The difference between a GPA and an employment contract

When concluding a civil law contract (CLA), it is necessary to carefully ensure that its terms exclude even the small possibility of being classified as a form of employment agreement.

In judicial practice, such requalification is not uncommon, and its consequences are fraught not only with the payment of an administrative fine, but also with additional assessment of insurance premiums and penalties for their late payment. IMPORTANT! Labor relations with an employee are regulated by the Labor Code of the Russian Federation, and civil relations with an individual are regulated by civil law.

To avoid possible problems, the following features must be observed in the terms of the contract:

1. The subject of the GPA is the provision of a certain service, performance of work or transfer of property rights, and not the performance of a labor function by profession. The result of the work should be a tangible result in the form of, for example, a completed project or assembled equipment. Accordingly, the basis for payment is not a time sheet, application or order, but an act of work performed (services rendered).

2. An employee under such a contract is not a full-time employee, which means that he cannot be subject to requirements for compliance with internal regulations and subordination in accordance with the hierarchical structure of the company, as well as standards for setting salaries in accordance with the staffing table. This means that there will be no such conditions in the GPA.

3. The procedure for payment under the GPA is determined by agreement of the parties and is not regulated by the Labor Code of the Russian Federation. Thus, payment of remuneration is possible only after completion of the work (their stages) stipulated by the contract or transfer of rights to property, unless its conditions indicate the need for an advance payment.

4. Unlike an employment agreement, such an agreement, regardless of its subject matter, status of the parties and special conditions, always has a finite period of validity.

5. In the case of providing services under the GPA, special attention should be paid to the frequency of their provision. If, under the contract, certificates of work performed or services provided are regularly issued for amounts of a comparable amount, this will be considered a clear sign of a disguised labor relationship and will attract the attention of inspectors.

About situations in which the courts regard the GPA as a labor one, read the material “GPA with an individual for the provision of services - the risk of reclassification as a labor one.”

What are the advantages and disadvantages of working under a GPC agreement?

The GPC agreement is governed by the general rules of Chapter. 27 of the Civil Code of the Russian Federation, and is not subject to the requirements of labor legislation. A businessman who has entered into such an agreement is exempt from the duties provided for by the Labor Code of the Russian Federation:

- The customer is not obliged to organize a workplace, provide equipment, materials, etc. This may be provided for by the terms of a specific GPC agreement, but there is no such obligation in the legislation.

- The customer may at any time, on his own initiative, terminate the contract for the provision of services (Article 782 of the Civil Code of the Russian Federation) or the work contract (Article 717 of the Civil Code of the Russian Federation). In such a situation, he must pay for the work already completed, as well as compensate for the expenses and losses of the contractor. Contracts may provide for a different procedure for their early termination: for example, by agreement of the parties or after prior notice.

- The customer is not obliged to provide labor protection for specialists who work under a GPC agreement. But, according to the Ministry of Labor, if such a specialist is involved in production activities, then he needs to be given instructions on labor protection (letter dated May 17, 2019 No. 15-2/OOG-1157).

- The Ministry of Labor did not explain what criteria should be used to determine the participation of a particular employee in production activities. It can be assumed that, first of all, we are talking about those specialists who have entered into a GPC agreement, but work on the employer’s territory and use its equipment. The settlement procedure under the GPC agreement is completely determined by its parties. The customer has no obligation to issue an advance or make payments at least twice a month.

- The customer should not provide the contractor with social guarantees: pay vacation pay, sick leave, issue compensation upon termination of the contract, etc.

In this case, a GPC agreement can be concluded with a full-time employee. But he will be able to fulfill his duties under this agreement only in his free time. This is stated in the letter of the Department of Tax Administration of Russia in Moscow dated 02/04/2000 No. 14-14/5848.

Comparison of work under an employment contract and under the GPC

The only disadvantage of the GPC agreement is the reduction in control opportunities. The contractor often performs tasks on his own territory and is not obliged to comply with the work schedule accepted by the customer.

The Contractor is responsible only for the final result and compliance with deadlines. The customer may establish penalties for late completion of work or late reporting. However, these measures do not always compensate for losses from the fact that the work was not done on time.

Risks can be reduced by establishing control points in the contract. To do this, the work should be divided into stages, at the end of each of which the contractor must deliver an intermediate result to the customer.

An example of a GPC agreement

Calculation of insurance premiums under GPC agreements in 2020-2021: features

One of the most important advantages of registering relations with an individual in a civil law manner is the possibility of reducing the amount of accrued insurance premiums, and sometimes the complete absence of the need to accrue them.

To understand which payments are subject to contributions and which are not, it is necessary to clearly define the subject of the agreement and its compliance with one of the categories listed in Art. 420 Tax Code of the Russian Federation:

| Subject of the agreement | Is the remuneration subject to insurance premiums? |

| Contracting, provision of services | Taxable |

| Royalties | Taxable, minus the amount of confirmed expenses |

| Alienation of rights to the results of intellectual activity | The amount reduced by the amount of confirmed expenses is taxed. |

| Transfer of ownership or temporary use of property (including lease agreements, donations) | Is not a subject to a tax |

| Reimbursement of expenses of volunteers in charitable organizations | Not taxed, with the exception of food expenses exceeding the daily allowance in accordance with clause 3 of Art. 217 Tax Code of the Russian Federation |

| Reimbursement of expenses for professional training, including student contracts | Is not a subject to a tax |

In the case of concluding an agreement with a mixed subject, for example, providing for both the sale or transfer for use of property and services associated with its transfer, contributions must be accrued only for that part of the remuneration that is subject to taxation. Therefore, in such GPAs it is necessary to distinguish between the amounts of an individual’s income into taxable and non-taxable parts.

ConsultantPlus experts have prepared detailed explanations on the calculation of insurance premiums for payments under a vehicle rental agreement with and without a crew. Go to the Ready-made solution by getting free trial access to the system.

The calculation of contributions does not depend on the form in which the GPC agreement is concluded: on paper or electronically .

Find out when to pay advance payments to the “physicist” contractor here .

See also “Reimbursing the expenses of a “physicist” under the GPA - should I pay fees? .

Contract agreement with foreigners: individuals and legal entities

The tax agent is a Russian organization. When calculating personal income tax, it is necessary to immediately determine whether a foreign person is a resident of our country. This definition includes citizens who have lived within the Russian Federation for at least 183 days a year. If not, the rate will be 30%.

Otherwise, the scheme is the same as when working with an ordinary individual:

- FSS injuries are paid at will, if specified in the contract and at the same rates as those established for other employees.

- There is no need to pay FSS for temporary disability

- In the Pension Fund of the Russian Federation and the Federal Compulsory Compulsory Medical Insurance Fund, contributions are made at established rates.

Exceptions to the general rule

Chapter 34 of the Tax Code of the Russian Federation, among other things, provides for a number of features in the taxation of insurance premiums relating to both the status of the insured person and the type of contract concluded with him:

1. Remunerations under the GPA, regardless of the subject of the agreement, are not subject to contributions for insurance against temporary disability or in connection with maternity (subclause 2, clause 3, article 422 of the Tax Code of the Russian Federation).

2. Amounts of income accrued to freelance employees are not subject to contributions for insurance against accidents and work-related injuries, unless this is expressly stated in the terms of the contract.

3. Remunerations to foreign citizens who have the status of temporary residents, in accordance with subparagraph. 15 clause 1 art. 422 of the Tax Code of the Russian Federation are not subject to insurance premiums, unless this is expressly provided for by federal laws on specific types of insurance.

4. Income under the GPA of foreign citizens working in company divisions abroad of the Russian Federation is not subject to insurance contributions.

Read about the nuances of calculating contributions on the income of foreigners in the material “Insurance contributions from foreigners in 2022 - 2021.”

5. If a GPC agreement is concluded with an individual in the status of an individual entrepreneur, then he is obliged to calculate and pay insurance premiums independently. This is due to the fact that in the light of Art. 419 of the Tax Code of the Russian Federation, private entrepreneurs are allocated to a separate class of payers.

Read about the specifics of calculating and paying individual entrepreneur contributions here.

What you need to remember about hiring employees under GPC agreements

- From the point of view of organizing work, a GPC agreement is much more convenient for a businessman than a labor agreement. The customer is not obliged to provide a social package, organize the performer’s workplace, or take care of the safety of working conditions. The parties can determine a convenient method of payment and acceptance of the work result. The GPC agreement should necessarily specify the conditions for its termination. It is impossible to terminate such an agreement unilaterally and in one day, unless this is specified in the conditions.

- To save as much as possible on taxes and contributions, you should enter into GPC agreements with individual entrepreneurs or self-employed people. This method is most beneficial for performers.

- When drawing up GPC contracts, it is necessary to take into account the risks associated with their possible retraining into labor contracts. It is better to enter into such an agreement for one-time projects or work, and you should not indicate conditions that could cause the reclassification of the GPC agreement into a labor agreement. For example, about providing the contractor with materials, about familiarizing him with the staffing schedule, the operating mode of the organization, etc.

Expense limit for reducing the taxable base for insurance premiums

In the case of royalties, as well as contracts for the alienation of rights to the results of intellectual activity, the amount of expenses by which the taxable base can be reduced must be documented and have a direct connection with the receipt of such income (clause 8 of Article 421 of the Tax Code of the Russian Federation) . The volume of expenses not confirmed by documents is limited (clause 9 of Article 412 of the Tax Code of the Russian Federation). The limits are set as a percentage of the accrued remuneration:

- for the creation and execution of literary works, scientific developments and works - 20%;

- for the creation of musical works not related to the theatrical sphere or audio design for video films - 25%;

- for the creation of artistic, architectural, audiovisual works, photographs - 30%;

- for inventions, discoveries and creation of industrial designs - 30% of the amount of income of an individual received during the first 2 years of using the results of work;

- for the creation of sculptures, decorative and design graphics, as well as musical works intended for theater or films - 40%.

Read about the cases in which income under the GPA is not subject to personal income tax.

Insurance premium rates for GPC in 2020-2021

According to established Art. 425 of the Tax Code of the Russian Federation, the amount of insurance premiums for calculation from the amounts of remuneration under GPC agreements is:

- for compulsory pension insurance - 22%, taking into account the maximum base for calculation and 10% on income exceeding it;

- for compulsory health insurance - 5.1% (there is no limit on the income base for these contributions).

Since April 2022, the President of the Russian Federation has introduced reduced rates for NSR. They can also be applied to payments under GPC agreements (Letter of the Ministry of Finance of Russia dated September 23, 2020 No. 03-15-06/83334).

Read more about the size of reduced tariffs in the material from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

The maximum base for calculating insurance contributions for pension insurance is equal to:

- in 2022 - RUB 1,465,000. (Resolution of the Government of the Russian Federation dated November 26, 2020 No. 1935);

- in 2022 - RUB 1,292,000. (Resolution of the Government of the Russian Federation dated November 6, 2019 No. 1407).

However, the size of the marginal base and the tariffs depending on it cease to play their role if the policyholder has the right to apply reduced premium rates.

How a GPC agreement helps you save on mandatory payments

One of the most significant advantages of working under a GPC agreement is savings on taxes and insurance premiums. It is possible not only for the customer, but also in many cases for the contractor.

The calculation of mandatory payments primarily depends on the legal status of the performer, which can be:

- An individual.

- An individual entrepreneur (IP) on the simplified taxation system (STS) “income”. This is the most favorable regime for the provision of services in terms of tax burden.

- Self-employed, i.e. payer of professional income tax (PIT).

When concluding an employment contract, the employer must withhold personal income tax (NDFL) at a rate of 13% and charge insurance premiums on salary amounts at a rate of 30%.

Working under a GPC agreement with an individual (not an individual entrepreneur or self-employed) is more profitable, but not much. Personal income tax will be the same 13%, and savings on insurance premiums will be small: 27.1% instead of 30%.

If you conclude a GPC agreement with an entrepreneur using the simplified tax system “income”, then the customer should not accrue any mandatory payments. The entrepreneur himself will pay 6% “simplified” tax on the amount of income.

However, this poses an additional problem for the performer. All entrepreneurs must pay fixed insurance premiums “for themselves” for pension and health insurance. In 2022, these contributions are equal to 40,874 rubles plus 1% of income that exceeds 300,000 rubles.

Individual entrepreneurs without employees can fully deduct insurance premiums from the “simplified” tax. But in order to “cover” the fixed contribution and the additional 1%, the entrepreneur’s income must exceed 760,000 rubles per year or 63,300 rubles per month.

760,000 rubles x 6% = 45,600 rubles

40,874 rubles + (760,000 rubles - 300,000 rubles) x 1% = 45,474 rubles

With lower income, the individual entrepreneur will experience a significant tax burden. For example, with an income of 300,000 rubles per year (25,000 rubles per month), an individual entrepreneur will pay 13.6% to the funds, which is comparable to the personal income tax rate:

40,874 rubles / 300,000 rubles = 13.6%

If the contractor is registered as self-employed, then he will not have all the problems described.

In this case, the customer also does not pay any taxes. A self-employed person pays 6% of income when working with legal entities or individual entrepreneurs. And if the performer has recently registered as an NAP payer, then until he exhausts the bonus of 10,000 rubles, the rate will be even lower - 4%. There are no mandatory insurance contributions for self-employed people.

Example

The agreement between the customer and the contractor indicates the accrued amount of remuneration of 100,000 rubles. Let's consider what mandatory payments the parties to the contract will have to make under different options for cooperation.

Calculation of the tax burden when the contractor’s remuneration is 100,000 rubles. The annual income of an individual entrepreneur exceeds 760,000 rubles. The data in brackets is relevant for newly registered self-employed until the bonus is exhausted

Application of reduced and additional GPA contribution rates

In Art. 427, 428 of the Tax Code of the Russian Federation clearly regulate cases when the payer can use reduced rates of insurance premiums or, conversely, must apply an additional rate.

The situation with a reduced tariff in relation to civil law contracts is quite simple: if the payer exercises the right to reduce insurance premiums for full-time employees, he has the right to apply the same tariffs under civil contracts.

Note! Starting from 2022, the list of persons entitled to preferential rates on contributions has been significantly reduced; in particular, the majority of simplifiers have lost this right. Since 2022, this list has decreased even more.

A more complex analysis is required before a decision is made on the assessment of additional contributions. As you know, this applies to work that is carried out in hazardous and unhealthy working conditions: the legislator lists professions that are subject to additional contributions for pension insurance in paragraphs 1–18 of Part 1 of Art. 30 of the Law “On Insurance Pensions” dated December 28, 2013 No. 400-FZ.

Thus, if the GPC agreement covers work related to the performance of duties in such professions, or it directly states that the work is carried out in hazardous conditions, then additional contributions are necessary. The same approach must be followed in the case where the place of work is the territory of an enterprise, which, as a result of a special assessment of work, has been assigned a certain class of danger or hazard.

However, in a situation where the contract does not indicate the location of the work or the wording of the subject of the contract is vague and does not directly indicate that work is being carried out in conditions of increased danger, the enterprise may not charge additional insurance premiums. But, taking advantage of this opportunity, it is necessary to understand that in case of an audit, you need to prepare to defend your position in the judicial authorities.

Features of the contract

The contract is concluded in writing and drawn up in two copies.

The first copy remains with the organization, and the second copy with the employee. The contractor determines the methods of performing the work independently. The organization has the right to regularly check the progress and quality of work (clause 3 of Article 715 of the Civil Code of the Russian Federation).

Please note: the contractor may perform the work himself or may involve others. In this case, the contractor carries out all settlements with such persons independently.

The term is one of the most important terms of a contract. If it is not agreed upon, the contract cannot be considered concluded.

Therefore, the contract must necessarily indicate the start date of the work and the completion date. The contractor may complete the work in stages. Then, in the contract, specify the deadlines for completing individual stages of work. They can be changed by agreement of the parties.

If the contractor incurs any expenses associated with the work, the organization must also pay for them. The procedure for paying such expenses, as well as the amount of the contractor’s remuneration, is established in the contract.

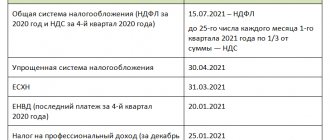

Payment and reporting of GPA insurance premiums in 2020-2021

Currently, reporting on insurance premiums (with the exception of contributions for insurance against accidents and industrial injuries, the calculation of which continues to be accepted by the Social Insurance Fund) is submitted to the Federal Tax Service. The form of this calculation is common to all contributions supervised by the service. For 2022, the ERSV is submitted according to the form approved. by order of the Federal Tax Service dated October 10, 2016 No. ММВ-7-11/551. For reporting for 2022, a new ERSV form is in effect - from the Federal Tax Service order No. ED-7-11 dated October 15, 2020 / [email protected] The calculation must be submitted no later than the 30th day of the month following the end of the reporting quarter/year.

This report does not highlight the amounts of payments under the GPA, so the main thing for the accountant is to correctly determine the part of the income paid that is taxable and non-taxable with insurance contributions.

Read more about the rules for filling out the new calculation here.

Reporting on insured persons is not limited to a single calculation form submitted to the Federal Tax Service. On a monthly basis, it is necessary to submit a report to the Pension Fund in the SZV-M form, which must indicate not only all employees who worked in the organization during the reporting period, but also all individuals with whom GPC agreements were concluded.

Among other things, all payers are obliged annually, before March 1 of the year following the reporting year, to provide personalized data on the length of service of insured persons to the Pension Fund in the form SZV-STAZH, approved by Resolution of the Board of the Pension Fund of December 6, 2018 No. 507p.

Payments under civil contracts

Author: L. V. Karpovich /expert of the magazine “Topical Issues of Accounting and Taxation”/

In every organization, situations arise when it is necessary to hire outside workers to perform a certain type of work or service.

As a rule, a civil law contract is concluded with such employees, which has advantages over a fixed-term employment contract from the point of view of tax savings. However, often the inspection authorities try to find clues in the content of the contract that would allow it to be reclassified as a labor agreement and, accordingly, additional taxes to be charged to the budget.This article explains how to correctly draw up a civil contract to avoid such troubles, as well as how to correctly conduct accounting and taxation of such payments.

The essence of a civil contract

The general definition of a civil contract is given in Art. 420 Civil Code of the Russian Federation . In accordance with it, a contract is understood as an agreement between two or more persons to establish, change or terminate civil rights and obligations. The agreement is concluded on a voluntary basis, its terms are determined at the discretion of the parties, except in cases where the corresponding condition is prescribed by law or other legal acts ( Article 422 of the Civil Code of the Russian Federation ). The price under the contract is also established by agreement of the parties.

There are many types of civil law contracts, and they are used in almost all areas of life. We are interested in those whose implementation is related to the labor activity of citizens. Each of the agreements has its own characteristics, and therefore many of them are devoted to separate chapters in the Civil Code of the Russian Federation. So, for example, a contract is discussed in Chapter . 37 , paid provision of services in Ch . 39 , transportation in ch . 40 , instructions in ch. 49 , commissions in ch. 51 , etc. Despite the variety of forms, they all have a number of common features that distinguish them from employment contracts. Let's look at these differences.

According to Art. 56 of the Labor Code of the Russian Federation , an employment contract is an agreement between an employer and an employee, according to which the employer undertakes to provide the employee with work for a specified labor function, to provide working conditions provided for by the Labor Code, laws and other regulations, collective agreements, agreements, local regulations , containing labor law norms, pay the employee wages in a timely manner and in full; in turn, the employee undertakes to perform the labor function defined by this agreement and to comply with the internal labor regulations in force in the organization.

A civil contract does not contain conditions obliging the contractor to observe work and rest schedules or obey the orders of the customer. This is its main difference from an employment contract.

In particular, under a contract, one party, on the instructions of the other, performs certain work (provides a service, performs an action, transaction, etc.) and delivers it on time to the customer, who in turn undertakes to accept and pay for the result of the work. At the same time, the citizen performs the work at his own risk, which is not inherent in labor relations in which the employer bears the property risks.

In addition, an employee who has entered into an employment contract regularly receives wages for his work based on tariff rates or salaries, regardless of the results achieved. A civil contract, as a rule, provides for the receipt of remuneration for the final result. Moreover, in case of failure to complete the work due to the fault of the contractor, the customer pays only for the completed part of the work.

The considered features of contracts must be taken into account when accepting citizens for temporary work. Typically, an organization seeks to conclude a civil contract with such an employee, since in doing so it manages to save on taxes. According to paragraph 3 of Art. 238 of the Tax Code of the Russian Federation , remunerations paid to individuals under civil contracts are not included in the tax base under the Unified Social Tax in terms of the amount of tax payable to the Federal Social Insurance Fund of the Russian Federation (2.9%). They are also not charged insurance premiums for compulsory social insurance against industrial accidents and occupational diseases, unless this is stipulated in the contract. In addition, if an employee falls ill, the organization does not have to pay sick leave, nor accrue vacation pay for time worked.

As you can see, the advantages are obvious. But we want to warn you that if the nature of the work from the point of view of the inspection organization, in particular the Federal Social Insurance Fund of the Russian Federation, does not comply with the terms of the civil contract, then it will certainly reclassify it as a fixed-term employment contract and, accordingly, will charge additional taxes.

Please note : in Art. 11 of the Labor Code of the Russian Federation states that civil law contracts concluded by an organization with individuals can be recognized as labor contracts only in a court of general jurisdiction. But this does not mean that this issue cannot be raised in arbitration court. In accordance with paragraphs. 4 paragraphs 2 art. 11 of Federal Law No. 165-FZ [1], insurers are obliged to ensure control over the correct calculation, timely payment and transfer of insurance premiums, and for this they must check contracts for compliance with current legislation.

As arbitration practice shows, the FSS of the Russian Federation is not always able to reclassify a civil contract into an employment contract; often the court considers the arguments of the fund representatives to be insufficiently substantiated and rejects their claims (see Resolution of the FAS North-West District dated April 14, 2005 No. A42-6525/03-16 ).

How important the content of the contract, the nature of the work or services provided under it, is shown by the Decision of the Federal Antimonopoly Service of the North-West District dated March 18, 2005 No. A42-5308/03-5 . As follows from the case materials, the budgetary organization entered into a contract agreement with the freelancer, under which he assumed obligations to manage, maintain and maintain the vehicle in good condition. The organization, in turn, created the conditions necessary for his normal work and paid him for his work in a timely manner and in full. The organization paid taxes on the amounts provided for in the contract to the budget, including to the Social Insurance Fund, in full, as under an employment contract. The inspection body considered that since the contract with a freelancer is called a contract agreement, that is, it is a civil contract, identifying it with a labor contract, the organization allowed the misuse of funds. However, the court did not support this point of view, pointing out that the nature of the contracts is determined not by the name, but by their content, and the contract concluded by the organization with the employee, called a contract agreement, is essentially a fixed-term employment contract.

How to correctly draw up a civil contract

When concluding a civil contract, an organization must stipulate in it:

– start and end dates of work;

– types of work (services) performed and requirements for their quality;

– procedure for delivery and acceptance of work;

– procedure for payment for work results;

– liability of the parties for violation of the terms of the contract.

Remuneration under a civil contract is paid by order of the manager. At the same time, a certificate of completion of work or another document confirming the completion of work is required only for two types of contracts: a work contract ( clause 1 of Article 702 of the Civil Code of the Russian Federation ) and an agreement on the provision of paid services ( Article 783 of the Civil Code of the Russian Federation ). When concluding other contracts of a civil law nature, in particular, agency contracts, orders, commissions, the execution of acceptance certificates is not provided for by law. In these cases, acts are drawn up only if such a requirement is established in the contract itself. If there are no corresponding clauses, then the act need not be drawn up. Claims from tax authorities arising due to the lack of certificates of work performed will be clearly untenable. The same opinion was expressed in Letter of the Ministry of Finance of the Russian Federation No. 04-02-05/1/33 [2]. As indicated in the letter, acts are drawn up either according to standardized forms (if any) or in a free form.

In this regard, we recall that unified forms exist only for work on repair, reconstruction and modernization of fixed assets ( form No. OS-3 [3]), as well as work in capital construction and construction and installation work ( form No. KS-2 [4 ]). Therefore, in other cases, acts are drawn up in any form indicating all the mandatory details listed in paragraph 2 of Art. 9 of Federal Law No. 129-FZ [5]: names and dates of drawing up the document, name of the organization on behalf of which the document was drawn up, content of the business transaction, its measures in kind and monetary terms, positions and signatures of responsible persons. In this case, the act will have the same legal force as the standard one (see Resolution of the Federal Antimonopoly Service of the Moscow Region dated January 13, 2004 No. KA-A/40/10978-03 ).

Please note : it is important to economically justify the costs of civil contracts. During audits, tax authorities may, for example, be interested in why a company, having a lawyer on staff, enters into an agreement for paid services with an outside lawyer, or, having construction workers, signs a contract with freelance builders. Such situations can be explained either by the need to perform an additional amount of work, or by the specifics of the work being carried out. But in order for such explanations to be more convincing, we recommend that the responsibilities of both full-time and freelance workers be specified in the appropriate documents.

Accounting and tax accounting of payments under civil contracts

In accounting, payments under civil contracts are reflected in the credit of account 76 “Settlements with various debtors and creditors.” The choice of debit of the correspondent account depends on the needs of which department the work or services are performed and for what purpose:

– account 20 for the needs of main production;

– account 23 for the needs of auxiliary production;

– account 26 for management services;

– account 44 for trade organizations;

– account 91 for works (services) not related to production and sales, etc.

Let's move on to tax accounting.

Personal income tax. According to paragraphs. 6 clause 1 art. 208 of the Tax Code of the Russian Federation, payments under civil contracts are subject to personal income tax. For residents of the Russian Federation, the tax rate is 13%, for non-residents – 30%. The tax is withheld and transferred to the budget by the organization (tax agent) upon actual payment of income to the taxpayer ( clause 4 of Article 226 of the Tax Code of the Russian Federation ). In addition, no later than April 1 of the year following the reporting year, a certificate of income in form 2-NDFL [6] ( clause 2 of Article 230 of the Tax Code of the Russian Federation ) is submitted to the tax office. If it is impossible to withhold the tax amount, for example, when paying income in kind, then within a month you must inform the tax office at the place of registration.

Please note : if a civil contract is concluded with an individual entrepreneur or a private notary, the organization is not obliged to withhold personal income tax from their income. These categories of persons must independently calculate and pay personal income tax in accordance with paragraphs. 1 , 2 p. 1 tbsp. 227 Tax Code of the Russian Federation . This rule also applies to individuals who received income from the sale of property owned by them ( subclause 2, clause 1, article 228 of the Tax Code of the Russian Federation ).

As an example, we can cite the FAS Resolution ZSO dated December 8, 2005 No. F04-8820/2005(17687-A27-27) , which states that there is no need to pay personal income tax and unified social tax on the amounts of remuneration paid by the organization to individuals under agreements for the sale and purchase of documentation and under agreements on the transfer of rights to know-how. The court noted that since property rights, as well as documentation, are included in the concept of property, then the company has no obligation to pay these taxes in this case.

Citizens working under civil contracts are entitled to standard and professional deductions.

Please note : according to clause 3 of Art. 210 of the Tax Code of the Russian Federation, tax deductions are provided only for income subject to personal income tax at a rate of 13%.

As stated in paragraph 3 of Art. 218 of the Tax Code of the Russian Federation , a standard tax deduction[7] can be provided by any tax agent who is a source of income for a citizen. Therefore, if desired, by writing an application and presenting the relevant documents, he has the right to receive this deduction from the organization with which he entered into a civil contract.

In accordance with paragraph 2 of Art. 221 of the Tax Code of the Russian Federation, a professional tax deduction for an individual working under a contract can also be provided on the basis of a written application to the tax agent accompanied by documents confirming expenses incurred under the contract, for example, the cost of materials purchased for work.

Under copyright agreements for the creation, performance or other use of works of science, literature and art, a professional deduction is provided in the amount of documented actual expenses, and in the absence of their confirmation - according to the cost standard given in clause 3 of Art. 221 of the Tax Code of the Russian Federation , based on the amount of accrued fees.

Example 1.

Photographer A.I. Klementyev entered into an author's agreement with the publishing house "Plamya" in the amount of 30,000 rubles, according to which he must provide photographs for the magazine "Wild Nature". After completing this work, the photographer wrote to the publishing house’s accounting department asking for standard and professional deductions. Of the documents required to receive deductions, he presented only a certificate of income, form 2-NDFL.

Before paying the fee, it is necessary to calculate the amount of personal income tax.

Since A.I. Klementyev did not have documentary evidence of the expenses incurred, the accountant used the standard given in paragraph 3 of Art. to calculate the professional deduction. 221 Tax Code of the Russian Federation , – 30%. The deduction amounted to 9,000 rubles. (RUB 30,000 x 30%).

Thus, the amount of personal income tax that needs to be withheld is 2,678 rubles. ((30,000 - 400 - 9,000) rub. x 13%).

The following entries were made in accounting:

| Contents of operation | Debit | Credit | Amount, rub. |

| Remuneration accrued under the copyright agreement | 20 | 76 | 30 000 |

| Personal income tax withheld – 13% | 76 | 68 | 2 678 |

| Personal income tax is transferred to the budget | 68 | 51 | 2 678 |

| Royalty paid | 76 | 50 | 27 322 |

UST and contributions to the Pension Fund of the Russian Federation . The organization must accrue unified social tax on all payments in favor of individuals under civil contracts, the subject of which is the performance of work, provision of services, as well as under copyright agreements (Clause 1 of Article 236 of the Tax Code of the Russian Federation ).

If the agreement is concluded with an individual entrepreneur, or the subject of the agreement is the transfer of ownership of property or its transfer for use, then the unified social tax is not accrued (see Resolution of the Federal Antimonopoly Service ZSO No. F04-8820/2005(17687-A27-27) ). There is no need to do this even if payments under the contract are classified as expenses that do not reduce the taxable base for profit ( clause 3 of Article 236 of the Tax Code of the Russian Federation ).

Please note : in the Information Letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated March 14, 2006 No. 106, clarifications are given regarding the taxation of unified social tax on payments of remuneration to members of the board of directors of the company. It states, in particular, that relations between the board of directors of the company and the company are of a civil nature, members of the board of directors perform managerial functions and, in accordance with clause 2 of Art. 64 of Federal Law No. 208-FZ [8], during the performance of their duties they may receive remuneration, the amount of which is established by a decision of the general meeting of shareholders. On this basis, the court ruled that such activities, in accordance with paragraph 1 of Art. 236 of the Tax Code of the Russian Federation , is subject to the Unified Social Tax.

Since no deductions are made to the Federal Social Insurance Fund of the Russian Federation from remuneration under civil law contracts, the overall UST rate is 23.1%. From this amount is credited:

– 20% to the federal budget;

– 2% in TFOMS;

– 1.1% in the Federal Compulsory Medical Insurance Fund.

In addition, we note that the amount of the Unified Tax accrued for payments under the author's agreement can be reduced by the amount of professional tax deductions established for calculating personal income tax, in accordance with clause 5 of Art. 237 Tax Code of the Russian Federation .

Now about pension contributions. In accordance with paragraph 2 of Art. 10 of Federal Law No. 167-FZ [9], contributions to the Pension Fund of the Russian Federation are calculated from the same tax base as the Unified Social Tax. At the same time, the amount of the unified social tax paid to the federal budget is reduced by the amount of such contributions ( clause 2 of article 243 of the Tax Code of the Russian Federation ).

Contributions for insurance against industrial accidents and occupational diseases. Individuals working under civil contracts are subject to this type of insurance if, in accordance with the contract, the policyholder is obliged to pay insurance premiums to the insurer. This is what it says in paragraph 1 of Art. 5 of Federal Law No. 125-FZ [10]. Therefore, if there are no such conditions in the contract, then there is no need to pay fees.

income tax . As is known, expenses reduce the taxable profit of an organization, provided they comply with the requirements of paragraph 1 of Art. 252 of the Tax Code of the Russian Federation , that is, they must be economically justified, documented and aimed at generating income. Consequently, if a civil contract meets these conditions, then payments under it are included in the organization’s costs.

At the same time, in order to correctly account for such expenses, it is necessary to take into account who performed the work. So, if an individual entrepreneur worked under a contract, then the costs should be classified as other expenses in accordance with paragraphs. 41 clause 1 art. 264 Tax Code of the Russian Federation . If the contract was concluded with an individual who is not on the staff of the organization, then his remuneration is taken into account as labor costs in accordance with clause 21 of Art. 255 Tax Code of the Russian Federation .

How to take into account such expenses if a civil contract is concluded with a full-time employee of an organization who performs work under the contract in his free time? The Ministry of Finance of the Russian Federation expressed its opinion on this issue in letters No. 03-03-01-04/1/234 [11], No. 03-05-02-04/205 [12] and dated 04.24.06 No. 03-03-04 /1/382 . These costs cannot be attributed to labor costs, since they are not specified in Art. 255 of the Tax Code of the Russian Federation , and are also not provided for in labor and collective agreements. They cannot be included in material or other expenses, because full-time employees are not third-party organizations and individual entrepreneurs. Therefore, payments under civil contracts concluded with full-time employees do not reduce the tax base for profits and are not subject to Unified Social Tax and contributions to the Pension Fund of the Russian Federation.

In our opinion, the point of view of the Ministry of Finance is controversial, since, as mentioned above, the main criterion for including expenses in the cost price is their compliance with the three conditions of paragraph 1 of Art. 252 Tax Code of the Russian Federation . On this basis, these payments can be taken into account as other expenses associated with production and sales, in accordance with paragraphs. 49 clause 1 art. 264 Tax Code of the Russian Federation .

However, in such a situation, in order to avoid claims from tax authorities, it is probably easier for an organization to follow the instructions of the Ministry of Finance of the Russian Federation and conclude not civil contracts with full-time employees, but contracts for part-time work, accordingly, charging all “salary” taxes on these amounts. Otherwise, you need to be prepared to defend your case in court.

Compensation payments under civil contracts

In a number of cases, the Civil Code of the Russian Federation ( Articles 709 and 783 ) provides for compensation for costs incurred by the employee in the performance of a civil contract. In order for compensation, as well as remuneration under a contract, to be taken into account when calculating the tax base for income tax, the conditions under which it is paid (for example, the availability of primary documents) must be stipulated in the contract.

This is especially important in the case when an employee must, for example, travel to another city to fulfill his obligations under the contract. It is impossible to arrange such a trip as a regular business trip by order of the manager, because the Labor Code of the Russian Federation provides for compensation of expenses associated with business trips only for full-time employees ( Article 166 of the Labor Code of the Russian Federation ). But by writing in the contract that amounts for the employee’s travel and accommodation are included in the total cost of the contract and will be compensated to him after presentation of the relevant documents, the organization will be able to legally include all expenses in the cost price. A similar opinion of the Ministry of Finance on this issue is presented in Letter No. 03-03-06/34 [13].

Is it necessary to subject the compensation amount to UST? Until recently, there was no clear answer to this question. Compensation payments, according to the Federal Tax Service of the Russian Federation, are additional remuneration to an individual for work or services performed by him under a civil contract, and therefore they should be subject to the Unified Tax on a general basis ( Letter of the Federal Tax Service of the Russian Federation No. GV-6-05 / [email protected] [ 14]). The financiers first argued that the amounts stipulated by the contract for compensation of expenses for travel to the place of their implementation and for accommodation actually performed by the contractor, confirmed by documents (hotel invoices, copies of railway or air tickets), should not be included in the tax base under the Unified Social Tax ( Letter of the Ministry of Finance of the Russian Federation No. 04-04-04/58 [15]). But later officials changed their opinion, agreeing with the Federal Tax Service of the Russian Federation ( letters of the Ministry of Finance of the Russian Federation No. 03-05-02-04/32 [16], No. 03-05-02-04/39 [17]). However, the Supreme Arbitration Court of the Russian Federation put an end to this issue. In Resolution No. 1443/05 dated August 18, 2005 , he emphasized that since the said compensation does not apply to the payments listed in clauses 1 , 2 of Art. 236 of the Tax Code of the Russian Federation (it is not remuneration for the performance of work), it is not recognized as an object of UST taxation, regardless of its inclusion in expenses when taxing profits.

The answer to this question is also contained in the later Information Letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated March 14, 2006 No. 106 . It states, in particular: compensation for the costs of persons providing services to society for a fee is aimed at repaying expenses incurred by the performers in the interests of the customer of the services, and, therefore, cannot be considered as payment for the services themselves. However, the court indicates that payments made in favor of individuals and aimed at compensating their general costs not directly related to the work performed (services provided) cannot be excluded from the object of taxation of the unified social tax.

The amount of compensation under the contract is also not subject to personal income tax, because, as stated in this decision of the Supreme Arbitration Court, it has the same legal nature as business trip expenses of employees who are in an employment relationship with the taxpayer, which are not subject to personal income tax in accordance with clause 3 Art. 217 Tax Code of the Russian Federation .

Example 2.

ZAO Alfa entered into a contract for the provision of legal services with P. B. Sidorov (born in 1965) in the amount of 15,000 rubles. The contract states that in addition to this amount, the lawyer will be compensated for expenses associated with the performance of work under the contract, subject to the presentation of primary documents. It does not provide for the organization’s obligation to pay insurance premiums against accidents.

To fulfill the terms of the agreement, P. B. Sidorov had to go to another city for three days. His expenses were: travel – 2,300 rubles, hotel accommodation – 2,000 rubles, which is confirmed by relevant documents.

The accountant made the following entries:

| Contents of operation | Debit | Credit | Amount, rub. |

| Remuneration accrued under the contract | 26 | 76 | 15 000 |

| Personal income tax withheld - 13% (RUB 15,000 x 3%) | 76 | 68 | 1 950 |

| UST accrued to the federal budget - 6% | 26 | 69-2-1 | 900 |

| Contributions to the Pension Fund for the insurance part of the pension are calculated - 14% | 26 | 69-2-2 | 2 100 |

| Contributions to the Federal Compulsory Compulsory Medical Insurance Fund accrued - 1.1% | 26 | 69-3-1 | 165 |

| Contributions to the TFOMS have been accrued - 2% | 26 | 69-3-2 | 300 |

| Compensation under the contract was accrued (2,300 + 2,000) rubles. | 26 | 76 | 4 300 |

| Remuneration and compensation under the contract were paid (15,000 - 1,950 + 4,300) rubles. | 76 | 50 | 17 350 |

| Costs under the contract were written off to cost (15,000 + 900 + 2,100 + 300 + 165 + 4,300) rubles. | 90-2 | 26 | 22 765 |

Let us remind you that a citizen performing work under a civil contract has the right to receive a professional tax deduction for personal income tax.

Therefore, if compensation for expenses is not provided for in the contract and the employee is paid only the amount of the agreed remuneration, then he can reduce the income he receives by the amount of expenses incurred during the implementation of the contract, which must be confirmed by documents. Example 3.

Let's change the terms of the contract from example 2. The total amount under the contract is 19,300 rubles, compensation for expenses is not provided.

After performing the services under the contract, P. B. Sidorov wrote an application for granting him a professional tax deduction based on the documents presented (train tickets, hotel bills) in the amount of 4,300 rubles.

In this case, the accounting under the contract will look like this:

| Contents of operation | Debit | Credit | Amount, rub. |

| Remuneration accrued under the contract | 26 | 76 | 19 300 |

| Personal income tax withheld - 13% ((19,300 - 4,300) rub. x 13%) | 76 | 68 | 1 950 |

| UST accrued in FB - 6% | 26 | 69-2-1 | 1 158 |

| Contributions to the Pension Fund for the insurance part of the pension are calculated - 14% | 26 | 69-2-2 | 2 702 |

| Contributions to the Federal Compulsory Compulsory Medical Insurance Fund accrued - 1.1% | 26 | 69-3-1 | 212 |

| Contributions to the TFOMS have been accrued - 2% | 26 | 69-3-2 | 386 |

| Remuneration under the contract was paid (19,300 - 1,950) rubles. | 76 | 50 | 17 350 |

| Costs under the contract were written off to cost (19,300 + 1,158 + 2,702 + 386 + 212) rubles. | 90-2 | 26 | 23 758 |

As you can see, in the second case, the amount received by the employee has not changed.

However, the organization's total expenses increased due to an increase in the amount of unified social tax paid to the budget. This circumstance of the organization must be kept in mind when planning financial performance when concluding civil contracts. Note : When using third-party workers to promote its products or services, an organization can choose how to account for these costs. In this case, according to Art. clause 4 art. 252 of the Tax Code of the Russian Federation , they can be included either in labor costs or classified as advertising expenses.

This freedom of choice is especially important for organizations that spend significant amounts of money on advertising. Such advertising expenses are standardized, and they can be taken into account when calculating income tax only in an amount not exceeding 1% of sales revenue (clause 4 of Article 264 of the Tax Code of the Russian Federation ). And labor costs, as we know, are included in the cost in full.

[1] Federal Law of July 16, 1999 No. 165-FZ “On the Basics of Compulsory Social Insurance.”

[2] Letter of the Ministry of Finance of the Russian Federation dated November 21, 2004 No. 04-02-05/1/33 “On the recognition in tax accounting of expenses under civil law contracts.”

[3] Form No. OS-3, approved. Resolution of the State Statistics Committee of Russia dated January 21, 2003 No. 7.

[4] Form No. KS-2, approved. Resolution of the State Statistics Committee of Russia dated November 11, 1999 No. 100.

[5] Federal Law of November 21, 1996 No. 129-FZ “On Accounting”.

[6] Approved by Order of the Federal Tax Service of the Russian Federation dated November 25, 2005 No. SAE-3-04/ [email protected] “On approval of the form of information on the income of individuals.”

[7] We remind you that the standard tax deduction is provided to a citizen in the amount of 400 rubles. until the month when his income exceeds 20,000 rubles, and 600 rubles. for each child up to a month when income exceeds 40,000 rubles.

[8] Federal Law of December 26, 1995 No. 208-FZ “On Joint-Stock Companies.”

[9] Federal Law of December 15, 2001 No. 167-FZ “On Compulsory Pension Insurance in the Russian Federation.”

[10] Federal Law No. 125-FZ dated July 24, 1998 “On compulsory social insurance against industrial accidents and occupational diseases.”

[11] Letter of the Ministry of Finance of the Russian Federation dated 05/06/05 No. 03-03-01-04/1/234.

[12] Letter of the DNP MF RF dated November 28, 2005 No. 03-05-02-04/205 “On the issue of paying the unified social tax and insurance contributions for compulsory pension insurance.”

[13] Letter of the Ministry of Finance of the Russian Federation dated 04.08.05 No. 03-03-06/34 “On the procedure for taxation of unified social tax compensation payments under civil contracts.”

[14] Letter of the Federal Tax Service of the Russian Federation dated April 13, 2005 No. GV-6-05/ [email protected] “On the taxation of reimbursement of travel and hotel costs by the unified social tax.”

[15] Letter of the Ministry of Finance of the Russian Federation dated May 25, 2004 No. 04-04-04/58 “On the issue of taxation with a single social tax of compensation for travel and accommodation expenses paid under agreements concluded with individuals for the performance of work (rendering services).”

[16] Letter of the Ministry of Finance of the Russian Federation dated October 12, 2004 No. 03-05-02-04/32 “On the payment of the unified social tax when holding lectures, seminars and conferences.”

[17] Letter of the Ministry of Finance of the Russian Federation dated October 29, 2004 No. 03-05-02-04/39 “Taxation with a single social tax of amounts of compensation to agents operating under civil contracts for travel expenses.”

Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up

Results

Despite the obvious attractiveness of using GPA agreements due to the possibility of charging insurance premiums for the payments they provide for in a smaller amount, their legal component requires accuracy in the wording of the terms of the agreement. For an accountant, the presence of freelance workers will mean the need to carefully collect and study documents confirming the possibility of non-payment of insurance premiums, as well as work together with a lawyer to exclude language from civil liability agreements that implies negative consequences for the business.

Sources:

- Tax Code of the Russian Federation

- Federal Law of December 28, 2013 No. 400-FZ

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.