc.);

- transport.

Intangible search assets: what they include

The group of regulatory legal acts are intangible assets associated with exploration activities, for example:

- the right to carry out such work, confirmed by a license;

- information obtained as a result of geo- and topographical studies or from other sources;

- results of exploratory drilling, sampling and analysis of samples;

- a report on the feasibility of subsequent subsoil development, revealing information about the company’s capabilities in developing the site and extracting raw materials, as well as the likelihood of projected profits that can cover the costs of mining work.

Accounting for search assets

Recognition of such assets as search assets is possible only if there is a license establishing the right to carry out the listed search works. They are assessed based on actual costs.

Like all non-current assets, PAs are depreciated and, if necessary, revalued. The company sets the useful life of each exploration asset independently, fixing it in its accounting policies. Accrual of depreciation begins in the company's accounting from the 1st day of the month following the month in which the PA was accepted for accounting.

After the economic feasibility of production is confirmed, the residual value of the PA is transferred to the structure of fixed assets and intangible assets.

Typical transactions for PA accounting are as follows:

| Operations | D/t | K/t |

| The initial cost of the PA is taken into account | 08/Investments in PA | 10,20,23,60,69,70,76 |

| MPA accepted for registration | 08/MPA | 08/Investments in PA |

| NPA accepted for registration | 08/NPA | 08/Investments in PA |

| Calculation of depreciation on PA | 23 | 02/PA depreciation |

| Write-off of the amount of depreciation to reduce the initial cost of the PA after establishing the commercial feasibility of production | 02 | 08/Investments in PA |

| PA transferred to OS | 01 | 08/MPA |

| Transfer of PA to the IMA | 04 | 08/NPA |

| PA is written off if production is considered unpromising | 91 | 08/MPA, 08/NPA |

How to take into account tangible and intangible search assets: an example

on the basis of a license to search for oil fields (worth 200,000 rubles), in August 2022, work began on drilling a well, concluding an agreement with the contractor Tekhno LLC in the amount of 8,160,000 rubles. (including VAT RUB 1,360,000).

The work was completed in September. In addition to the cost of contract work, the costs of creating a PA include the salary of the company’s personnel in the amount of 1,000,000 rubles, contributions to funds - 300,000 rubles. and materials in the amount of RUB 1,200,000.

Based on the results of the work performed, on September 30, 2022, the accountant formed the cost of the new PA:

| Operations | D/t | K/t | Amount in rub. |

| The initial cost of PA includes: | |||

| Costs for obtaining a license | 08/Investments in PA | 76 | 200 000 |

| Cost of work of Tekhno LLC | 08/Investments in PA | 60 | 6 800 000 |

| VAT on the cost of drilling work | 19 | 60 | 1 360 000 |

| VAT is accepted for deduction | 68 | 19 | 1 360 000 |

| Salary of customer personnel | 08/Investments in PA | 70 | 1 000 000 |

| Deductions from the patch | 08/Investments in PA | 69 | 300 000 |

| Inventory taken into account | 08/Investments in PA | 10 | 1 200 000 |

| Regulatory legal acts have been formed (license cost) | 08/NPA | 08/Investments in PA | 200 000 |

| Accepted for accounting MPA (6,800,000 + 1,000,000 + 300,000 + 1,200,000) | 08/MPA | 08/Investments in PA | 9 300 000 |

Based on these entries, new values appeared in the enterprise’s balance sheet for 9 months of 2018: in line 1130 - the initial cost of legal acts in the amount of 200,000 rubles, in line 1140 - MPA in the amount of 9,300,000 rubles.

From October 1, 2022, according to the IPA, the accountant began to charge depreciation on a monthly basis in accordance with the service life assigned to the asset and the method adopted by the company (similar to OS).