Bank services: transactions without VAT

Operations for opening and servicing a current account, cash transactions (except for collection), making payments, issuing a bank guarantee, servicing a bank client and others listed in clause 3 of Article 149 of the Tax Code of the Russian Federation are not subject to taxation.

Services of credit institutions without VAT should be reflected in correspondence with the cash account:

Dt 91.02 Kt 51, 52, 55, 57.

Bank transactions for services without VAT:

| Operation | Debit | Credit |

| Commission for execution of payment order | 91.02 | 51 |

| Commission for RKO in March | 91.02 | 51 |

| Fee for using a bank client | 91.02 | 51 |

| Commission for execution of payment in foreign currency | 91.02 | 52.02 |

| Acquiring fees | 91.02 | 57.03 |

| Refund of erroneously charged commission | 51 | 91.01 |

If an organization deposits funds in excess of the cash limit to a bank for crediting to a current account independently, without involving collectors, then the service for receiving and recounting cash is not subject to VAT.

Delivery of proceeds to the bank, postings:

| Operation | Debit | Credit |

| Cash deposit to current account (revenue) | 51 | 50 |

| Cash conversion fee | 91.02 | 51 |

| Cash acceptance fee | 91.02 | 51 |

A banking offer called “salary project” has become quite popular, which allows organizations to save accounting time on issuing wages, shortens and simplifies the procedure for paying wages.

Many credit organizations charge a commission within the framework of a salary project for transferring funds to employee cards; this type of commission is not subject to VAT. The accounting entry when paying for servicing a salary project:

Dt 91.02 Kt 51.

Can a company take into account bank commission when calculating income tax?

author of the answer,

Question

The company issued an employee a loan for housing construction at interest (2/3 of the key rate). Bank for transferring funds to a physical card. persons removed a significant commission. Can a company take these expenses into account when calculating income taxes?

Answer

An enterprise can take into account bank commissions as expenses when taxing profits.

The loan is issued to the employee at interest, therefore, the organization will receive economic benefits from this operation. Interest will be non-operating income for the organization, and, therefore, the bank commission can be taken into account for the purposes of determining the tax base for income tax.

Rationale

The optimal option was to include in the loan agreement the conditions that the costs associated with the provision of the loan are borne by the lender, and the costs associated with the repayment of the loan and interest are borne by the borrower. Then the question of the legality of accounting for bank commissions for profit tax purposes would not even arise.

However, the loan is given to the employee at interest, therefore, the organization will receive economic benefits from this transaction. Interest will be non-operating income for the organization, and, therefore, the bank commission can be taken into account for the purposes of determining the tax base for income tax.

For the purpose of taxing the profits of organizations, expenses are recognized as justified and documented expenses incurred by the taxpayer in carrying out activities aimed at generating income (clause 1 of Article 252 of the Tax Code of the Russian Federation).

According to subparagraph 25 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation, other expenses associated with production and sales include the taxpayer’s expenses for postal, telephone, telegraph and other similar services, expenses for payment for communication services, computer centers and banks, including expenses for fax and satellite communications, e-mail, as well as information systems (SWIFT, information and telecommunications network Internet and other similar systems).

In addition, in accordance with subparagraph 15 of paragraph 1 of Article 265 of the Tax Code of the Russian Federation, expenses for banking services are classified as non-operating expenses.

Thus, the taxpayer’s expenses for paying bank commissions are included in expenses if these expenses are economically justified (Letter of the Ministry of Finance of Russia dated January 18, 2017 N 03-03-06/1/1916).

| She answered the question: Lyudmila Mikhailovna Zolina, Consultant at IPC "Consultant+Askon" |

Attend an educational event on this topic:

%custom getevent(3306)%

Postings to the bank for services subject to VAT

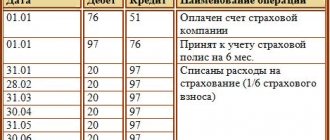

Banking products not specified in clause 3 of Art. 149 of the Tax Code of the Russian Federation, are subject to VAT at a rate of 18% in the general manner. The peculiarity of these banking services is that it is necessary not only to pay for them, but also to obtain primary documents confirming the fact of their receipt. To reflect expenses for services of credit institutions, subject to VAT, the use of an account for mutual settlements with suppliers is required; most often, account 76 is used for these purposes.

When the bank's services are paid for, the posting is generated in correspondence with the cash accounts:

Dt 76 Kt 51.

When the UPD is received from the bank, a posting is generated in correspondence with the expense account.

Examples of transactions for banking services with VAT are given in the table.

| Banking service | Debit | Credit |

| Service costs under the factoring agreement, including VAT | 91.02 19.04 | 76.13 76.13 |

| Paid expenses under the factoring agreement (statement) | 76.13 | 51 |

| Expenses for servicing a foreign exchange contract, including VAT | 91.02 19.04 | 76.09 |

| Paid the bank commission for performing the functions of a currency control agent (bank statement) | 76.09 | 51 |

| Expenses for collection of proceeds by the servicing bank | 91.02 19.04 | 76.09 |

| Collection of proceeds paid (extract) | 76.09 | 51 |

Expenses for banking services - transfer of wages to employee cards

The bank charges a fee for processing documentation related to the transfer of salaries to employees' accounts. According to the provisions of the Letter of the Ministry of Finance of the Russian Federation dated April 20, 2009 No. 03-03-06/2/88 and the Letter of the Ministry of Finance of the Russian Federation dated August 4, 2008 No. 03-04-06-02/88, the costs of paying remuneration to the bank in this case are allowed to be included in income tax expenses.

But controversy is caused by a reduction in the tax base by the amount of expenses for paying the bank a commission for issuing and annual servicing of plastic cards of employees, on which salaries are received. The condition for including expenses as expenses is their economic justification, and the commission is paid to the bank by the enterprise, but the cards are used by workers. The latest statement on this matter by the Ministry of Finance of the Russian Federation is set out in Letter No. 03-04-06/6-255 dated October 28, 2010, which states that the commission paid to the bank for servicing salary cards is not the income and benefit of employees (not subject to personal income tax) who use these cards is just a necessity related to the choice of payment method for wages

(the employer is obliged to pay wages on time through the cash register or in another way).

Important!

Payments by the employer to the bank for servicing employee salary accounts are not subject to personal income tax and are not subject to insurance contributions.

As for judicial practice, the courts accept the position of taxpayers and allow the costs of paying bank commissions to be taken into account as expenses. For example, the FAS Decree UO dated October 29, 2009 No. Ф09-8382/09-С3 explains the following:

- according to employment contracts, the costs of paying for bank services for servicing the salary account are borne by the employer;

- bank cards are needed to fulfill the employer’s obligation to pay wages (wages are related to the conduct of commercial activities);

- salary cards are not the property of employees - they are the property of banks and are issued to employees for temporary use.

Important!

In the agreement with the bank on servicing salary accounts, it should be mentioned that the cards were made for the needs of the enterprise, and not for the employee.

The accountant must take into account the costs in question as part of other expenses, taking care of the proper execution of personnel documents. In the text of employment contracts, additional agreements to such or other internal acts of the company, it is necessary to specify the following conditions:

- salaries will be paid by non-cash method;

- the costs of banking servicing of salary accounts are borne by the employer;

- in case of dismissal, the employee returns the card to the employer.

Bank expenses

Expenses arise from reductions in benefits in the form of outflows or debt. And this leads to the fact that equity capital decreases significantly. While income increases the amount of capital, expenses significantly reduce it.

Expenses are usually divided into bank, non-bank operating and incidental expenses. To bank expenses

include those that are directly related to the activities of the bank.

Non-banking expenses

include other costs that relate to additional activities of the credit institution.

In turn, banking expenses are also divided into several types. For example, there are interest, trading and commission expenses. To interest expenses

include expenses that are observed all the time and affect the results of banking activities.

This includes expenses on deposits and loans, as well as transactions with securities, amortization of premiums on shares. Bank commission expenses

are also included in the list of interest expenses: these may be the costs of placing money in the form of a loan.

The main component of banking expenses is interest payments on deposits. Moreover, most of the expenses are spent on the purchase of time deposits. A small fee is established for demand deposits.

Commission expenses include expenses for services received from third parties. For example, expenses for cash management operations, storage of valuables and servicing deposits. Commissions also include transactions on the banking metals market and the foreign exchange market.

In addition, the bank incurs trading losses. These are expenses for the purchase and sale of financial instruments. For example, net losses from activities in the foreign exchange market, from transactions with securities.

Other bank expenses include those that were not included in the groups listed above. Non-bank expenses

divided into administrative and other operating expenses. The first expenses are related to ensuring the activities of the credit institution.

It is worth including in the list of administrative expenses the costs of maintaining employees (bonuses and wages), operating fixed assets and other intangible assets, and paying mandatory payments and taxes. This also includes other operating costs: remuneration to intermediaries, services that the credit institution uses in the course of its activities, security, and the like.

Other non-bank operating expenses

appear due to non-banking transactions.

A banking institution, like any other organization, has unforeseen expenses.

.

In essence, they are recognized as such if they arose as a result of an emergency and had the nature of an event that happened once. Damage is determined after the fact of an emergency has been established. It is also important that such costs are not repeated several times. For example, bank expenses that arose due to changed accounting rules will not be classified as unexpected bank expenses. At the same time, for the financial assessment of the bank’s activities, unforeseen expenses are not taken into account. Currencyhistory.ru We advise on the topic:

- All banks deprived of a Central Bank license in 2022

- In 2022, deposits and accounts, real estate transactions will come under stricter control

- Deposit with a high interest rate in Moscow - deposit at 6.5% in RESO Credit Bank

News:

- Bank "KKB" (WebMoney) deprived of license

- Taking out several loans from different banks at once will be almost impossible

- The Central Bank proposes to introduce checks when depositing cash on cards through ATMs

Common mistakes

Error:

The company refuses to recognize the bank commission for the letter of credit as an expense for bank services.

A comment:

This method is the most beneficial for organizations on the grounds that it allows the commission to be legally attributed to the reduction of income for tax purposes at a time (clause 7 of Article 272 of the Tax Code of the Russian Federation), and not included in expenses through depreciation.

Error:

The accountant recognized as a one-time tax expense the company's expenses for paying bank commissions for servicing employees' salary accounts.

A comment:

Such costs must be distributed between reporting periods, since costs must be taken into account in the period during which they arose based on the terms of the transaction, and card servicing is carried out continuously throughout the annual period.

Financial sector

Text: Alexander Pyatkov, Senior Manager, KPMG

From "Who's to blame?" to “What should I do?”

Much has already been said about the reasons for the phenomena that occurred in the financial markets. The answer to one of the fundamental questions of the Russian intelligentsia, “Who is to blame?” everyone can find a wide range of opinions expressed based on their own ideas about reality and the level of financial literacy. In the meantime, the time has come to look for an answer to the question “What to do?”

| Expense item | Share in bank operating expenses, % |

| Personnel costs | 40-55 |

| Communications and IT | 10-20 |

| Rent | 5-10 |

| Advertising and Marketing | 2-5 |

| Other | 18-25 |

Despite the differences in the problems faced by companies in both the financial and real sectors, the answer to this question comes down to one solution - to improve business efficiency. One of the important elements of this process is a cost reduction program, which is especially in demand after a period of rapid growth, when efficiency is often sacrificed for the sake of double-digit growth rates, and the earned profit covers the costs associated with not always correct management decisions and ineffective personnel activities.

Cost/income indicator by region, % | |

| 40,76 | |

| Malaysia | 44,50 |

| Singapore | 49,02 |

| China | 49,93 |

| South Korea | 53,34 |

| Thailand | 53,82 |

| Australia | 56,35 |

| Philippines | 63,82 |

| Taiwan | 64,54 |

| Japan | 71,43 |

| Central and Eastern Europe | |

| Russia | 47,81 |

| Slovenia | 48,93 |

| Hungary | 54,34 |

| Poland | 70,85 |

| Latin America | |

| Mexico | 52,31 |

| Chile | 53,70 |

| Brazil | 61,15 |

| Peru | 63,91 |

| Argentina | 66,07 |

| Near East | |

| Kuwait | 25,46 |

| UAE | 27,99 |

| Saudi Arabia | 31,18 |

| Bahrain | 37,84 |

| Iran | 57,40 |

| Israel | 62,04 |

| North America | |

| USA | 58,19 |

| Canada | 66,37 |

| Western Europe | |

| Norway | 53,22 |

| Great Britain | 53,74 |

| Spain | 55,70 |

| Netherlands | 55,89 |

| Denmark | 55,95 |

| Switzerland | 56,29 |

| Portugal | 59,59 |

| Austria | 60,60 |

| Germany | 63,00 |

| Italy | 63,11 |

| Sweden | 64,52 |

| France | 64,60 |

| Belgium | 67,80 |

Currently, we have come to the point where banks, from the “engine” that “drives the blood” throughout the economy and earn significant profits (for example, in the US over the past five years, the financial sector has earned up to 40% of all “corporate” profits), are turning into the next three to five years into a classic “cost center.” Thus, the main assessment of the work of banks for the period until 2012 will be solely their efficiency, ability to operate and develop at minimal costs. But the first thing that needs to be done now and as quickly as possible is to deal with the “legacy of rapid growth.”

Cost-cutting programs lasting one to two years have become commonplace for Western banks, the goal of which is to increase the profitability of operations in the stable but weakly growing European banking market. For example, German banks cut about 10% of their staff in the prosperous and calm year of 2001. Before the onset of the crisis in financial markets, the main factors putting pressure on the profits of Western banks, and, as a consequence, the main reasons for conducting cost reduction programs were:

– increasing the level of competition in the financial services market;

– development of e-commerce and the Internet as a sales channel for banking products, characterized by almost “zero” cost;

– consumer perception of a banking product that can be obtained at any bank branch without “significant” deviations in quality and price.

These long-term trends led to a reduction in banks' margins for the services provided and made measures to improve operational efficiency a necessary condition for increasing the bank's shareholder value.

Traditionally, the first area of cost reduction was the item related to personnel costs. And this is understandable, because its share in operating expenses is usually 50–55%. The time has come to think about the efficiency of both the personnel and the technologies and processes used.

To measure business efficiency, it is customary to use the “Cost to Income Ratio” (CIR) indicator, which has several calculation methods, but, as a rule, is equal to the share of operating expenses in the bank’s operating income. The value of this indicator varies depending on the size of the bank and the region in which it operates.

As can be seen from the table, the best values for this indicator (25–37%) are found in banks operating in the Middle East, which can be explained by their small number in these countries and the influx of “petrodollars” into these countries.

Japanese banks remain the least efficient in the global banking community with an indicator value of 71.43%, despite its significant decline in recent years (by more than 10% compared to 2004). Banks from Poland also have one of the worst indicators (70.85%), although the value of this indicator has improved by more than 6% in recent years. At the same time, Belgian banks show the opposite trend, worsening their CIR from 62.42 to 67.8%.

Russian banks, with an indicator of 47.81%, occupy a worthy place in the world “table of ranks”.

Despite the undeniability of the thesis about the need to take measures to optimize and improve the efficiency of banks' business, the implementation of such programs is fraught with many dangers and limitations. For example, it is known that one of the most popular measures to optimize non-operating expenses is staff reduction. However, it is not uncommon for financial institutions to lay off employees only to be forced to rehire them a few months later to maintain their ongoing operations. Western banks have already realized that staff reductions and increased productivity are not directly related, and certainly not adjacent links in the cause-and-effect chain.

Basic principles of the cost reduction program

In order to avoid possible mistakes when developing and implementing a cost reduction program, you can use the following basic principles.

Principle 1: The first step in program development should be a step that at first glance has nothing to do with cost. This step consists of confirmation by shareholders, taking into account the changes that have occurred, the main goals and directions of development of the bank for the next two to three years. For example, if a bank’s shareholders see prospects for the development of corporate business, then a retail project launched several years ago or a “small and medium-sized business” project being prepared for launch will be the first to suffer when implementing a cost reduction program. At the same time, if the future of the bank lies in the area of providing banking services to individuals, then the target territory and emphasis for optimization are shifted to other areas of the bank’s business.

So, the first principle provides for a strict link between the program and the goals set by shareholders.

Principle 2. Despite the significant share of personnel costs in operating expenses, you should not focus only on this item. It is worth assessing the efficiency of using bank office space. An indicator that is actively used by chain retailers, namely “revenue per square meter,” can help here. When applied to financial institutions, this indicator may look like “operating income per unit area of the bank’s point of presence” or “assets/liabilities of the point of presence per unit area.” You should not ignore the costs associated with advertising, IT and the purchase of office supplies.

It is possible that cost analysis and measures to reduce them may lead to a review and significant changes in the operating model of the bank's business, and the bank's top managers should be prepared for this.

Principle 3. The success of a cost reduction program largely depends on the determination of top management and its willingness to accept changes. Therefore, for its successful implementation, a responsible person from the bank’s management is needed, who will be personally responsible for achieving the result. Ideally, it is possible to appoint two or three managers, each of whom will play a role in implementing changes: one acts as a “diplomat”, trying to convey to all interested parties information about the need for changes; the second should be well acquainted with the details of the functioning of this bank and act as an “expert”, confirming that the proposed changes are possible and feasible; the third acts as a “conductor” of these changes, constantly monitoring the implementation of assigned tasks. Combining all these roles in one position is possible, but quite rare.

So, the third principle speaks of the need to create a team of top managers who are personally responsible for the implementation of the approved program.

Approaches to developing a cost reduction program

When setting goals, you can follow two approaches.

The first approach involves setting goals based on the indicators demonstrated by the most successful banks using a similar business model.

The second approach is based on the bank’s internal analysis and search for opportunities to reduce costs based on its own understanding of the situation, without involving the “wisdom of the market” and competitors.

The main areas of work, activities and the possible effect of their implementation are shown in the table.

We have come to the point where banks, from being an “engine” that earns significant profits, are turning into a classic “cost center” over the next 3-5 years.

Depending on certain circumstances, the bank may achieve indicators both above and below the calculated ones.

It is also important to understand that a cost reduction program can be effectively developed only with adequate accounting and allocation of costs to bank departments. Without this element, making any management decisions in this direction and comparing the performance of a particular bank with the market is simply impossible.

In the coming years, it seems to me, we will have to see Russian experience in improving the efficiency of banking business, as well as find out which approaches are most effective in Russian reality and what the real results of their application are.

Main areas of work to reduce costs

| Category | Examples | Comments |

| Personnel (cost reduction potential - 5–10%) | Certification of employees for compliance with the position and salary. Increasing control over the performance discipline of personnel. Establishing a stronger link between performance and rewards | The most expensive item, often accounting for about 50% of all operating expenses. Reducing personnel costs by more than 15–20% will require an “organizational” restructuring of the bank. It is possible to significantly reduce the part of costs associated with the “administration” of personnel (up to 25%) |

| Rental costs (cost reduction potential - 5–20%) | Revision of lease terms. Reduction of rented space | Difficulties may arise due to existing lease agreements. If you aggressively follow the course of reducing real estate rental costs, it is possible to reduce them by up to 20% |

| Travel and entertainment expenses (cost reduction potential - 5–10%) | Review the policies and procedures associated with this cost group. Strengthening control and requirements for reporting documents | Short-term cost reductions of up to 30% are possible, but these reductions are not sustainable. According to a number of studies, about 25% of employees often take a “creative” approach to reporting on this group of expenses |

| Marketing and advertising costs (cost reduction potential - 5–10%) | Review the policies and procedures associated with this cost group. Increasing the efficiency of use and monitoring the impact of marketing and advertising activities | This item can amount to 2–5% of the bank's operating expenses. While significant cost savings may be possible in the short term (60–90 days), in the long term, shrinking marketing budgets can have a negative impact on the business. Banks that continue marketing activity even in a crisis situation have a higher chance of increasing their market share |

| Household expenses (cost reduction potential - 15–25%) | Increased transparency in supplier selection and contracting processes. Strengthening control over market prices for purchased goods and services, centralization of supplies. Creation of uniform standards and cost norms. Reduced number of suppliers. Strengthening control over compliance with contracts by suppliers | Renegotiation of contract terms and intensive negotiations with suppliers can reduce the amount of business expenses by up to 7%. Increasing transparency in the supplier selection process can result in savings of up to 3%. Reviewing the terms of current contracts and checking their compliance with reality can bring up to 4% savings. Implementing cost standards and monitoring their implementation can bring up to 5% savings |

| Centralization of functions (cost reduction potential - 10–20%) | Centralization of some bank business servicing functions (for example, credit risk assessment, call center) at the head office level to take advantage of economies of scale. Service centers can be located in areas of lower real estate and labor costs | By centralizing functions, the bank has the opportunity to hire highly qualified specialists at the head office and forever close the issue of lack of local expertise. Duplication of service center functions is often the result of acquisitions of banks that remain unintegrated into the overall system for a long time, causing additional costs. With centralization, the quality and efficiency of preparation of management reporting also improves due to the concentration of information and responsibility for its preparation. It is possible to create the position of “administrative director of the bank”, heading a single division, which may include the functions of personnel management, property/real estate, and carrying out business expenses. However, the creation of such functionality may take up to two years. |

| Outsourcing (cost reduction potential - up to 10%) | Business process outsourcing. Transferring the performance of certain functions to a third party, for which this activity is the main one and is carried out at lower costs (for example, search and training of personnel, cash collection, cleaning of premises, car services). Concluding strategic partnerships with service providers | The bank has the opportunity to receive additional income from strategic partnerships with suppliers. It is important to note that outsourcing is not a cure for inefficient operations. In this regard, before outsourcing the execution of operations, it is necessary to optimize the transferred processes |

| Automation (cost reduction potential - 15–20%) | Automation of the process of accounting for travel and hospitality expenses. Automation of the process of issuing invoices, paying them upon authorization and tracking the timing of receivables | Activities in this direction are the most expensive and require significant effort. At the same time, the costs of the process, as well as the number of personnel errors, become minimal. Elimination of non-automated processes will reduce the number of personnel. For example, by automating the process of accounting for travel and hospitality expenses, savings can range from 10 to 80% Automatic tracking of receivables aging leads to a reduction in collection times |

| Change/Optimization of business processes (cost reduction potential - 25–30%) | Assess and resolve workflow bottlenecks | At the first stage of work in this direction, several key processes that are important for the bank are identified and their optimality is analyzed. When evaluating existing processes, a key question to answer is: What would the process look like if it were built from scratch today? Optimizing business processes can lead to a significant reduction in staff numbers. As a result of process optimization, the acceptable level of operational risk should not be exceeded |