What is “cession”? Assignment is the transfer (assignment) of rights to claim debt. Currently the most

Balance sheet analysis can be carried out directly from the balance sheet or from an aggregated analytical balance sheet. Let's consider

What is an accounting chart of accounts? Accounting charts of accounts are consolidated documents approved by legal acts

Fine for failure to submit a VAT return, legislative framework Fine for failure to submit a VAT return

To control the expenditure of funds issued to employees, an advance report is used. It can also be used

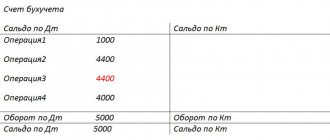

History of occurrence and methodology of application of reversal Reversal is an option for adjusting the accounting of all

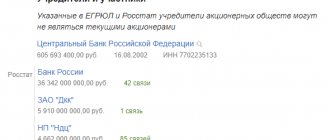

Structure of an extract from the Unified State Register of Legal Entities The generated extract from the Unified State Register of Legal Entities contains the following sections: Name.

Many enterprises in the course of doing business one way or another encounter foreign currency.

Starting point - technical documentation Fixed assets recorded on the organization’s balance sheet may contain precious metals

What it is? Insurance payments under compulsory motor liability insurance are the money that the owner of the car receives,