General information

The register in form TORG-31 is the primary accounting document. Papers for expenditure and receipt transactions can be accounted for sequentially, or a separate form is used for each type of transaction. The register contains information about the documents and the organization that sent them, the number of sheets, and additional information.

The financially responsible person fills out two copies of the form for each reporting period. One copy must be submitted to the accounting department along with the documents, and the second remains with the employee who filled out the register.

You can enter information into the register by hand or on a computer. With the second method, you need to keep in mind that the signatures on the document must be “live”. The employee who submits the documents (for example, a purchasing manager), who receives the documents (an accountant), and who checks the documents (for example, the head of a company or an authorized person) signs.

Drawing up an act when changing an accountant

In addition to the manager, the chief accountant is also considered responsible in any company. If it is calculated, care must be taken to ensure that all accounting and financial documents are transferred to the new employee. This act will allow the new chief accountant to understand what documentation he will have to deal with in the future.

How to draw up an act when changing an accountant

Cases and documents related to strict reporting documents are often transferred. Many people in such situations are engaged in drawing up a separate act. Such important documents are recorded here. The same applies to situations where a seal is transferred. It is also recommended to formalize it with a new act. Quite often, accounting documents are of high value. Therefore, their transfer is recorded by a special commission created in the company. Its members check the availability of documents and the correctness of the act.

Sample

A few words about the TORG-31 form

This unified form was established for use by Decree of the State Statistics Committee of December 25, 1998 No. 132. It became recommended for use from the beginning of 2013 (information of the Ministry of Finance of Russia No. PZ-10/2012). From now on, organizations decide for themselves what forms of primary information they should use: unified or independently developed.

If the company decides to develop the forms itself, then you need to remember that the required details of the primary accounting document are available. They are listed in paragraph 2 of Art. 9 Federal Law No. 402-FZ “Accounting Law”. The developed forms must be approved in the company’s accounting policies by a special order from the manager.

Accountant's responsibility

If an accountant, especially the chief one, resigns, he must hand over all files and documentation. To do this, an authorized person is appointed who takes over the entire farm under the act on the basis of an order from the head of the organization. In this act it is necessary to list everything for which the chief accountant is directly responsible. In particular:

- accounting, tax and management reporting;

- accounting policies and local regulations;

- EDS key certificates for electronic exchange with banks and regulatory authorities;

- correspondence with the tax office and other regulatory authorities (requirements and reconciliation reports).

Exactly how many documents were transferred and the periods for which they were compiled can be indicated in the act itself or in the appendices to it. In addition, the appendices to the act may contain a kind of detailed balance sheet of the organization: a balance sheet for the accounting accounts as of the date of transfer of affairs.

A sample act of acceptance and transfer of accounting documents looks like this:

We fill out the register using the TORG-31 form

The document consists of a header and a tabular section. The following information must be included in the header:

- Name of the business entity and its OKPO code.

- Structural subdivision.

- Type of company activity.

- Document number and date of its preparation.

- Reporting period.

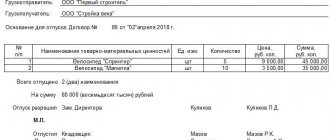

In the tabular section you need to indicate the following data:

- Name of the supplier organization.

- Its OKPO code.

- The name of the document (form number and name), its number and date of preparation.

- Number of sheets in the document.

- Note. Here you can indicate any clarifications or explanations.

The table continues on the reverse side. If the number of rows in the table is not enough, then in the electronic version you can add the required number of rows.

After filling out the table, they summarize the number of sheets in the document. Next, indicate in words the total number of papers and sheets in them. When the document is verified, the employees sign: the one who handed over the documents, the one who accepted the documents, and the one who checked all the information about the documents. It is necessary to indicate positions and transcripts of signatures.

Let's summarize

- The above registers are basic and should be present in any organization striving for order in office work.

- Depending on the specifics of document flow in your organization, the list of registers may not be exhaustive. In this case, you will be able to create the types of registration logs you need, similar to those given in this article, for example: a register of railway and air tickets, a register of registration of business trips of employees of third-party organizations, a register of accounting for the issue of office equipment to employees for use, etc.

Now, won't you be scared if you need to create a "registration-register-of-something-that-no-one-has-ever-registered before"? I'm sure not! Moreover, show ingenuity, wit and a creative approach to this seemingly very routine area of \u200b\u200bthe secretary's activity.

[1] To simplify the terminology, we will agree that by registering a document we mean making an entry about a document in the appropriate journal (register) with (or without applying) a mark on the document itself containing the incoming number, date of registration, surname and position of the employee who carried out the registration. Also, for simplicity, in the future we will call the employee involved in registration and distribution of documents secretary.

[2] For more information on compiling and maintaining the register, see: Nazarova L.A. Creating a register of orders for core activities: 5 simple steps // Secretary-referent. 2015. No. 6. pp. 20–25.

[3]See: Nazarova L.A. We create an electronic register of contracts in MS Excel // Secretary-referent. 2015. No. 3. pp. 34–37.

Is it allowed to make corrections to the document?

If factual errors were identified in the register, for example, the employee entered the document number incorrectly or entered the wrong date, then in this case the inaccuracy can be corrected using the traditional algorithm:

- Erroneous data must be carefully crossed out with one line.

- Write the correct data next to or above the line.

- Next you need to write: “Believe the corrected.”

- After this, the employee who made the corrections must sign and date it.

Errors must be corrected in each copy of the document. All employees who participate in filling out or checking this register are familiarized with the changes made.

Act of acceptance and transfer of accounting documents

Usually there is an order to appoint a commission, by decision of which the act of transferring documentation will be carried out. When compiling files, a special form is used. This occurs, for example, when the chief accountant, who was in possession of important documents, is dismissed. First of all, we relate to accounting. They must be transferred to another person who will replace the dismissed person.

To transfer securities, the appropriate form is used. Regarding accounting of accounting records, special acts are drawn up. Cases transferred are often drawn up in a table. It contains the following information:

- day month Year;

- numbers;

- names of accounting files.

Certificate of acceptance and transfer of documents for storage by the state

Situations often arise when it is necessary to seize information from enterprises for state storage. In this case, it is necessary to prepare an appropriate act on the basis of which the transfer for permanent storage will be carried out.

- reorganization measures in the company;

- expiration of the storage period for documentation at the enterprise;

- Liquidation of company;

- other situations.

When accepting documents for state storage, you must indicate such information as the name of the company transferring the documents and the name of the archive itself that receives them. An example, the loss of important papers, requires that this situation be noted in the act. In the case when a transfer is made to state storage and certain notes are made, they must be indicated in the act.

Acceptance and transfer certificate for housing cooperative accounting department

In this situation, the accounting files of the housing cooperative are sent according to the same principle as in the case of receiving and transmitting information related to accounting in other cases. These are the most important documents of the housing cooperative and mistakes should be avoided in the process of drawing up the act, so it is better to use a sample.

You should download a file on which the date is stamped and the location is indicated. According to the order, a commission consisting of three people is formed. Their names, as well as the name of the enterprise, the name of the person receiving and transferring, must be indicated.

A correctly composed form from one person to another will help avoid misunderstandings. This procedure is carried out without fail by decision of the commission.

CT acceptance and transfer upon change of director

Post Views: 638

Transfer and acceptance certificate when replacing a director

The director and chief accountant are responsible for certifying important accounting documents. If the task is to change the director, in this case an act is drawn up transferring his rights to another person.

When changing the director, as well as the chief accountant, it is necessary to notify the organizations involved in the control of enterprises, as well as the bank that services the company. For state-owned enterprises where there is a change of director, the following rule applies. As for private organizations, in this case they make their own decisions.

To draw up the act, you will need a special form that must be filled out in accordance with generally accepted standards. It should be said that when changing a director, a lot of questions and problems may arise only in relation to budget companies. But they are completely solvable. Admission is carried out by a commission, which is created on the basis of an order.

Certificate of acceptance and transfer of personnel documentation

In order to correctly fill out such a file, a sample is needed. When sending personnel records to another person in the company upon dismissal, you must fill out a form. Always in the process of filling out personnel documents, you must indicate the following points:

- item number;

- Name;

- a period of time;

- number of files;

- notes.

If situations such as loss of personal files or failure to fill out personal cards occur, this should be indicated in a note when transferring personnel documents.