In what cases is it compiled?

Such documentation is drawn up when the OS cannot be used for its intended purpose due to breakdowns or wear and tear.

There are several reasons for issuing defective statements:

- The document explains the reasons for writing off the company's property.

- The information in the report helps to analyze the reasons for the failure of the written-off fixed asset, which allows further avoidance of damage before the end of its service life.

- The form serves as proof of the validity of the fact of writing off an asset from the balance sheet of the enterprise. Confirms the economic feasibility of the write-off procedure.

For the reasons listed above, the act must reflect facts that irrefutably indicate the impossibility of further operation of the fixed asset and, accordingly, the advisability of its write-off.

Proof of repair costs

To include expenses as expenses that reduce the taxable base, it is necessary to prepare documents confirming such expenses (clause 1 of Article 252 of the Tax Code of the Russian Federation).

Documents that will confirm the costs of repairs:

- report of detected defects or defective statement

- order to carry out repairs in any form.

- repair schedule

- an estimate reflecting labor costs, the cost of materials and the cost of repairs in general

- invoice for the issue of materials to the side

- act of acceptance and transfer of repaired objects according to form No. OS-3

- inventory card in form No. OS-6, which reflects information about the repairs performed

Organizations have the right to use Form OS-16 or develop a defective statement, having it approved by order and annex to the accounting policies.

The defective statement is drawn up in one copy if the organization carries out repairs on its own and in two (or more) if the repair work is carried out by a third party: 1 from the company and 1 from the contractor with the act (statement) signed by representatives from both sides.

Who draws up the act?

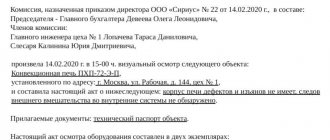

To write off fixed assets from the balance sheet of the enterprise, the manager, by order, approves a special commission - the procedure for creation.

It includes middle managers and accountants.

When inspecting the property, members of the commission must draw up a defective statement reflecting all the shortcomings and confirming the impossibility of further using the company’s fixed asset for its intended purpose.

How to fill out the form correctly?

The defective statement contains written arguments about the impossibility of further operation of fixed assets. On its basis, the property is immediately written off as soon as possible.

It is recommended to draw up a form showing the main points:

- full name of the company;

- the structural unit in which the property is registered;

- composition of the commission approved by the head of the company (data of all commission members is entered);

- a record of the impossibility of further use of the fixed asset;

- list of objects inspected (all characteristics of each OS are listed in detail);

- specific designation of identified defects and malfunctions of the property in question;

- the conclusion of the commission and the fact of the need to write off the object due to the impracticality of repair or sale are stated.

The defective statement must be signed by all members of the commission. The document can be drawn up according to the form approved by the company. The law does not provide restrictions in this regard.

It is not recommended to make mistakes or typos in the form. The document can be typed or handwritten using a blue or black pen. You cannot make entries in pencil.

If the document is printed on a computer, the signatures of the commission members, the chairman and the director must be made exclusively by hand.

An example of preparing a defective statement for writing off fixed assets -.

Rules for document execution

You can draw up a defective statement either on a regular sheet of paper or on company letterhead. It doesn’t matter, just like whether it will be written by hand or printed on a computer.

Basically, the defect report is drawn up in several copies to be provided to each of the interested parties. All copies must be signed by the head of the enterprise and all members of the commission. There is no need to put a stamp on the defective statement, since it refers to the internal documents of the organizations.

All documents, after being used for their intended purpose, are sent to the archive for storage for a period established by law or provided for by the company’s internal regulations.

conclusions

Several main conclusions can be drawn on this topic:

- The defective statement is drawn up by a specially created write-off commission.

- The document confirms the need to deregister the object, the impossibility of its intended use and sale.

- The form can be drawn up in a free form approved by the enterprise. However, the document must contain mandatory information.

- The form is signed by all members of the commission, including the chairman.

- The document will not be considered valid without the visa approval of the manager.

Why do you need a defective statement?

In the course of the activities of any enterprise, there is periodically a need to write off and dispose of equipment, vehicles, production mechanisms or other material assets.

For the purpose of recording written-off assets, as well as to document the fact of their write-off, a defect sheet is used. In addition, this document can be used for the following purposes:

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

- accounting at the enterprise;

- taxation (in this and the previous case, the defective statement must be drawn up in accordance with the requirements of Article 9 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ, hereinafter referred to as the Law “On Accounting”);

- formation of the financial and economic policy of the enterprise, etc.

Local documentation of the organization usually establishes the procedure for writing off both low-value funds and funds of increased value. In the latter case, a special commission is formed to inspect and form a conclusion on the need to write off or repair (restore, update) material assets for one reason or another.

Defective list for write-off of spare parts: document structure

It is proposed to reflect in the defective statement:

- name of the company where spare parts are written off (as one of the stages of repair of a technical object);

- a list of types of equipment inspected for defects;

- information about the persons who carried out a technical inspection of spare parts to determine the presence of certain malfunctions;

- information about relevant faults (in relation to specific structural elements);

- conclusion of technical specialists on the need to replace faulty structural elements with new ones.

The defective statement form can be downloaded for free by clicking on the image below:

It also makes sense to supplement the form proposed by Rosleskhoz:

- a block containing the conclusion of technical specialists on the advisability of writing off damaged spare parts and replacing them with new ones;

- columns containing inventory numbers of the types of equipment being inspected.

The document can be certified by the signatures of technical specialists who inspected the equipment.

If you need a sample of a defective list for writing off spare parts, you can download this source on our website.

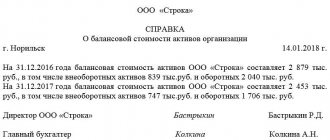

Furniture write-off act: sample

The current form of the act will depend on what furniture is subject to write-off. If we are talking about a fixed asset object, then you can use the act of writing off fixed assets form OS-4, and for writing off a group of fixed assets - OS-4b (Resolution of the State Statistics Committee of the Russian Federation dated January 21, 2003 No. 7). However, the requirement to use only unified forms of acts is no longer valid since 2013 - you can develop your own form taking into account the required details.

When the cost of furniture is low, the company receives it as inventory. Such objects are not depreciated and are written off simultaneously.

When disposing of furniture, an organization can use an act developed independently. The form of the act should be approved by order of the head of the organization. It is important that the document contains mandatory details, such as:

- Name of the piece of furniture being written off;

- Quantity to be written off;

- The results of the commission’s inspection of the piece of furniture, a list of identified defects, damage, etc.;

- Reasons for writing off furniture;

- Conclusion of the commission (for example, on the inappropriateness of repairs);

- Signatures of the commission members.

Sample write-off of furniture (act):

Results

During a tax audit, the Federal Tax Service, a business owner, an investor or a superior management company, having discovered the disposal of an asset due to write-off, may request the presentation of a document confirming the legality of this action. The defective statement becomes such a document. It reflects the fact of technical inspection of OS objects, records information about malfunctions and defects, and also provides an opinion from specialists on the advisability of writing off the OS due to the impossibility of their further operation.

Defective statement to justify repair or reconstruction

Let us recall that repair costs are included in income tax expenses in the period in which they were incurred. But the costs of modernization (reconstruction) are subject to inclusion in expenses through depreciation, increasing the cost of the fixed asset.

It is known that taxpayers and inspectors often argue over the issues of attributing costs to current repairs or to the cost of fixed assets.

If faulty parts of furniture are replaced with new ones (even more modern ones), then this basis alone does not serve as a criterion for attributing costs to modernization. Thus, as a result of replacing the old upholstery of an office sofa with another, the number of seats does not increase.

On the other hand, by replacing the crosspiece of a director's chair made of genuine leather, its service life can be increased. Such costs can be qualified as modernization. the causes of the defect and measures to repair in the defective statement . To qualify the costs as repairs, it is important to indicate specifically the restoration of the original performance qualities of the furniture.

Description of faults in the defect list

The defective statement justifies the nature of the work. When carrying out work that changes technological features, the work relates to reconstruction or modernization, which will be the basis for increasing the initial cost by the cost of the work performed.

The purpose of repair is necessary to maintain the fixed asset in working order for its useful life without changing the original technical indicators. The cost of repair work will be taken into account as part of repair expenses for tax purposes.

Formation of a commission to draw up a defective statement

The members of the commission include employees of their own organization and a representative of a third party:

- worker working on faulty equipment

- MOL

- accountant

- representatives of the organization that will carry out the repairs

A representative of the organization that will carry out the repairs has the right to confirm the faulty condition in the defective statement and will give a description of the planned repairs, make proposals for restoration work and competently indicate the deadlines for completion.

The statement must indicate the signatures of the commission members with a transcript, although the Federal Tax Service will not refuse to write off expenses on this basis, because statement is an internal document.