IT and SHE: what is it and how to calculate

Deferred tax assets (DTA) and deferred tax liabilities (DTL) are special concepts introduced into the accounting system to reflect the differences between accounting and tax profits.

The article “Calculating the difference between accounting and tax profit” will tell you why such differences arise.

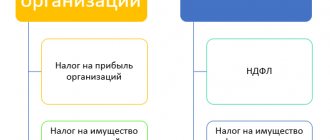

How accounting legislation deciphers the terms ONA and ONO, see the figure:

SHE and IT are determined based on the size of temporary differences, due to which differences arise between accounting and tax profits. The difference arises due to the fact that certain expenses and income are recognized in accounting in the reporting tax period, and in tax accounting in the next period and vice versa. To calculate the amount of SHE and IT, you need to multiply the temporary difference by the income tax rate.

What changes in income tax await us:

- “The list of income on which it is not necessary to pay income tax has been added”;

- “Disputes around the income tax rate: one less reason.”

Correct calculation of discrepancies in the amount of accounting and tax profits allows you to generate reliable indicators in reporting, as well as determine the amount of tax payments for the current and subsequent periods.

Deferred tax asset when writing off fixed assets

Causes and consequences

First, let's define what a deferred tax asset (DTA) is. The answer to this question is contained in PBU 18/02 “Accounting for income tax calculations”. ONA refers to the part of deferred income tax, which should lead to a reduction in the amount of tax payable to the budget in the reporting period. IT can be paid to the treasury in one or more subsequent reporting periods.

Essentially, deferred tax assets are deductible temporary differences multiplied by the income tax rate. It follows that IT arises at the same time that deductible temporary differences appear. Let us recall these cases (clause 11 of PBU 18/02):

- the use of different methods of depreciation for accounting and tax purposes;

- application of different methods of recognition of commercial and administrative expenses in the cost of products sold, goods, works, services in the reporting period for accounting and tax purposes;

- excessive payment of tax, the amount of which is not returned to the organization, but is accepted for credit when forming taxable profit in the next reporting period or in subsequent reporting periods, etc.

Information about SHA that the company has is reflected in account 09 with the same name. This is a requirement of the Chart of Accounts. The deferred tax asset should be reflected in the debit of account 09 in correspondence with the credit of the account for settlements of taxes and fees (clause 17 of PBU 18/02).

Example 1

In July, Brik LLC purchased a telefax for management purposes for 29,500 rubles. (including VAT - 4,500 rubles), which was put into operation in the same month. In accordance with Government Decree No. 1 of January 1, 2002, this equipment belongs to the third depreciation group with a useful life of 3 to 5 years inclusive. The order on accounting policy determines that depreciation for accounting purposes is calculated based on the sum of the numbers of years of the useful life, for tax accounting purposes - using the linear method. SPI - 4 years. Depreciation of fixed assets begins on the 1st day of the month following the month the facility was put into operation.

At the same time, depreciation in the third quarter of 2007 will be:

- for accounting purposes - 1250 rubles;

- for tax accounting purposes - 1045 rubles.

The amount of depreciation for accounting purposes exceeds the amount of depreciation for tax accounting purposes by 205 rubles, and it is this amount that is the deductible temporary difference that arose in the reporting period.

The amount of deferred income tax will accordingly be equal to 49.2 rubles. (RUB 205 × 24%).

In accounting, the accrual of a deferred tax asset, which increases the amount of conditional expense (income) of the reporting period, will be reflected in the following entry: Debit of account 09 Credit of account 68 “Calculations for income tax” .

In the next or subsequent reporting periods, when the amount of deductible temporary differences decreases, the amount of deferred tax assets will decrease accordingly. The amounts by which tax is reduced must be reflected as a credit to the account for deferred tax assets in correspondence with the debit of the account for settlements of taxes and fees.

Thus, a decrease or complete repayment of deferred tax assets to reduce the conditional expense (income) of the reporting period is reflected as follows: Debit of account 68 “Calculations for income tax” Credit 09 “Deferred tax assets” .

Disposal of a “deferred” object

If an organization needs to get rid of an object for which it is accrued, it is faced with the question: what to do with the deferred asset? Should I write it off at once or continue to account for it in parts? According to representatives of the main financial department, in such a situation, the amount of the accrued deferred asset is written off to the profit and loss account in an amount by which the taxable profit of both the reporting and subsequent reporting periods will not be reduced (letter of the Ministry of Finance dated May 2, 2007 No. 07 -05-06/116). The following entry will be made in accounting: Debit account 99 “Profits and losses” Credit account 09 “Deferred tax assets” .

Example 2

Let's continue the condition of the first example. Let's say that a year later the company sold a laptop for 16,520, including VAT - 2,520 rubles. Depreciation in accounting will be 7,500 rubles, and in tax accounting - 6,270 rubles. The deductible temporary difference will be 1230 rubles, and IT will be 295 rubles.

The following entries will be made in the company's accounting when selling an object:

Debit 62 Credit 91-1 - 16,520 rubles. — revenue from the sale of a laptop is reflected;

Debit 91-2 Credit 68 - 2520 rub. — VAT charged;

Debit 01-2 Credit 01-1 - 25,000 rubles. — the initial cost of the laptop was classified as “disposal”;

Debit 02 Credit 01-2 - 7500 rub. — depreciation is written off according to accounting data;

Debit 91-2 Credit 01-2 - 17,250 rubles. — the residual value of the sold fixed asset is written off;

Debit 99 Credit 09 - 295 rub. — the deferred tax liability has been repaid;

Debit 68 Credit 99 - 295 rub. — a permanent tax liability is reflected.

Please note that during the year, differences arising in accounting are recognized as temporary, and at the end of the tax period, the accumulated amount of differences will represent a permanent difference, which the taxpayer does not have the right to recognize for tax purposes.

T. Makarova , columnist for the Federal Agency for Financial Information

Which entry should be used to record the amount of tax liabilities and assets?

SHE and IT are reflected in accounting in two ways:

- As differences arise in accounting and tax accounting;

- At the time of calculation of income tax at the end of the year or reporting period.

The first method is typical for automated accounting programs. The second method is used in conditions of manual calculations for income tax.

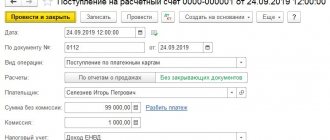

How the amount of a deferred tax asset can be reflected - the posting links the following accounting accounts:

How the amount of deferred tax liability can be reflected - the posting is as follows:

Thus, different accounting accounts are provided for ONO and ONA. At the same time, all information about the value of these indicators is collected in one subaccount “Calculations for income tax” to account 68. As a result, SHE and IT participate in determining the final amount of the current income tax.

The latest clarifications on legislative innovations can be found on our website:

- “Land tax: changes 2019”;

- “Starting 2022, the sale of part of the property of individual entrepreneurs will be preferential”;

- “The deduction for Plato is cancelled.”

SHE calculation

The account records OTA amounts that arise when there are deductible temporary differences between the data on income and expenses in accounting and tax accounting. The SHE indicator is defined as follows:

SHE = Vvr * STn;

Where:

- Вр - deductible temporary difference;

- STn is the rate for calculating income tax for a given enterprise.

Who does not need to understand the entries for accounting for deferred tax assets and liabilities

Organizations that are legally allowed to submit simplified reporting and keep records according to simplified rules, as well as a number of other entities, may not apply PBU 18/02 and, therefore, not reflect IT and ONA in accounting:

If NPOs, Skolkovo residents and small businesses decide to voluntarily apply PBU 18/02, they have the right to do so. The legislation does not contain any prohibitions in this regard. They need to consolidate their intention in their accounting policies.

Whether NPOs submit reports using the SZV-M form, we tell you here.

Will the accounting treatment of deferred tax assets and liabilities change in 2019-2020?

Taxpayers applying PBU 18/02 or planning to do so in the future should pay attention to the order of the Ministry of Finance of Russia “On Amendments...” dated November 20, 2018 No. 236n. He made adjustments to PBU 18/02, which are applied from reporting for 2022. Early application of the updated version of this PBU is also allowed if the taxpayer wants to introduce changes to accounting practices starting next year (clause 2 of Order No. 236n).

What are the adjustments:

- changes affected the terms used in the text;

- the list of temporary differences has been expanded;

- the composition of the information reflected in the reporting has been changed, etc.

We informed you about these changes in one of our publications.

Do the amendments affect the procedure for reflecting ONA and ONO in accounting? Do the current postings change due to adjustments to the accounting regulations? Law No. 236n does not contain any instructions for changing the entries used in accounting. Consequently, the wiring diagram for ONA and ONO remains the same.

Results

The posting for the reflection of a deferred tax asset is made to the debit of account 09 “Deferred tax assets” and the credit of the sub-account “Calculations for income tax” to account 68. The same sub-account corresponds by debit with the credit of account 77 “Deferred tax liabilities”, if it is formed in the accounting deferred tax liability.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What is a permanent tax liability?

The emergence of permanent differences leads to the appearance of permanent tax liabilities (PNO) or assets (PNA). When the difference increases the amount of the income tax payment, a PNA is formed, when the payment decreases, a PNA is formed.

PST is the amount of tax that increases the income tax. It appears if income is recognized exclusively in tax accounting, or expense is recognized only in accounting. In this case, the profit in accounting is less than in tax accounting. And you will have to pay more to the budget than is required according to accounting data.

The amount of PTI is determined as the product of the constant difference of the reporting period and the income tax rate. Recognize the IRR in the same period in which the permanent differences arise.

PNO = PR * 20%