How to find out your checkpoint of an individual?

The value of the checkpoint can be found out from the certificate or notification of registration. The checkpoint of the organization at its location is also indicated in the Unified State Register of Legal Entities (USRLE). The first four digits of the checkpoint represent the code of the tax authority with which the organization is registered.

Interesting materials:

How to enable XMP profile? How to enable strikethrough text? How to enable downloading over the iPhone mobile network? How to enable slow motion on Xiaomi? How to enable screen recording on iPhone 11? How to enable screen recording on iPad? How to enable screen recording on Huawei p10 Lite? How to enable screen recording on Honor? How to enable screen recording on a laptop? How to enable recording on iPhone?

General Audit Department on the issue of assigning a checkpoint to the largest taxpayer

Answer In accordance with paragraph 1 of Article 83 of the Tax Code of the Russian Federation, for the purpose of tax control, organizations and individuals are subject to registration with the tax authorities, respectively, at the location of the organization, the location of its separate divisions, the place of residence of the individual, as well as the location of their property. real estate and vehicles and on other grounds provided for by this Code.

The Ministry of Finance of the Russian Federation has the right to determine the features of accounting of the largest taxpayers by the tax authorities

Order of the Ministry of Finance of the Russian Federation dated July 11, 2005 No. 85n approved the Features of registration of the largest taxpayers (hereinafter referred to as the Features).

Based on paragraph 5 of the Peculiarities, when registering the largest taxpayer with the interregional (interdistrict) inspectorate of the Federal Tax Service of Russia for the largest taxpayers, the taxpayer identification number (TIN) assigned to the inspectorate of the Federal Tax Service of Russia at the location of the organization does not change. The Interregional (Interdistrict) Inspectorate of the Federal Tax Service of Russia for the largest taxpayers assigns the largest taxpayer a new reason for registration code (KPP)

, the first four characters of which are the code of the interregional (interdistrict) inspection of the Federal Tax Service of Russia for the largest taxpayers. The sign that an organization is classified as a major taxpayer is contained in the 5th and 6th digits of the reason for registration code (RRC), having a value of 50.

Thus, due to the presence of several grounds for registration - at the location of the organization and as the largest taxpayer, the organization was assigned two checkpoints.

Let us note that the current legislation does not directly explain which checkpoint to indicate to counterparties when preparing primary documents, payment orders and other documents addressed to the largest taxpayer.

Let us note that with regard to the procedure for filling out invoices, tax returns, payment orders, the fiscal authorities provided clarifications according to which the largest taxpayers should indicate the checkpoint, which is contained in the notice of registration with the tax authority as the largest taxpayer

.

Letter of the Ministry of Finance of the Russian Federation dated May 14, 2007 No. 03-01-10/4-96:

“In accordance with paragraph 1 of Art. 83 of the Tax Code of the Russian Federation (hereinafter referred to as the Code), the specifics of registering the largest taxpayers are determined by the Ministry of Finance of the Russian Federation.

Order of the Ministry of Finance of the Russian Federation dated July 11, 2005 N 85n approved the Features of registration of the largest taxpayers, in accordance with which the interdistrict inspectorate of the Federal Tax Service of Russia for the largest taxpayers issues a Notice of registration with the tax authority of a legal entity as the largest taxpayer in Form N 9- KNU, approved by Order of the Federal Tax Service of Russia dated April 26, 2005 N SAE-3-09/178 (hereinafter referred to as the Notification). The Notification indicates the taxpayer identification number (TIN) and the registration reason code (KPP), the 5th and 6th digits of which have the value 50.

When registering with the tax authority at its location, the largest taxpayer is issued a Certificate of registration of a legal entity with the tax authority at its location on the territory of the Russian Federation in form N 1-1-Accounting, approved by Order of the Federal Tax Service of Russia dated December 1, 2006 N SAE- 3-09/826 (hereinafter referred to as the Certificate). The Certificate indicates the TIN and KPP, the 5th and 6th digits of which have the value 01.

Thus, the largest taxpayer in the case cited in the appeal was assigned two KPP values on the grounds established by the Code.

In cases where the taxpayer is registered with the tax authorities on several grounds, then in order to calculate value added tax, the following must be taken into account.

In accordance with paragraph 1 of Art. 169 of the Code, an invoice is a document that serves as the basis for the buyer to accept the goods (works, services), property rights presented by the seller (including the commission agent, agent who sell goods, works, services, property rights on their own behalf) tax amounts for deduction in in the manner prescribed by Ch. 21 of the Code.

Clause 1 of Art. 172 of the Code establishes that tax deductions provided for in Art. 171 of the Code, are made on the basis of invoices issued by sellers when the taxpayer purchases goods (work, services), documents confirming the actual payment of tax amounts when importing goods into the customs territory of the Russian Federation, after registration of these goods (work, services), property rights.

For the purpose of carrying out tax control established by the provisions of Chapter. 14 of the Code, in accordance with paragraph 5 of Art. 174 of the Code, taxpayers (tax agents) are required to submit a corresponding tax return to the tax authorities at their place of registration.

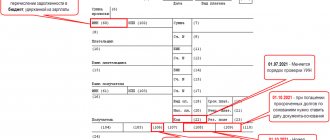

Since the VAT return is submitted by the largest taxpayers to the tax authority at the place of registration as the largest taxpayer, this declaration indicates the checkpoint contained in the Notification

.

In order to ensure the effectiveness of the administration of value added tax, the largest taxpayer, when filling out invoices, must also indicate the checkpoint contained in the Notification and tax return for value added tax

.

Accordingly, in payment documents for the payment of value added tax to the federal budget, in the “Payer checkpoint” field, the checkpoint specified in the Notification should be reflected

.

It should be noted that if the taxpayer indicated in documents, the procedure for filling which is not regulated by the Code, the checkpoint specified in the Certificate, such a document should not be considered as drawn up with violations

».

Letter of the Ministry of Finance of the Russian Federation dated October 22, 2008 No. 03-07-09/33:

“According to paragraph 3 of Art. 169 of the Tax Code of the Russian Federation, the obligation to prepare invoices, keep logs of received and issued invoices, purchase books and sales books is assigned to value added tax taxpayers.

When selling goods (work, services) by an organization registered with the tax authority as the largest taxpayer

,

in line 2b “TIN/KPP of the seller” of the invoice, the KPP of the organization is indicated, which is contained in the notice of registration with the tax authority as the largest taxpayer

.

Accordingly, when purchasing goods (works, services) by such an organization, the invoice in line 6b “TIN/KPP of the buyer ”

indicates the KPP of the organization, which is contained in the specified notification

.

It should be noted that if goods are sold by an organization through its divisions, invoices for shipped goods (works, services) can be issued by these divisions to customers only on behalf of the organization. At the same time, when filling out invoices for goods sold by divisions of the specified organization, in line 2b “TIN/KPP of the seller” the KPP of the corresponding division is indicated. When purchasing goods (work, services) by divisions of an organization, line 6b “TIN/KPP of the buyer” indicates the KPP of the corresponding division.”

Taking into account the above, we believe that in documents drawn up with a counterparty who has been assigned the status of the largest taxpayer, it is advisable to indicate checkpoint

,

which is contained in the notice of registration with the tax authority as the largest taxpayer

.

Answers to the most interesting questions on our telegram channel knk_audit

Back to section

In which documents should the checkpoint be indicated?

The checkpoint is a mandatory component of the official details of a commercial company. Therefore, this code must be indicated in a number of tax and accounting documents.

Important: since one legal entity can have several checkpoints, the document must contain a code that is relevant specifically for a specific document.

Where to indicate the checkpoint:

Same checkpoints for different organizations

TIN is assigned to any person; this number is unique and does not change under any circumstances. In contrast, the checkpoint depends on the region and tax authority to which the enterprise is attached, so all organizations belonging to the same tax authority can have the same checkpoint. Provided that the reason for registering with these organizations also coincides.

That is, the same number can be assigned to many organizations when they are registered with the same tax office.

Match with TIN

- The TIN and KPP may have the same first 4 digits, which indicate the code of the tax authority with which the company is registered and where these codes were issued. That is, it is possible to determine the location of the enterprise and the details of the tax authority to which it belongs, both by INN and by KPP.

- Subsequent characters in these codes usually do not match: the TIN then contains 5 digits that indicate the unique taxpayer number in a given tax authority, and the last digit is a special control code.

- In the checkpoint, the next 5 or 6 characters indicate the basis for registration, then there are 3 digits showing the serial number of registration for the corresponding reason.

The checkpoint does not serve as an independent source of information on a particular enterprise; it is an addition to the tax identification number, and is almost always used in conjunction with it.

Considering that some business entities may be registered with the tax service under two checkpoints, the question often arises of which checkpoint should be indicated for the largest taxpayer in the invoice when it is generated.

Let's consider the concept, features, structure of the checkpoint, and the features of generating an invoice for enterprises with this status.

Checkpoint of the organization and its branch

The checkpoint of an organization (legal entity) and its own may differ from each other. Those enterprises that have branches on the territory of the Russian Federation are required to register at the location of each separate division. A separate unit has a completely different reason for registering than the main unit.

It is necessary to register enterprises at their location for the following reasons:

- To be able to classify them according to different criteria: geographically, by industry, and so on.

- To facilitate accounting for tax subjects, .

That is, by examining the code, you can determine in which region the enterprise or separate division is located and for what reason it was created.

Separate divisions are:

- branch;

- a separate workplace that has existed for more than 30 days.

Their addresses cannot, by law, coincide with the address of the head enterprise (Article 11 of the Tax Code of the Russian Federation), therefore they are attached to the tax authority at their location. Each parent company’s own checkpoint is a mandatory requirement, and branches and representative offices may have the same code as the main company.

Branches and representative offices of the company are not independent taxpayers (Article 84, paragraph 7 of the Tax Code of the Russian Federation), therefore they cannot have their own tax identification number, but each of them receives its own checkpoint at its location within 5 days after submitting the application to the nearest tax office.

Decoding checkpoint

KPP is an abbreviation for the concept “ reason code for registration ”, i.e. for what reason a legal entity registered with the tax service.

The code contains additional identifying information for the organization's TIN. It is formed from 9 digits, each of which has a specific meaning:

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 |

- Positions “1” and “2” are the code of the subject of the Russian Federation . The list of subjects is posted in the directory of the official Internet resource of the Federal Tax Service (FTS): nalog.ru/html/docs/kods_regions.doc. They can also be found on Wikipedia (this source contains subject codes in 4 versions: according to the Constitution, traffic police codes, OKATO and OKTMO codes (territorial and municipal division), as well as according to the international ISO standard). For example, the code of the Moscow region is “50”. And for the largest taxpayers of the Russian Federation, a separate code “99” has been allocated.

- “3” and “4” are the code of the Federal Tax Service inspection (IFTS), which assigned the legal entity. person registered. Knowing these 2 numbers, you can determine where this inspection is located and what its details are. How to do it:

- go to the official website of the Federal Tax Service: https://www.nalog.ru

- at the very top of the page enter the code of the subject of the Russian Federation (first and second digits of the checkpoint),

- click on the “Contacts” menu option,

*clicking on the picture will open it full size in a new window - a page will appear on the screen, one of the sections of which is called “Inspections of your region”, * when you click on the picture it will open full size in a new window

- By clicking on the name of the Federal Tax Service, you will see its number and full information about this organization. Please note that the number consists of 4 digits, the first two are the region code, the next two are the Federal Tax Service number itself. Having scrolled through the list of inspections in this way, select the one you need and read the information you need.

- Positions “5” and “6” indicate the reason for registration :

- “01” – by location,

- “02, 03, 04, 05, 31, 32” - at the location of the structural unit - at the place of property registration,

- “10 – 29” – at the place of registration of vehicles owned by it,

- the number "50" means that it is the largest taxpayer,

- numbers from “50” and more are assigned to foreign companies.

- Positions “7 – 9” indicate how many times legal entities. a person registered for tax purposes for a specific reason.

Example of checkpoint decoding

Let's say a checkpoint of some organization is known. What information can be gleaned from the code?

Sberbank checkpoint as an example and decipher it:

- “77” – the company is registered with the Federal Tax Service of Moscow;

- “36” – registrar number: Federal Tax Service No. 36 of Moscow, South-Western Autonomous District;

- “01” – legal. the person is registered at the place of location;

- “001” – the organization registered for tax purposes for the first time for this reason.