Why do you need a completed balance sheet: example

The balance sheet for 2022 is a document that summarizes accounting data on the financial performance of an organization for a certain period.

ATTENTION! Starting from 2022, financial statements will be submitted exclusively in electronic form. Paper forms will no longer be accepted. Read more about changes to the rules for presenting financial statements here. We also remind you that in 2022 the reporting forms have been updated.

Despite the fact that the 2022 balance sheet form that is relevant for the Russian Federation - you can download the form for free directly from the article - is filled in with data for very specific dates, a comparison of these data reflects their dynamics over time.

A correct reading of the 2022 balance sheet form provides fairly broad information of an economic nature to the interested user. These users include primarily:

- owners of the organization;

- financial and economic service of the enterprise;

- Inspectorate of the Federal Tax Service;

- state statistics bodies;

- banks from which the company receives loans;

- investors;

- sponsors;

- counterparties with whom current interaction is carried out;

- administrations of the regions where the enterprise operates.

The balance sheet for 2022, as well as the balance sheet for 2022, allows you to see not only the specific financial and economic situation at the reporting date, but also analyze its changes in comparison with data for past years. And taking into account long-term development plans, it makes it possible to draw up a forecast of the enterprise’s activities and, accordingly, a forecast balance sheet.

For external users, as a rule, it is enough to present the balance sheet on the 2022 form with a certain frequency (month, quarter, year). They may be satisfied with the standard reporting form, which is used to submit a report to the Federal Tax Service and state statistics bodies, but options for transforming the data into other reporting forms similar to the 2021 balance sheet are possible.

For internal purposes, the main of which is the current analysis of activities and timely adoption of measures to adjust the operation of the enterprise, the balance sheet - Form 1 on the 2022 form - can be compiled at any frequency and in a very wide range of its types.

Thus, the value of the balance sheet goes very far beyond the boundaries of the usual accounting records created for the Federal Tax Service. Therefore, special attention should be paid to filling it out and knowing how to draw up a balance sheet correctly.

For general requirements for financial reporting, read the article “What requirements should accounting reporting satisfy?” .

Balance sheet 2022: features

By filling out the form, the company itself details the indicators by item, taking into account the level of materiality of each. Financial statements must be submitted to the regulatory authorities (IFTS and statistical departments) in a form that includes line codes. We will present a sample of filling out the balance sheet for 2022 in exactly this form.

The basis for drawing up a balance are accounting registers, for example, a chess sheet, memorial orders, order journals, a balance sheet or a general ledger.

Forms in which it is possible to create a balance sheet

To be presented as official reporting, the balance sheet has a specific form. For the internal needs of an organization, it can have many modifications depending on the purpose and the type of data for its compilation:

- data can be taken either on specific dates (balance sheet) or by turnover for a period (turnover balance);

- the source data can be either only accounting, or only inventory, or accounting that is confirmed by inventory results;

- data can be taken into account either with the inclusion of regulatory items (depreciation, reserves, markup) or without them;

- the balance sheet can be drawn up in relation to only one of the types of activities of the enterprise;

- the balance sheet can have either a full or an abbreviated (simplified) form;

- the balance sheet can be drawn up in the form of equality between assets and the sum of capital and liabilities, or it can take the form of equality between capital and the difference between assets and liabilities;

- the balance sheet can be made for one organization or include data for several enterprises (consolidated and consolidated balance sheets);

- in relation to the event, there may be opening, liquidation, separation, and unification balance sheets;

- the balance can be preliminary, forecast, interim, final.

And this is not a complete list of possible options for drawing up a balance sheet for an organization to solve its internal problems. However, the fundamental approaches to filling out this form remain the same regardless of the way the source data is reflected in it.

You can download a sample balance sheet in the new edition with comments on completion from K+ experts in the ConsultantPlus legal reference system. To do this, get a free trial demo access to K+:

Balance sheet form for 2022: how the document is structured

The balance sheet of the organization is a table, on the left side of which all the assets of the company are reflected, and on the right side - the sources of these funds. Both of them must be equal, since the value of the property cannot be more or less than the sources of its formation.

The left side is divided into 2 sections, the first contains non-current assets, and the second contains current assets.

The right side of the balance sheet is a liability, divided into 3 parts, in which information about reserves, capital and liabilities is consistently recorded.

How to draw up a balance sheet - 2022 for the Federal Tax Service: rules and techniques

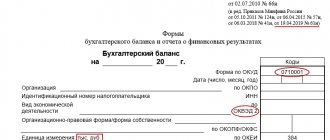

Recommended reporting forms for submission to the Federal Tax Service were approved by Order of the Ministry of Finance of the Russian Federation dated July 2, 2010 No. 66n. Since 2022, the balance sheet form as amended by Order of the Ministry of Finance dated April 19, 2019 No. 61n has been used.

The innovations in it are as follows:

- the unit of measurement has become thousands of rubles, it is impossible to fill out reports in millions;

- OKVED was replaced by OKVED2;

- A line has been entered to indicate whether the reporting is subject to mandatory audit or not. If yes, you will need to indicate information about the auditor.

The full form of the balance sheet contains the entire list of items that are recommended to be highlighted in the appropriate sections of the balance sheet. However, an enterprise may exclude items from this report for which it does not have the data to fill out, and, conversely, include additional items if this increases the reliability of the reports being compiled.

The full form has a box to display notes for each article. The enterprise decides for itself whether it needs to use this column. Obviously, it becomes necessary for any deviation from the standard recommended form.

In the abbreviated (simplified) form, which can be used by some legal entities that meet certain requirements if they consider it possible to present reporting in a simplified form, there is no division into sections and a column for notes, and the articles are combined in order to consolidate the indicators.

Read about which legal entities can create accounting records in a simplified form here.

How to fill out a balance sheet? The basic rules governing the procedure for drawing up the 2021 balance sheet for official reporting purposes are contained in PBU 4/99, approved by Order of the Ministry of Finance of the Russian Federation dated July 6, 1999 No. 43n. They boil down to the following:

- the source of information for drawing up the balance sheet is accounting data;

- accounting data must be generated according to the rules of the current accounting regulations and in accordance with the accounting policies adopted by the enterprise;

Read about the specifics of accounting policies when applying the simplified tax system in the article “Procedure for maintaining accounting records under the simplified tax system .

- credentials must meet the requirements of completeness and reliability;

- an enterprise that has branches draws up a single balance sheet for the organization;

- data reflected in the balance sheet must be neutral and correlated with data from previous periods;

- the allocation of items in sections of the balance sheet is carried out according to the principle of materiality;

- the reporting period for the balance sheet is a calendar year;

- assets and liabilities reflected in the balance sheet should be divided into short-term and long-term (existing less than and more than 12 months, respectively);

- offset between items of assets and liabilities is not made if it is not provided for by the PBU;

- property is valued at its “net” value (less regulatory items);

- The accounting data of the annual report must be confirmed by the inventory.

In what cases is it permissible to deviate from the above rules provided for by PBU 4/99, find out in the expert opinion of ConsultantPlus by receiving trial access to the system for free.

How to prepare a balance sheet?

The essence of creating a balance sheet is to fill out all lines of the approved Form No. 1, the composition of which the enterprise has the right to adjust in accordance with the peculiarities of conducting business activities and the property used.

Both the Asset and Liability balance sheet consist of a sequence of lines, each of which records a certain indicator of the financial condition of the organization.

Each line has the name of an indicator and a fixed serial number, which reflects the position of the indicator in the hierarchical structure of the table.

So, for example, in the “Non-current assets” section in the Balance Sheet, the first line corresponds to number 110 (if the management of the enterprise increases the number of lines in form No. 1, the number may have a larger number) and is called “Intangible assets”.

The value of this row is usually obtained by adding the values of rows numbered 111 to 119, if such exist.

After all the rows in the Asset table are filled in, to obtain the final value, it is necessary to add up the results of the first two sections of the balance sheet, which were obtained by summing the other rows in a hierarchical sequence.

Consignment note – sample filling. How to write an explanatory note to the balance sheet?

The same principle works in the Passive table.

The first section of this table, “Capital and Reserves,” has serial number 310, since it is the third main section of the entire balance sheet and is formed by adding the rows that are in its subgroup of the hierarchy, that is, rows numbered from 311 to 319.

Filling out the balance sheet can be done starting from any table (Liability or Asset)

The main condition for the correct preparation of a balance sheet table is the exact correspondence of the value of each line and the indicator entered into it, as well as the presence of monetary values in all lines established by the enterprise.

There are exceptions when the amount for some indicator may be zero, in which case it is necessary to provide explanations for this item in the financial report.

As a rule, all indicators are displayed in numbers that mean thousands of rubles, for example, if the value of an organization’s real estate is 10,000,000 rubles, then 10,000 must be written in the balance sheet asset in the corresponding line.

Of course, if the company has a larger scale, and their cash turnover is mainly in the millions, then you can enter numbers by removing the last six digits, and indicate the numerical unit million rubles in the title of the indicator column.

The final numbers of the Asset and Liability balance sheets must coincide, since, in fact, the Asset reflects everything that the organization has, and the Liability balance sheet provides a description of where all the listed Assets were obtained from.

For a more detailed description of the preparation of the balance sheet, we will consider the principle of filling out each line of the Liability and Asset tables.

What does the abbreviation TZR (decoding) and others mean?

Further in the article, abbreviations that are often used in accounting will be frequently mentioned. But beginners may have difficulty deciphering them, so we will give the full name of such abbreviations:

- TZR - transportation and procurement costs.

- OS - fixed assets.

- R&D - research and development work.

- Intangible assets - intangible assets.

- WIP - work in progress.

- FBP - deferred expenses.

- Commodities and materials - inventory items.

- FSS - social insurance fund.

General rules for filling out the balance sheet

The balance sheet is filled out on the basis of information about the balances in the accounting accounts as of the reporting date. These balances are reflected in the balance sheet in accordance with the objectives assigned to a specific report.

How to make a balance sheet - step-by-step instructions with examples will be given below . In relation to data on the financial result (retained earnings/uncovered loss), the current balance sheet is prepared, as a rule, by including in the reporting period the full number of months of the year for which it is formed. This is due to the fact that financial results accounts are generally closed on a monthly basis.

The division of assets and liabilities into long-term and short-term is provided for by the structure of the balance sheet. In his assets, 2 sections are allocated for this: non-current assets (long-term) and current assets (short-term). The liability is divided into three sections, two of which are sections on obligations, divided by the time of circulation (long-term and short-term). The third liability section reflects data on equity, which occupies a special position in the structure of the balance sheet.

Reflecting information on specific balance lines has its own characteristics. Let's figure out what is important when filling out a balance sheet - an example with a breakdown:

- data on the cost of fixed assets (including those intended for rental) and intangible assets are shown, as a rule, minus depreciation;

- information on R&D, tangible and intangible exploration assets is filled in only if such assets are available, while exploration assets are reflected net of depreciation;

- data on financial investments, which are loans issued, cash investments in banks (deposits), deposits in other organizations, in securities, are divided depending on their maturity into long-term and short-term and are shown, respectively, in different sections of the asset, while amounts are reflected less the created reserve for impairment of financial investments;

- information on deferred tax assets and liabilities present in the asset (non-current assets) and liability (long-term liabilities) lines of the balance sheet is filled out only by those organizations that apply PBU 18/02;

- data on inventories, including balances on accounts for materials (with inventory items), goods, finished products, work in progress, RBP, are reduced by the amount of created reserves for depreciation of goods and materials and the value of the trade margin, if goods are accounted for with it;

- accounts receivable and payable, which are amounts that someone owes the company and that the company owes to someone (counterparties, budget, funds, employees), are shown in detail and are reflected, respectively, in the assets and liabilities of the balance sheet as part of short-term liabilities; in this case, accounts receivable are reduced by the amount of created reserves for doubtful debts and data recorded on other balance sheet lines (financial investments);

- VAT on advances may be reflected in the balance sheet differently, depending on the accounting policy adopted by the enterprise;

For information on options for reflecting VAT on the balance sheet, read the article “How is VAT reflected on the balance sheet?” .

- funds (cash, non-cash, foreign currency) are shown in the total amount minus deposits accounted for in the lines of financial investments;

- the amount of additional capital, if present in accounting, is divided into two lines, depending on whether it is related to the revaluation of property;

- the financial result (retained profit or uncovered loss) in the annual balance sheet represents the result of activities for a finite number of years (after the balance sheet reform), and in interim reporting it consists of two figures (the financial result of previous years and the financial result of the current period), regardless depending on the reporting period, it may be a negative value;

Read about the reformation of the balance sheet in the material “How and when to reform the balance sheet?” .

- data on borrowed funds are divided into long-term and short-term liabilities according to the remaining period of their repayment and are shown in different sections of liabilities, while accrued interest on long-term loans is included in short-term debt;

- in a similar manner, depending on the remaining period of use, estimated liabilities are divided into long-term and short-term liabilities reflected in different sections of liabilities, which correspond to the amounts of created reserves for future expenses;

- data on future income additionally includes information on the amounts of targeted financing;

- all sections of the balance sheet, with the exception of the “Capital and Reserves” section, have a line for reflecting other assets or liabilities, intended for entering into it data that does not find a place in other lines of the corresponding section, or for those data that the organization decided to show separately.

When compiling an abbreviated (simplified) form of the balance sheet, a number of items highlighted in the full form are combined into items with new names:

- under the article “Tangible non-current assets”, one amount shows information about fixed assets and incomplete capital investments, which in the full form of the balance sheet is divided into 4 articles: “Intangible exploration assets”, “Tangible exploration assets”, “Fixed assets”, “Profitable investments in assets” ";

ATTENTION! With the reporting campaign for 2022, changes to PBU 18/02, 16/02, 13/2000, FSBU 5/2019 “Reserves” come into effect. And starting with reporting for 2022, the new FSBU 25/2018 “Lease Accounting”, FSBU 6/2020 “Fixed Assets”, FSBU 26/2020 “Capital Investments” should be applied. You can start applying new accounting standards earlier. This decision needs to be fixed in the accounting policy of the enterprise.

- the article “Intangible, financial and other non-current assets” combines data on the value of intangible assets, R&D, unfinished investments in intangible assets, information on long-term financial investments and deferred tax assets;

- the article “Financial and other current assets” together provides information on short-term financial investments, VAT on acquired assets and accounts receivable;

- the article “Capital and reserves” combines information on authorized, additional and reserve capital, purchased own shares, data on the revaluation of property and on retained earnings (uncovered loss);

- the item “Other long-term liabilities” jointly shows data on deferred tax liabilities and long-term provisions;

- in the article “Other short-term liabilities,” one amount shows data on future income and short-term estimated liabilities.

For information on how estimated liabilities are formed, read the publication “Procedure for calculating reserves in accounting.”

Balance sheet: how to fill out item by item

To fill out balance sheet items, data on balances formed as of the reporting date is taken from specific accounting accounts. In relation to the current version of the accounting chart of accounts, approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n, when filling out the full form of the balance sheet 2022 - which can be downloaded for free in our article - the balances on the following accounts are used:

- for the article “Intangible assets” - the final balance on account 04 minus the total on account 05, while for account 04 the data included in the line “Results of research and development” is not taken into account, and for account 05 – figures related to intangible exploration assets ;

- for the article “Results of research and development”, data on R&D costs reflected in the balance on account 04 is selected;

- for the articles “Intangible exploration assets” and “Tangible exploration assets”, data on the costs of developing natural resources is taken from account 08 minus depreciation related to these assets, taken into account, respectively, on accounts 02 and 05;

- for the item “Fixed assets”, the data is determined as the difference between the balances of accounts 01 and 02 (account 02 does not take into account figures related to material exploration assets and profitable investments in tangible assets), to which is added the amount of capital investment costs recorded in the accounts 07 and 08 (except for the figures included in the lines “Intangible search assets” and “Tangible search assets”);

- for the article “Profitable investments in assets”, the difference between the balances of accounts 03 and 02 in relation to the same objects is taken;

- for the item “Financial investments” in non-current assets, data on long-term amounts (with a maturity of more than 12 months) in accounts 55 (for deposits), 58, 73 (for loans issued to employees) is selected, which are reduced by the amount of reserves for long-term investments (count 59);

- for the item “Deferred tax assets”, the balance of account 09 is taken;

- for the item “Inventories”, the amount is formed by adding the balances on accounts 10, 11 (both accounts minus the reserve recorded on account 14), 15, 16, 20, 21, 23, 28, 29, 41 (minus account 42, if accounting of goods is carried out with a markup), 43, 44, 45, 46, 97;

- for the article “Value added tax on acquired assets”, the balance of account 19 is taken;

- for the item “Receivables”, the debit balances on accounts 60, 62 (both accounts minus the reserves formed on account 63), 66, 67, 68, 69, 70, 71, 73 (minus the data recorded under the item “Financial attachments"), 75, 76;

- for the article “Financial investments (except for cash equivalents)” in current assets, data on short-term amounts (with a maturity of less than 12 months) in accounts 55 (for deposits), 58, 73 (for loans issued to employees) are selected, which are reduced for the amount of reserves for short-term investments (account 59);

- for the item “Cash and cash equivalents” the amount is obtained by adding the balances of accounts 50, 51, 52, 55 (except for deposits), 57;

- for the article “Authorized capital (share capital, authorized capital, contributions of partners)” the data is taken as the balance of account 80;

- for the item “Own shares purchased from shareholders”, the balance of account 81 is taken;

- for the article “Revaluation of non-current assets”, data on balances on account 83 related to fixed assets and intangible assets are selected.

- for the item “Additional capital (without revaluation)” the data is formed as balances on account 83 minus data related to fixed assets and intangible assets;

- for the item “Reserve capital”, the balance of account 82 is taken;

- for the article “Retained earnings (uncovered loss),” the annual balance sheet includes the balance of account 84, and when preparing interim reporting, two balances are added up: account 84 (financial result of previous years) and 99 (financial result of the current period of the reporting year), with In this case, the sum can be formed both by addition and by subtraction;

- for the item “Borrowed funds” in the section “Long-term liabilities”, long-term (with a remaining maturity of more than 12 months) debt on loans and borrowings is selected from the balances on account 67, while interest on long-term borrowed funds must be taken into account as part of short-term accounts payable;

- for the item “Deferred tax liabilities”, the balance of account 77 is taken;

- for the item “Estimated liabilities” in the section “Long-term liabilities”, from the balances on account 96, data on long-term reserves, the period of use of which exceeds 12 months, is selected;

- for the item “Borrowed funds” in the section “Short-term liabilities”, the balances on account 66, interest on long-term borrowed funds taken into account in the balances on account 67, and that debt on long-term loans and borrowings (account 67), which at the time of drawing up the report became short-term (less than 12 months left until its maturity);

- for the item “Accounts payable”, credit balances on accounts 60, 62, 68, 69, 70, 71, 73, 75, 76 are summed up;

- for the item “Deferred income”, the balances of accounts 86 and 98 are added up;

- for the item “Estimated Liabilities” in the “Short-Term Liabilities” section, from the balances on account 96, data on short-term reserves, the useful life of which is less than 12 months, is selected.

To fill out the combined items of the reduced balance sheet, the balances on the following accounts are used:

- for the article “Tangible non-current assets”, the sum of the balances on accounts 01 and 03 minus the balance on account 02 is determined, which is then added to the balances on accounts 07 and 08, which are classified as non-current assets;

- for the article “Intangible, financial and other non-current assets”, the difference in balances on accounts 04 and 05 is summed up with data on long-term amounts on accounts 55 (for deposits), 58, 73 (for loans issued to employees), reduced by the amount of reserves for long-term investments (account 59), with the balance of account 09 and with data on unfinished investments in intangible assets and R&D reflected in account 08;

- for the article “Financial and other current assets”, data on accounts 19, 55 (less long-term deposits), 58 (on short-term investments) is combined with a decrease in the amount of reserves related to them (account 59), 60, 62 (both accounts less reserves formed on account 63), 66, 67, 68, 69, 70, 71, 73 (less amounts of long-term loans), 75, 76;

- for the item “Capital and reserves” the total amount of balances on accounts 80, 81, 82, 83, 84 is determined;

- for the item “Other long-term liabilities”, the balances of accounts 77 and 96 are combined (in relation to reserves with a period of use of more than 12 months);

- for the item “Other short-term liabilities” the balances on accounts 86, 96 (in relation to short-term reserves) and 98 are summed up.

The items “Inventories”, “Cash and cash equivalents”, “Long-term borrowed funds”, “Short-term borrowed funds”, “Accounts payable” are filled out according to the same accounts as similar items in the full balance sheet.

About the features of filling out individual lines of the balance sheet

Filling out the balance sheet 2022 according to the lines of the passive part

| Line code | Account balances included | |

| D/t | K/t | |

| Section III | ||

| 1310 | 80 | |

| 1320 | 81 | |

| 1340 | 83 s/account “Additional assessment of fixed assets and intangible assets” | |

| 1350 | 83 (except for additional valuation of fixed assets and intangible assets) | |

| 1360 | 82 | |

| 1370 | 84 | |

| 1300: Total for Section III | sum of section III row values | |

| Section IV | ||

| 1410 | 67 | |

| 1420 | 77 | |

| 1430 | 96 | |

| 1450 | amounts not included in the lines of section IV | |

| 1400: Total for Section IV | sum of rows of section IV | |

| Section V | ||

| 1510 | 66, 67 | |

| 1520 | 60, 62, 68, 69, 70, 71, 73, 75, 76 | |

| 1530 | 98, 86 | |

| 1540 | 96 | |

| 1550 | amounts not included in the previous lines of section V | |

| 1500: Section V total | sum of rows of section V | |

| 1700: Total liabilities | sum of row values of sections III, IV and V | |

If all balance lines are filled out correctly, the final results on lines 1600 and 1700 will be the same.

Balance sheet: example of filling out the general form

An example of a balance sheet completed by specialists is of interest to many accountants, both beginners and experienced, especially if a complex situation arises.

Examples of balance sheets with entered indicators can be seen on the websites of almost all reference and legal systems. In addition, an example of a balance sheet can be a form filled out automatically by an accounting program. However, Form 1 - Balance Sheet for 2022 completed in this way requires its verification. To carry out such a check and correctly configure its completion in the program, you need to understand the entire mechanism for generating the balance sheet.

Let's look at how to draw up an accounting balance sheet using the example of accounting data for which the financial result is formed after carrying out the necessary regulatory operations and reforming the balance sheet.

Let's assume that we are talking about an organization engaged in manufacturing and wholesale trade. The features of her credentials are due to the fact that she:

- has OS and intangible assets;

- makes capital investments;

- has financial investments;

- creates reserves for depreciation of goods and materials and financial investments, reserves for doubtful debts;

- creates a reserve for vacation payments;

- takes loans from banks;

- reimburses VAT;

- receives reimbursement of expenses for sick leave from the Social Insurance Fund;

- applies PBU 18/02;

- has a profit for previous years;

- has a loss based on the results of work for the current year.

We will display its accounting data as of the reporting date in the form of a table with a breakdown by accounting accounts in relation to the current version of the chart of accounts, approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n.

The table will contain detailed data on debit and credit balances, which, for ease of presentation, are not broken down by subaccount and rounded to the nearest thousand rubles without decimal places.

| Account number | Debit balance | Credit balance | Note |

| 01 | 5 274 | — | Fixed assets |

| 02 | — | 1 017 | Depreciation of fixed assets |

| 04 | 305 | — | Intangible assets |

| 05 | — | 57 | Depreciation of intangible assets |

| 08 | 924 | — | Capital investments |

| 09 | 102 | — | Deferred tax assets |

| 10 | 1 014 | — | Material reserves |

| 14 | — | 101 | Provision for impairment of inventories |

| 19 | 219 | — | VAT on purchased assets |

| 20 | 1 714 | — | Unfinished production |

| 41 | 2 011 | — | Goods |

| 44 | 415 | — | Selling expenses |

| 51 | 543 | — | Cash in current accounts |

| 55 | 100 | — | Special accounts. 100 – long-term deposit |

| 58 | 314 | — | Financial investments. Of these, 107 are long-term, 207 are short-term |

| 59 | — | 62 | Provisions for impairment of financial investments. Of these, 20 are long-term, 42 are short-term |

| 60 | 907 | 10 103 | By credit - debt to suppliers, by debit - advances transferred to them |

| 62 | 9 125 | 642 | By debit - debt of customers, by credit - advances received from them |

| 63 | — | 1 115 | Provision for doubtful accounts receivable |

| 66 | 18 | 2 019 | Short-term loans with interest on them. For debit 18 – overpayment of interest |

| 67 | — | 3 004 | Long-term loans with interest on them. Of these, 2,342 are with a remaining maturity of more than 12 months, 505 are with a remaining maturity of less than 12 months, 157 are interest on all long-term loans |

| 68 | 516 | 1 327 | Calculations with the budget. By debit - overpayment of taxes and the amount of VAT to be reimbursed, by credit - debt to the budget |

| 69 | 54 | 219 | Calculations for insurance premiums. On debit – overpayment on them and the amount of compensation from the Social Insurance Fund, on credit – arrears in contributions |

| 70 | — | 1 095 | Payments to personnel regarding wages. Debt to employees |

| 71 | 98 | 355 | Calculations with accountable persons. By debit - amounts issued on account, by credit - debt to accountable persons according to advance reports |

| 73 | 150 | — | Settlements with personnel for other operations. 150 – short-term loan issued to an employee |

| 76 | 129 | 1 438 | Settlements with other debtors and creditors. On debit – interest on loans issued and VAT on advances received, on credit – debt on customer claims and deposited wages |

| 77 | — | 96 | Deferred tax liabilities |

| 80 | — | 100 | Authorized capital |

| 82 | — | 2 | Reserve capital |

| 84 | — | 239 | retained earnings |

| 96 | — | 972 | Reserves for future expenses. 972 – reserve for payment of vacations with a period of use of less than 12 months |

| 97 | 31 | — | Future expenses |

| Total: | 23 963 | 23 963 |

The balance sheet of an enterprise, filled out as an example of the 2021 sample, will look like this.

| Balance sheet sections | Amount at the reporting date | Formula for calculating the amount based on the accounting account numbers from which the balance values are taken |

| ASSETS | ||

| I. NON-CURRENT ASSETS | ||

| Intangible assets | 248 | 04 – 05 |

| Fixed assets | 5 181 | 01 – 02 + 08 |

| Financial investments | 187 | 55 + 58 (long-term) – 59 (long-term) |

| Deferred tax assets | 102 | 09 |

| Total for Section I | 5 718 | |

| II. CURRENT ASSETS | ||

| Reserves | 5 084 | 10 – 14 + 20 + 41 + 44 + 97 |

| Value added tax | 219 | 19 |

| Accounts receivable | 9 732 | 60 + 62 – 63 + 66 + 68 + 69 + 71 + 76 |

| Financial investments | 315 | 58 (short-term) – 59 (short-term) + 73 |

| Cash and cash equivalents | 543 | 51 |

| Total for Section II | 15 893 | |

| BALANCE | 21 611 | |

| PASSIVE | ||

| III. CAPITAL AND RESERVES | ||

| Authorized capital | 100 | 80 |

| Reserve capital | 2 | 82 |

| retained earnings | 239 | 84 |

| Total for Section III | 341 | |

| IV. LONG TERM DUTIES | ||

| Borrowed funds | 2 342 | 67 (loans with a remaining maturity of more than 12 months) |

| Deferred tax liabilities | 96 | 77 |

| Total for Section IV | 2 438 | |

| V. SHORT-TERM LIABILITIES | ||

| Borrowed funds | 2 681 | 66 + 67 (loans with remaining maturity less than 12 months) + 67 (interest on all long-term loans) |

| Accounts payable | 15 179 | 60 + 62 + 68 + 69 +70 + 71 + 76 |

| Estimated liabilities | 972 | 96 |

| Total for Section V | 18 832 | |

| BALANCE | 21 611 |

The correctness of filling out the balance sheet form 1 on the 20210 form can be checked arithmetically. This can be done in two ways: from the total of debit balances and from the total of credit balances.

When checking in the first way, from the total amount of debit balances on accounting accounts, it is necessary to subtract the values related to regulatory items (depreciation, provisions for impairment), i.e. credit balances on accounts 02, 05, 14, 59, 63. The result should be equal to the balance sheet asset total.

Let's check: 23,963 – 1,017 – 57 – 101 – 62 – 1,115 = 21,611.

A similar formula is used when checking in the second way: the values of regulatory items are subtracted from the total amount of credit balances on the accounting accounts (credit balances on the same accounts 02, 05, 14, 59, 63). The result should be equal to the total liabilities of the balance sheet.

Let's check: 23,963 – 1,017 – 57 – 101 – 62 – 1,115 = 21,611.

If the above accounting data related to interim reporting, then their only difference would be the presence of data on account 99 (due to the absence of balance sheet reformation performed only at the close of the year). In our example of the balance sheet before the reformation, account 99 had a loss of 70,000 rubles. (i.e., debit balance), and account 84 showed the profit of previous years in the amount of 309,000 rubles, which had not yet been reduced by the loss of the reporting year. In this case, the amount in the balance sheet would remain arithmetically the same, but the data on the line “Retained earnings” would be taken as the difference between the figures reflected in accounts 84 and 99. The total amounts of debit and credit balances in this case would be greater by the amount of the loss, and in the verification formulas the amount of loss would have to be additionally subtracted from them.

The balance sheet form 1 on the 2022 sample form, filled out automatically in the accounting program, must be checked. To do this, its figures are verified with data obtained from the consolidated balance sheet for the accounting accounts generated as of the reporting date. To select data on the analytics of property, financial investments, loans, additional capital, reserves, balance sheets for the corresponding accounting accounts are used. The greatest difficulty is checking the correctness of the formation of detailed balances on accounts for settlements with counterparties. Here you will have to sum up both the balances of individual accounts and the debt of specific counterparties.

The deadline for submitting financial statements, including the balance sheet, is set at March 31 of the year following the reporting year.

Find out what liability is established for late submission of financial statements and violation of accounting rules in the ConsultantPlus Tax Guide by receiving free trial access.

Where is a sample of filling out the balance sheet for 2021-2022

The 2021-2022 balance sheet form can be downloaded from our website using the link below:

The balance sheet form can also be found, filled out and sent to its destination on the Federal Tax Service website, in the taxpayer’s personal account.

Filling out the balance sheet form for 2022 in 2022 must take into account data from the accounting accounts and obey the following rules:

- When generating a report, the reporting period is a year. Interim reporting is prepared only by decision of management or owners.

- An approved form is used, which, if deeper detail is necessary, can be supplemented with new lines.

- The form provides for the reflection of indicators for the current year and for the previous 2 years.

- The balance sheet should include indicators in a net valuation, that is, cleared of regulatory values (for example, depreciation of fixed assets).

- Debit and credit balances for accounts in the balance sheet are shown in detail if the net valuation rule does not apply to these accounts. In a net valuation, property is reflected in the asset at its book value, that is, fixed assets and intangible assets - at the residual value, and inventory and materials - at the cost minus reserves (if they are formed).

- Interest on long-term loans should be shown as part of short-term debt, and interest on financial investments should be shown as part of settlements with the counterparty.

- The issue of reducing the debt to customers from whom an advance was received by the amount of VAT accrued on these advances is decided by the reporting preparer independently.

- A separate column provides links to explanations, disclosing information, etc.

For an example of compiling a balance sheet, see ConsultantPlus by receiving trial demo access to the K+ system for free (click on the link below):

Balance sheet: example of filling out a simplified form

The balance sheet of an enterprise, filled out using the example of the 2021 sample in a simplified form, will be as follows.

| Balance Sheet Lines | Amount at the reporting date | Formula for calculating the amount based on the accounting account numbers from which the balance values are taken |

| ASSETS | ||

| Tangible non-current assets | 5 181 | 01 – 02 + 08 |

| Intangible, financial and other non-current assets | 537 | 04 – 05 + 09 + 55 + 58 (long-term) – 59 (long-term) |

| Reserves | 5 084 | 10 – 14 + 20 + 41 + 44 + 97 |

| Cash and cash equivalents | 543 | 51 |

| Financial and other current assets | 10 266 | 19 + 58 (short-term) – 59 (short-term) + 60 + 62 – 63 + 66 + 68 + 69 + 71 + 73 + 76 |

| BALANCE | 21 611 | |

| PASSIVE | ||

| Capital and reserves | 341 | 80 + 82 + 84 |

| Long-term borrowed funds | 2 342 | 67 (loans with a remaining maturity of more than 12 months) |

| Other long-term liabilities | 96 | 77 |

| Short-term borrowed funds | 2 681 | 66 + 67 (loans with remaining maturity less than 12 months) + 67 (interest on all long-term loans) |

| Accounts payable | 15 179 | 60 + 62 + 68 + 69 +70 + 71 + 76 |

| Other current liabilities | 972 | 96 |

| BALANCE | 21 611 |

In the abbreviated form of the balance sheet - the 2022 form can be downloaded for free from the link below - the combined lines must contain the code of the indicator that makes up the majority of the amount in this indicator.

If previously the balance sheet of the organization was presented to the Federal Tax Service in full, and then a decision was made to form it in an abbreviated form, then the data for previous years must be transformed into a simplified form, preserving their original values and in compliance with the rules for reflection in simplified reporting.

The balance sheet drawn up in accordance with the form approved by Order of the Ministry of Finance of the Russian Federation dated July 2, 2010 No. 66n, must contain, in addition to reporting data, data as of the end of the two previous years. Data from previous years must coincide with official reporting figures for these years.

Before filling out the text section in the balance sheet located above the main balance sheet table, we recommend paying attention to 3 things:

- the type of economic activity is indicated by the type of activity that brought the largest amount of revenue in the reporting period;

- codes related to the organization are taken from the tax registration certificate, a letter from the state statistics body about the codes and reference books of the relevant codes.

To learn how to make a simplified balance sheet, read the article “Preparing a balance sheet under the simplified tax system .

Results

The preparation of a balance sheet is subject to a number of rules established both for all accounting in general and specifically for the balance sheet. The balance required for submission to the Federal Tax Service is created on the prescribed form. However, some organizations have the right to draw it up in a simplified form.

Sources:

- Order of the Ministry of Finance of Russia dated July 2, 2010 N 66n

- Order of the Ministry of Finance of the Russian Federation dated April 19, 2019 N 61n

- Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 N 94n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Financial statements: forms 1 and 2 - what are these reports

Data from forms 1 and 2 are the main components of financial statements:

- Form 1 – balance sheet;

- Form 2 – statement of financial results.

Starting with reporting for 2022, all enterprises use accounting forms, approved. By Order of the Ministry of Finance dated 07/02/10 No. 66n as amended by Department Order No. 61n dated 04/19/2019. In the new edition, in particular:

- OKVED code was replaced by OKVED2;

- There is only one allowed unit of measurement left - thousand rubles. (previously it was possible to indicate data in million rubles);

- OKEY code has been corrected.