Right to vacation

If an employee is hired under an employment contract, the employer is obliged to provide him with paid rest annually for 28 calendar days. This is the so-called main leave, and some categories employed in dangerous or harmful working conditions are also entitled to additional leave for a period of at least 7 calendar days.

An employee receives the right to vacation from a specific employer after he has worked continuously for the first six months, but with mutual agreement of the parties, he can go on vacation earlier. The employer's consent is not required to go on vacation earlier than six months if we are talking about women preparing to go on maternity leave; minors; who have adopted a child under three months of age. In such cases, only a statement from the employee is sufficient (Article 122 of the Labor Code of the Russian Federation).

Please note: labor laws do not apply to performers under civil contracts, so they are not entitled to leave at the expense of the employer.

At least three calendar days before the employee leaves for vacation, he must be paid vacation pay. The payment amount is calculated based on average daily earnings, which is multiplied by the number of vacation days. Income can be issued either in cash or by transfer to an individual’s card.

Responsibilities of a tax agent

Article 226 of the Tax Code of the Russian Federation obliges organizations and individual entrepreneurs from which an individual received income to withhold and transfer income tax to the budget. Vacation payments are subject to personal income tax at the same rate as wages:

- 13% on income up to 5 million rubles per year, further 15% if the employee is recognized as a Russian resident (stayed in the Russian Federation for at least 183 calendar days for 12 consecutive months)

- 30% of income if the employee is a non-resident.

In general, the tax agent transfers the income tax withheld from an individual to the Federal Tax Service at the place of his registration. If an organization has a separate division, then the tax withheld from its employees is transferred to the location of the OP. Individual entrepreneurs who are PSN payers transfer personal income tax on the income of individuals at the place of conduct of the relevant activity. This follows from paragraph 7 of Article 226 of the Tax Code of the Russian Federation.

Important: for violation of the tax agent’s obligation to withhold and transfer income tax from wages, vacation pay and other payments, a fine is imposed under Article 123 of the Tax Code of the Russian Federation. The amount of recovery is 20% of the unwithheld or not transferred personal income tax amount.

Sequence of salary payment

When transferring amounts for wages this year, the third order of payment for wages is in the order for the bank. If debts on wages or severance pay of the organization’s employees are collected through writs of execution, they are repaid in the second place.

If you look carefully at the plate, it’s easy to figure out, for example, what payment priority 3 means - this is the payment of taxes and insurance premiums collected by the Federal Tax Service forcibly. If the number 3 is indicated in field 21, if the organization fails to pay taxes and insurance contributions, the Federal Tax Service receives priority authority to write off debts over other recipients of money in the fourth and fifth stages. But neither collection of tax arrears nor payment of labor have priority in the order of transfer over each other. Payments are queued and funds are debited sequentially in the calendar order in which orders are received by the bank.

Financiers often spoke out against establishing priority for the transfer of wages over the collection of tax debts, citing Constitutional Court Resolution No. 21-P of December 23, 1997. It says that such an advantage sometimes leads to a violation of the obligation to pay taxes and fees, which is established by Art. 57 of the Constitution of the Russian Federation. That is why now the collection of debts of non-performing taxpayers and the transfer of current wages to employees have the same repayment queue.

Use the ConsultantPlus instructions for free to correctly fill out employee pay slips.

When to transfer taxes to the budget

Before amendments were made to Article 226 (6) of the Tax Code of the Russian Federation, there was one general principle for the transfer of personal income tax by tax agents:

- no later than the day of issue when receiving cash at a bank cash desk or transferring it to an individual’s account;

- no later than the next day after the date of actual receipt of income, if they were paid in another way, for example, from cash proceeds.

Difficulties in the question of when to transfer personal income tax from vacation pay were explained by the fact that previously the legislation did not clearly define this point. The fact is that the norms of the Labor Code include vacation pay as part of the employee’s salary. Thus, Article 136 of the Labor Code of the Russian Federation “Procedure, place and timing of payment of wages” determines that payment for vacation is made no later than three days before its start.

However, the fact that vacation pay belongs to the category of employee remuneration does not mean that the deadlines for transferring personal income tax from vacation pay to the Tax Code of the Russian Federation are given in paragraph 2 of Article 223. This provision applies only to the withholding of tax from wages, but not vacation pay. And the deadlines for paying personal income tax on vacation pay in 2022 are indicated separately, in Article 226 of the Tax Code of the Russian Federation.

| Type of income | Personal income tax payment |

| Wage | No later than the day following the payday |

| Income in kind | No later than the next day after the day of payment of income in kind |

| Disability benefits (sick leave) | No later than the last day of the month in which the benefit was paid |

| Vacation pay | No later than the last day of the month in which vacation pay was paid |

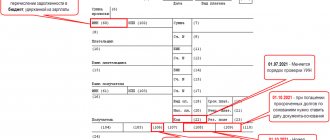

Thus, to the question of when to pay personal income tax on vacation pay in 2022, there is a clear answer: no later than the end of the month in which they were paid . The timing of the transfer of personal income tax from vacation pay this year allows the accountant to pay income tax from several employees at once. This is especially true in the summer, when people go on vacation en masse. In addition, personal income tax on sick leave can be paid in one payment order with income tax on vacation pay if they were paid in the same month.

Please note: Article 226 only determines the deadline for paying personal income tax on vacation pay in 2022, i.e. transferring it to the budget. And the calculation and withholding of income tax on vacation pay occurs upon actual payment (Article 226 (4) of the Tax Code of the Russian Federation).

Why indicate the order of payments?

According to the list and description of the details of payment bank documents (Instruction of the Bank of Russia dated July 5, 2017 No. 4449-U), the order of payment in the payment order in 2022 is reflected in field 21. The

payment details have a digital value and are established by federal law. The value of the details is determined in accordance with clause 2 of Art. 855 of the Civil Code of the Russian Federation. It is necessary to indicate the order of payments at the bank in 2020 in order to determine the order of debiting funds for making all transfers according to the presented payment documents. Such information is especially important if there are insufficient funds in the account.

If the funds available for debiting in the organization’s account are sufficient to satisfy all requirements, the bank will write off the amounts in the order in which orders are received from the client and other persons (for example, tax authorities, bailiffs, etc.).

| Code | Payment type |

| 1 | Compensation for harm to life or health according to enforcement documents. Alimony |

| 2 | According to executive documents on the collection of arrears of wages and severance pay |

| 3 | Remuneration (current, not based on court decisions). Debt on taxes and insurance contributions (according to collection orders from tax authorities) |

| 4 | According to executive documents on other grounds |

| 5 | All other transfers of funds in calendar order |

Examples of transferring personal income tax from vacation pay in 2022

Interested in what’s new in personal income tax on vacation pay in 2022, what changes? An example of income tax transfer is given using the following data:

The employee wrote an application for leave from June 7, 2022 for 28 calendar days. The vacationer must receive payments no later than three calendar days before the vacation, so the accountant made the payment on June 3, 2022. In this case, personal income tax is paid no later than June 30, but earlier payment will also not be a violation.

Let's change the example a little: the employee goes on vacation from June 1, 2022. In this case, vacation pay must be paid no later than May 29, 2022. As you can see, the payment month is different here, so you must transfer income tax no later than May 31.

In letter dated April 15, 2016 No. 14-1/B-351, the Russian Ministry of Labor spoke on the issue of personal income tax on vacation pay. An example of calculations is associated with a situation where the holiday period falls on a non-working day on June 12. Should it be taken into account in the total duration of vacation? The Department believes that holidays falling during the vacation period are not included in the number of calendar days of vacation. Non-working holidays must be taken into account when calculating the average salary.

Vacation pay: income code in the payment order

Vacation pay is the average salary paid for the period the employee is on vacation. Accordingly, vacation payments are part of the wages from which recovery is possible under writs of execution, but only within the following limits established by Article of the Law on Enforcement Proceedings No. 229-FZ dated 10/02/2007:

- no more than 70% - when collecting alimony for minor children, as well as when compensating for damage - to health, in connection with the death of the breadwinner, or caused by a crime;

- no more than 50% - in other cases.

Amount of deductions from earnings, incl. and from vacation pay, calculated from the amount remaining after deducting personal income tax.

Personal income tax for compensation for unused vacation

When an employee is dismissed, a situation often arises when he has unused vacation days left. According to the general rule of Article 127 of the Labor Code of the Russian Federation, in this case the employee must be paid monetary compensation for all unused vacation days. Another option is to provide leave followed by dismissal, but this is only possible upon a written request from the employee.

Is it possible to pay monetary compensation for unused vacation if the employee does not plan to quit? Article 126 of the Labor Code allows you to replace vacation with money, but only those days that exceed the usual duration of 28 calendar days. That is, we are not talking about regular, but about extended basic or additional leave.

In addition, there are personnel categories for whom the issuance of monetary compensation without dismissal is prohibited by law:

- pregnant women and minors;

- those employed in jobs with harmful and/or dangerous working conditions (only in relation to additional paid leave).

Cash compensation is recognized as income of an individual and is subject to income tax. However, unlike vacation pay, personal income tax on this income is paid to the budget no later than the day following the day of payment.

Deadlines for filing income taxes

Vacation pay is always subject to income tax. The employee receives the amount minus personal income tax. Tax withholding is made on the day of issuance of vacation pay, and its transfer is due no later than the last day of the current month.

This rule also applies to rolling vacation pay, when the start of the vacation falls on one month and the end on another.

Thanks to such payment deadlines, the accountant can transfer income tax at the end of the month for several employees who went on vacation. To pay, it is enough to fill out one payment order form.

Example:

The employee took leave from February 20 to March 12, 2022. They accrued his vacation pay on February 16 and withheld income tax on the same day. Personal income tax must be transferred by February 28 of this year.

The letter from the Federal Tax Service dated July 12, 2016 states that it is necessary to fill out separate payment orders if income tax is transferred on vacation pay this month and personal income tax on wages for last month.

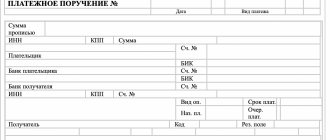

How is it filled out?

When filling out a payment order, it is important to remember that all amounts are written in full rubles. Pennies are rounded according to arithmetic rules.

There should also be no blank fields. The write-off amount and date should be written in words and numbers. The chronological order of payment invoice numbering should not be violated.

Each field on the payment form has its own number.

The payer status is indicated in 101 fields. According to the law, there are three types of status and corresponding codes:

- Tax agent, code - "02".

- Individual entrepreneur, code – “09”.

- Individual, code – “13”.

If the payment is filled out by a budget organization, then code “02” is filled in.

In field 16 entitled “Recipient” it is written – Federal Treasury Department for .... region. The name of the tax office is also written in brackets.

Columns 61 and 103 of the payment order indicate the checkpoint and tax identification number.

In field 104, the KBK code for paying personal income tax on vacation pay is indicated. It was changed in 2018. Now, when listing vacation pay, you should indicate the code 18210102010011000110.

21 fields indicate the order of payment; there are two types. The number 5 is put if the monthly withheld personal income tax is transferred, and the number 3 is put when the income tax is transferred in connection with the requirement of the tax inspectorate. Such designations are needed so that the bank understands in what order to transfer money.

Column 105 in the payment slip is filled out in connection with the order of Rosstandart of 2013. The OKTMO code is indicated here, which has eight digits.

In the next 106th column of the payment order, the target direction of the payment is filled in. It consists of two letters:

- ZD – voluntarily transferred debt.

- AP – repayment of arrears according to the tax inspection report.

- TP – current payment.

- TR – repayment of debt at the request of inspection authorities.

If none of these encodings are suitable, then you need to write “0”.

The frequency of payment of income tax is indicated in the payment slip in gr. 107.

Here you can write a specific date.

The word “frequency” means the period for which the tax is transferred. She may be:

- Menstruation - MS,

- Quarterly - KV,

- Semi-annual - PL.

- Annual - GD.

For example, if money is transferred from vacation pay assigned in March 2022, then “MS.03.2019” is written on the payment form.

In gr. 108 of the payment order form, as a rule, is always entered “0”. The figure needs to be changed when the debt is repaid due to the requirement of the regulatory authority.

In field 109 of the order, write the date of certification of the declaration for tax payment. The number “0” is entered when the tax is transferred earlier than the declaration is submitted. If the debt is repaid at the request of the tax office, then the repayment date is filled in this field.

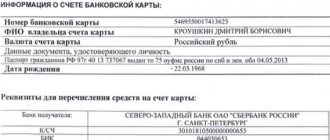

In the remaining columns of the payment order, the details of the payer and recipient of the amount and other data are entered:

- 3 – payment order number.

- 4 – document date.

- 6 – amount in words.

- 7 - sum in numbers.

- 8 – name of the payer.

- 9 – Payer’s current account.

- 10 – Payer’s bank.

- 12 – Payer’s bank account.

- 13 – Recipient's bank.

- 17 – Recipient's bank account.

Fields 11 and 14 indicate BIC, that is, bank identification code.

Column 24 indicates the purpose of the payment.

Incorrect information will result in the payment being returned, which may result in late income tax penalties.

After filling out the document, it is secured with a signature and seal.

What purpose of payment should I indicate when transferring?

When filling out a payment order from vacation pay, you need to indicate its purpose. Since vacation pay is written on a separate payment slip from the salary, the following purpose is indicated in this field: “Income tax for individuals on vacation pay for _______ 2019.”

The name of the month in which the accrual is made is indicated in the blank space.

Sample payment slip

Below is an example of filling out a payment order when transferring income tax on vacation pay: