Our author Alexey Ivanov talks about the legal reduction of income tax in his Telegram channel.

Some useful information about the possibilities of accounting policies for optimizing taxation. Today we’ll talk about income tax again – it has the most such opportunities.

There is something in tax accounting that is pleasant for the taxpayer and unpleasant for the accountant - reserves. If you are not engaged in specific types of activities, then there are 4 of them:

- for doubtful debts (Article 266 of the Tax Code of the Russian Federation)

- for the repair of fixed assets (Article 260 of the Tax Code of the Russian Federation)

- for warranty repairs and warranty service (Article 267 of the Tax Code of the Russian Federation)

- for vacation pay (Article 324.1 of the Tax Code of the Russian Federation)

The taxpayer has the right to create them, securing his decision in the accounting policy.

The purpose of creating reserves is to defer tax payment. Let me remind you: it gives you the opportunity to put the saved money into circulation and have time to earn your own rate of profit on it. How is this delay achieved? By creating a reserve, you recognize an expense before you actually incur it. Sometimes it happens that the expense will not be made at all, but a reserve has been created for it. And it's legal. Such a reserve will then have to be included in income, but by that time the money will have already turned around and brought profit.

For an accountant, this wonderful relief from the state turns into a complication of both tax and accounting. PBU 18/02 and that’s all. Therefore, Aunt Masha tries not to tell her employer about him.

Provision for doubtful debts

First, I’ll explain what a doubtful debt is.

This is what accountants call receivables (customers owe us) that were not paid on time. However, there are no guarantees of payment in the future (collateral, surety or bank guarantee). Therefore, we doubt that we will ever receive this money. Doubtful debts are bad for business. Even worse, the government calculates income tax on an accrual basis. This means that income is considered received not at the moment the money is received in your account, but at the moment the goods are shipped to the buyer. From now on, the buyer owes you money, which means that this quarter's taxable income will increase by the amount owed. Not only did the buyer not pay, but you also owe the state 20% of the difference between receivables and the cost of the goods.

A win-win situation, but only for the buyer and the state. It's not cool for you. It will be possible to include a doubtful debt as an expense only after 3 years - after the expiration of the statute of limitations. Or earlier - if the debtor is liquidated. But that's the default. In order not to pay income tax on doubtful debts, create a reserve provided for in Article 266 of the Tax Code of the Russian Federation.

How it works?

At the end of the quarter, an inventory of receivables is carried out - the presence of doubtful debts is checked. If there are any, you need to look at how late the payment is on the last day of the quarter. If the delay is more than 90 days, all doubtful debt is included in expenses and reduces taxable profit. From 45 to 90 days – half can be included in expenses. Less than 45 days - sorry, wait for the next quarter.

What will happen to the tax later?

There are two possible options for the debtor's behavior.

- Conscience tormented or collectors - paid the debt.

- Conscience is disabled in the settings, immunity to collectors - I did not pay the debt.

In the first case, the payment amount is included in income.

This must be done in the quarter when the money arrived in the account or cash register. Tax will have to be paid, but only on money actually received. In the second case, the debt is recognized as bad and written off after 3 years or after receiving an extract from the Unified State Register of Legal Entities on the liquidation of the debtor. The write-off occurs at the expense of the reserve; this no longer affects the amount of tax - the expense was recognized when the reserve was created. This means that the unpaid tax was invested in the business and managed to bring profit. What is needed to create a reserve?

The reserve is voluntary. If you decide to create it, fix the decision in your accounting policies. Aunt Masha will be against: carry out inventory quarterly, explain to the tax authorities the choice of an insolvent counterparty, apply complex PBU 18/02 - traditional arguments. Therefore, the main thing here is to overcome her resistance.

Provision for repairs of fixed assets

A little about the taxation of expenses for the repair of fixed assets.

Above in the channel I talked about when buildings, structures, machines, equipment and other similar objects are considered fixed assets. The Tax Code adds one more criterion: the cost must exceed 100 thousand rubles, otherwise it is immediately written off as a tax reduction. It is clear that expensive assets with a long service life sometimes need to be repaired. Generally, renovation costs reduce taxable income in the quarter in which the renovations are made. The reserve provided for in Article 324 of the Tax Code of the Russian Federation allows you to recognize repair costs before the fixed asset begins to be repaired. Thanks to this, you reduce income tax starting from the first quarter. Even if no repairs have yet been made. Even if they are never produced. In the latter case, at the end of the year you will have to increase taxable profit by the amount of the unused reserve, but during the year the unpaid money will have time to generate income. This is the main thing you need to know - technical details will follow. How it works?

At the beginning of the year, you estimate how much money will be spent during the year on repairs of fixed assets and draw up a cost estimate. The result of the estimate is the so-called maximum amount of contributions to the reserve. There is a limitation: the maximum amount cannot exceed the average annual actual repair costs calculated for the last 3 years. Then you determine the total cost of fixed assets - the sum of the initial costs of all fixed assets of the company (at these values the fixed assets were taken into account at the beginning of their careers).

Divide the first amount by the second - you get the standard for contributions to the reserve. ¼ of the product of the total cost of fixed assets by the standard will reduce taxable profit on a quarterly basis.

Example 1:

In 2022, you plan to spend 700 thousand rubles on repairs of fixed assets. In 2022, 600 thousand rubles were spent for this purpose, in 2017 - 500 thousand rubles, in 2016 - 400 thousand rubles. At the beginning of 2019, the initial cost of your company’s fixed assets was 10 million rubles.

Average annual actual costs for repairs amounted to 500 thousand rubles. (600 thousand rubles + 500 thousand rubles + 400 thousand rubles) / 3). Therefore, the maximum amount of contributions to the reserve will not be 700 thousand rubles, but only 500 thousand rubles.

The standard for contributions to the reserve = 500 thousand rubles. / 10 million rub. * 100% = 5%.

Starting from March 31, 125 thousand rubles will be transferred to the reserve quarterly. (1/4 * 5% * 10 million rubles).

What will happen to the tax later?

When repairs are actually made, they are financed only from the reserve. This means that there will be no expenses for repairs of fixed assets in this quarter - they were already recognized earlier. At the end of the year, an inventory of the reserve is carried out. If it is greater than the actual repair costs, the excess is included in income. If less, it’s an expense.

Example 2:

You have been greedy all year (or you have been lucky all year) and fixed assets have not been repaired. During the year, 500 thousand rubles were allocated to the reserve. On December 31, this amount is included in income and increases taxable income.

What is needed to create a reserve?

The reserve is voluntary. You just need to make a decision and consolidate it in your accounting policies.

A reserve for the repair of fixed assets can be created in a larger amount than the maximum amount of deductions. This is permitted for particularly complex and expensive types of major repairs that last more than a year. In this case, calculating contributions to the reserve will be more difficult, but the amount of savings will be greater. Tell us in more detail or go to the last reserve - for warranty repairs and warranty service?

How to accept a liability for the amount of the reserve?

The institution must accept a deferred liability for the amount of the reserve for future expenses.

According to clause 308 of Instruction No. 157n, deferred liabilities are obligations of an institution, the amount of which is determined at the time of their acceptance conditionally (calculated) and (or) for which the time (financial period) for their fulfillment is not determined, subject to the creation of an institution in the accounting records for these obligations reserve for future expenses.

Deferred liabilities are reflected in analytical group 90 “Authorization for other subsequent years (outside the planning period)” of the synthetic expense authorization account (clause 309 of Instruction No. 157n). Guided by Instruction No. 162n and clause 1.2.3 of Part 1 of the Appendix “Drawing up and submission of monthly, quarterly budget reporting, quarterly accounting reports of state budgetary and autonomous institutions in 2017” to the joint letter of the Ministry of Finance of Russia No. 02-07-07/21798, Treasury Russia No. 07-04-05/02-308 dated 04/07/2017 (hereinafter referred to as the Letter), transactions on deferred obligations in the accounting of government institutions are reflected:

- Debit 1,501,93,000 Credit 1,502,99,000 – deferred liabilities accepted (clause 141.2 of Instruction No. 162n);

- Debit 1,502,99,000 Credit 1,502,11,000 - the budget obligation of the current financial year was accepted using the previously created reserve (clause 141.2 of Instruction No. 162n);

- Debit 1,501 13,000 Credit 1,501 93,000 - the budget obligation of the current financial year was accepted using the previously created reserve (clause 134 of Instruction 162n).

More on the topic: What to take into account on off-balance sheet account 02 in 2018?

Accounting entries for deferred liabilities in the accounting of budgetary and autonomous institutions are reflected in the same way.

Guided by Instruction No. 174n, Instruction No. 183n and clause 1.2.3 of the Letter, transactions on deferred obligations in the accounting of budgetary and autonomous institutions are reflected:

- Debit 0 506 90 000 Credit 0 502 99 000 – deferred liabilities accepted (clause 174 of Instruction No. 174n, clause 203 of Instruction No. 183n);

- Debit 0 502 99 000 Credit 0 502 11 000 - the obligation of the current financial year was accepted using the previously created reserve (clause 167 of Instruction No. 174n, clause 196 of Instruction No. 183n);

- Debit 0 506 10 000 Credit 0 506 90 000 - the obligation of the current financial year was accepted using the previously created reserve.

Warranty repair reserve

If you sell products and promise to repair them free of charge during the warranty period, the cost of repairs reduces your taxable income.

The reserve provided for in Article 267 of the Tax Code of the Russian Federation allows them to be recognized earlier than upset buyers begin to make warranty claims. Thanks to this, you reduce income tax starting from the first quarter. Even if no repairs have yet been made. Even if they are never produced. In the latter case, at the end of the year you will have to increase taxable profit by the amount of the unused reserve, but during the year the unpaid money will have time to generate income. Everything is the same as with already sorted reserves. How it works?

At the beginning of the year, you estimate how much money has been spent on warranty repairs over the past three years. If the guarantee began to be provided less than three years ago, take this period into account. The amount received must be divided by the proceeds from the sale of warranty goods for the same time. The result is the percentage of contributions to the reserve. It must be multiplied quarterly by revenue from the sale of warranty goods. This amount will reduce the taxable income for the quarter.

Example 1:

During 2016-2018, you sold warranty goods worth 100 million rubles. At the same time, 5 million rubles were spent on warranty repairs.

Percentage of contributions to the reserve = 5 million rubles. / 100 million rub. * 100% = 5%.

In the first quarter of 2022, warranty goods worth RUB 3 million were sold.

This means that the taxable profit of the quarter can be reduced by 5% * 3 million rubles. = 150 thousand rubles.

What will happen to the tax later?

When repairs are actually made, they are financed only from the reserve. This means that there will be no expenses for warranty repairs this quarter - they were already recognized earlier. At the end of the year, an inventory of the reserve is carried out. If it is greater than the actual repair costs, the excess is included in income. If less, it’s an expense.

Example 2:

You were lucky all year and there were no warranty repairs. During the year, you sold 12 million rubles worth of guaranteed goods. and 600 thousand rubles were transferred to the reserve. On December 31, this amount is included in income and increases taxable income. But if you plan to create a reserve again next year, the unused balance can be transferred to the next year and not included in income now.

What is needed to create a reserve?

The reserve is voluntary. You just need to make a decision and consolidate it in your accounting policies.

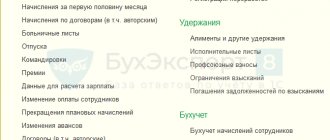

Reserve for vacation pay

A little about vacation pay.

If you have employees, the Labor Code obliges you to provide them with paid leave of at least 28 calendar days annually. From the employer's point of view, vacation pay is the same expense as salary. Only the worker is lying on the beach or skiing at this time, and is not giving the country coal. By default, vacation pay is included in expenses in the month in which the employee goes on vacation. Now about the reserve for vacation pay, provided for in Article 324.1 of the Tax Code of the Russian Federation. First of all, don't be fooled by the name. Like all other tax reserves, it is not created to set aside money to pay for anything. Its task is to recognize expenses for the upcoming payment of vacation pay before the obligation for this payment arises. Thanks to this, you reduce your income tax starting in January. Even if not a single employee has gone on vacation yet. This is the main thing you need to know - further details will come for the most meticulous.

How it works?

At the beginning of the year, you estimate how much money will be spent during the year on vacation pay. Then consider the estimated labor costs (salaries, bonuses, allowances, etc.). Divide the first amount by the second - you get the percentage of monthly contributions to the reserve. You multiply it every month by the actual accrued labor costs. These will be deductions to the reserve, which will reduce taxable profit.

To all indicators in the calculations, you need to add the amount of mandatory social contributions from them (pension, social and health insurance + insurance against accidents and occupational diseases). You also need to set a limit on the amount of contributions to the reserve. Typically, it is the monthly deduction percentage multiplied by the estimated labor costs for the year. But it is better to take a larger amount so that contributions to the reserve are guaranteed not to stop until the end of the year - the Tax Code does not regulate the procedure for calculating this amount.

Example 1:

The LLC has a single employee - a director with a salary of 100,000 rubles. per month. Mandatory social contributions are 30.2%. In order not to complicate the calculation, the estimated vacation pay will also amount to 100,000 rubles. Social contributions from them are 30,200 rubles. Estimated annual labor costs will be RUB 1,200,000. (RUB 100,000/month * 12 months). Social contributions from them are 362,400 rubles. (RUB 30,200/month * 12 months). In total, it is planned to spend 1,562,400 rubles on labor costs.

Percentage of contributions to the reserve = 130,200 rubles. / RUB 1,562,400 * 100% = 8%.

Starting in January, 10,416 rubles will be transferred to the reserve monthly. (8% * 130,200 rub.).

What will happen to the tax later?

When an employee goes on vacation, vacation pay is accrued only from the reserve. This means that there will be no vacation expenses this month - they were already recognized earlier. At the end of the year, an inventory of the reserve is carried out. If it is more than the actual accrued vacation pay, the excess is included in income. If less, it’s an expense.

Example 2:

The director from the previous example wanted to go on vacation in December, but something went wrong. The vacation had to be postponed until January next year. During the year, 124,992 rubles were added to the reserve. (RUB 10,416/month * 12 months). Since vacation pay was not actually accrued, on December 31 this amount is included in income and increases taxable profit.

What is needed to create a reserve?

The reserve is voluntary. If you decide to create it, fix the decision in your accounting policies.

For what obligations do reserves for future expenses need to be formed?

According to clause 302.1 of the Instructions, approved. By Order of the Ministry of Finance of Russia dated December 1, 2010 No. 157n (hereinafter referred to as Instruction No. 157n), reserves for future expenses represent information on the status and movement of amounts reserved for the purpose of uniform inclusion of expenses on the financial result of the institution for obligations of uncertain magnitude and ( or) execution time.

A reserve for future expenses can be created by:

- upcoming payment of vacations for actually worked time or compensation for unused vacations, including upon dismissal, including payments for compulsory social insurance of an employee (employee) of the institution;

- upcoming payment at the request of buyers for warranty repairs, routine maintenance in cases stipulated by the supply agreement;

- other similar upcoming payments;

- obligations arising by virtue of the legislation of the Russian Federation when making a decision on restructuring the activities of an institution, including the creation, changing the structure (composition) of separate divisions of the institution and (or) changing the types of activities of the institution, as well as when making a decision on the reorganization or liquidation of an institution;

- obligations arising from claims and lawsuits as a result of facts of economic life in the amount of amounts presented for the establishment of penalties (penalties), other compensation;

- obligations of the institution arising from facts of economic activity (transactions, operations), the accrual of which there is uncertainty in their size at the reporting date due to the lack of primary accounting documents;

- other obligations of uncertain magnitude and (or) time of fulfillment, in cases provided for by an act of the institution adopted when forming its accounting policies.

The list of expenses for which reserves can be formed is open.

The procedure for the formation of reserves (types of reserves formed, methods for assessing liabilities, date of recognition in accounting, etc.) is established by the institution as part of the formation of accounting policies.

More on the topic: Insurance premiums from 2022: 5 important innovations