Why is it needed?

So, an accounting certificate is an internal document of an organization. It is needed when an accountant needs to carry out a business transaction for which no other primary is provided, or there is a primary, but it is not enough. In addition, the certificate helps to detail accounting or correct errors in it.

Important : an accounting certificate cannot replace the primary document, in the preparation of which other persons must participate in addition to the accountant.

For example : if an acceptance certificate for completed work or an invoice from a counterparty is lost, then such documents cannot be replaced with an accounting certificate.

Connect electronic document management in Taxkoy and stop losing primary documents. We support roaming with all operators.

Why do you need a certificate of interest paid?

According to current legislation, when purchasing residential real estate using a mortgage loan from a bank, the buyer has the right to receive a tax deduction on interest. This means that he can get back the income taxes that were withheld from his wages. The maximum compensation is 390 thousand rubles (13% of 3 million). It is paid in installments - every year. As the borrower pays interest on the mortgage.

Important! The mortgage deduction is only available for the amount of interest actually paid. You can confirm the fact of payment, as well as the amount of funds spent, using a certificate of interest paid.

An individual submits to the tax office:

- declaration 3-NDFL;

- a certificate of mortgage interest paid for the past year;

- copy of passport;

- a copy of the loan agreement;

- a standard application with your bank account details;

- title documents for the purchase of real estate.

On their basis, a tax deduction is provided for the payment of mortgage interest.

Only working citizens who pay income tax at a rate of 13% have the right to receive it. You must submit a complete package of documents to the tax office within three years from the date of withholding of income tax. Therefore, there is no need to postpone this procedure.

This compensation is not available to non-working pensioners, women on maternity leave, who receive only social benefits.

Accounting certificate form

There is no unified form of certificate. Each organization can develop and approve its own form. The main thing is that the developed certificate contains the details required for primary documents (Part 2 of Article 9 of the Law of December 6, 2011 No. 402-FZ):

- title of the document and date of its preparation;

- Name of the organization;

- contents of the business operation;

- position, full name and signature of the person responsible for drawing up the document.

You can take an accounting certificate form for government agencies: form according to OKUD 0504833 (Order of the Ministry of Finance dated March 30, 2015 No. 52n) and create your own based on it. We recommend that the developed certificate form be approved by order on the organization’s accounting policies.

Usually the certificate is signed by the chief accountant and the executor. But in some cases, it is possible to include the signature of the manager in the certificate.

For example: if approval is required to account for any expenses.

Accounting certificate-explanation

Such certificates are prepared for transactions for which forms of primary documents are not provided.

Such operations include:

- writing off expired debt;

- contribution of funds to the authorized capital;

- adjusting the debt according to the reconciliation report when it is not possible to establish the cause of the discrepancies;

- translation of goods into materials, etc.

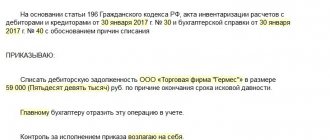

Example:

Accounting certificate-calculation

Sometimes, before recording a transaction, an accountant first needs to make calculations. In this case, the calculation itself and the final result are recorded in the accounting statement.

Typically, accountants reflect calculations of the following indicators in the certificate:

- material benefits and the amount of personal income tax for using the loan;

- vacation pay;

- excess daily allowance;

- dividends;

- exchange rate differences;

- taxes, etc.

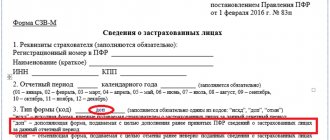

Example:

Zero tax reporting for individual entrepreneurs and LLCs for 92 rubles per month. Without visiting government agencies. The electronic signature is already included. Order.

How to get it from Sberbank

More than 50% of all mortgage loans are issued at Sberbank. This institution has the largest customer base, is a participant in all government mortgage programs, and offers favorable lending conditions. These factors can explain the high demand for mortgages at Sberbank. Current mortgage interest rates in 2022 can be viewed here.

The 3-NDFL declaration is submitted to the tax office along with a certificate of interest paid on the mortgage at Sberbank.

The procedure for obtaining a mortgage certificate:

- The client or a person authorized by the client contacts the bank branch.

- At the reception, the employee signs an application for issuing a certificate and provides the accompanying documents.

- The certificate can be collected in person from the service manager after it is issued.

Important! The tax office accepts only genuine certificates with a signature and blue seal of the bank. Therefore, you need to receive the document in person - a printed copy of the electronic document will not work.

The right to pay a tax deduction arises the next year after the loan is issued. For example, the mortgage was issued in 2022. The borrower must submit documents to the tax office in 2022. This procedure is repeated annually until the loan is paid off and the deduction limit is selected (390 thousand rubles).

Accounting certificate confirming the correction of errors

If an accountant discovers an accounting error, it needs to be corrected. In this case, an accounting certificate is also drawn up. It describes where and why the error occurred and how it was corrected.

An accountant can correct an accounting error through a reversal entry or additional posting.

Example:

Accounting certificate for transfer of information

Sometimes it is necessary to issue an accounting certificate for presentation to government authorities. In such situations, the certificate is for informational purposes only.

For example: an organization acts as a defendant in a labor dispute with an employee who was fired unlawfully. And now this employee is demanding through the court to pay him the average salary for the period of forced absence. Information on average earnings can be presented to the court in the form of an accounting certificate.

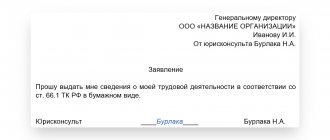

Example:

Exchange documents with government agencies without leaving your workplace. Online Sprinter is an online reporting service with 24/7 technical support. Work for 30 days for free and appreciate all the benefits of the service !

Production time and cost

All information that is indicated in the certificate is already in the program used by Sberbank. It will not be difficult to form it. The official document is provided within one business day.

According to the current tariffs of the financial institution, no commission is charged for issuing.

In most Sberbank branches, starting from 2022, a certificate of interest paid for the tax office is issued immediately upon contacting a bank employee.

How long and how to store accounting statements

Prepared accounting certificates are stored together with the documents of the corresponding accounting register.

For example: if a certificate is drawn up to write off a debt, then it is filed with the inventory sheet for settlements with counterparties or reconciliation acts with a specific counterparty.

Accounting certificates are kept for at least 5 years. However, in some cases this period may be extended.

For example: if the certificate contains information on the calculation of dividends, then it, like the statements for the issuance of dividends, must be stored for 50 years (if the document was drawn up after 2003. For documents drawn up before the specified date, the storage period is 75 years) (p 122 order of the Federal Archive of December 20, 2019 No. 236).

Calculation formulas for loan interest

The interest rate can be determined in two proven ways:

- Online service for calculating interest under a preliminary agreement.

- Independent calculations using special mathematical formulas.

The option of using an online service is the most convenient and attractive for clients who do not have knowledge in the field of lending. Using virtual programs, you can calculate the accrual of interest on a loan and find out from what day fines will be accrued. The second method is considered relatively complex, but quite reliable. After all, in this case the client receives real information about lending.

For example, you can use the calculation formula:

Amount of cash loan x Rate/Days per year x Days in a specific payment period

This calculation option is relevant for loans that are issued for a certain period of time.

For simple loans, you can use a more simplified version of the formula:

Ks=C x (1+T/Tyear x Ps)

According to this formula, Kc will be used as a designation for the total amount of interest, With the initial amount of debt upon receipt, T period, year of days in the billing year, and Ps rate.

As a rule, the use of mathematical formulas, due to the unknown and complexity, repels clients. Therefore, people most often turn to online services that have a simple interface and allow you to calculate loan interest in detail.

Special programs are available on our website Brobank.ru, websites of banking companies and microfinance organizations. However, for accuracy, customers can also use the service on third-party pages that are not tied to a specific bank. In this case, you can get the maximum accuracy of the calculation and check the honesty of the official calculator. It is important to remember that any online calculations are best done only on trusted resources that have reviews from other users.

It is worth noting that if the agreement specifies interest rates that are too high, the borrower can prove through the courts that they are too high and achieve a real reduction in the future. However, it is important to take into account the timely repayment of all debts. After all, a bank or microfinance organization may, by law, demand urgent payment immediately after the deadline is announced. In such a situation, the client will be forced to return the money, and in their absence, compensate for all expenses in any other way that is described in the agreement or official contract. When applying for a loan or microloan, a citizen bears full responsibility for his own actions. Therefore, you should carefully study all the information before lending.

5 / 5 ( 3 voices)

about the author

Evgeniy Nikitin Higher education majoring in Journalism at Lobachevsky University. For more than 4 years he worked with individuals at NBD Bank and Volga-Credit. Has experience working in newspapers and television in Nizhny Novgorod. She is an analyst of banking products and services. Professional journalist and copywriter in the financial environment [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email