Accounting account 97 is used to reflect generalized information about the amounts of expenses actually incurred

In this article we consider the issues of filling out and submitting a zero declaration on UTII for

Why write a letter This question is quite reasonable, especially considering the variety of forms of modern communications. IN

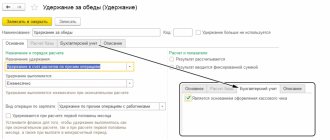

Salary in cash and non-monetary form The employer must pay the employee’s labor (Article 129 of the Labor Code

Author: Maria Novikova It is regulated at the legislative level how an employer can correctly fill out a form with a pen

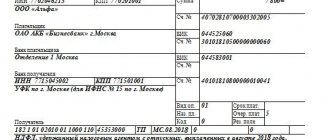

Let's consider the features of reflecting in 1C the acceptance of VAT for deduction when offsetting advances received from

FSBU 6/2020 “Fixed assets”, mandatory for use from 2022, allows enterprises to depreciate fixed assets

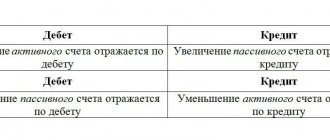

What are accounting entries? Every day millions of payments are made around the world. They are made like

Right to vacation If an employee is hired under an employment contract, the employer is obliged to provide annual

Can an individual entrepreneur pay his own wages? According to the law, entrepreneurs have the right to hire people