One-time reporting via the Internet: submission methods

Electronic reporting via the World Wide Web has long become an integral part of an accountant’s activities.

The Tax Code of the Russian Federation stipulates the obligation to send tax returns to the Federal Tax Service, including in electronic form, according to established deadlines. There are several ways to submit electronic reports. Read more about this in the article “Electronic reporting via the Internet - which is better?”

You can send tax reports via the Internet only if you have an electronic signature. It is purchased on a paid basis from certification centers or upon concluding an agreement with an EDF operator.

ATTENTION! From 01/01/2022, the Federal Tax Service will issue digital signatures for legal entities and individual entrepreneurs free of charge. Tax authorities plan to begin providing the service as early as 07/01/2021. See details here.

One-time reporting can be submitted to the tax authorities in two ways: through the Federal Tax Service website and through electronic document management (EDF) operators. In turn, submission through the tax website is more often used for one-time filing of reports and can be done either with the payer’s own electronic signature or by proxy.

ConsultantPlus experts explained who is required to submit electronic reports. If you don't have access to the system, get a free trial online.

Who submits 3-NDFL

When receiving income on which it is necessary to calculate and pay personal income tax, or to receive a refund of part of the tax previously paid to the budget, a declaration to the Federal Tax Service is required. As required by the Tax Code of the Russian Federation, at the end of the year the report is submitted to:

- Individual entrepreneurs (IP) on the general taxation system.

- Lawyers and notaries who have established private offices.

- Heads of farms (peasants).

- Tax residents of the Russian Federation who received income in other countries in the reporting year (these are persons who actually resided in Russia for at least 183 days a year, but received funds from foreign sources outside its borders).

- Citizens who received income from renting out their property or from fulfilling GPC agreements (provided that the customer did not fulfill the duty of a tax agent). In addition, a tax return for personal income tax (form 3-NDFL) is submitted upon sale of property. Although it is mandatory to declare receipt of income in this case, tax will have to be paid provided that the taxpayer owned it for less than the established minimum period (three years). As for real estate, you must pay income tax when selling an apartment (house):

- owned for less than 5 years, if acquired after 01/01/2016;

- owned for less than 3 years, if the property was purchased before 01/01/2016 or received by inheritance, as a gift, under a lifelong maintenance agreement with a dependent, as a result of privatization.

Citizens who win the lottery or sports betting also pay tax on the amount of their winnings, but in relation to them the tax agents are the organizers of these promotions and drawings, who paid them the amount of the winnings. If the gift is received in kind, the winner must pay tax on it themselves. In this case, he should fill out and submit the report.

Submitting reports via the Federal Tax Service website

Sending one-time reports via telecommunications channels (TCS) can be carried out directly through the official Internet resource of the Federal Tax Service of the Russian Federation. For this purpose, a special service was developed. It can be used by any taxpayer who has an electronic signature and is able to meet certain technical requirements.

Read more about this option for submitting reports in the article “Procedure for submitting tax reports via the Internet.”

The disadvantage of this method of sending reports is the installation of software and the taxpayer’s independent study of the instructions. Document files generated in other programs must be reloaded into a special tax service program.

Sending reports through EDF operators

Submission of reports can be carried out with the help of electronic document management operators through TCS channels.

According to Art. 80 of the Tax Code of the Russian Federation, the taxpayer undertakes to provide reports in electronic form in the following cases:

- If over the past calendar year the number of company employees exceeded 100 people (according to paragraph 3, clause 3).

- If a reorganization of a company with more than 100 employees was carried out (according to paragraph 4, paragraph 3).

- If this obligation is applicable to a specific type of tax (according to paragraph 5, paragraph 3).

ATTENTION! 6-NDFL and RSV must be submitted electronically if the list of individuals for whom the report is being submitted is 10 people or more (Articles 230, 431 of the Tax Code of the Russian Federation)

The list of EDF operators can be found on the official website of the Federal Tax Service.

Sending reports through EDF operators has the following advantages:

- no need to visit tax authorities;

- no need to create and certify paper versions of sent documents;

- the number of errors when preparing declarations is reduced;

- the taxpayer gets access to his individual data in the Federal Tax Service (for example, personal account information);

- the taxpayer gets the opportunity to electronically manage documents with the Federal Tax Service (for example, he can request certificates about the status of the debt to the budget or a reconciliation report of such debt).

When does an individual entrepreneur need electronic reporting?

Individual entrepreneurs must send reports electronically:

1. To the Federal Tax Service, if the individual entrepreneur:

- is a VAT payer;

- has a staff of employees exceeding 10 people for the previous year;

- submits a declaration for the first time and at the time of filing it has formed a staff of more than 100 people.

2. In the FSS, if:

- The individual entrepreneur has a staff of employees exceeding 25 people for the previous year;

- The individual entrepreneur submits reports to the funds for the first time and at the time of its submission formed a staff of more than 25 people.

Submitting reports without involving EDF operators

Submitting reports on TCS without using the services of EDF operators is carried out in two main ways:

- Registration of personal digital signature. This method is most convenient for individual entrepreneurs, since it does not require the execution of a notarized, expensive power of attorney. Using this method involves sending reports on behalf of the individual entrepreneur through the Federal Tax Service website. The digital signature is issued within 1–3 days, after which the individual entrepreneur can begin sending reports.

- Execution of a power of attorney for a representative organization or an individual with an electronic signature. For such a shipment, in addition to signing an agreement for the provision of relevant services, it is necessary to issue a notarized power of attorney. An electronic copy of the power of attorney is attached to the submitted report, and then submitted to the Federal Tax Service in paper form.

The procedure for filling out a report for individual entrepreneurs

Let us examine in detail how to fill out the 3-NDFL declaration for an individual entrepreneur.

Title page

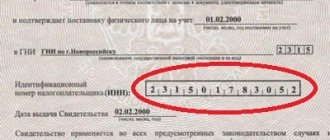

In the “TIN” paragraph on the title and all other sheets, indicate the correct identification number of the respondent taxpayer. If the report is submitted for the first time, then in the column “Correction number” you should indicate 000, and if a revised document is submitted again, then the serial number of the correction should be entered in this column. In the column “Tax period (code)” the code of the reporting period is entered; for annual reporting this is code 34. If the declaration is not submitted for a year, then indicate the following values:

- first quarter - 21;

- half-year - 31;

- nine months - 33.

The “Reporting tax period” field is intended to indicate the year for which income is declared. In addition, the column “Provided to the tax authority (code)” should be filled out correctly. It contains the four-digit number of the tax authority with which the taxpayer is registered. In this code, the first two digits are the region number, and the last two are the Federal Tax Service inspection code.

An important field that you should pay attention to when preparing the title page is the taxpayer category code. All values used are given in Appendix No. 1 to the procedure for filling out the report. Here are some of them:

- IP - 720;

- notary - 730;

- lawyer - 740;

- individuals without individual entrepreneur status - 760;

- farmer - 770.

The taxpayer provides the following information about himself: last name, first name, patronymic, date of birth (full), place of birth (as recorded in the passport), details of the passport itself. You no longer need to provide your permanent address of residence.

Identity documents have their own coding system, which is given in Appendix No. 2 to the procedure for filling out the reporting form:

- passport of a citizen of the Russian Federation - 21;

- birth certificate - 03;

- military ID - 07;

- temporary certificate issued instead of a military ID - 08;

- passport of a foreign citizen - 10;

- certificate of consideration of an application to recognize a person as a refugee on the territory of the Russian Federation - 11;

- residence permit in the Russian Federation - 12;

- refugee certificate - 13;

- temporary identity card of a citizen of the Russian Federation - 14;

- temporary residence permit in the Russian Federation - 15;

- certificate of temporary asylum in the Russian Federation - 18;

- birth certificate issued by an authorized body of a foreign state - 23;

- ID card of a Russian military personnel, military ID of a reserve officer - 24;

- other documents - 91.

The “Taxpayer Status” field is intended to indicate residence; the number 1 in it means that the taxpayer is a resident of the Russian Federation, and the number 2 means a non-resident of the Russian Federation. Also on the title page indicate the total number of sheets in the report, put a signature and the date of its completion.

If the report is submitted through a representative, then his full data must be indicated. In addition, such a person must attach to the declaration a copy of a document confirming his authority.

Other sheets

Of the remaining sheets, the taxpayer fills out those that contain information. It is only obligatory for everyone to fill out Section 1 “Information on the amounts of tax subject to payment (addition) to the budget / refund from the budget.” It provides relevant data on the amount of personal income tax or deduction.

When filling out this section, pay attention to the correct BCC for tax payment and its type. Please note that the surname and initials should be indicated on each page, as well as its serial number.

Let's consider an example of filling out a 3-NDFL declaration by an individual entrepreneur using the general taxation system. The individual entrepreneur fills out the title page of the declaration and section 1. In addition, he fills out section 2, appendices 1, 3 and 8. This individual entrepreneur in 2022 received income from business activities in the amount of 1,880,000 rubles.

In addition, he has the right to apply a professional tax deduction in the amount of 1,370,000 rubles. It included:

- material costs - 670,000 rubles;

- payments under employment contracts - 530,000 rubles;

- other expenses - 170,000 rubles.

For 2022, the individual entrepreneur transferred 35,000 rubles in advance payments for personal income tax to the budget. The entrepreneur is a participant in an investment partnership on the basis of an agreement and received income from the sale of securities that were in his ownership for less than three years.

Next, fill out Appendix 1 “Income from sources in the Russian Federation.” In it, the entrepreneur indicates all sources of income in Russia, their details and amounts.

In a similar Appendix 2, income from sources outside the Russian Federation is indicated, indicating the amounts and full details.

Appendix 3 “Income received from business, advocacy and private practice” contains generalized information on income received from business activities during the reporting period. In our example, this is 1,800,000 rubles.

IMPORTANT!

We indicate the OKVED activity code from which the income was received, the amount and expenses incurred during the reporting period.

How to get an electronic signature

A certification center accredited by the Ministry of Telecom and Mass Media of the Russian Federation can issue an electronic signature. According to the terms of the order of the Federal Tax Service of the Russian Federation dated April 8, 2013 No. ММВ-7-4/142, for correct authorization in the system, a special key certificate is used, which verifies the electronic signature.

According to Art. 80 of the Tax Code of the Russian Federation, reporting on TKS is sent with a qualified electronic signature. According to the law of April 6, 2011 No. 63-FZ, the concept of a simple and qualified, or enhanced, electronic signature was introduced. Tax reporting submitted to the Federal Tax Service is signed only by a qualified digital signature.

Similar to paper documentation certified by a signature and seal, an electronic document acquires legal force and status after an electronic signature is affixed to it.

Deadline for submitting a declaration under the simplified tax system for 2021

The tax return for the single tax under the simplified tax system by legal entities annually, before March 31 of the year following the reporting year (subclause 1, clause 1, article 346.23 of the Tax Code of the Russian Federation).

the legal entity's report for 2022 must be submitted by March 31, 2022 .

The tax return for the single tax under the simplified tax system by individual entrepreneurs annually, before April 30 of the year following the reporting year (subclause 2, clause 1, article 346.23 of the Tax Code of the Russian Federation). This year April 30 is a holiday, so the deadline has been moved to the next working day.

The individual entrepreneur's report for 2022 must be submitted by May 4, 2022 .

What do you need to send reports online?

When submitting reports via the Federal Tax Service website, the taxpayer must have:

- A certified electronic signature key issued by a special certification center and meeting the requirements of Order No. ММВ-7-4/142 of the Federal Tax Service of the Russian Federation dated 04/08/2013.

- Subscriber ID. You can receive it after registering on the Federal Tax Service website without contacting the EDF operator. You can register on the Federal Tax Service website using this link.

- Electronic information protection tool. Most often, encryption programs are used, or CIPF - means of cryptographic information protection. This name is given to programs that create private and public digital signature keys. The Crypto Pro program is mainly used.

- A computer connected to the Internet and an Internet Explorer browser (data encryption and transmission programs designed for filing tax reports work correctly in IE).

ConsultantPlus experts explained how a legal entity can obtain an enhanced qualified electronic signature. Get trial access to the K+ system and upgrade to the Ready Solution for free.

Obtaining subscriber ID

In order for an individual entrepreneur to submit reports through the taxpayer’s personal account, a unique subscriber identifier is required, which is assigned by the tax authority when registering an electronic signature. Without it, submitting reports through the Federal Tax Service service is impossible.

You can obtain an identifier on a special portal of the Federal Tax Service. To register, please provide your email address and password. After the user registers, a message will appear indicating that the subscriber ID has not yet been assigned.

To obtain an identifier, you need to register an electronic signature certificate. To do this, you need to download the file with the certificate from the cryptographic protection program. If you chose CryptoPro, follow these steps:

- 1. Open the Start menu and open “User Certificates” in the program folder.

2. Go to the Personal → Certificates folder and open the CEP certificate by double-clicking. 3. Go to the “Composition” tab and click the “Copy to file” button. In this case, the token with an electronic signature must be connected to the computer; 4. After this, the “Certificate Export Wizard” program will launch. Make sure the "Don't export private key" option is selected and click Next. 5. Leave the default file format in which the certificate will be exported and click Next. Specify the name of the file to create and click Next again. 6. Click Finish. Return to the browser tab with the service for self-registration of taxpayers to submit tax reports and click “Register certificate”. Select the created file and submit it for registration.

After registering the certificate, the subscriber ID should appear in the top field.

Results

You can send one-time reports via the Internet through the official website of the Federal Tax Service with the issuance of a personal digital signature or by proxy, without resorting to issuing a personal digital signature.

You can also use the services of EDF operators, the contract with which is concluded for a minimum period of one year. To send reports, you must obtain an electronic signature, subscriber ID and certificate from the certification authority. You should definitely pay attention to the security and reliability of the information specified in the electronic documentation. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What is the 3-NDFL declaration

The declaration form and instructions for filling out 3-NDFL were approved by order of the Federal Tax Service of Russia No. ED-7-11 / [email protected] dated 08/28/2020. This is a lengthy report of 13 pages, which includes a traditional title page and two main sections. The first section is only one page long and must be completed by all respondents. The second section, together with applications (the number of which takes 9 pages, but they are filled out only if there is information that should be indicated in them, depending on the status of the taxpayer.

The personal income tax return is an annual reporting form. It is intended not only to inform the Federal Tax Service about income received for the purpose of paying tax on them, but also for possible receipt of tax deductions.