“Colleagues, we need to finish the statistical report for the meeting. Who can stay to do extra work?” —

When new material assets begin to function at an enterprise, their receipt must be properly documented,

Contents Who must pay personal income tax on income abroad? How to declare foreign income? What

According to the new rules, benefits are paid to employees not by the employer, but directly by the Social Insurance Fund (see Government resolutions

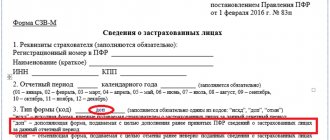

Why is a supplementary SZV-M needed? A supplementary SZV-M allows the employer to clarify and supplement previously transmitted

Property tax for an individual refers to payment for real estate in favor of the state. Subject to

The amount of wages depends on how many days an employee works in a month. If month

Methods for valuing inventories In accounting, there are possible methods for valuing inventories upon disposal: at the cost of each

Collection of alimony Alimony is called cash payments for the maintenance of a minor child, made by one of his

Today, Russian citizens who have the right to receive subsidies by paying property taxes can apply for