What is investment in fixed capital

Investments in fixed capital are understood (section II of Rosstat order No. 746 dated November 25, 2016):

- costs of creation, reconstruction (modernization) of facilities, purchase of machinery, equipment, inventory, classified from an accounting point of view as non-current assets;

- investments in intellectual property;

- investments in biological resources.

Investments in fixed capital can be made both at the expense of one’s own funds and at the expense of borrowed (or received as assistance) funds, within the framework of exchange agreements and equity participation agreements.

Investments in fixed capital do not include the cost of acquiring assets whose price is less than 40,000 rubles, except for cases when these assets are reflected in accounting as fixed assets.

The following are not recognized as investments in the fixed capital of an organization:

- purchase of fixed assets that were previously on the balance sheet of third-party organizations;

- costs of purchasing apartments in multi-apartment residential buildings;

- purchase of land plots, environmental management facilities;

- concluding lease agreements, purchasing licenses, purchasing goodwill, marketing connections (related to non-produced assets in accordance with the system of national accounts).

A synonym for the concept of “investment in fixed capital” is “capital investments” (Article 1 of the Law “On Investment Activities” dated February 25, 1999 No. 39-FZ).

It should be noted that investments in fixed assets (as opposed to, in fact, fixed capital) are outside the jurisdiction of the main sources of law governing the accounting of fixed assets - Order of the Ministry of Finance dated October 13, 2003 No. 91n, as well as PBU 6/01. What rules of law should be considered as guiding principles when accounting for capital investments?

Regulations on accounting for long-term investments

The content and composition of an organization's accounting objects depends on its investment activities. Main accounting tasks:

- complete and timely reflection of expenses incurred in the formation of long-term investments;

- tracking of funds used during construction, commissioning of production facilities, fixed assets, intangible assets;

- correct determination and reflection of the inventory value of acquired and commissioned fixed assets and intangible assets;

- monitoring the availability and correct use of sources of financing for long-term investments.

Legal regulation of accounting in Russia is based on a four-level system of regulations:

- Laws, presidential decrees and government regulations of the Russian Federation establishing uniform legal standards for organizing and maintaining domestic accounting. Provisions affecting accounting issues contained in other federal acts must comply with the Federal Law “On Accounting”.

- Russian standards “Accounting Regulations” are approved by the Government of the Russian Federation and federal executive authorities.

- Instructions, guidelines, recommendations and other similar documents that are developed and approved by ministries, federal and other executive authorities on the basis of laws and regulations of the first and second levels. The documents of the third level include “Charts of accounts for accounting of financial and economic activities of organizations,” as well as instructions for their use.

- Documents relating to the organization and maintenance of accounting for obligations, business transactions, and certain types of property. They are intended for internal use by specific organizations. Documentation of reporting, content, status, principles of construction, procedure for preparation and approval are determined by the management of enterprises within the framework of the existing accounting policy.

According to the definition of current legislation, long-term investments are securities, targeted bank deposits, cash, shares, technologies, equipment, licenses, intellectual values, property rights invested in objects of economic activity for the purpose of making a profit. They can be used for:

- capital construction, reconstruction and technical re-equipment of an existing enterprise or non-production facility;

- acquisition of buildings, structures, vehicles, equipment and other objects classified as fixed assets;

- purchase of land plots, environmental management facilities;

- creation of intangible assets.

Accounting for long-term investments is regulated by such basic documents as:

- Tax Code of the Russian Federation;

- Civil Code of the Russian Federation;

- “Regulations on accounting and reporting in the Russian Federation”, approved by order of the Ministry of Finance of Russia No. 34n dated July 29, 1998;

- “Regulations on accounting of fixed assets” (PBU 6/01), approved by order of the Ministry of Finance of Russia No. 26n dated March 30, 2001;

- “Regulations on accounting for long-term investments” (“Regulation 160”), approved by letter of the Ministry of Finance of Russia No. 160 dated December 30, 1993;

- “Regulations on accounting for intangible assets” (PBU 14/2007), approved by order of the Ministry of Finance of Russia No. 153n dated December 27, 2007;

- “Instructions for the application of the chart of accounts for accounting of financial and economic activities of organizations”, approved by order of the Ministry of Finance of Russia No. 94n dated October 31, 2000.

One of the important components of the reform of the Russian accounting system is the transition to International Financial Reporting Standards. A comparison of IFRS and PBU shows a number of fundamental differences. Russian regulations are focused primarily on compliance with the requirements of domestic legislation. They do not take into account the inflation rate. In international standards, the priority is a truthful reflection of the economic activity of the subject.

Financial statements prepared in accordance with PBU must satisfy, first of all, the needs of tax and other regulatory authorities. It contains a lot of obscure and unnecessary information for investors. Reports prepared according to international standards are aimed at satisfying the requests of external users of these documents. Therefore, the transition to IFRS implies stricter self-control in the activities of managers, as well as improving the methods of analyzing business transactions and assessing risks.

The main difference between PBU and IFRS lies in the methods for assessing and reporting assets and liabilities. In addition, Russian standards do not contain key concepts inherent in IFRS, such as fair value, adjustments for hyperinflation, impairment of assets, etc.

There is no single, approved or recommended “Chart of Accounts” in IFRS. Each company reporting according to international standards develops its own chart of accounts, based on the specifics of the activity and financial detail of the information. In Russia, all companies are required to use a single “Chart of Accounts” approved by order of the Ministry of Finance. If any organization wants to use an account number not provided for by the plan, it can only do so with the permission of the Ministry of Finance. In the case when reporting is prepared according to IFRS, any company has the right to use the chart of accounts according to RAS.

Accounting for investments in fixed assets: basic regulatory standards

The legislator's main attention is paid to accounting for the results of investments - directly the fixed capital listed on the organization's balance sheet. As soon as fixed capital is formed and reflected in accounting at its original cost, it already falls under the jurisdiction of the specified rules of law - order No. 91n and PBU 6/01.

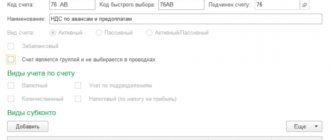

Until the moment an object of fixed assets is registered, an accountant can legally be guided by only one source of law - Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n, which introduces charts of accounts used by private enterprises.

How to account for investments in fixed capital according to Order No. 94n (on accounting accounts)

The order in question introduces account 08 “Investments in non-current assets”, which can be legally used to reflect investments on the balance sheet of an enterprise as accounting objects. But as soon as the result of these investments is the manufacture or acquisition of a fixed asset, its accounting is kept in another account - 01 “Fixed Assets”, and this accounting is regulated, as we noted above, by the norms of Order No. 91n and PBU 6/01.

Account 08 “Investments in non-current assets” can reflect costs incurred from any sources of financing:

- own;

- borrowed;

- allocated from the budget.

Account 08 reflects the costs of creating, modernizing, as well as maintaining the enterprise’s capacities, purchasing equipment, machinery and other production and non-production fixed assets.

This is evidenced by the provisions of clause 1.2.1 of the Recommendations for accounting in agricultural cooperatives, approved by the Ministry of Agriculture of Russia on January 25, 2001. Based on the principle of legal analogy, due to the absence of other industry norms, this formulation can also be applied to enterprises in other areas not related to agriculture.

An enterprise, when accounting for investments in fixed assets, can open various sub-accounts to account 08 if necessary. For example, if capital investments are made in the independent production of an asset, then subaccount 08.03 “Construction of fixed assets” can be used. If an asset is purchased, subaccount 08.04 “Purchase of fixed assets” is used.

Account 08 of the Chart of Accounts is rightfully classified as active. That is, its debit reflects directly investments in working capital, and its credit reflects the write-off of the enterprise’s costs in the process of capitalizing certain assets. The entries in this account reflect the monetary value of business transactions on an accrual basis from the beginning of the reporting year.

In what cases are investments in non-current assets subject to property tax, ConsultantPlus experts explained. Get trial access to the K+ system and go to the Tax Guide for free.

Let us now study the nuances of accounting for investments in fixed assets using the specified account and its subaccounts in more detail.

Investments in OS can be made in the form of:

- investments in independent production of funds;

- investments in the production of funds using contractors;

- purchases of ready-made funds.

Accounting for capital investments on account 08: OS production

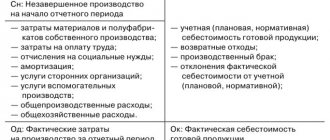

Accounting for funds produced by an enterprise independently in an economic way is carried out during the following business transactions:

1. Payment of wages to employees involved in the production of fixed assets. This payment is made by posting:

Dt 08.03 Kt 70 - the accrual of the actual salary is reflected;

Dt 08.03 Kt 69.01 (02, 03, 04) - the accrual of contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund, and the Federal Compulsory Medical Insurance Fund is reflected on wages.

2. Acceptance of equipment into the production workshop for the purpose of installing it on the fixed asset facility being created. This operation is reflected in the register using the following entries:

Dt 08.03 Ct 07.

3. Acceptance of materials into the production workshop for the purpose of their use in the creation of fixed assets. The following correspondence applies here:

Dt 08.03 Kt 10.

4. Implementation of other expenses not classified within the above operations, but directly related to the creation of an item of fixed assets, which characterize the corresponding operations. For example, these may be costs associated with paying for the services of transport companies. They are reflected in the registers by posting:

Dt 03/08 Kt 60.

Thus, the main accounting objects within the framework of investing in fixed assets will be:

- expenses for labor, equipment, materials;

- expenses for third party services.

In turn, if an enterprise, investing in the production of fixed assets, attracts contractors, then the cost of work performed by these contractors (excluding VAT) is reflected in the debit of account 08 and the credit of account 60. VAT is reflected in the debit of account 19.01.

Another way to invest in OS is to purchase ready-made assets.

Accounting for long-term investments: postings

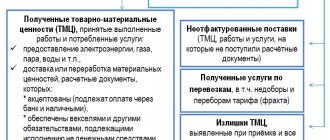

Investments (financial investments) at the time of acquisition are valued at the purchase price, taking into account the costs associated with paying for brokerage, banking, consulting and other services. Their accounting is kept on synthetic account 58 “Financial investments”:

- by debit – receipt;

- for the loan - disposal.

To maintain analytical accounting, sub-accounts are opened:

- “Units and shares” – 58-1;

- “Debt securities” – 58-2;

- “Loans provided” – 58-3;

- “Deposits under a simple partnership agreement” – 58-4.

Income and expenses that arise upon disposal of financial investments are reflected in account 91 “Other income and expenses.”

Typical wiring

| Debit | Credit | Name of business transaction |

| 58 | 76 | Purchase of shares, bonds |

| 51 | Providing a short-term loan | |

| Providing a loan with interest | ||

| 91 | Increase in market value of shares | |

| Monthly allocation of the difference between the par and purchase values of bonds when the price is below par | ||

| 76 | 91 | Monthly accrual of interest due on bonds |

| Monthly interest accrual on the loan provided | ||

| Attribution of the difference between the book and contract values of the transferred property | ||

| Write-off of accounts payable when repaying bonds | ||

| Reflection of the amount of the share sale agreement | ||

| 91 | 76 | Accounting for intermediary services for the acquisition of financial investments |

| 58 | Reflection of a decrease in the market value of shares | |

| Monthly allocation of the difference between the purchase and face value of bonds | ||

| Redemption of bonds | ||

| Write-off of the actual cost of shares sold | ||

| 99 | Formation of a reserve for reducing the value of financial investments | |

| 59 | ||

| 51 | 76 | Receipt of payments for shares sold |

| Redemption of bonds | ||

| Receiving interest on the loan provided | ||

| 58 | Return of borrowed funds | |

| 59 | 91 | Attribution of increased value of financial investments |

| Write-off of reserve |

Accounting for capital investments: purchasing OS

Business transactions that characterize this option for investing in fixed assets are reflected on almost the same principle as in the case of registration of transactions involving the services of contractors during the construction of fixed assets. That is, provided:

- reflecting expenses for the purchase of fixed assets in the debit of account 08 and the credit of account 60;

- when accounting for VAT on the debit of account 19.01.

In addition, if additional spare parts and tools are supplied to fixed assets, their cost can be reflected in the debit of account 10.05. If necessary, other subaccounts of account 10 can be used. For example, subaccount 10.03, if gasoline is supplied along with the fixed asset represented by a car. Or - subaccount 10.09, if the main asset, for example represented by a tractor, is also supplied with agricultural implements (mowers, winnowers).

Fixed assets are accepted for operation at the generated initial cost, and the corresponding business transaction is reflected by posting Dt 01 KT 08. After this, the enterprise accounts for the fixed asset accepted on the balance sheet according to the standards established by the above federal regulations.

You can learn more about the features of accounting using postings to account 08 in the article “08 accounting account (nuances)” .

Results

Investing in fixed assets (making capital investments) refers to the process in which an enterprise invests capital in the creation, modernization or purchase of fixed assets. Before this object is accepted on the balance sheet, account 08 is used to account for investment in it. Afterwards, accounting for the fixed assets object is carried out using account 01 (in accordance with the norms of PBU 06/01 and corresponding sources of law).

You can get acquainted with other facts about the capital investments of the enterprise in the articles:

- “Capital investments in accounting are...”;

- “Formula for calculating specific capital investments (nuances)”.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What is needed to attract investment?

No one will engage in charity and invest in activities without benefit. For this reason, a special investment agreement is drawn up, which specifies the object, the obligations of both parties, their responsibilities and deadlines. On its basis, the investor receives the right to his share of the profit.

In such a partnership, the risk exists only for the investor, because he cannot be completely sure of the profitability of the business activity. Moreover, if the company does not receive income, it will not have to pay anything to the investor.

Investors will also not make deposits without special reasons. To raise funds, you need to draw up a competent business plan. It must reflect and justify the profitability of investments. It is necessary to first consider the conditions under which the company will agree to invest. In addition, it is worth considering the details present in this process. Otherwise, the entrepreneur may find himself in an uncertain situation.

Investments in fixed assets are easy to attract, and this is a beneficial interaction for both parties to the transaction. For this reason, it is also easy to find an investor for a truly profitable business.

Tags: asset, balance sheet, accountant, inventory, capital, loan, order, expense, write-off