Specifics of using account 46 in accounting

Account 46 is active. Like other active accounts, it reflects the organization’s property. But the organization ceases to own this property immediately after the completion and transfer of work. Thus, account 46 reflects information about fulfilled contractual obligations, and not about one’s own tangible assets.

According to PBU 2/94, the following methods are used to determine the total amount of a particular stage:

- on the construction site;

- depending on the type of order completed.

In the first case, the total amount of each stage will be determined only after the project is completed. In the second, the customer has the opportunity to pay for each stage of the project, but only after its reliable cost has been determined.

The debit of account 46 reflects the amounts for work performed that were accepted by the customer. Most often, transactions with a score of 46 involve the following accounts: 62, 90, 20.

After the completion of the next stage of work and its payment by the customer, the amount of funds for a specific stage is taken into account on the debit of account 46 in correspondence with account 90 “Sales”. In this case, the amount of money spent in completing the work stage is transferred from the credit of account 20 “Main production” to the debit of account 90 “Sales”.

Amounts received from the customer for the accepted stages of work are reflected in correspondence with account 62 “Settlements with buyers and customers”, which are recorded on its debit. The debit of the same account will reflect the total amount of the project after delivery and payment of all its stages.

Basic account transactions $46$

The debit of the account $46$ reflects the cost of the stages of work that were paid by customers and completed. The following works were also accepted:

- Dt $46$ – Ct $90$.

- Dt $90$ – Kt $20$ (simultaneously with the previous one) – for the amount of costs.

- Dt $50, 51$ – Kt $62$ – receipt of funds from the customer for accepted work, goods, services.

Are you an expert in this subject area? We invite you to become the author of the Directory Working Conditions

Upon completion of all work, the entire cost of the stages paid by the customer, which was collected on the account $46$, is written off as a debit to the account $62$.

- Dt $62$ – Ct $46$

The cost of fully completed work, which was invoiced at $62, is offset by previously received advances and the amount received in final payment from the customer.

Analytical accounting is carried out by type of work.

The account is used to calculate intermediate stages of work performed. According to the accounting regulations, the contractor can use two methods for determining income from the delivery of construction work :

- Income based on the cost of the construction project

- Income based on the cost of work as it is completed.

In the first case, the financial result is determined after the complete completion of construction of the facility. Production costs are reflected in the debit of the account $20$, from the beginning of construction to its completion.

In the second case, the financial result is determined upon completion of individual works, according to the design stages provided for by the project, and the costs associated with them. The use of this method is used if the work performed and costs can be estimated. The costs of the work are taken into account by the contractor on an accrual basis. Same as work in progress.

Finished works on a similar topic

Course work Features of product accounting when using an account 46,480 ₽ Abstract Features of product accounting when using an account 46,260 ₽ Test work Features of product accounting when using an account 46,200 ₽

Receive completed work or specialist advice on your educational project Find out the cost

Important Features

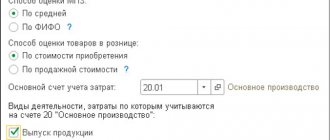

The balance of account 46 is taken into account when calculating property tax. In this regard, the organization must remember that if the revenue for the project stages is not determined, then it is taken into account as the amount of funds spent on the implementation of the project stages. Therefore, you need to pay attention to the following points of accounting policy:

- on the procedure for recognizing the organization’s revenue (for individual stages of work or for all stages at once);

- on the method of determining the readiness of products, works, services.

Features of accounting when using account 46 “Completed stages for work in progress”

Organizations that produce products with a long manufacturing cycle or provide complex services (construction, scientific, design, geological, etc.) can recognize the sale of products, works and services (and therefore profit).

a) in general for the work completed and delivered to the customer;

b) for individual stages of the work performed.

The first option is traditional, and accounting for the sale of products is carried out according to one of the already described methods for accounting for the sale of products, works, and services.

In the second option, the calculation is carried out based on completed stages or complexes that have independent significance, or the customer makes an advance to the organization until the work is completed in the amount of the contract price. In the second option, account 46 “Completed stages for work in progress” is used.

The debit of this account takes into account the cost of stages of work completed by the organization, paid for by the customer, accepted in the prescribed manner and reflected on the credit of account 90. At the same time, the costs of completed and accepted stages of work are written off from the credit of account 20 to the debit of account 90. The amounts of received payment are reflected on the debit of the accounting accounts funds from the credit of account 62 “Settlements with buyers and customers”.

Upon completion of all stages of work, the cost of the stages paid by the customer is written off from account 46 to the debit of account 62 “Settlements with buyers and customers”. The cost of fully completed work recorded on account 62 “Settlements with buyers and customers” and for the amount received in the final settlement as a debit to cash accounting accounts.

The balance of account 46 is taken into account when calculating property tax. If revenue from the sale of products, performance of work and provision of services cannot be determined, then it is taken into account in the amount of recognized expenses for the manufacture of these products, performance of this work and provision of this service (clause 14 of PBU 9/99). It follows from this that, as part of the information on the accounting policies of the organization, at least the following information is subject to disclosure:

on the procedure for recognizing the organization’s revenue (for individual stages of work or for all stages at once);

on the method of determining the readiness of products, works, services.

Accounting for sales expenses

Selling expenses include expenses associated with the sale of products (works, services) paid by the supplier. Selling expenses together with production costs form the total cost of products sold.

Selling expenses include:

costs of containers and packaging of products in finished product warehouses (cost of services of its auxiliary workshops engaged in the manufacture of containers and packaging, cost of containers purchased externally, payment for packaging and packaging of products by third parties);

expenses for transporting products (costs for delivering products to the station or pier of departure, loading into wagons, ships, cars, etc., payment for the services of specialized transport and forwarding offices);

commission fees and deductions paid to sales and intermediary organizations in accordance with contracts;

advertising costs, including expenses for advertisements in print and on television, prospectuses, catalogs, booklets, for participation in exhibitions, fairs, the cost of samples of goods transferred in accordance with contracts, agreements and other documents to buyers or intermediary organizations free of charge, and other similar expenses;

other sales expenses (costs of storage, part-time work, sub-sorting, etc.).

Advertising expenses are written off to account 44 “Sales expenses” in the amount of actual expenses. However, for tax purposes they are accepted within the established standards. The order of the Ministry of Finance of the Russian Federation dated March 15, 2000 No. 26n (as amended by the order of the Ministry of Finance of the Russian Federation dated March 1, 2001 No. 18n) established the following maximum amounts of advertising expenses per year (Table 4).

Table 5. Limits on advertising expenses per year

| Volume of proceeds from the sale of products (works, services) (including value added tax) | Limits on advertising expenses accepted for profit tax purposes | |

| Before April 1, 2001 | Since April 1, 2001 | |

| Up to 30 million rubles. inclusive Over 30 million rubles. Over 300 million rubles. | 5% of the volume of 1.5 million rubles. + 2.5% on volumes exceeding RUB 30 million. 8.25 million rubles. + 1% on volume exceeding RUB 300 million. | 7.5% of the volume of 2.25 million rubles. + 3.75% from volume exceeding 30 million rubles. RUB 12.375 million + 1.5% on volumes exceeding RUB 300 million. |

Organizations engaged in trading activities use the gross profit indicator when calculating the maximum amount of advertising expenses.

To account for business expenses, use active account 44 “Sales expenses”. The debit of this account takes into account the costs of sales from the credit of the corresponding material, settlement and cash accounts:

account 10 “Materials” - for the cost of consumed containers;

account 23 “Auxiliary production” - for the cost of services for sending products from the warehouse to the station (pier, airport) of departure or to the buyer’s warehouse using the company’s vehicles;

account 60 “Settlements with suppliers and contractors” - for the cost of services for sending products to the buyer, provided by third parties;

account 70 “Settlements with personnel for wages” - for the payment of workers accompanying the products, and other accounts.

Analytical accounting for account 44 is carried out in the statement of accounting for general business expenses, deferred expenses and sales expenses for the previously indicated expense items.

At the end of each month, selling expenses are written off to cost of goods sold. They are applied directly to certain types of products, and if it is not possible, they are distributed in proportion to their production costs, the volume of products sold at the organization’s wholesale prices or in another way.

The write-off of sales expenses is recorded using the following accounting entry:

Debit account 90 “Sales”

Credit to account 44 “Sales expenses”.

If only part of the output is sold in the reporting month, then the amount of sales expenses is distributed between sold and unsold products in proportion to their production costs or in another way.

Organizations that produce products with a long manufacturing cycle or provide complex services (construction, scientific, design, geological, etc.) can recognize the sale of products, works and services (and therefore profit).

a) in general for the work completed and delivered to the customer;

b) for individual stages of the work performed.

The first option is traditional, and accounting for the sale of products is carried out according to one of the already described methods for accounting for the sale of products, works, and services.

In the second option, the calculation is carried out based on completed stages or complexes that have independent significance, or the customer makes an advance to the organization until the work is completed in the amount of the contract price. In the second option, account 46 “Completed stages for work in progress” is used.

The debit of this account takes into account the cost of stages of work completed by the organization, paid for by the customer, accepted in the prescribed manner and reflected on the credit of account 90. At the same time, the costs of completed and accepted stages of work are written off from the credit of account 20 to the debit of account 90. The amounts of received payment are reflected on the debit of the accounting accounts funds from the credit of account 62 “Settlements with buyers and customers”.

Upon completion of all stages of work, the cost of the stages paid by the customer is written off from account 46 to the debit of account 62 “Settlements with buyers and customers”. The cost of fully completed work recorded on account 62 “Settlements with buyers and customers” and for the amount received in the final settlement as a debit to cash accounting accounts.

The balance of account 46 is taken into account when calculating property tax. If revenue from the sale of products, performance of work and provision of services cannot be determined, then it is taken into account in the amount of recognized expenses for the manufacture of these products, performance of this work and provision of this service (clause 14 of PBU 9/99). It follows from this that, as part of the information on the accounting policies of the organization, at least the following information is subject to disclosure:

on the procedure for recognizing the organization’s revenue (for individual stages of work or for all stages at once);

on the method of determining the readiness of products, works, services.

Accounting for sales expenses

Selling expenses include expenses associated with the sale of products (works, services) paid by the supplier. Selling expenses together with production costs form the total cost of products sold.

Selling expenses include:

costs of containers and packaging of products in finished product warehouses (cost of services of its auxiliary workshops engaged in the manufacture of containers and packaging, cost of containers purchased externally, payment for packaging and packaging of products by third parties);

expenses for transporting products (costs for delivering products to the station or pier of departure, loading into wagons, ships, cars, etc., payment for the services of specialized transport and forwarding offices);

commission fees and deductions paid to sales and intermediary organizations in accordance with contracts;

advertising costs, including expenses for advertisements in print and on television, prospectuses, catalogs, booklets, for participation in exhibitions, fairs, the cost of samples of goods transferred in accordance with contracts, agreements and other documents to buyers or intermediary organizations free of charge, and other similar expenses;

other sales expenses (costs of storage, part-time work, sub-sorting, etc.).

Advertising expenses are written off to account 44 “Sales expenses” in the amount of actual expenses. However, for tax purposes they are accepted within the established standards. The order of the Ministry of Finance of the Russian Federation dated March 15, 2000 No. 26n (as amended by the order of the Ministry of Finance of the Russian Federation dated March 1, 2001 No. 18n) established the following maximum amounts of advertising expenses per year (Table 4).

Table 5. Limits on advertising expenses per year

| Volume of proceeds from the sale of products (works, services) (including value added tax) | Limits on advertising expenses accepted for profit tax purposes | |

| Before April 1, 2001 | Since April 1, 2001 | |

| Up to 30 million rubles. inclusive Over 30 million rubles. Over 300 million rubles. | 5% of the volume of 1.5 million rubles. + 2.5% on volumes exceeding RUB 30 million. 8.25 million rubles. + 1% on volume exceeding RUB 300 million. | 7.5% of the volume of 2.25 million rubles. + 3.75% from volume exceeding 30 million rubles. RUB 12.375 million + 1.5% on volumes exceeding RUB 300 million. |

Organizations engaged in trading activities use the gross profit indicator when calculating the maximum amount of advertising expenses.

To account for business expenses, use active account 44 “Sales expenses”. The debit of this account takes into account the costs of sales from the credit of the corresponding material, settlement and cash accounts:

account 10 “Materials” - for the cost of consumed containers;

account 23 “Auxiliary production” - for the cost of services for sending products from the warehouse to the station (pier, airport) of departure or to the buyer’s warehouse using the company’s vehicles;

account 60 “Settlements with suppliers and contractors” - for the cost of services for sending products to the buyer, provided by third parties;

account 70 “Settlements with personnel for wages” - for the payment of workers accompanying the products, and other accounts.

Analytical accounting for account 44 is carried out in the statement of accounting for general business expenses, deferred expenses and sales expenses for the previously indicated expense items.

At the end of each month, selling expenses are written off to cost of goods sold. They are applied directly to certain types of products, and if it is not possible, they are distributed in proportion to their production costs, the volume of products sold at the organization’s wholesale prices or in another way.

The write-off of sales expenses is recorded using the following accounting entry:

Debit account 90 “Sales”

Credit to account 44 “Sales expenses”.

If only part of the output is sold in the reporting month, then the amount of sales expenses is distributed between sold and unsold products in proportion to their production costs or in another way.

Accounting entries with account 46

The list of transactions using account 46 and accounts directly related to it within several stages of the project is as follows:

- Dt 51 – Kt 62 – receipt of an advance for a specific stage of work from the customer;

- Dt 20 – Kt 10 (69, 70) – reflection of the contractor’s costs for completing a specific stage;

- Dt 46 – Kt 90 – completion of the first stage;

- Dt 90 – Kt 20 – write-off of the cost of the first stage;

- Dt 90 – Kt 99 – reflection of the financial result of the completed stage;

- Dt 46 – Kt 90 – delivery of the next stage of completed work;

- Dt 20 – Kt 10 (69, 70) – reflection of the contractor’s costs for fulfilling the conditions under the drawn up contract;

- Dt 90 – Kt 20 – the fact of writing off the cost of all costs necessary to complete the second stage;

- Dt 90 – Kt 99 – reflection of the financial result of the second completed stage;

- Dt 62 – Kt 46 – actual write-off of the amount for all completed stages;

- Dt 51 – Kt 62 – receipt of final payment from the customer for the completed project.