Basic Concepts

A defect is a product, work process or its component that does not meet established requirements and standards. A defective product cannot be used for its intended purpose without correction.

Identifying and sending the finished product for revision is the concern of the quality control service, which is the most important component of the organizational structure of enterprises.

Based on the specifics of detection, marriage is divided into two large categories:

- external defect identified by the consumer;

- internal defects identified either by quality control department employees or workshop and warehouse workers.

External defects are more expensive for the enterprise, as they contribute to:

- a decrease in customer loyalty to the manufacturer and its products immediately after purchasing the first defective product;

- the formation of losses not only due to the costs of creating products, but also related costs - transportation, sales, compensation, etc.

Allocation of indirect costs

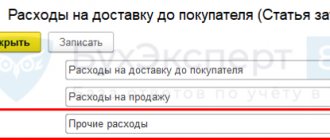

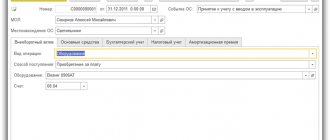

Settings for the distribution of indirect costs for accounting purposes are made in the Accounting policy form (Section Main) using the Indirect costs group of details (Fig. 1).

Rice. 1. Indirect cost distribution settings

In the Distribution base field, the distribution base is indicated, which is selected from the drop-down list and can take the following values:

- Issue volume;

- Planned production cost;

- Salary;

- Material costs;

- Revenue;

- Direct costs.

The selected distribution base is used as the basic rule for the distribution of all types of indirect costs by product.

Sometimes businesses have special allocation rules, for example for certain departments or for certain costs. Such rules can be configured as exceptions. To do this, use a separate Cost Allocation Rules form, which can be accessed by following the hyperlink located next to the text Special Allocation Rules.

In the form that opens, click the Add button to fill out the tabular part, indicating the cost account, division and (or) cost item for which special rules apply, as well as the distribution base different from the main one (Fig. 2).

Rice. 2. Special rules for the distribution of indirect costs

Special rules also apply when an organization uses an allocation base that is not in the list of possible values for the main rule. For example, you cannot select distribution according to a list of cost items as a basic rule. But such a distribution can be indicated in the form of exceptions.

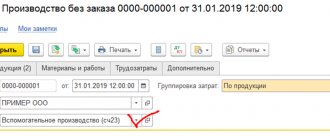

Accounted for 25

Now the program allows you to reflect on account 25 the costs of departments that service production, but do not produce products, do not perform work and do not provide production services.

In other words, these are the costs that were previously taken into account in account 26 and distributed among the cost of finished products (work, services). For example, account 26 could take into account the costs of laboratories, boiler houses, repair shops, etc.

Costs recorded on account 25 are distributed automatically when performing the routine operation Closing accounts 20, 23, 25, 26, which is included in the Closing of the month processing (section Operations).

Since the scope of account 25 has been expanded, the procedure for distributing costs accounted for in account 25 has changed and takes place in two stages.

At the first stage, general production costs of divisions that produce products (work, services) are distributed.

The costs of production divisions are distributed within each such division into item groups according to the rules specified in the accounting policy settings. In this order 25 the account was distributed before (distribution “to itself”).

At the second stage, all remaining costs (costs of service departments) are distributed between production departments according to product groups. This is how count 26 was previously distributed (distribution to “everyone”).

Let's look at the new procedure for distributing account 25 using an example.

Example

Modern Technologies LLC produces textile products in two production divisions:

- in “Workshop No. 1” - a light women’s dress and bed linen;

- in “Workshop No. 2” there are pillows and blankets, as well as soft toys.

Account 25 “General production expenses” takes into account both the costs of production departments and the costs of the quality laboratory, which serves both production departments.

Administrative costs are accounted for on account 26 “General business expenses”. Management costs include administration costs, with the exception of the costs of remunerating the deputy director for production, who deals exclusively with production issues. His wages with accrued insurance premiums are credited to account 25.

According to the accounting policy of the organization, direct production costs are used as the basis for the distribution of all indirect costs.

In January 2022, the amount of direct costs recorded on account 20.01 “Main production” amounted to RUB 1,575,000.00, including by item groups:

- “Light women's dress” - RUB 225,000.00;

- “Bed linen - RUB 1,230,000.00;

- “Soft toy” - RUB 20,000.00;

- “Pillows and blankets” - RUB 100,000.00.

The amount of indirect costs recorded on account 25 amounted to 350,315.05 rubles, including by department:

- “Administration” - RUB 130,200.00;

- “Laboratory” - 50,000.00 rubles;

- “Workshop No. 1” - 89,495.05 rubles;

- “Workshop No. 2” - RUB 80,620.00.

According to the terms of the Example, when performing the routine operation Closing accounts 20, 23, 25, 26, indirect costs recorded on account 25 are distributed in proportion to direct costs.

First, the costs of production departments are distributed:

- costs of Shop No. 1 - by item groups “Light women's dress” and “Bed linen”;

- costs of Shop No. 2 - for the product groups “Soft Toy” and “Pillows and Blankets”.

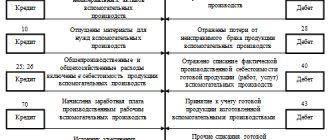

A detailed calculation of the results of the first stage of distribution is given in the first part of the help-calculation Distribution of indirect costs (Fig. 3).

Rice. 3. Distribution of indirect costs of production units

Then all remaining costs are distributed between production departments according to product groups. A detailed calculation of the results of the distribution of service departments is given in the second part of the help-calculation Distribution of indirect costs (Fig. 4).

Rice. 4. Distribution of indirect costs of service departments

Based on the calculation results, postings are generated in the context of analytics:

Debit 20.01 Credit 25

- for the calculated amounts presented in columns 9 of the calculation certificate Distribution of indirect costs (see Fig. 3, 4).

Thus, the combined method used to distribute costs recorded on account 25 allows it to be closed without errors.

How in the program “1C: Accounting 8” edition 3.0 from 2022 the costs accounted for in account 25 are distributed

Accounted for 20

The basic distribution rule will also apply when distributing indirect costs accounted for on account 20.01. We remind you that in account 20.01 you can take into account indirect costs in cases where they are not directly related to a specific product, that is, when the Products subaccount is not filled in. Such costs will be distributed by type of product within the product group.

If for any reason the distribution base specified by the user cannot be applied to the costs accounted for in account 20, the program uses an automatic distribution algorithm. This procedure allows, when closing account 20, to avoid errors associated with minor errors made by the user when setting up the distribution of indirect costs.

A detailed calculation of the results of distribution of costs assigned to a product group and accounted for on account 20.01 (including the distribution base automatically selected by the program) is given in the help calculation Cost of manufactured products and services.

Using account 28 in accounting

Account 28 is active. The formation of a debit account turnover, which includes correction costs incurred during the production of defective goods, occurs within one reporting month. Credit turnover refers to the amount of funds received as reimbursement of expenses from those responsible for defective products (for example, the cost of serviceable spare parts to be returned to production). The balance in this case is final and equal to the sum of all losses - it is written off monthly at the end of the period. Write-off occurs based on the costs of manufacturing similar products or to account 25.

When calculating the costs of losses due to defects, it is necessary to take into account only that part of the costs that is not written off to the culprits or rejected materials. At the same time, the reporting documentation must indicate all business transactions related to the marriage.

Accounting for manufacturing defects is extremely important from a tax point of view, since it is directly related to VAT and NP (income tax): losses resulting from defects reduce the tax base.

Accounting for VAT on defects discovered in production is not without a large number of controversial issues. To avoid troubles with the tax authorities, businesses use VAT recovery.

What is a manufacturing defect?

Manufactured products that do not meet the basic standards of their analogues are considered defective. Defective goods are products of reduced quality, which may require additional financial investments to eliminate defects.

If a product is intentionally manufactured according to non-standard technical characteristics, then such types of products are not considered defective.

Depending on the existing characteristics, the following types of marriage are distinguished:

- External. Poor quality products put on sale or shipped to the buyer.

- Interior. Defective goods are identified at the production stage, found in workshops and warehouses of the organization.

- Correctable. Products of inadequate quality that can be brought to standard conditions. The cost of correction must be economically feasible to achieve a satisfactory result.

- Incorrigible. A defective product that cannot be repaired or is not economically viable. Recognized as a final marriage.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8000 books purchased |

Subaccounts and analytics

Maintaining a 28th account is advisable in enterprises specializing in mass production of various products. At the same time, all subaccounts used in analytics must be specified in an individual accounting policy.

Analytical accounting for account 28 makes it possible to collect information about the defect and the persons responsible for its occurrence. This approach allows us to improve production processes, increase their efficiency and track the sources of defects.

Loss analysis

Analytical monitoring of amounts accounted for in the “Defects in production” account is carried out according to:

- Departments in which defective products were found;

- Types of products (nomenclature groups of goods);

- Cost items;

- Causes of defects:

- Identified culprits.

Attention! Subaccounts used for analytical accounting must be recorded in the enterprise's accounting policies.

Analysis of the causes and sources of damaged products allows you to make management decisions to increase the efficiency of the production process.

When defects are corrected, products are included in sales in the standard manner.

Losses from detected faults are written off monthly as production costs. The amounts are included in the cost of work performed for which defects were discovered; account 28 does not have a final balance.

If defective products sold in previous periods are identified, the costs are written off to the cost of similar products of the current period as part of production costs.

To determine the cost of detected faults, all costs taken into account when calculating the cost of manufactured products are summed up, with the exception of indirect administrative costs.

For correctable defects, the costs of funds for the purchase of materials used in correcting defects, remuneration of employees and a share of general production expenses are taken into account.

Attention! The cost of the defective products themselves is not taken into account as part of the losses incurred to eliminate faults and is not displayed on account 28.

Correctable and irreparable marriage

- A fixable marriage . If it is possible to correct the defect, then the debit of account 28 collects funds for correction. A certain amount of these expenses is written off from the credit of account 28 to the cost of production to the debit of account 20 “Main production”.

- An irreparable marriage. In this case, a certain amount of money is withheld from the employee who released the defective product. Returnable waste also appears, which goes to the warehouse for further use.

Case from practice

Let’s imagine a situation that at a certain industrial enterprise, inspectors identified a defective product in the amount of 3 copies. As was subsequently shown in the act of internal defect, 1 of the copies refers to a correctable defect, and the remaining 2 copies should be considered an irreparable defect. Wherein:

- the cost of inventories used in the production process is 840 rubles;

- the salary of the employee who corrected the deficiency is 4,200 rubles;

- the amount of insurance contributions from accrued wages amounted to 1,340 rubles;

- 4,200 rubles were withheld from the salary of an employee who made a defect in production;

- the amount of overhead costs amounted to 170 rubles;

- the cost of returnable waste after the defective products were written off was 270 rubles.

In this situation, the accounting entries for account 28 should be as follows:

a) according to a good marriage:

1) Dt 28

Kt 10 – 840 rubles, material costs for correcting the defect;

2) Dt 28

Kt 70 – 4,200 rubles, wages for the employee who eliminated the defect;

3) Dt 28

Kt 69 – 1,340 rubles, accounting for insurance premiums of the employee who eliminated the defect;

4) Dt 73

Kt 28 – 4,200 rubles, deduction from the salary of the employee who committed the defect;

5) Dt 20

Kt 28 – 2,180 rubles, writing off the costs of eliminating the defect to the cost of the goods;

b) in the case of an irreparable defect:

1) Dt 28

Kt 20 – 6,550 rubles, write-off of the cost of defective products;

2) Dt 73

Kt 28 – 4,200 rubles, deduction from the wages of the employee who committed the defect;

3) Dt 10

Kt 28 – 270 rub., posting of returnable waste to the warehouse;

4) Dt 20

Kt 28 – 2,080 rubles, write-off of losses from defects to the cost of manufactured products.

Example of using count 28

At a plant producing various metal parts, the quality control service identified a defective product, which a specialist characterized as an irreparable defect. The acceptance committee conducted an inspection and determined that the defect arose through the fault of the employee. The following calculation was made:

- the cost of creating a part, including costs for casting, wages, experimental work and experimental work, amounted to 50 thousand rubles;

- It is possible to sell a defective part for scrap and receive 12 thousand rubles;

- 10 thousand rubles were collected from an employee of the enterprise;

- Uncompensated damage amounted to 28 thousand rubles.

Regulatory regulation

· Instructions for accounting of income and expenses, approved by Resolution of the Ministry of Finance of the Republic of Belarus dated September 30, 2011 No. 102 (hereinafter referred to as Instruction No. 102);

· standard chart of accounts and Instruction No. 50;

· Instructions for accounting of inventories, approved by the resolution of the Ministry of Finance of the Republic of Belarus dated 12.11. 2010 No. 133 (hereinafter referred to as Instruction No. 133);

· Methodological recommendations for forecasting, accounting and calculating the cost of products (goods, works, services) in industrial organizations of the Ministry of Industry of the Republic of Belarus, approved by Order of the Ministry of Industry of the Republic of Belarus dated 06/05/2015 No. 273 (hereinafter referred to as Guidelines No. 273);

· Labor Code of the Republic of Belarus (hereinafter referred to as the Labor Code).

A typical correspondence of accounts for account 28 (Appendix 20 to Instruction No. 50) is presented in table. 1:

>> Full text is available to subscribers. Get access. >>