When joining an SRO, a construction company undertakes to pay an entrance fee and transfer funds to the compendium. In the future, participants pay regular fees, and some self-regulatory organizations also require a civil liability insurance policy to avoid spending the SRO's comp fund in the event of damage. To avoid problems with the tax office, an organization must keep records of the costs of joining a non-profit partnership.

Taxation under the general system

If joining an SRO is a prerequisite for carrying out the activities of a construction organization, membership fees are taken into account when calculating income tax. Payments are accounted for in accordance with paragraphs. 29. clause 1 art. 264 of the Tax Code of the Russian Federation and is carried out at a time (letter of the Ministry of Finance No. 03-03-06/1/803). Accounting for insurance payments is carried out in accordance with clause 1 of Art. 263 of the Tax Code of the Russian Federation, and write-off is carried out in equal shares during the period of validity of the agreement (clause 6 of Article 272 of the Tax Code of the Russian Federation).

If an organization joined an SRO on a voluntary basis - for the prestige of the organization, difficulties may arise. The tax service may recognize such costs as unjustified, so it is recommended to take them into account as “ other expenses” , equating them to the costs of production and sales (clause 49, clause 1, article 264 of the Tax Code of the Russian Federation).

Accounting for membership fees

To account for membership fees, you should use the deferred expenses account (account 97 “Deferred expenses”).

Membership payments will be debited from him to expenses for ordinary activities evenly based on the period for which contributions are paid.

This procedure can be explained by the fact that only membership in an SRO gives the right to engage in construction during the time the organization is a member of the SRO.

In the balance sheet, expenses written off on a straight-line basis may be reflected as part of other non-current or current assets. Due to the fact that membership fees are not long-term in nature (within a year), the costs of their payment, taken into account as deferred expenses, should be reflected as part of other current assets.

Taxation under a simplified system

For construction companies that operate under a simplified system, amounts contributed to the SRO are taken into account as expenses in accordance with paragraphs. 32.1. clause 1 art. 346.16 Tax Code of the Russian Federation.

The simplified taxation system allows only compulsory types of insurance to be included in expenses (clause 7, clause 1, article 346.16 of the Tax Code of the Russian Federation). And the insurance policy required for joining an SRO is not qualified by the Tax Code as mandatory, so it will be more difficult to correctly reflect it in accounting.

Although such insurance is inherently mandatory, and only if an organization has a policy can it carry out activities, tax inspectors will most likely choose a formal approach to the interpretation of the legislative act and cancel the costs of insurance. Therefore, it is better not to include the amount of civil liability insurance in expenses in advance.

How to reflect contributions in accounting

Annual contributions must be included in the operating expenses of the period for which they are paid. Thus, monthly contributions should be attributed to the costs of the corresponding month, and quarterly contributions – to the costs of the corresponding quarter. If regular payments are transferred once a year, then it is better to distribute them by quarters or months. The distribution method can be any: equal shares, proportional to revenue, etc. The entrance fee and the contribution to the compensation fund are one-time payments; they are transferred when joining an SRO, and the money is not returned upon departure. These amounts were traditionally accounted for in account 97 “Deferred expenses”. True, due to the amendments made to clause 65 of the Accounting Regulations*, the use of this account has recently raised many questions. But in one of its recent letters, the Russian Ministry of Finance dispelled doubts and said that there were no fundamental innovations. In particular, any expenses that do not entail the emergence of assets can be taken into account as RBP (letter dated January 12, 2012 No. 07-02-06/5). This conclusion fully applies to one-time contributions to a self-regulatory organization.

When reflecting future expenses, it is necessary to establish the period during which they will be written off as current expenses. Since the certificate of entry into the SRO is issued for an indefinite period, the company itself must approve the write-off period. It usually ranges from three to five years. The moment when entry fees can be shown in accounting is the date of receipt of the certificate.

It turns out that in tax and accounting, contributions to SROs are written off differently: in tax accounting immediately, and in accounting - over a certain period. This results in a taxable temporary difference and a deferred tax liability (DTL).

Example

In January 2012, the construction company joined a self-regulatory organization and paid a one-time fee of 90,000 rubles, as well as a contribution to the compensation fund in the amount of 350,000 rubles. The director issued an order according to which these contributions will be written off as expenses in equal parts over three years (3 years x 12 months = 36 months). The certificate of entry into the SRO was received in January 2012.

Starting in January, the company began making monthly regular contributions in the amount of 6,000 rubles.

In January 2012, the accountant made the following entries: DEBIT 76 CREDIT 51 - 440,000 rubles. (90,000 + 350,000) – money was transferred to the SRO; DEBIT 97 CREDIT 76 – 440,000 rub. – the entrance fee and contribution to the compensation fund are reflected as deferred expenses; DEBIT 68 CREDIT 77 – 88,000 rub. (RUB 440,000 x 20%) – IT is reflected.

Every month from January 2012 to December 2014 inclusive, the accountant made entries: DEBIT 76 CREDIT 51 - 6,000 rubles. – the monthly contribution to the SRO is transferred; DEBIT 26 CREDIT 76 – 6,000 rub. – the regular monthly contribution is written off for current expenses; DEBIT 26 CREDIT 97 – 12,222.22 rub. (RUB 440,000: 36 months) – deferred expenses are partially written off as current expenses; DEBIT 77 CREDIT 68 – RUB 2,444.44. (RUB 12,222.22 x 20%) – IT has been reduced.

We add that according to paragraph 5 of PBU 10/99 “Expenses of the organization”, regular and one-time contributions are considered expenses for ordinary activities. In the cash flow statement, they are indicated in the “Cash flows from current operations” section in line with code 4129 “Other payments”.

How does the type of SRO expenses affect their tax accounting?

The procedure for recognizing SRO expenses in tax accounting depends on their type.

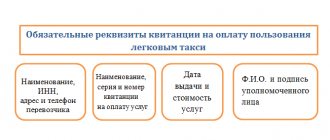

Primary documents

It is possible to avoid problems with the tax authorities only if you pay close attention to the preparation of the “primary” document. These documents confirm the deposit of funds and are used as a material basis for processing the transaction.

The main difficulty is that individual entrepreneurs or individuals do not sign an agreement when joining a non-profit association. The fact of membership in a self-regulatory organization is confirmed by a certificate, but it does not contain information about the terms of payment and the amount of paid contributions.

You can apply for documents with data on payment amounts from the SRO. A self-regulatory organization, in response to an appeal from an interested party, provides invoices issued to applicants for participation in a non-profit partnership; photocopies of the regulations on the amount of contributions.

If the SRO does not provide the necessary documents, you can print out the membership regulations or minutes of the meeting of participants from the SRO website yourself. It is permitted to use such documentation as primary documentation.

basic information

Let's name the main payments that are paid upon joining an SRO:

- Introductory fees (paid once).

- Membership (paid quarterly).

- To the compensation fund.

- Insurance payments.

The amount of most of these contributions is set by the SRO itself. There are no clear rules regarding the accounting of contributions. Accounting procedures should be based on basic principles. It makes sense to recognize contributions as other expenses within the framework of tax accounting. They are recognized evenly throughout the tax period, which will avoid questions from the tax authorities. The accounting periods are determined by the SRO independently.

IMPORTANT! Membership payments payable quarterly are recognized as other expenses at a time. They are taken into account by the date of payment.

Reflection of SRO contributions in accounting

There are some differences in the treatment of regular and one-time payments. It is rational to reflect monthly payments in the reporting periods when they were made - once a month or quarterly. When reflecting deferred expenses (FPR), the terms for writing off funds for current expenses are indicated within 3-5 years.

For regular payments:

- DT 76 – CT 51 – payment of membership fees.

- DT 97 – CT 76 – reflection of contributions as BPM.

- DT 20 - KT 97 - regular write-off of contributions as production costs.

The entrance payment and contribution to the compensation fund are made once and are not returned upon leaving the SRO, therefore they are reflected in the postings as:

- DT 76 – CT 51 – payment of membership fees.

- DT 20 – CT 76 – write-off of contributions.

Accounting for the entrance fee and contribution to the compensation fund

The entrance fee and contribution to the compensation fund are considered current costs for accounting purposes, subject to the availability of documents confirming not only payment, but also the result of the expenses (certificate of membership in a self-regulatory organization and certificate of admission to construction work).

If these documents were issued for a certain period, then the costs of paying the entrance fee and contribution to the compensation fund could be written off gradually.

But this is not necessary, since the certificate of admission to construction work does not have a validity period, and the certificate of membership is “renewed” at the expense of other membership fees, which are paid for a certain period.

Other accounting options

In accordance with paragraph 1 of Art. 272 of the Tax Code of the Russian Federation, if the connection between income and expenses is not clearly defined, the taxpayer can distribute expenses at his own discretion. Using this legislative norm, accountants adjust tax accounting to accounting and reflect the entrance payment and the amount of contribution to the compendium as regular RBI.

Also, SRO contributions can be reflected as intangible assets without determining the useful life. However, in accordance with Accounting Regulation 14/2007, depreciation is not accrued on these amounts.

How does the type of SRO expenses affect their tax accounting?

The procedure for recognizing SRO expenses in tax accounting depends on their type.

Entrance, compensation and membership fees to SRO

These types of expenses have two specific features that affect the procedure for their tax accounting:

- indefiniteness - membership in an SRO does not have an end date and it is impossible to determine the period to which periodic and one-time payments to the SRO relate, therefore such expenses can be recognized at a time on the basis of clause. 3 paragraph 7 art. 272 of the Tax Code of the Russian Federation (see letter of the Ministry of Finance of Russia dated July 12, 2010 No. 03-03-05/150);

- cash method of recognition - only paid contributions can be taken into account when calculating income tax (subclause 29, clause 1, article 264 of the Tax Code of the Russian Federation).

How to use Art. 264 of the Tax Code of the Russian Federation to justify expenses - find out from the material “Art. 264 of the Tax Code of the Russian Federation: questions and answers.”

For a reasonable write-off of expenses you will need:

- provide in the accounting policy the date for recognition of expenses for SRO - to do this, you need to select one of the options listed in subparagraph. 3 paragraph 7 art. 272 Tax Code of the Russian Federation;

- take care of documentary evidence of expenses - collect payment slips for the transfer of contributions to the SRO, a copy of the certificate of membership in the SRO, a copy of the regulations on contributions, invoices for payment, etc.

Insurance payment

Those joining an SRO must insure their civil liability - fulfilling this condition is one of the mandatory requirements when going through the procedure for registering membership in an SRO.

Insurance expenses cannot be written off immediately - the scheme for including this payment in tax expenses is described in paragraph 6 of Art. 272 of the Tax Code of the Russian Federation. To use it you need:

- specification of the date of recognition of expenses for payment of insurance - the day (period) of its payment in accordance with the contract;

- clarification of the algorithm for including insurance in expenses depending on the features of payment - a one-time payment (expenses are recognized over reporting periods evenly during the term of the insurance contract in proportion to the number of calendar days of validity of the contract) or in installments (each part of the paid insurance is recognized in tax expenses in proportion to the number of calendar days of validity contracts in the reporting period).

You will find recommendations on insurance accounting in the material “Entering insurance premiums in accounting”.

It is problematic to recognize the amount of paid insurance and other contributions as tax expenses if a company joins an SRO voluntarily; tax authorities question the legality of recognizing such expenses due to their economic unjustification.

How are membership fees to a self-regulatory organization reflected in accounting? The answer to this question is discussed in detail in ConsultantPlus. Explore it by getting a trial demo access to the K+ system for free.