Let's consider the features of reflecting in 1C the acceptance of VAT for deduction when offsetting advances received from customers.

You will learn:

- features of crediting advance payments when selling goods (works, services);

- what document is used to document in 1C the acceptance of VAT for deduction when offsetting an advance payment;

- what transactions and movements are generated in the VAT tax register - the purchase book;

- what lines of the VAT declaration are filled out.

For more details, see the online course: “Accounting and tax accounting in 1C: Accounting 8th ed. 3 from A to Z"

Offsetting advances received in 1C 8.3: step-by-step instructions

Attention! The VAT rate has been changed from 01/01/2019 from 18% to 20% and from 18/118 to 20/120.

The organization entered into an agreement with the buyer LLC Architectural Workshop for the supply of office furniture in the amount of 354,000 rubles. (including VAT 18%).

On September 30, a 100% advance payment from the buyer was received into the bank account.

On October 11, office furniture was sold to the buyer:

- MIKKE desk – 15 pcs. at a price of 5,900 rubles. (including VAT 18%);

- Chair MARCUS – 15 pcs. at a price of 11,800 rubles. (including VAT 18%);

- File cabinet ERIC – 10 pcs. at a price of 8,850 rubles. (including VAT 18%).

Let's look at step-by-step instructions for creating an example. PDF

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Sales of goods | |||||||

| October 11 | 62.01 | 90.01.1 | 354 000 | 354 000 | 300 000 | Revenue from sales of goods | Sales (act, invoice) - Goods (invoice) |

| 90.02 | 41.01 | 245 000 | 245 000 | 245 000 | Write-off of the cost of goods | ||

| 90.03 | 68.02 | 54 000 | VAT accrual on revenue | ||||

| 62.02 | 62.01 | 354 000 | 354 000 | 354 000 | Advance offset | ||

| Issuance of SF for shipment to the buyer | |||||||

| October 11 | — | — | 354 000 | Issuing SF for shipment | Invoice issued for sales | ||

| — | — | 54 000 | Reflection of VAT in the Sales Book | Sales book report | |||

| Acceptance of VAT for deduction when offsetting the buyer's advance payment | |||||||

| 31th of December | 68.02 | 76.AB | 54 000 | Acceptance of VAT for deduction | Generating purchase ledger entries | ||

| — | — | 54 000 | Reflection of VAT deduction in the Purchase Book | Purchase Book report | |||

For the beginning of the example, see the publications:

- Issuing an invoice to the buyer and receiving an advance from him

- Calculation of VAT on advances

- Sales of goods

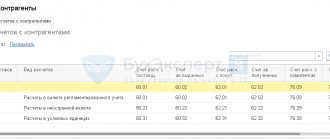

Which columns of the purchase book must be filled in when specifying code 22

If an entry is made in the purchase book for an invoice with transaction type code 22, the following columns are filled in:

- Column 2 - this is where the transaction type code 22 is actually reflected;

- column 3 - number and date of the invoice for prepayment;

- columns 9 and 10 - the seller’s own details: name and TIN/KPP;

- columns 14 and 15 - the cost of goods according to the invoice with VAT and the amount of tax.

If the product is subject to traceability, then from 07/01/2021 columns 16-19 are also filled in.

Let's look at an example of how to fill out a purchase book with transaction code 22 (assuming that the product is not traceable):

Elektrozavod LLC entered into an agreement with Rotor PJSC for the supply of electric motors. The cost of delivery is RUB 3,349,960. The supplier works on a 40% prepayment basis. The buyer agreed to these conditions and made an advance payment in the amount of RUB 1,339,984. (including VAT = RUB 223,330.67). Elektrozavod LLC formalized the receipt of the advance with an invoice dated July 23, 2021 No. A412 and reflected this in its sales book with code 02.

Elektrozavod LLC shipped a batch of electric motors to Rotor PJSC in August and issued an invoice dated August 29, 2021 No. 464 in the amount of RUB 3,349,960. (including VAT = RUB 558,326.67). The supplier reflected this operation in his sales book with code 01. And in the purchase book he registered an invoice for prepayment previously issued by Rotor PJSC.

Elektrozavod LLC filled out the columns in the purchase book as follows:

Find out about the rules for filling out field 22 in a payment order here.

Sales of goods

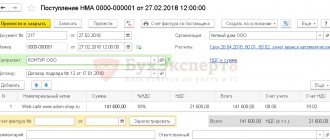

The sale of goods and the simultaneous offset of the advance received from the buyer is reflected in the document Sales (act, invoice) transaction type Goods (invoice) in the section Sales – Sales – Sales (acts, invoices) – Goods (invoice).

Please note that when offsetting advances received in 1s 8.3, when filling out the Calculations , indicate:

- Method of offset of advance payment – Automatically , it starts automatic offset of advance payment in the context of the Counterparty and the Agreement when posting a document.

See also the key points for registering the sale of goods in wholesale trade

Offsetting the buyer's advance in 1C 8.3 - postings

When posting a document, the advance previously received from the buyer is offset in the amount of the advance payment under the contract, but not more than the total amount under the document:

- Dt 62.02 Kt 62.01 – offset of the buyer’s advance in 1s 8.3.

Nuances of calculating advance VAT during the transition period 2018-2019

From January 1, 2019, the VAT rate increased from 18% to 20%, and the estimated tax rate also changed from 18/118 to 20/120 and from 15.25 to 16.67% (Law No. 303-FZ dated August 3, 2018). Business operations were not interrupted in connection with such innovations: in 2022, suppliers received advances from buyers for shipments that occurred or were yet to occur in 2022. But this did not in any way affect the design of purchase and sales books and the codes of transaction types in them. The same codes should apply as in 2022.

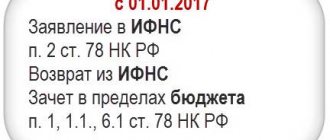

How to cope with the nuances of the transition period was explained by the Federal Tax Service of Russia in a letter dated October 23, 2018 No. SD-4-3 / [email protected] The procedure for the buyer and seller according to the tax service’s methodology is presented in the figure below:

Let us explain the procedure proposed by the Federal Tax Service using an example.

In November 2022, the office furniture supplier Mebelshchik LLC received an advance payment of 276,000 rubles from the buyer Service Center PJSC. From this amount, Mebelshchik LLC calculated VAT:

276,000 × 18/118 = 42,101.69 rubles.

In January 2022, furniture was shipped to PJSC Service Center in the amount of RUB 233,898.31. The supplier charged VAT on this transaction at a rate of 20%:

233,898.31 × 20% = 46,779.66 rubles.

VAT accrued on prepayment in November 2022 was accepted for deduction in the amount of RUB 42,101.69.

Transactions with VAT from the buyer PJSC "Service Center":

- after the prepayment is transferred, VAT in the amount of RUB 42,101.69 is accepted for deduction;

- after receiving the furniture, tax in the amount of RUB 46,779.66. accepted for deduction with the simultaneous restoration of VAT in the amount of 42,101.69 rubles. with prepayment.

Find out what a taxpayer should do if an additional 2% VAT is paid due to an increase in the tax rate from this publication.

Issuing an invoice for shipment to the buyer

An invoice for shipped goods is issued using the Issue invoice , located at the bottom of the Sales document (act, invoice) .

Invoice document is automatically filled with data from the Sales document (act, invoice) .

- Operation type code – “” Sale of goods, works, services...”

Please note that the tabular section Payment documents is automatically filled in with data from the fields According to document No. from , specified in the Receipt to current account . PDF

Find out more about VAT calculation when selling goods in wholesale trade

VAT on advances from buyers in 1C: Enterprise Accounting 8

Published 05/30/2016 09:02 Author: Administrator Calculation of VAT on advances received from customers for upcoming deliveries very often raises questions among novice accountants and not only. In this article, I would like to break down this process (and write down the transactions) using one specific example in the 1C program: Enterprise Accounting 8. Consider an option in which an organization receives an advance from the buyer, calculates VAT on this advance, and then makes the shipment goods against the received advance payment.

The fact of receiving an advance is reflected in the document “Receipt to the current account”, located in the menu “Bank and cash desk” - “Bank statements”. We make sure to check that the VAT rate is indicated correctly in the document, especially if bank statements are loaded into 1C from third-party programs.

When posting a document, movements are generated on accounts 51 and 62.02.

Based on the document “Receipt to current account” we can create an invoice for the advance payment. To do this, use the corresponding button on the top panel of the document.

The document is filled in automatically; we only need to check the correctness of the data.

Then we carry out the document and look at the movements on the accounts. In this case, wiring Dt 76.AV Kt 68.02 is generated, i.e. the amount of VAT on the advance received is calculated for payment. The document also makes movements in other registers of the VAT accounting subsystem in 1C: Accounting, which are necessary for correctly filling out the declaration.

Since issuing invoices for each advance manually is very labor-intensive, the program provides a mechanism for group registration of invoices for advance payments. I talked about how to work with it, as well as the necessary accounting policy settings, in my video Registration of invoices for advance payments in 1C: Accounting 8 - VIDEO

Then we reflect the fact of shipment of the goods, which in our case occurs a week later than payment. To do this, go to the “Sales” section and create the “Sales (acts, invoices)” document.

We make sure to check the correctness of the settlement accounts (in our case, these are accounts 62.01 and 62.02, as in the document “Receipt to the current account”) and the VAT rate. Then click on the “Write an invoice” button at the bottom of the document.

When posting the document, the advance payment is offset (Dt 62.02 Kt 62.01) and VAT is charged on the shipment (Dt 90.03 K 68.02). Movements in the “VAT sales” register are also generated.

As we can see, VAT in the amount of RUB 15,254.24. was accrued in our case twice (entries were made to account credit 68.02):

1. when registering an invoice for an advance payment - posting Dt 76.AV Kt 68.02

2. upon shipment of goods - posting Dt 90.03 Kt 68.02

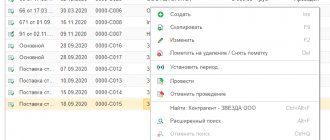

Accordingly, so that the amount of tax payable is not overestimated, we need to do one more operation - deduct the amount of VAT from the offset advance. This operation is performed during regulatory procedures for VAT at the end of the tax period; the document “Creating purchase ledger entries” is used. You can find it in the “Operations” menu, the “VAT Accounting Assistant” or “VAT Regular Operations” items. I talked in detail about how to work with this document in my video tutorial Document “Creating purchase book entries” in the 1C program: Enterprise Accounting 8 - VIDEO We create a new document, click the “Fill out the document” button and go to the “Advances received” tab.

The required entry is included in the document automatically with the “Advance payment” event. We post the document and see that our VAT amount goes to the debit of account 68.02, reducing the total amount of VAT payable, and to credit 76.AB, closing settlements for this counterparty. Movements are also generated in the “Purchase VAT” register, due to which this amount is included in the VAT return.

Of course, it is impossible to talk about all the nuances of calculating VAT on advances in one article, so if you want to fully master this and other topics related to VAT calculation, I recommend you our video course “VAT: from concept to declaration”! We share practical experience and help bring order to your database. The course is structured according to the “theory + practice in 1C” scheme. Detailed information about the course is available at the link VAT: from concept to declaration.

Did you like the article? Subscribe to the newsletter for new materials

Add a comment

Comments

0 Olga Shulova 10/22/2019 10:32 I quote Alexander:

Good afternoon Olga. Please tell me what to do: When trying to generate a VAT return and perform routine operations, account 62 was not checked for correct offset of advances and the program registered 2 c/f for the advance, in addition to the c/f for sales to the counterparty. An analysis of the subconto was carried out, errors were corrected, and there were no advances in fact. All d/s receipts were credited to sales. Advance tax payments are reversed, but VAT on these reversed amounts in the declaration is not reduced for payment. All transactions were in one quarter. What was done wrong and what needs to be done to reduce the tax payable by the amount of sorted income tax? Thank you in advance.

Good afternoon

If advance invoices were issued in the same period, then they can simply be deleted rather than reversed. After this, perform the routine operations again. Quote 0 Alexander 10/19/2019 10:08 Good afternoon Olga. Please tell me what to do: When trying to generate a VAT return and perform routine operations, account 62 was not checked for correct offset of advances and the program registered 2 c/f for the advance, in addition to the c/f for sales to the counterparty. An analysis of the subconto was carried out, errors were corrected, and there were no advances in fact. All d/s receipts were credited to sales. Advance tax payments are reversed, but VAT on these reversed amounts in the declaration is not reduced for payment. All transactions were in one quarter. What was done wrong and what needs to be done to reduce the tax payable by the amount of sorted income tax? Thank you in advance.

Quote

0 Olga Shulova 08/13/2019 18:42 I quote Maria:

Good afternoon. What to do when the sales amount is greater than the advance received and in the document Formation of purchase ledger entries, the amount of VAT is placed greater than in the advance receipt document.

Good afternoon

An amount not exceeding the calculated VAT on advances under the document can be deducted. 1C programs work exactly this way. In your case, there was probably an error in record keeping. If documents are entered correctly, this situation is impossible. Try to re-post the documents and repeat the routine operations. Quote 0 Maria 08/13/2019 12:55 Good afternoon. What to do when the sales amount is greater than the advance received and in the document Formation of purchase ledger entries, the amount of VAT is placed greater than in the advance receipt document.

Quote

Update list of comments

JComments

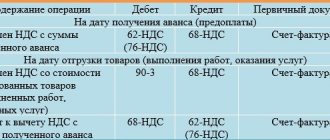

Acceptance of VAT for deduction when offsetting the buyer's advance payment

Regulatory regulation

The organization has the right to deduct VAT from advances received from customers as of the date:

- shipment of goods (work, services) to the buyer (clause 6 of Article 172 of the Tax Code of the Russian Federation);

- refund of the advance due to changes in conditions or termination of the contract (clause 5 of Article 171 of the Tax Code of the Russian Federation).

Tax authorities believe that if an advance payment under a terminated contract was offset against payments under another contract with the same customer, then VAT deduction cannot be used at this moment (clause 5 of Article 171 of the Tax Code of the Russian Federation).

At the same time, VAT calculated and paid by the seller from the amount of this advance payment can be deducted upon actual shipment under another agreement (Letters of the Ministry of Finance of the Russian Federation dated July 18, 2016 N 03-07-11/41972, dated October 14, 2015 N 03-07-11/58845).

VAT is deducted in the amount of tax calculated from the cost of shipped goods (work, services), for which an advance payment was previously received (clause 6 of Article 172 of the Tax Code of the Russian Federation). This means that if you have charged VAT on advances at a rate of 18/118%, and goods are shipped at a rate of 10%, then only that part of the VAT that is calculated at a rate of 10/110% can be taken into account (Letter of the Ministry of Finance of the Russian Federation dated November 28. 2014 N 03-07-11/60891).

In the 1C program, VAT is automatically deducted in the amount in which VAT was calculated on advances. The offset mechanism provided for by the current edition of clause 6 of Art. 172 of the Tax Code of the Russian Federation, has not yet been implemented in the program. Be careful!

For the amount of VAT accepted for deduction:

- in the purchase book, a registration entry is made of the advance invoice, on which VAT was previously calculated, with the transaction type code “Advances received”;

- In accounting, the entry Dt 68.02 Kt 76.AV “VAT on advances and prepayments” is generated.

Accounting in 1C

Acceptance of VAT for deduction when offsetting advances received from the buyer is formalized by the document Formation of purchase ledger entries in the section Operations - Closing the period - Regular VAT operations.

To automatically fill out the Advances received , use the Fill .

Postings according to the document

The document generates transactions:

- Dt 68.02 Kt 76.AV – acceptance of VAT for deduction on offset advance payment.

The document generates movements in the VAT Purchases :

- record of an advance invoice with transaction type code 22 “Advances received” for the amount of accepted VAT for deduction.

Purchase Book report can be generated from the Reports – VAT – Purchase Book section. PDF

Let's check the calculation of the amount of VAT accepted for deduction when offsetting the buyer's advance using the following algorithm:

- Let's determine the amount of the credited advance payment, on which VAT was previously calculated - Dt 62.02 Kt 62.01 RUB 354,000.

- Let's carry out an arithmetic check of the VAT accepted for deduction from the credited advance payment using the formula:

VAT deductible = 354,000 * 18/118 = 54,000 rub.

To check the amount of VAT accepted for deduction, you can generate the report Turnover balance sheet for account 76.AB by counterparty.

The amount of VAT accepted for deduction under Kt 76.AB in 1C coincides with the verified amount. There is no balance on the invoice on which VAT was previously calculated. This means that VAT has been deducted correctly for the entire amount of the advance invoice.

VAT declaration

The VAT amount subject to recovery is reflected in the declaration:

In Section 3, page 170 “The amount of tax calculated by the seller from the amounts of payment, partial payment, subject to deduction from the seller from the date of shipment...”: PDF

- the amount of VAT subject to deduction.

In Section 8 “Information from the purchase book”:

- advance invoice issued, transaction type code "".

Reflection in the declaration

The procedure and instructions for how to reflect the offset of advances received in the VAT return are established by the order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/ [email protected] (as amended on December 28, 2018). Special recommendations are provided for the seller and buyer.

Reflection from the seller

According to legislative norms, the seller is obliged to calculate and pay tax on vehicles received in the standard manner. There are no special codes for transferring tax amounts to the budget. There are no special rules for reflecting advance VAT in the declaration. The seller calculates the tax on the day the advance payment is received, and pays it as part of the total amount of tax liabilities at the end of the quarter.

After the actual shipment of the goods, the seller declares the amount of VAT paid in advance as a deduction. Reflect in section No. 3, line 130, column 3 - indicate the amount of the advance.

Reflection from the buyer

Current instructions for the purchaser of goods, works and services on how to reflect VAT on an advance payment in the declaration, step by step:

- In the report, record the deduction from the transferred advance. Then record the recovery of the tax liability upon actual shipment.

- Include the AT tax benefit in your reporting for the quarter in which it was accepted for deduction.

- In section No. 3, line 130, column 3, indicate the amount of the advance.

- In section No. 8, reflect in the standard order the data from the purchase book about all advance invoices.

Reflect the amounts of the restored tax in the declaration in the quarter in which you accept input tax on shipment for deduction. Indicate the obligation to restore in column 5 of line 090 of section No. 3 of the declaration. In section No. 9, reflect the data from the sales book about advance invoices issued by the seller in the standard manner.

If the advance payment issued earlier was returned by the seller, then restore it on a general basis. Reflect the recalculated advance payments in the VAT return for the quarter in which the terms of the supply agreement changed. If only part of the advance tranche is returned, then restore the obligations to the budget only from the refund amount.

To consolidate the material, consider example 2:

| The organization Fortura LLC (TIN/KPP 7816*****/780101001), under a contract for the supply of goods, received from Nadezhda LLC (TIN/KPP 7743******/997850001) an advance payment for upcoming deliveries of goods. Fortuna LLC issues invoice No. A100010331 dated June 17, 2022 to Nadezhda LLC for a total amount of 291,000.00 rubles, incl. VAT – 44,389.83 rubles, and is registered in the sales book with code “02”. LLC "Nadezhda" received from LLC "Fortuna" invoice No. A100010331 dated June 17, 2022 for an advance in the total amount of 291,000.00 rubles, incl. VAT – 44,389.83 rubles, reflected in the purchase book with code “02” (clause 12 of article 171, clause 9 of article 172 of the Code). After shipment of goods to Nadezhda LLC, Nadezhda LLC issues an invoice for sales No. 10331 dated July 20, 2022 for a total amount of 177,000.00 rubles, incl. VAT – 27,000.00 rubles, and is registered in the sales book with code “01”. In the purchase book, Fortuna LLC registers previously issued invoice No. A100010331 dated June 17, 2022 to Nadezhda LLC for advance payment in the amount of 291,000.00 rubles, incl. VAT – 27,000.0 rubles with code “22”. After receiving and registering the goods, Nadezhda LLC registers invoice No. 10331 dated July 20, 2022 in the purchase book for a total amount of 177,000.00 rubles, incl. VAT – 27,000.0 rubles with code “01”, and restores the amount of VAT previously accepted for deduction on the basis of an advance invoice, registering in the sales book invoice No. A100010331 dated 06/17/2022 for a total amount of 291,000.00 rubles , incl. VAT – 27,000.00 rubles with code “21”. |

| N p/p | Operation type code | Seller's invoice number and date | Seller's name | Seller's INN/KPP | Cost of purchases according to the invoice, difference in cost according to the adjustment invoice (including VAT) in the invoice currency | The amount of VAT on the invoice, the difference in the amount of VAT on the adjustment invoice, accepted for deduction, in rubles and kopecks | |

| 1 | 2 | 3 | 9 | 10 | 15 | 16 | |

| 1 | 22 | No. A100010331 dated 06/17/2022 | Fortuna LLC | 7816*****/780101001 | 291 000,00 | 27 000,00 | |