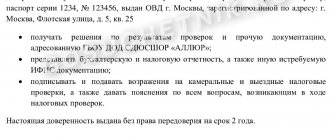

A power of attorney is a written authority giving the chief accountant the right to perform legally significant actions on behalf of an organization or individual entrepreneur. Thus, it is necessary to submit to the tax service a copy of the power of attorney for the right to sign tax reports, and this must be done before the reports signed by the accountant are sent.

The power of attorney for the chief accountant must be drawn up without errors and comply with all legal requirements that apply to such documents. Otherwise, she simply will not be accepted. All powers of attorney available in the organization must be checked regularly. Perhaps some of them have already expired or were compiled without taking into account the amendments made to the Civil Code of the Russian Federation.

In what cases is it necessary to draw up a power of attorney?

How to understand whether a power of attorney is needed for the chief accountant in certain cases? To get an answer to this question, check out the list of possible situations in which you cannot do without a power of attorney:

- exchanging documents with the bank, receiving current account statements (in this case, you need to draw up a power of attorney for the chief accountant at the bank);

- submission of tax returns and other reporting documentation to the Federal Tax Service;

- power of attorney for the right to sign the chief accountant - a sample of such a power of attorney will be required to transfer reports under the TCS if the electronic signature (electronic signature) certificate is not issued to the head of the company or individual entrepreneur;

- applying for state registration of changes in constituent documents;

- submission of documents to the Pension Fund and the Federal Social Insurance Fund of the Russian Federation, as well as familiarization with the results of inspections, receipt of requests for the provision of documents.

Read also: How to certify copies of documents for the tax authorities

How to obtain credentials

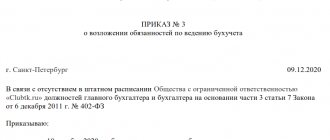

In general, there are two ways to transfer authority to sign primary documents to the chief accountant - an order from the manager and a power of attorney.

Based on the meaning of Art. 169 of the Tax Code of the Russian Federation, both of these methods are equivalent. However, it should be taken into account that if the powers of the chief accountant are supposed to be extended to interaction with certain external factors, for example, with the Federal Tax Service, then an order may not be enough, since an order is always an internal document.

That is, the method of formalizing powers will depend on the range of these powers. Definitely, the most functional option would be to issue a power of attorney.

Do I need to have a power of attorney certified by a notary?

The law does not require mandatory certification of a power of attorney from an organization by a notary. To give the document legal force, the signature of the general director and the company seal are sufficient.

Notarization will be required when a power of attorney is issued by an individual entrepreneur, as well as in the following cases:

- if a power of attorney is issued to complete a transaction, which according to the law must go through a notary;

- when submitting applications for state registration (rights, transactions);

- if an irrevocable power of attorney is issued to the accountant.

A sample power of attorney for the chief accountant (general) can be taken as a basis when drawing up a similar document for your organization.

Read also: How to check a notarized power of attorney

How to make a power of attorney in 1C 8.3 Accounting?

Scrupulousness when filling out accounting documents is the basis for success in the work of an accountant. Situations often arise in which the driver has traveled a certain distance to the place where the cargo is received, significant funds have been spent (fuels, driver's wages) and time, but the power of attorney was incorrectly drawn up in the accounting department, and therefore the delivery of the cargo was refused.

In order to eliminate such cases and make the work of accountants easier, today we will tell you how to issue a power of attorney in 1C: Accounting 8.

The meaning of the term “Power of Attorney” and its unified forms were recorded by the State Statistics Committee of the Russian Federation on October 30, 1997 No. 71a (hereinafter referred to as the Resolution). In particular, the Resolution establishes that the power of attorney is issued in a single copy and is issued against signature to the specific person indicated there. Fifteen days is the deadline for this document to be valid.

You can find a power of attorney in 1C at the address: “Purchases-Powers of Attorney”.

Fig.1 Purchases-Power of Attorney

As in many 1C documents, there is a filter by counterparty.

Fig.2 Filter by counterparty

Click the “Create” button and fill out the power of attorney, sequentially entering the document details: date, validity period of the power of attorney (10 days), name of the counterparty, contract details, as well as the name and quantity of the goods. Semenov Pavel Andreevich was appointed as the accountable person.

Fig.3 Filling out the power of attorney

The name of the received product can be filled in by selecting it from the “Items” directory, or you can enter arbitrary text directly in the line of our document.

Having entered the necessary details, click sequentially on “Record” and “Post”. Then we turn to the “Print” button. The system gives the right to choose the printing of two forms “M-2” (Fig. 4) and “M-2a”. Form “M-2a” is used when the company provides for a large number of operations for the pickup of goods.

Fig.4 Print

From the “Individuals” directory, information about the details of an identity document is automatically transferred to our document; in our example, these are the employee’s passport details.

Current legislation requires keeping a log of issued powers of attorney. It must be numbered, stitched and sealed. 1C:Enterprise 8.3 has an electronic journal that can be generated for any date or for a certain period.

Fig.5 Journal of issued powers of attorney

Maintaining an electronic register of issued documents does not free the company from registering them in a journal on paper, but it greatly facilitates the search and work with these documents. In the document log, there is an advanced search function based on the details of the “Power of Attorney” document (Counterparty, accountable person, etc.).

Fig.6 Advanced search function by accountable person

After delivery of the cargo, it is possible to register the receipt of goods at the warehouse using the “Power of Attorney” document. To do this, go into it and click on the “Create based on” button.

Fig.7 Create based on

An “Invoice” is created (Fig. 8), which automatically receives information from the Power of Attorney about the name of the goods, the seller, the contract, and the quantity of goods received.

Fig.8 Invoice

In this case, the name of the goods will be automatically transferred to the invoice in the case where the power of attorney was filled in with elements of the “Nomenclature” directory. If arbitrary text is entered in a line, a line in the goods receipt document will not be automatically created - you must first add the goods to the “Nomenclature” directory, and then select it in the goods receipt document.

We fill in the fields of the warehouse where the goods are delivered, the details of the invoice (if any), the number and date of the invoice, as well as the cost of the goods (our document does not indicate the cost of the goods).

Automation of the preparation of powers of attorney eliminates inaccuracies in the document, saves time and increases control over the timeliness of reporting to the accounting department by accountable persons. If you have any questions, please contact our 1C comprehensive support specialists - we will be happy to help you!

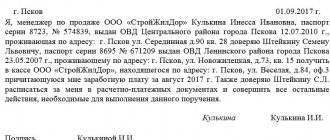

Power of attorney to the bank

This document is quite in demand, since the manager does not always have the opportunity to be personally present at the bank to carry out financial and business transactions. Both legal entities and individual entrepreneurs can draw up such a power of attorney.

A power of attorney to the bank for the chief accountant, a sample of which is presented below, must include: information about the principal and the authorized person, the name of the bank, a list of actions that the authorized person has the right to carry out.

It is important to remember that a power of attorney issued by an individual entrepreneur must be certified by a notary.

The same applies to drawing up a power of attorney for the chief accountant at the tax office. The document must clearly indicate the powers of the trustee. If accounting is outsourced, the document is issued to a specific specialist or to the head of the outsourcing company.

Read also: Power of attorney in the FSS

Purpose of the document

The Power of Attorney document in 1C is used to formalize the right to receive material assets from a supplier by an accountable person.

Creating a Power of Attorney in 1C allows you to:

- create a printed form for both a one-time power of attorney and a multiple-use power of attorney, which is issued for more than one purchase;

- quickly and automatically issue a Receipt document (act, invoice).

The power of attorney is issued in one copy. To confirm the identity of the employee, you must have a passport or other identification document.

Is there a unified document form?

There is no single template that can be applied universally to all enterprises. Large organizations often draw up a power of attorney on company letterhead, but this condition is not mandatory.

When drawing up a document, you must be guided by the provisions of Art. 185-186 Civil Code of the Russian Federation:

- the power of attorney must be drawn up in writing (handwritten and printed versions have the same legal force);

- the document must be certified by the signature of the manager (IP) or another person authorized to perform such actions;

- the power of attorney should indicate its validity period and date of preparation; Without indicating the date of issue, the power of attorney will be considered void.

How to draw up a power of attorney for the chief accountant?

A power of attorney for the chief accountant to the tax office (a sample is given below) is drawn up as follows:

- The name of the document must be indicated at the top (for example, “Power of Attorney”);

- In the “header” you must indicate the name of the place of issue, the date of drawing up the power of attorney;

- After this, indicate the full name of the organization and its details: OGRN, INN, KPP, full name. leader.

- Then you need to indicate information about the authorized person: full name, number and series of the passport, who issued it and when, address of the place of registration. Usually this information is indicated after the phrase: “This power of attorney authorizes...”.

- After this, it is necessary to list the actions that the authorized person has the right to perform.

- Below you need to indicate the validity period of the document and make a note about whether the trustee has the right of subrogation.

- Next, signatures and full name must be present. the authorized representative and the general director, as well as the seal of the organization (if available).

The principal has the right to revoke the power of attorney at any time. When dismissing an employee, it is recommended to revoke all powers of attorney issued to him.

How to issue a power of attorney to submit reports to the tax office?

According to the Civil Code of the Russian Federation, absolutely all subordinates of a particular company can submit statistical, accounting and tax reports. The only requirement is the presence of an appropriate power of attorney, on the basis of which they will be able to perform these actions. Therefore, a chief accountant is a reliable option for such transactions.

In order for an accountant to submit reports, the head of the organization must draw up a special trust document and write down the appropriate authority in it. Of course, there are also companies in which chief accountants can carry out these procedures without a power of attorney - this must be enshrined in the company’s charter. But first, the tax service must provide information about such an employee. Here it should also be taken into account that employees of the federal tax service have grounds to refuse to accept such information. This in turn means that they will need a trust document.

There are other nuances for submitting reports to the tax service. So, in addition to the chief accountant, a completely different company engaged in accounting affairs has the right to submit such reports on behalf of a specific organization. In this case, the power of attorney must be issued in the name of the director of this organization. As a rule, this is where a mark with the right to delegate is placed - this will allow the head of the organization involved in accounting reports to delegate the trust document to a specific person to conduct business with the tax service.