Why do you need to make an inventory of transferred documents?

An inventory of documents is necessary to record the fact of their transfer to the addressee, which can be either a government authority (IFTS, court, etc.) or a counterparty under the contract.

Drawing up an inventory is usually resorted to in situations where it is required to transfer not just one document (application, claim, certificate, etc.), but a certain set or set of documentation. Exchange legally significant “primary data” with counterparties via the Internet. Free inbox.

The inventory is most widespread when working with traditional paper documents. However, it is possible to compile an inventory when sending information electronically. Especially if this happens via regular email.

Option one: paper archive

If you store all documents in the office or in a specially designated archive room in the organization, you get several advantages:

- access to data is constant;

- The company organizes the storage system in a way that is convenient for it, for example, it uses color marking of folders, numbering, bar codes, etc.

- archiving is carried out by a full-time employee and is responsible for his work.

There are also a number of disadvantages:

- you need to allocate storage space, renting an office for such purposes will cost a pretty penny, and when using a warehouse, it is not a fact that safety conditions will be ensured (paper does not like dampness) and convenient access;

- for large volumes, you need to appoint a separate employee to organize and manage the archive. If there is a turnover of personnel in the company, then newcomers will need time to understand the storage system, even worse if things were done incorrectly - accountants know what kind of rubble they sometimes have to sort out, left by their predecessors;

- Unfortunately, some managers suffer from a love of bureaucracy - for example, they will have to seek permission to access the archive, and this will slow down the work.

To prepare a selection for submission to the tax service or other government agency, you will have to go through several steps : collect all the necessary documents, making a selection, for example, for a certain reporting period, then copy or scan the documents, staple them or collect them into a single file (if there are a lot of documents, you need “compress” them, reducing the amount of data and archive them with a special program).

Note! The prepared copies must be numbered and a register must be drawn up for them, as well as certified - put a stamp (if an LLC or individual entrepreneur uses it), the inscription “Copy is correct” and the signature of the responsible person, it may be necessary to indicate the date of certification.

Once you have collected and prepared everything, send or personally hand over the kit for verification. Be sure to keep confirmation of the transfer - a list of attachments and a mail receipt, your copy of the register with a receipt mark, an electronic receipt for sending through the TKS operator.

Gradually, the traditional storage system is becoming a thing of the past. Many organizational archives are now being digitized, because this protects documents from loss. Sometimes the accounting department receives checks on paper that resembles a magician's props - today everything printed on it is visible, but a month later - only a white sheet. How can I then confirm my expenses?

Standards for compiling an inventory of documents

There are no uniform legal requirements for compiling an inventory of documents. Therefore, depending on the purpose of submitting documentation, both unified forms (for example, when sending registered letters) and those developed by the receiving or transmitting party independently can be used.

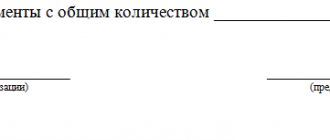

In any case, the inventory must contain information about the type (name, details) of each of the transferred documents (for example, purchase and sale agreement No. 1 or personal income tax declaration for 2021) and the number of copies. Additionally, if necessary, other information may be indicated - about the number of sheets of each copy of the document, the total number of sheets of all documents specified in the inventory, recipients, reasons for transfer, etc.

List of documents to be submitted to the tax office

When communicating with the tax authority, it is only necessary to draw up an inventory if the documents are transmitted in classic paper form. The legislation does not establish requirements for the form of such an inventory. Therefore, it can be compiled in any form. Moreover, the inventory can be drawn up as a separate document or included as part of a cover letter (clause 6 of Appendix No. 18 to the Order of the Federal Tax Service of Russia dated November 7, 2018 No. MMV-7-2 / [email protected] ).

ATTENTION

When sending documentation to the Federal Tax Service in electronic form, there is no need to create an inventory, because The composition of the documents in this case is recorded automatically by the corresponding software.

Request a tax reconciliation report from the Federal Tax Service via the Internet Request for free

As for the contents of the inventory, it is advisable to reflect not only data on the documents being transferred (date, number, name, number of sheets and copies), but also information regarding the reasons for their transfer, as well as the sender and addressee. Thus, this inventory will additionally contain the details of the organization (IP) transferring the documents, as well as the number and date of the request or other document from the Federal Tax Service, in connection with which the documentation specified in the inventory is provided. It would not be amiss to number the documents being submitted in the inventory, and not just provide a list of them.

Such preparation of the inventory will help, in the event of any further claims from the Federal Tax Service (or questions during the consideration of the dispute in court), to quickly navigate the composition of the transferred documents and promptly submit the necessary explanations or objections.

Is a taxpayer required to attach a register of documents to the 3-NDFL declaration?

In paragraph 1.16. Procedure for filling out 3-NDFL, approved. Federal Tax Service Order No. ED-7-11/ [email protected] states that the decision to submit the register is made by the taxpayer. He has the right, but is not obligated, to draw up an inventory of the attached documents and submit it to the Federal Tax Service. The total number of sheets with information confirming the declaration data is indicated on the title page of the report. Moreover, there are two such fields - separately for the taxpayer and the Federal Tax Service inspector.

Please note that when sending a declaration by mail, an inventory must be submitted (clause 4 of Article 80 of the Tax Code of the Russian Federation). It is enough to indicate in it that the envelope contains the 3-NDFL declaration with attachments on so many sheets. The postal worker will verify the inventory. 1 copy will remain with the sender, the second will go to the Federal Tax Service. A detailed inventory of the mail attachment, indicating each attached document, is quite capable of replacing the register.

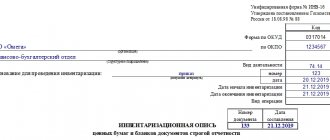

Inventory of documents for transfer to the archive

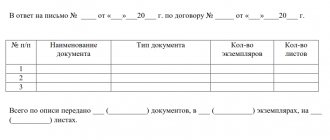

When transferring documents to the archive for each case, an internal inventory of the documents included in it is compiled. The form of such an inventory is given in Appendix No. 27 to the rules, which were approved by order of the Ministry of Culture of Russia dated 03/31/15 No. 526. And the procedure for its preparation is described in sufficient detail in clause 3.6.17 of the Rules for the work of archives of organizations (approved by the decision of the Board of the Russian Archive dated 02/06/02 ).

In particular, it is indicated that the inventory must be drawn up on a separate sheet and signed by the compiler. The internal inventory contains information about the serial numbers of the case documents, their indexes, dates, headings and sheet numbers of the case. And at the end of the inventory there should be a final record, which indicates in numbers and in words the number of documents included in it and the number of sheets of the internal inventory. In this case, the specific content of documents in the “archival” inventory is not required to be disclosed. Since documents of the same type are placed in the case, a heading (name of the counterparty, full name of the employee, etc.) is sufficient.

What happens if the taxpayer does not submit the register?

The Federal Tax Service cannot require the reporting person to submit a register of supporting documents 3-NDFL. Moreover, in clause 4.3 of the Regulations for the interaction of Federal Tax Service bodies, approved. Order of the Federal Tax Service dated February 25, 2016 No. ММВ-7-6/ [email protected] describes the procedure for inspectors to act when accepting reports:

- documents attached to 3-NDFL, incl. copies, separated from the declaration;

- then they check the presence of the register: if there is one, the tax officer will check the total number of attached sheets indicated in it, as well as on the title page of the declaration;

- if the inventory is missing or its data does not coincide with the actual ones, the inspector himself will draw up a register of documents.

The Tax Code does not provide for any liability for the lack of a register. However, its presence, in case of loss of the attached documents, will confirm the good faith of the taxpayer. It is especially important to have such evidence when claiming deductions. For example, for a social deduction for treatment, the original certificate for the tax authorities issued by the medical institution is attached to the declaration. The applicant will have a register in his hands to confirm the submission of the certificate.

Inventory of documents for transfer to another organization

The legislator has not established any special rules for preparing an inventory when transferring documents to a counterparty. Therefore, if the specific form of the inventory is not separately agreed upon by the parties (for example, as an annex to the contract), then it can be drawn up in free form. The main requirement is that the inventory must make it clear what, in what quantity, when, in connection with what, from whom and to whom it was transferred.

As in the case of the “tax” inventory, in addition to the actual details of the transferred documentation, it is worth supplementing the inventory with data on the grounds for the transfer (for example, making a reference to a clause in the agreement or correspondence), as well as an indication of the transferring and receiving parties. To certify the inventory, you must indicate your full name, position, affix the signature of the compiler and the date of compilation.

List of documents to be sent by Russian Post

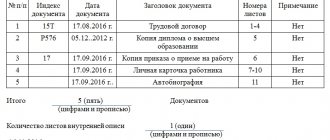

The document inventory form, which is used when sending registered postal items with declared value, is given in Appendix No. 26 to the procedure for receiving and delivering internal registered postal items (approved order of the Federal State Unitary Enterprise "Russian Post" dated 03/07/19 No. 98-p). As clause 6.1.1.1 of the procedure states, when sending documents in the inventory according to f. 107 indicates their name and, if necessary, details, as well as the number of sheets in each document. Next, each document must be assigned a valuation amount in full rubles (i.e., at least 1 ruble). After this, the overall total of both the number of sheets sent and the assessment amount is displayed.

IMPORTANT

Inventory according to f.

107 is filled out in 2 copies, each of which is signed by the sender. If the number of documents being sent is such that there are not enough lines on the inventory form, then additional forms must be used. In this case, the first one is marked “sheet 1”, the second one is marked “sheet 2”, etc. Accordingly, the total of the number of sheets and the amount of assessment is summarized only on the last sheet of the inventory. But the sender’s signature must be on each of them.

How to send a letter with an attachment description?

You need to contact the Russian Post office operator with:

- unsealed envelope

- documents included in it,

- two completed inventory forms,

- the amount of money in your wallet for shipping.

The operator will check the entered data in the form with the attachment in the envelope, the correctness of filling out the inventory and the envelope, put a stamp on each sheet of the inventory with the date of acceptance, sign on each and give one copy to the sender along with the payment receipt.

By the way! For example, you can send a tax return in only one copy; your copy remains with you with an inventory form attached to it with the date the letter was sent.