The person authorized to sign the financial statements is the head of the business entity or manager, to whom these powers are assigned by a decision of the management bodies of the given entity. Unless otherwise provided by the company's charter, the manager has the right to transfer his authority to sign financial statements to another person. Such transfer is accompanied by the execution of a corresponding power of attorney. And there is no need to report this to the organization’s governing bodies.

The legislative framework

Law 402-FZ “On Accounting” does not contain provisions that would limit the rights of the head of an organization to transfer the authority to sign accounting records to another person. In accordance with Art. 13 402-FZ, reporting is considered completed only after it is signed by the head. A copy of the financial statements signed by the manager must be kept in the organization. Moreover, in addition to the signature, the date of signing of this copy of the report must also be indicated.

The head of the company is a person who is either the sole executive body or responsible for the conduct of affairs in the company. In addition, the manager of the company, to whom the functions of the sole executive body have been transferred, can also be considered a manager (

Can a director delegate the authority to sign statements to another person?

The issue of transferring the authority of the head of an economic entity to sign accounting (financial) statements to another person on the basis of a power of attorney was considered by the Federal Tax Service in Letter dated June 26, 2013 N ED-4-3 / [email protected] Tax department specialists clarified: according to clause 7 of Art. 3 of Federal Law N 402-FZ, the head of an economic entity is recognized as a person who is its sole executive body, or a person responsible for conducting the affairs of an economic entity, or a manager to whom the functions of the sole executive body have been transferred.

It should be taken into account that in accordance with paragraphs. 2 p. 3 art. 91 of the Civil Code of the Russian Federation, the competence of the general meeting of LLC participants includes the formation of the executive bodies of the company and the early termination of their powers, as well as the adoption of decisions on the transfer of powers of the sole executive body of the company to the manager, approval of such a manager and the terms of the agreement with him, if the company’s charter does not cover the resolution of these issues within the competence of the board of directors (supervisory board) of the company.

According to paragraph 4 of Art. 40 of Federal Law N 14-FZ (Federal Law of 02/08/1998 N 14-FZ “On Limited Liability Companies”) the procedure for conducting activities by the sole executive body of the company and making decisions by it is established by the charter, internal documents of the company, as well as an agreement concluded between the company and the person performing the functions of its sole executive body. At the same time, in paragraphs. 2 p. 3 art. 40 of Federal Law No. 14-FZ states that the sole executive body of a company issues powers of attorney for the right of representation on behalf of the company, including powers of attorney with the right of substitution.

In accordance with paragraphs. 1 and 3 paragraphs 1 art. 103 of the Civil Code of the Russian Federation, the competence of the general meeting of shareholders of the company includes changing the charter of the company, the formation of the executive bodies of the company and the early termination of their powers, if the charter of the company does not include the resolution of these issues within the competence of the board of directors (supervisory board). At the same time, on the basis of clause 3 of Art. 103 of the Civil Code of the Russian Federation, by decision of the general meeting of shareholders, the powers of the executive body of the company can be transferred under an agreement to another commercial organization or to an individual entrepreneur (manager).

By virtue of clause 2 of Art. 69 of Federal Law N 208-FZ (Federal Law of December 26, 1995 N 208-FZ “On Joint-Stock Companies”) the competence of the executive body of the company includes all issues of managing the current activities of the company, with the exception of issues falling within the competence of the general meeting of shareholders or the board of directors (supervisory board) of the company.

Based on the above, the Federal Tax Service came to the conclusion: accounting (financial) statements must be signed by persons authorized to do so by the legislation of the Russian Federation or the constituent documents of an economic entity, decisions of the relevant management bodies of the economic entity. Such persons include the head of an economic entity, that is, the sole executive body, or the manager to whom the powers of the former were transferred based on a decision of the management bodies of the economic entity. At the same time, unless otherwise provided by the charter of an economic entity, its director has the right to transfer his powers on the basis of a power of attorney, including the signing of accounting (financial) statements, without informing the management bodies of the economic entity about this.

The position of the tax department, set out in the said Letter, is recommended for communication to subordinate tax authorities, as well as to taxpayers.

For your information. The Ministry of Finance in Letter dated 04/30/2013 N 07-01-10/15212 also expressed the opinion that Federal Law N 402-FZ does not contain provisions limiting the right of the head of an economic entity to delegate his powers to sign the accounting (financial) statements of this economic entity to another person on the basis of a power of attorney.

What are financial statements

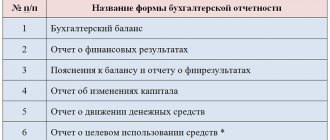

Before you figure out what a person has the right to sign, you need to understand what is meant by financial statements. Accounting statements are any reporting document containing information about the financial and economic operations carried out by the company. Typically, these are reports prepared and submitted at a certain frequency (for example, quarterly, annually or only once every six months) to regulatory authorities, which include:

- Federal Tax Service (FTS);

- Goskomstat;

- FSS;

- Pension Fund.

Important! Which of the company's persons has the right to sign reports submitted to the listed bodies will depend on the norms of responsibility for the approval of documents that are assigned to the organization.

What forms do organizations use to submit their financial statements to the simplified tax system?

All organizations must prepare and submit annual financial statements to the tax authorities, regardless of the taxation regime. Consequently, organizations using the simplified tax system also have this obligation (clause 1, part 1, article 2, part 2, article 13, article 18 of the Federal Law of December 6, 2011 N 402-FZ, clause 5.1, clause 1 Article 23 of the Tax Code of the Russian Federation, Letters of the Ministry of Finance of Russia dated 01/23/2015 N 03-11-06/2/1742, dated 02/27/2015 N 03-11-06/2/10013). Organizations using the simplified tax system submit their financial statements, including the balance sheet, according to the forms approved by Order of the Ministry of Finance of Russia dated July 2, 2010 N 66n.

Power of attorney for the right to sign statements

The head of the organization has the right to issue a power of attorney for the right to sign statements to another person, who may be:

- Chief Accountant;

- head of a company department;

- organization lawyer;

- another employee.

This document can be drawn up by the organization’s secretary or lawyer, but after that it is signed by the head. A document such as a power of attorney for signing accounting records gives the right to sign only strictly defined documents, therefore they must be clearly indicated in the power of attorney.

There are no specific strict requirements for drawing up a power of attorney, however, when drawing up this document, it is necessary to adhere to the rules of office work for these documents. The main requirement for this power of attorney will be the indication of information about the principal and the personal data of the authorized person. In addition, the power of attorney also indicates the validity period of the document and contains signatures of both the principal and the authorized representative. The wider the range of powers assigned to the authorized person, the more detailed information about him and the principal must be indicated.

How to draw up a power of attorney:

- The header of the document must contain its name (“Power of Attorney”). If necessary, the document is assigned a number. Next, indicate the place where the document was drawn up, as well as the date (the date is usually indicated in words).

- After this, the details of the organization are indicated. You must indicate the full name of the organization, its INN, KPP, OGRN, as well as its legal address.

- Next, information about the principal is indicated, that is, the person on whose behalf the document is drawn up (usually the director). His full name is indicated, as well as the document on the basis of which the person acts (for example, “based on the Charter”).

- After this, information about the principal is indicated. The power of attorney includes the full name of this employee, details of his identification document and registration address.

- The main part of the power of attorney must contain the powers that the authorized person is given by this power of attorney (this is a list of documents that he can sign).

- The final part indicates the period for which this power of attorney is issued and the possibility of transferring the right of signature to an authorized person.

- The document is signed by the principal and the authorized representative. The power of attorney is also affixed with the company’s seal, unless the company refuses to use it.

Sample power of attorney

Paper and electronic power of attorney

The form of the power of attorney depends on the situation in which it is drawn up:

- The reporting is signed by an electronic signature issued to the accountant of this organization.

- Reporting is carried out by a third-party organization indicating the responsible person authorized to submit reports.

- The reporting of an individual entrepreneur is maintained by another individual entrepreneur, and the power of attorney is notarized.

- Power of attorney to the Pension Fund

sample power of attorney

sample power of attorney

sample power of attorney

sample power of attorney

Such a power of attorney contains information:

- registration address of the organization and date of drawing up the form;

- text indicating for which regulatory authority the power of attorney was drawn up;

- information about the trustor company:

- Name;

- Full name and position of the manager or deputy;

- Full name and position of the authorized employee;

- details of the identity document of the authorized employee;

If the validity period is not specified, then the power of attorney is valid for one year.

If the obligation to submit reports is assigned to an employee of an organization or individual entrepreneur, for example, a full-time accountant, then there is no need to have the power of attorney certified by a notary. If powers are transferred to a third-party organization or individual entrepreneur, then the document is certified by a notary.

Such a power of attorney is usually issued in paper form. In order to submit electronic reports, you need a digital version of the power of attorney. An electronic power of attorney contains the same information as a paper one. It is attached to the report in electronic form, signed by the principal’s UKEP and sent via TKS.

Answers to common questions

Question: Can the chief accountant, who is entrusted with the responsibility for signing the accounting records, delegate this responsibility to another person?

Answer: Usually, such powers of attorney are drawn up without the right of subrogation, otherwise the new document will require certification by a notary.

Question: For how long is a power of attorney for the right to sign accounting records issued?

Answer: The duration of the power of attorney for the right to sign accounting and/or tax reporting can be any. For example, it could be one year, three or five years. If the document does not indicate a validity period, it will be considered to be equal to one year from the date of signing of the power of attorney.

Who signs the financial statements in accordance with the law?

Law 402-FZ “On Accounting” does not contain provisions that strictly regulate the restriction of the rights of the head of the company to delegate the authority to sign statements to other persons. According to Art. 13 of this law, financial statements are recognized as drawn up after they are signed on paper by the head of the company. A copy of the financial statements signed by the manager must be kept in the company. In this case, the manager’s signature must also contain the date of signing the copy of the reporting.

The head of a company is understood as a person who is the sole executive body or is responsible for conducting affairs in the company. A manager may also be considered a manager, to whom the functions of the sole executive body are transferred.

Only the head of the company has the right to sign financial statements. The authority to sign financial statements is prescribed in the company's constituent documents by decision of the governing body (meeting of founders). This decision is formalized in the appropriate protocol (

How to control an outsourcer

For many managers, an outsourced accountant is seen as a “pig in a poke”; it is not clear what he does, how and when to control his actions is not clear. In fact, it is no longer difficult to monitor an accountant remotely, here’s why:

- Clients are offered Personal Accounts, which make it possible to track what is currently being worked on and within what time frame this or that task will be completed;

- All clients have online access to their company’s accounting database 24/7;

- An accounting company that values its reputation will be interested in the constant improvement of control procedures on the part of the customer.

Therefore, if you are thinking of transferring the accounting of your company to a third-party accountant, then do not worry and feel free to trust the professionals.

Find out why accounting outsourcing is one of the most popular today.