What property is classified as fixed assets when reflected on the balance sheet?

The accounting rules for this category are established by PBU 6/01. The list includes property used in the manufacture of products (carrying out work, providing services) and necessary for the purpose of managing the organization.

Signs of OS are the absence of plans to sell this asset and the possibility of extracting benefits from it.

The main criterion by which an asset in accounting is classified in this category is its useful life of more than 12 months (or another period that coincides with the operating cycle of the organization). This is logical, since these are long-term assets of the organization.

The fixed assets include:

- buildings, capital and non-capital construction projects;

- plots of land;

- production and work equipment;

- cars, motorcycles;

- computers, office equipment;

- household equipment;

- other specialized types of assets.

This type of asset also includes natural resources, capital investments in land or rental property.

The ways in which a company acquires this type of asset may be different. These include a purchase under a sales contract, a gratuitous transfer, a contribution to the company's charter, an exchange as part of barter, production within an organization or through the use of contractors, or the identification of surplus during an inventory check.

general information

Let's start with terminology. Tangible non-current assets are the property of an enterprise that is used repeatedly and during this process transfers its property to products in parts. In practice, this includes everything that has been used for more than one year and its value exceeds fifteen non-taxable minimum income of the enterprise.

More specifically, tangible non-current assets are:

- equipment and machinery;

- fixed assets;

- unfinished capital investments (investments);

- other tangible non-current assets.

This is not a complete list due to the large number of possible physical manifestations. In operating activities, tangible non-current assets have a number of advantages and disadvantages. Let's look at them in more detail.

How are fixed assets reflected on the balance sheet?

Fixed assets in the balance sheet are reflected in a separate line under code 1150 (in accordance with Order of the Ministry of Finance No. 66n).

The value of this asset is determined as the difference in the balances on the following accounts:

| Account number | Account name | Note |

| 01 | Fixed assets | — |

| 02 | Depreciation of fixed assets | Depreciation on items listed on line 1140 (Tangible Exploration Assets) should not be taken into account. |

| 07 | Equipment for installation | The balance of this account is taken in relation to the costs of construction in progress. |

| 08 | Investments in non-current assets | The balance of the invoice for costs of construction in progress is accepted when indicated in line 1150. |

It is important to note: objects that fall under the OS criteria, but are temporarily owned and used to generate income, are accounted for separately. To do this, use account 03 “Profitable investments in material assets.” In this case, depreciation for them is calculated on the credit of account 02. If the company has similar objects, then when entering data in line 1150, the debit of account 01 should be subtracted from the depreciation amount.

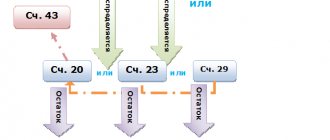

Practical examples of capitalization of fixed assets

Example 1

LLC "Medved" purchased a machine worth 250 thousand rubles. (including VAT - 38135.59). The price included additional costs for transporting the machine and installing it at the workplace.

All transactions are reflected in the accounting records of the LLC with the following entries:

RUB 211,864.41 — accounting for the costs of purchasing an asset (transportation and installation are carried out by the seller and are included in the price).

RUB 38,135.59 - input VAT shown.

211864.41 rub. — the initial cost of the equipment was formed, the machine was put into operation.

RUB 38,135.59 — input VAT is deductible.

Example 2

A manufacturing company decided to create a new warehouse for storing materials and goods. The construction of the building was carried out by the company’s workers, the final cost of the work according to the estimate was 10 million rubles.

The accounting transactions show:

Dt08.03 Kt60,10,70, 69, etc.

10 million rubles — the actual costs of building a warehouse are taken into account (salaries of employees involved in construction, insurance contributions from wages, cost of materials used (according to the act of writing off inventories), costs for additional services of contractors (for example, drawing up estimate documentation), etc.) .

Dt01 Kt08.03

10 million rub. — a new warehouse building was registered and put into operation

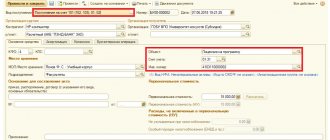

An example of how fixed assets are reflected on the balance sheet

The rules for entering data for this type of asset coincide with the requirements for creating a balance sheet. It is filled in using the value “thousands”. rub.".

Let's take as an example the display of assets from the balance sheet of a company:

| № | Indicator name | Code | Data as of December 31, 2018 | Data as of 12/31/2019 | Data as of 12/31/2020 |

| 001 | 1. NON-CURRENT ASSETS Intangible assets | 1110 | 2 007 | 1 645 | 1 560 |

| Research and development results | 1120 | — | — | — | |

| Intangible search assets | 1130 | — | — | — | |

| Material prospecting assets | 1140 | — | — | — | |

| 002 | Fixed assets | 1150 | 10 718 | 11 856 | 11 947 |

| Profitable investments in material assets | 1160 | — | — | — | |

| Financial investments | 1170 | — | — | — | |

| Deferred tax assets | 1180 | 85 | 56 | 76 | |

| Other noncurrent assets | 1190 | — | — | — | |

| Total: | 1100 | 12 810 | 13 557 | 13 583 | |

| 004 | 2. CURRENT ASSETS Inventories | 1210 | 9 560 | 8 156 | 10 745 |

| VAT on purchased assets | 1220 | 945 | 3 948 | 1 564 | |

| 005 | Accounts receivable | 1230 | 5 875 | 7 046 | 5 378 |

| Financial investments (excluding cash equivalents) | 1240 | — | — | — | |

| Cash and cash equivalents | 1250 | 3 450 | 2 735 | 1 837 | |

| Other current assets | 1260 | — | — | — | |

| Total: | 1200 | 19 830 | 21 885 | 19 524 | |

| BALANCE | 1600 | 32 640 | 35 442 | 33 107 |

As can be seen from the balance sheet:

- fixed assets are reflected in one line and are one of the elements of the first section “Non-current assets”;

- data is entered into the line without decryption in a single amount;

- If necessary, details can be provided in the balance sheet appendix.

In particular, changes in the value of fixed assets as a result of their reconstruction or additional equipment are included in the annexes. The same scheme is followed if the property is revalued as a result of recalculation of the actual market value. The differences are recorded as additional capital.

Passive

Line 1370 Capital and reserves

- Authorized capital: Kt 80.

- Dt 81 minus.

- Kt 82.

- Kt 83.01 + Kt 83.02 + Kt 83.03 + Kt 83.09.

- balance 84.

Line 1410 Long-term borrowed funds

- Borrowed funds: Kt 67.01 + Kt 67.03 + Kt 67.05 + Kt 67.21 + Kt 67.23 + Kt 67.25.

Line 1450 Other long-term liabilities

- Deferred tax liabilities: Kt 77.

- Kt 96 (reserve for upcoming events).

- Kt 60.01, Kt 60.02, Kt 76, Kt 75, Kt 73.03.

Line 1510 Short-term borrowed funds

- Borrowed funds: Kt 66 + Kt 67.02 + Kt 67.22 + Kt 67.04 + Kt 67.24 + Kt 67.06 + Kt 67.26.

Line 1520 Accounts payable

- Accounts payable: Kt 62.02 minus Dt 76.AB + Kt 60.01 + Kt 68 + Kt 69 + Kt 70 + Kt 71 + Kt 73.03 + Kt 76 + etc.

Line 1540 Other short-term liabilities

- Deferred income: Kt 86 + Kt 98.

- Kt 96 (short-term).

- Kt 76.NA;

The balance currency for the Asset and Liability must be the same. PDF

See also:

- Checking the financial results statement using a simplified form

- Balance check

- Interconnection of reporting forms

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Cost of fixed assets to be reflected on the balance sheet

When accounting, fixed assets include assets whose cost usually exceeds 40 thousand rubles, and whose service period is over 12 months. They should be reflected in the balance sheet minus the amount of depreciation (at the so-called residual value).

If an asset has the characteristics of a fixed asset, but its cost is less than 40 thousand rubles, then the company can take it into account both in the column “Fixed assets” and in the column “Inventories”. The second column records the assets that the organization plans to use during the year.

The organization determines the value limits for classifying property as a certain category of assets in its accounting policy (in accordance with clause 5 of PBU 6/01).

When the value of an asset changes, the new value can be accepted for accounting only after it has been adjusted.

Example

The LLC fills out a simplified balance sheet at the end of the year. As of December 31, the organization has the following assets:

- purchased fixed assets (account 01) – 100 thousand rubles. — tangible non-current assets (line code 1110);

- cash (account 51) - 10 thousand rubles. – line code 1250;

- buyer debt - 15 thousand rubles. – DZ (line code 1260).

Total assets: 125 thousand rubles.

Liabilities:

- Management Company + Profit: 115 thousand rubles. - line code 1310.

- Accounts payable (for wages, to contractors, to the budget) – 10 thousand rubles. – line code 1330.

Total liabilities: 45 thousand rubles.

conclusions

The organization's fixed assets in the balance sheet are displayed on a special line in the first section of the reporting document, which is dedicated to the company's non-current assets. Assignment of property to this category is carried out in accordance with internal accounting policies when fixing a certain cost and period of use (standard thresholds are 40 thousand rubles and more than 12 months of use).

To send reports to government agencies, use Astral Report 5.0 - an online service that allows you to generate and submit electronic documents from any PC and from anywhere in the world with Internet access.

Legislative regulation

At the state level, a number of NAPs have been developed that regulate the process of asset accounting. In particular, Federal Law No. 208 describes in detail the structure of capital (Article 25), the minimum requirements for its size (Article 26), the process of changing the amount of capital (Articles 26-30), as well as issues of protecting the rights of the creditor and issuing securities (vv. 31-33).

The norms of this Federal Law apply only to JSCs. CJSCs and organizations of other forms of ownership have their own accounting rules. In particular, Federal Law No. 402 describes in detail how tangible non-current assets and liabilities of an organization should be taken into account.

Flaws

But, alas, there were some negative aspects. Among them we should mention:

- Tangible non-current assets are property subject to obsolescence. Therefore, it loses its value even when idle.

- They are difficult to manage because their structure cannot be changed. Even when there is a decline in market conditions, the period of their use decreases.

- Most often, they are low-liquid assets, which is why they cannot act as means of payment.

Advantages

Speaking about tangible non-current assets, it is necessary to note:

- there is practically no exposure to inflation, due to which they are protected from its influence;

- have a small commercial risk of losses in operating activities;

- can bring stable profits, produce various products, depending on market conditions;

- help reduce losses during storage of inventory items;

- expand the volume of production activities when market conditions rise, thanks to the created reserves.

Let's say a word about classification

Let's look at what an MBA is from different points of view. So, there are functional types:

- Fixed assets. These are MBA enterprises, expressed in the form of labor tools, which are reused and gradually transfer their value to the created products.

- Unfinished capital investments (investments). This means the amount of costs that were actually spent on the construction and installation of fixed assets until they were put into operation.

- Machinery and equipment are necessary to produce products. These include measuring equipment and other instruments.

- Other types of non-current assets.

The division can also be carried out based on the type of activity where it is used:

- Operating. These are tangible non-current assets that are used in the economic and commercial economic activities of the entity.

- Investment. They mean long-term non-current assets that were formed as a result of investments in an enterprise in order to obtain greater profits in the future.

- Non-productive. Needed to satisfy the social needs of staff. An example would be a recreation room or dining room.