One of the parents, guardian or adoptive parent has the right to receive a one-time state benefit at the birth of a child (Article of the Law on State Benefits dated May 19, 1995 N 81-FZ). The benefit amount is fixed and is indexed annually from February 1 at the legislative level. From 02/01/2018, the benefit amount was 16,759.09 rubles, before this time (from 02/01/2017 to 01/31/2018) – 16,350.33 rubles. The allowance is calculated on the date of birth; you can apply for it before the child is six months old.

The benefit is assigned for each child born. The specified amount is paid for one baby; if twins are born, the payment is made in double amount, for triplets - in triple amount, etc. When calculating benefits, the regional coefficient established for a specific region is taken into account. Employed parents (adoptive parents) apply to the employer for benefits. Also, the employer can additionally pay financial assistance for a newborn from its own funds. Let's consider the features of registration of these operations in the company's accounting.

One-time benefit for the birth of a child: postings

They reflect the accrual and payment of state benefits in the company in the same way as payroll settlements with personnel - on account 70, crediting it when accrued and debiting when issued. Since the payment of benefits is carried out not from the company’s funds, but from the budget of the Social Insurance Fund, account 70 corresponds to account 69 “Social insurance payments”.

Benefits are paid based on an application and a certificate from the registry office about the birth of a child. Written confirmation (for example, a certificate from the place of work) is also required that this benefit was not assigned or paid to the other parent.

Subsequently, the employer transfers all submitted documents to the Social Insurance Fund, from where it receives reimbursement of costs. The company does not have the right to postpone the payment of benefits (it must make it within 10 days from the date of submission of documents), citing the lack of funds from the Social Insurance Fund, therefore all settlements with the Fund, as a rule, are made later.

In practice, in the company’s accounting, all actions for calculations and payment of benefits are reflected as follows:

| Contents of operation | D/t | K/t |

| Benefit accrued | 69/1 | 70 |

| Payment from the cash register or crediting to the employee’s bank card | 70 | 50,51 |

| Reimbursement by the Social Insurance Fund of expenses for payment of benefits (credited to the employer’s account) | 51 | 69/1 |

The current mechanism for calculating maternity benefits excludes the calculation of insurance premiums for these payments. They are not subject to personal income tax.

Registration in the early period of pregnancy - calculation of benefits

Starting from February last year, the amount of benefits for employees registering in the early stages of pregnancy is 655.49 rubles. If a regional coefficient must be applied to the salary, the benefit amount increases. Let’s assume that in Krasnoyarsk the regional coefficient is 1.2, which means that the benefit amount increases to 786.59 rubles.

Conditions for payment of benefits:

- Six months from the end of maternity and pregnancy leave have not yet expired;

- There is a certificate from the medical clinic confirming registration at an early stage of pregnancy.

Most often, benefits for registration at an early stage of pregnancy are paid together with maternity and pregnancy benefits. If the document is submitted later than the disability form, then within ten days.

Personal income tax withholding and insurance premiums do not apply to such benefits.

Benefits are paid entirely from the Social Insurance Fund.

Let's move on to how to enter information about the accrual of benefits of this nature into 1C: accounting.

First of all, we issue a new type of accrual.

- We need the “Salary Settings” subsection located in the “Salaries and Personnel” menu.

- Now go to the “Accruals” subsection, having previously clicked on “Payroll calculation”.

- Click on “Create” and create a new accrual.

- We enter the data and complete the work in this section. You can assign the type of benefit you need using the “Payroll” document.

- Now we draw up the document, indicate the employee in whose name the benefit is due, and by clicking on “Accrue” we determine the newly created accrual from the drop-down window.

- In the new window, indicate the amount (if necessary, calculated using the regional coefficient). For example, let’s indicate the accrual amount for Krasnoyarsk: 655.49 rubles multiplied by a coefficient of 1.2, we get 786.59 rubles.

- Viewing the posting is available after clicking on Dt/Kt.

We draw up a document called “Contribution Accounting Transaction” to reflect the accrual of benefits in regulated reporting.

Taking into account the fact that the accrual was carried out in April last year, we will check the preparation of the reporting “Calculation of insurance premiums” for the first half of 2022.

Examples of calculation and payment of a one-time benefit for a newborn

Example 1

In September 2022, the VET engineer submitted an application to the accounting department for the payment of a one-time benefit for the birth of her daughter on August 25, 2018. The regional coefficient in force in the area where the company is located is 0.15.

The amount of the benefit due was 19,272.95 rubles. (16759.09 x 1.15). Postings in company accounting:

| Operations | D/t | K/t | Sum |

| Benefit accrued | 69/1 | 70 | 19272,95 |

| Payment made from the cash register | 70 | 50 | 19272,95 |

In the future, the funds for the paid benefits to the company will be reimbursed by the FSS department. Upon receipt of money into the company’s account, the accountant makes an entry: D/t 51 K/t 69/1 – 19272.95.

Example 2

A sales consultant at a retail chain gave birth to twins on September 10, 2018. On October 1, she submitted an application for payment of a one-time benefit for the birth of children, confirming that she had not received it at her husband’s place of work. The territorial coefficient of the location of the company is 0.2.

The benefit amount will be 40,221.82 rubles. (16,759.09 x 2 x 1.2). The payment is not subject to insurance contributions and income tax; the amount is given to the applicant in full. The accountant for operations for a lump sum benefit for the birth of a child will make the following entries:

D/t 69/1 K/t 70 in the amount of 40,221.82 rubles. - benefits have been accrued.

D/t 70 K/t 51 in the amount of 40,221.82 rubles. – the benefit is transferred to the employee’s card.

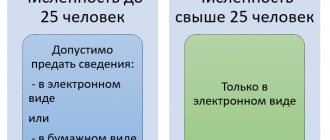

Formation of a register of information for the assignment and payment of benefits

When generating an electronic register of information in the program in accordance with Appendices No. 1, 2 to the order of the Federal Social Insurance Fund of the Russian Federation dated November 24, 2017 No. 579 from the workplace Benefits at the expense of the Social Insurance Fund or the section Reporting, certificates - Transfer of information about benefits to the Social Insurance Fund in the Register type field is indicated value of Disability Benefit (Fig. 2). Filling out the register is no different from filling out the register for temporary disability benefits.

Rice. 2

1C:ITS

For information on creating a register of information in 1C for the assignment and payment of benefits, see the section “Instructions for accounting in 1C programs.”

Financial assistance from the employer

Large enterprises often provide employees with financial assistance on the occasion of the birth of a child as a measure of support, enshrining this right in a collective agreement or other local act. Financial assistance is paid on the basis of a free-form application and the corresponding order of the manager.

The legislator does not stipulate the amount of such benefits, since this is the prerogative of the company, however, there are aspects that should be taken into account - the amount of payment is up to 50,000 rubles. for one child is not subject to either personal income tax (clause 8 of Article 217 of the Tax Code) or insurance contributions (clause 3 of clause 1 of Article 422 of the Tax Code) if it is made during the first year of the child’s life. This tax exemption is provided to each of the parents (letter of the Ministry of Finance of the Russian Federation dated March 21, 2018 No. 03-04-06/17568). If the payment is made when the child is already 1 year old, only 4,000 rubles are exempt from taxation.

Payment of financial assistance is made at the expense of the company’s own funds. Such assistance is a social plan payment; it does not relate to labor relations, therefore it is reflected in the account. 73 “Settlements with personnel for other operations.”

A peculiarity of accounting for transactions for the payment of material assistance is the fact that it is not taken into account in tax expenses, which leads to the emergence of a difference between tax and accounting, with which a permanent tax liability for income tax is calculated - PNO (clauses 4, 7 PBU 18/ 02). Postings:

| Contents of operation | D/t | K/t |

| Financial assistance was awarded due to the birth of a newborn | 91/2 | 73 |

| Payment made | 73 | 50,51 |

| Reflected PNI from costs not taken into account when calculating NNP | 99 | 68 |

Example 3

The employee was accrued and paid a one-time financial assistance for the birth of a child in the amount of 40,000 rubles. The transaction will be reflected in accounting as follows:

| Contents of operation | D/t | K/t | Sum |

| Financial assistance accrued | 91/2 | 73 | 40000 |

| Payment from the cash register | 73 | 50 | 40000 |

| PNO reflected (40,000 x 20%) | 99 | 68 | 8000 |

Benefits at the expense of the Social Insurance Fund: types and procedure for registration

The purpose of the FSS is to provide compulsory insurance to citizens of the Russian Federation. Organizations are required to transfer contributions to the Social Insurance Fund and are involved in the calculation and payment of benefits for their employees.

Legal relations in the field of compulsory social insurance are regulated by the Federal Law of December 29, 2006. No. 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity”, Federal Law of July 24, 2009. No. 212-FZ “On insurance contributions to the Pension Fund, Social Insurance Fund, FFOMS and TFOMS” and other regulations.

The amount of expenses for the purposes of compulsory social insurance reduces the amount of contributions of organizations due for payment to the Social Insurance Fund.

Please note: In accordance with clause 2.1 of Article 15 of Federal Law No. 212-FZ, the payer of insurance premiums has the right, within the billing period, to set off the amount of excess expenses for the payment of compulsory insurance coverage for compulsory social insurance over the amount of accrued insurance premiums for the specified type compulsory social insurance against upcoming payments for compulsory social insurance.

The billing period, according to Article 10 of Law No. 212-FZ, is a calendar year.

This means that if an organization’s expenses for paying benefits under the Social Insurance Fund were not “offset” against contributions payable within the calendar year, then such “overspending” cannot be offset against upcoming contributions in the next year. In this case, the accountant should submit an application to the Social Insurance Fund for the transfer of funds from the Social Insurance Fund to the organization based on the results of the calendar year and at the same time pay contributions in a timely manner in the new billing period.

Please note: documents for FSS reimbursement are not accepted during the reporting period .

There are many nuances associated with the procedure for processing benefits paid from the Social Insurance Fund. In our article we will try to reveal the most important of them in order to help the accountant avoid troubles when passing inspections by the Social Insurance Fund.

1. Temporary disability benefit.

The most common payment is temporary disability benefits. Those. sick leave.

The payment of this benefit is regulated by Article 183 of the Labor Code of the Russian Federation, according to which - in case of temporary disability, the employer pays the employee a benefit.

Calculation and payment of sick leave is carried out in accordance with Law 255-FZ.

In case of illness or injury of an employee (including in connection with an operation for artificial termination of pregnancy or in vitro fertilization) , payment of benefits from the Social Insurance Fund is made from the fourth day, in other cases - from the first day of incapacity for work during the insurance period:

- up to 5 years - 60% of average earnings,

- from 5 to 8 years - 80% of average earnings,

- 8 or more years - 100% of average earnings.

- For an insured person who has an insurance period of less than 6 months - in an amount not exceeding the minimum wage for a full calendar month (from 06/01/2011 - 4,611 rubles).

Please note: The maximum amount for sick leave payment is 1,136.99 .

per day (at 100% of average earnings). In accordance with paragraph 3 of Law 255-FZ, sick leave for child care during outpatient treatment is paid depending on the length of insurance for the first 10 calendar days. Subsequent days of such sick leave are paid in the amount of 50% of average earnings. Sick leave for child care during inpatient treatment is paid depending on the length of insurance coverage.

Please note: Sick leave for illness or injury is paid to insured persons in the amount of 60 percent of average earnings in the event of illness or injury occurring within 30 calendar days after termination of work.

Sick leave is paid based on the minimum wage in the following cases:

- Violation of the regime (from the day of violation).

- Failure to appear for an examination or examination without good reason (from the date of failure to appear).

- The illness or injury occurred as a result of alcohol, drug, or toxic intoxication.

All of the above circumstances must be noted on the sick leave certificate.

Please note: citations for alcohol intoxication, disorderly conduct, and failure to appear are not sufficient in themselves to reduce the amount of benefits. A written explanation from the employee/investigation/obtainment of a medical report is required. Otherwise, the employee may go to court.

In accordance with Article 124 of the Labor Code of the Russian Federation, if during annual leave an employee is on sick leave, then the leave must be extended or postponed to another period determined by the employer taking into account the wishes of the employee.

Please note: leave is extended only if the employee himself is incapacitated. Sick leave for caring for a child and other family members is paid only from the moment the employee was supposed to start work.

A sick leave certificate is a valuable document. Recently, cases of forgery of certificates of incapacity for work have become more frequent. Accountants and personnel department employees need to carefully study the sick leave certificates presented to them. A fake can be identified by comparing several sick leave notes and paying attention to the following points:

- Watermarks should be visible in the light, not painted on.

- Paper – should be similar in structure to the one on which money is printed.

- The number should be embossed, not printed.

The FSS will not pay for a false sick leave certificate and will report it to the prosecutor's office.

The severity of the violation depends on its timing - the more time ago the sick leave was declared, the more the offender used budget money and the more serious his offense. If the company has claims against the employee, then a criminal case will be opened against him under Art. 327 of the Criminal Code of the Russian Federation. In accordance with paragraph 3 of Article 327 of the Criminal Code, the use of a knowingly forged document is punishable by a fine in the amount of up to eighty thousand rubles or in the amount of wages or other income of the convicted person for a period of up to six months, or by compulsory labor for a period of one hundred eighty to two hundred and forty hours, or correctional labor for up to two years, or arrest for up to six months.

Documents that will need to be submitted to the FSS during the inspection:

- Sick leave issued in accordance with the established procedure.

- Calculation of benefits for sick leave.

For organizations using the simplified tax system, the following is also required:

- Work book (employment contract for part-time workers)

- Confirmation of payment of sick leave.

2. Maternity benefit.

Payment of maternity benefits is guaranteed to working women under Article 255 of the Labor Code.

In accordance with clause 1 of Article 10 of Law 255-FZ, maternity benefits are paid in total for the entire period of maternity leave lasting 70 (in the case of multiple pregnancies - 84) calendar days before childbirth and 70 (in the case of complicated childbirth - 86, for the birth of two or more children - 110) calendar days after birth.

Please note: maternity benefits are calculated cumulatively and are provided to the woman completely regardless of the number of days actually used by her before giving birth.

Sick leave for pregnancy and childbirth is paid in the amount of 100% of average earnings, but not more than 1,136.99 rubles per day. If the insurance period is less than six months , the benefit is paid in an amount not exceeding the minimum wage for a full calendar month.

Payment of maternity benefits is carried out at the expense of the Social Insurance Fund from the first day of incapacity for work.

Average daily earnings for calculating benefits, starting from 01/01/2011. , is determined based on average earnings calculated for two calendar years preceding the year of maternity leave.

Average daily earnings until 01/01/2011 , was determined based on earnings for the last 12 calendar months preceding the month of the insured event.

Please note: in accordance with paragraph 2 of Article 3 of Law 343-FZ of December 8, 2010, the employee herself can choose the method of calculating maternity benefits in the period from January 1, 2011 to December 31, 2012 (inclusive). To calculate benefits “as before,” you must write an application in any form.

The amount of the accrued benefit at the expense of the Social Insurance Fund cannot exceed its maximum amount.

If an employee, at the time of maternity leave, works for several insurers, then the benefit is assigned and paid for all places of work on several sick leaves (but not more than the maximum amount).

When an employee worked for other insurers in the two previous calendar years, the benefit is calculated taking into account income received from other employers, based on a certificate of earnings.

In accordance with paragraph 3, paragraph 2, article 4.1 of Law 255-FZ, the organization is obliged to issue the insured person a certificate of the amount of earnings for the two calendar years preceding the year of termination of work or the year of applying for a certificate of the amount of earnings, and the current calendar year, on which insurance premiums were calculated.

The certificate is issued on the day of termination of work or upon a written application of the insured person after termination of work for this policyholder no later than three working days from the date of filing this application.

The form of the certificate of the amount of earnings was approved by the Order of the Ministry of Health and Social Development dated January 17, 2011. No. 4n.

Please note: in cases where an employee is unable to provide a certificate of the amount of earnings, then, upon his application, the organization sends a request to the authorities of the Pension Fund of the Russian Federation to provide information on wages based on personalized accounting information.

Documents that will need to be submitted to the FSS during the inspection:

- Sick leave issued in accordance with the established procedure.

- A certificate of the amount of earnings from the previous place of work with another insurer (if the employee worked in another place).

- Calculation of benefits for sick leave.

- Application in any form, in case of calculating benefits “as before”.

For organizations using the simplified tax system, they also need a work book (employment contract for part-time workers), an order for the provision of maternity leave.

- Confirmation of payment of sick leave.

3. Benefit for the adoption of a child.

In accordance with Art. 257 of the Labor Code of the Russian Federation, employees who have adopted a child are granted parental leave. Leave is granted from the date of adoption until the expiration of 70 calendar days from the date of birth of the adopted child. When adopting two or more children – 110 calendar days from the date of their birth.

The procedure for granting leave to employees who have adopted a child, approved by the Decree of the Government of the Russian Federation of October 11, 2001. No. 719, it is provided that women, at their request, may be granted maternity leave instead of maternity leave. The basis for its provision will be a sick leave certificate issued in the prescribed manner and an application.

Please note: The benefit for the care of an adopted child is paid in the manner and amount established for the payment of maternity benefits (clause 6 of the Procedure).

Documents that will need to be submitted to the FSS during the inspection:

- Application for leave to care for an adopted child.

- A decision or a copy of a court decision establishing the adoption of a child.

- A copy of the child(ren)'s birth certificate.

- If maternity leave is taken out - sick leave issued in the prescribed manner.

- Benefit calculation.

- A certificate from the second parent’s place of work stating that benefits for the adoption of a child were not assigned or paid to him (for non-working parents - a copy of the work record book and a certificate from the social security authorities).

For organizations using the simplified tax system, they also need a work book (employment contract for part-time workers), an order to grant leave.

- Confirmation of payment of benefits.

4. Benefits for women who register with a medical institution in the early stages of pregnancy.

Along with the maternity benefit, working women who are registered with a medical institution before 12 weeks of pregnancy are assigned a lump sum benefit in the amount of 438.87 rubles. (from 01/01/2011). Payment of this benefit is made entirely from the funds of the Social Insurance Fund.

Documents that will need to be submitted to the FSS during the inspection:

- Certificate from a medical institution confirming registration at the antenatal clinic in the early stages of pregnancy (up to 12 weeks).

- For organizations using the simplified tax system, confirmation of payment of benefits is also required.

5. One-time benefit for the birth of a child.

In accordance with Article 11 of Federal Law No. 81-FZ of May 19, 1995. “On state benefits for citizens with children”, one of the child’s parents has the right to a lump sum benefit upon the birth of a child.

A one-time benefit for the birth of a child is paid in full from the funds of the Social Insurance Fund. Benefit amount from 01/01/2011 is 11,703.13 rubles.

Documents that will need to be submitted to the FSS during the inspection:

- Certificate from the registry office about the birth of a child in form No. 24 or No. 25 for a single parent (Appendix No. 38 to the Administrative Regulations, approved by Government Decree No. 1274 of October 31, 1998).

- A certificate from the place of work of the second parent stating that a lump sum benefit for the birth of a child was not assigned or paid to him (for non-working parents - a copy of the work record book and a certificate from the social security authorities about non-receipt of benefits).

- For organizations using the simplified tax system, they also need a work book (employment contract for part-time workers).

- Confirmation of benefit payment.

6. Monthly allowance for child care up to one and a half years old.

In accordance with Article 256 of the Labor Code of the Russian Federation, a woman, upon her application, is granted leave to care for a child until the child reaches the age of three years. During the period of parental leave, the employee retains his place of work.

Based on Article 13 of Law No. 81-FZ, the following have the right to a monthly child care allowance: mothers or fathers or other relatives, guardians who actually care for the child.

If several persons care for a child, the right to receive child care benefits is granted to only one of them.

The right to benefits remains if the person on parental leave works part-time or from home.

Please note: if while the mother is on maternity leave until the child reaches the age of one and a half years, she begins maternity leave, she has the right to choose one of two types of benefits paid during the periods of the corresponding leaves (clause 3 of Art. 10 of Law 255-FZ).

Child care benefits are paid until the child reaches the age of one and a half years .

The benefit is 40% of average earnings, on which insurance premiums are calculated. At the same time, the amount of the benefit is limited and in 2011 is:

- For caring for one child - at least 2,194.34 rubles. and no more than 13,825.75 rubles.

- For caring for two or more children – at least 4,388.67 rubles. and no more than 13,825.75 rubles.

As in the case of calculating maternity benefits, an employee from 01/01/2011 to 12/31/2012 (inclusive) has the right to choose how (based on 12 months or 2 previous years) the average earnings will be calculated to determine the care allowance for the child (clause 2 of article 3 of law 343-FZ of December 8, 2010).

Documents that will need to be submitted to the FSS during the inspection:

- Application for granting benefits.

- Order on granting parental leave.

- A copy of the birth certificate of the child being cared for, as well as a copy of the birth certificate of the previous child (if any).

- Application in any form, in case of calculating benefits “as before”.

- Benefit calculation.

- A certificate from the second parent’s place of employment stating that he does not use leave and does not receive monthly child care benefits.

- A copy of the certificate of incapacity for work for pregnancy and childbirth.

For organizations using the simplified tax system, they also need a work book (employment contract for part-time workers)

- Confirmation of payment of this benefit.

7. Social benefit for funeral.

In accordance with clause 1 of Article 10 of Federal Law No. 8-FZ “On Burial and Funeral Business,” if the burial was carried out at the expense of relatives or other persons who took upon themselves the responsibility to carry out the burial, they are paid a social benefit for the funeral.

The amount of the benefit is as of 01/01/2011. RUB 4,260

Payment of funeral benefits, in accordance with clause 2 of Article 10 of Law No. 8-FZ, is carried out by the organization that was the insurer of the deceased on the day of his death, or is the insurer of one of the parents (other representatives or family members) of the deceased minor on the day of his death.

The benefit is paid if the representative of the deceased applies for it no later than six months from the date of death.

Documents that will need to be submitted to the FSS during the inspection:

- Certificate from the Civil Registry Office about death in form No. 33 (Appendix No. 47 to the Administrative Regulations, approved by Government Decree No. 1274 of October 31, 1998).

- Application for benefits (from a relative of the deceased).

- For organizations using the simplified tax system, confirmation of payment of benefits is also required.

8. Payment for 4 additional days off to care for disabled children.

In accordance with Article 262 of the Labor Code of the Russian Federation, one of the parents, upon his written application, is provided with four additional paid days off per month to care for disabled children. These days can be used either by one of the parents (guardians, trustees) or divided between them at their discretion.

Additional days off are paid in the amount of the average earnings of the Social Insurance Fund from the federal budget.

In accordance with clause 10 of the Explanations “On the procedure for providing and paying additional days off per month to one of the working parents (guardian, trustee) for caring for disabled children,” approved by the resolution of the Ministry of Labor and Social Development of the Russian Federation and the Social Insurance Fund dated 04.04.2000. No. 26/34:

- Payment for an additional day off for a working parent to care for disabled children and people with disabilities from childhood until they reach the age of 18 is made in the amount of daily earnings. Daily earnings mean average daily earnings, determined in the manner established by the Ministry of Labor for calculating average earnings.

- When recording working hours in aggregate, the average daily earnings paid from the Social Insurance Fund are determined by multiplying the average hourly earnings by the number of working hours to be paid. Payment for each additional day off under part-time conditions is carried out in the same manner.

Documents that will need to be submitted to the FSS during the inspection:

- Application for granting benefits.

- Order from the enterprise to provide additional days off.

- A copy of the child's birth certificate.

- Calculation of this benefit.

- A certificate from the second parent’s place of work stating that he does not use additional days off to care for the child.

- Certificate of disability of the child.

- For organizations using the simplified tax system, confirmation of payment of benefits is also required.

Hello Guest! Offer from "Clerk"

Online professional retraining “Chief accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up