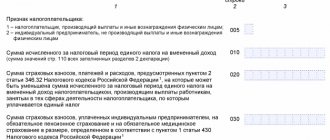

Taxpayers who carried out transactions not subject to VAT under Articles 146, 147, 148 or 149 of the Tax Code of the Russian Federation must include Section 7 in their VAT return for the reporting period. The tax authority has the right to request explanations and documents for such preferential transactions. At the same time, the number of documents can be reduced if you provide the tax office with explanations in the form of a register of supporting documents, as well as a list and forms of standard agreements used when carrying out transactions under the corresponding codes. Using the example of the 1C: Accounting 8 version 3.0 program, 1C experts tell you how to account for VAT on non-taxable transactions, fill out Section 7 of the VAT return and the register of supporting documents.

Procedure for filling out Section 7 of the VAT return

According to the Procedure for filling out a VAT return, approved. By order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/ [email protected] (hereinafter referred to as the Procedure), Section 7 is included in the tax return if in the corresponding tax period the taxpayer carried out:

- transactions not subject to taxation (exempt from taxation) (Article 149 of the Tax Code of the Russian Federation);

- operations that are not recognized as an object of taxation (clause 2 of article 146 of the Tax Code of the Russian Federation);

- operations for the sale of goods (works, services), the place of sale of which is not recognized as the territory of the Russian Federation (Article 147 and Article 148 of the Tax Code of the Russian Federation, paragraph 29 of the Protocol on the procedure for collecting indirect taxes and the mechanism for monitoring their payment when exporting and importing goods, fulfilling works, provision of services (Appendix No. 18 to the Treaty on the Eurasian Economic Union dated May 29, 2014)); and

- received amounts of payment, partial payment on account of upcoming deliveries of goods (performance of work, provision of services), the duration of the production cycle of which is more than six months (clause 1 of Article 154, clause 13 of Article 167 of the Tax Code of the Russian Federation).

When filling out Section 7 of the tax return, column 1 indicates the transaction codes given in Appendix No. 1 to the Procedure.

When reflecting operations in column 1:

- not subject to taxation (exempt from taxation), under the corresponding transaction codes, the indicators in columns 2, 3 and 4 on line 010 are filled in;

- not recognized as an object of taxation, as well as transactions for the sale of goods (works, services), the place of sale of which is not recognized as the territory of the Russian Federation, the taxpayer fills in the indicators in column 2 under the corresponding transaction codes. At the same time, the indicators in columns 3 and 4 are not filled in (in the indicated columns put a dash).

According to paragraph 6 of Article 88 of the Tax Code of the Russian Federation, when conducting a desk tax audit, the tax authority has the right to demand that the taxpayer provide, within five days, the necessary explanations about the transactions (property) for which tax benefits have been applied, and (or) request, in the prescribed manner, from these taxpayers documents, confirming their right to such tax benefits.

In order to increase the efficiency of VAT administration, while simultaneously reducing the volume of required documents, the Federal Tax Service of Russia, in a letter dated January 26, 2017 No. ED-4-15 / [email protected] , sent recommendations for conducting desk tax audits of VAT tax returns that reflect transactions not subject to VAT taxation (exempt from taxation) in accordance with paragraph 2 and paragraph 3 of Article 149 of the Tax Code of the Russian Federation and falling under the concept of a tax benefit, taking into account paragraph 1 of Article 56 of the Tax Code of the Russian Federation and paragraph 14 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated May 30, 2014 No. 33.

In these recommendations, the tax service invited taxpayers to submit explanations to the tax authority in the form of a register of supporting documents (hereinafter referred to as the Register), as well as a list and forms of standard agreements used when carrying out transactions under the corresponding codes. The recommended form of the register is given in Appendix No. 1 to this letter.

If the taxpayer submits explanations in the form of a Register according to the proposed form, then the volume of required documents is significantly reduced and is produced using the risk-based approach set out in Appendix No. 2 to this letter.

If the taxpayer fails to submit the Register or if the Register is not submitted in the recommended form (if it is impossible to identify supporting documents, it is impossible to correlate them with the benefits used, it is impossible to comply with the requirements of this letter, the transaction amount is not indicated in the register), the documents are requested without using a risk-based approach.

Regulatory regulation

The Federal Tax Service has approved the recommended form and electronic format of the register, which must be submitted at the request of the tax authority to confirm the VAT benefit (Letter of the Federal Tax Service of the Russian Federation dated November 12, 2020 N EA-4-15/18589).

The register must be submitted within 5 working days from the date of receipt of the request for explanations (clause 6 of article 6.1, clause 6 of article 88 of the Tax Code of the Russian Federation).

The tax office has the right to demand all primary documents for preferential transactions if the taxpayer submits (Letter of the Federal Tax Service of the Russian Federation dated November 12, 2020 N EA-4-15/18589):

- the register is not electronic, but in paper form,

- an explanation of the requirement not in the form recommended in the letter.

Later, the Federal Tax Service issued Order No. ED-7-15/ [email protected] , which replaced the letter. Since release 3.0.98.17 the following have been added to 1C:

- Register of documents confirming the validity of the application of VAT tax benefits - applicable from 07/01/2021;

- Register of documents confirming the validity of the application of tax benefits for corporate property tax - applicable from 07/30/2021.

Filling out Section 7 of the VAT return in “1C: Accounting 8” (rev. 3.0)

We will consider the procedure for accounting for VAT on non-taxable transactions, filling out Section 7 of the VAT return and the register of supporting documents using the following example.

Example

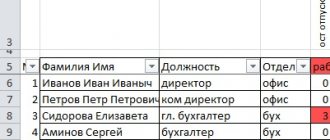

The organization TF-Mega LLC, which applies the general taxation system, carried out the following operations in the second quarter of 2022:

|

Also, TF-Mega LLC rented office space from Delta LLC. The cost of rental services for the second quarter of 2022 amounted to RUB 177,000.00. (including VAT 18% - RUB 27,000.00).

The sequence of operations is given in Table 1.

Setting up accounting policies and accounting parameters

A taxpayer carrying out transactions subject to VAT and transactions not subject to taxation must make the appropriate program settings.

On the VAT tab of the Accounting Policy form (section Main - subsection Settings - Taxes and reports form), you need to set the checkbox Separate accounting of incoming VAT and Separate accounting of VAT by accounting methods.

In the accounting parameters settings (section Administration - subsection Program settings - Accounting parameters form), by clicking on the hyperlink Setting up a chart of accounts, in the line Accounting for VAT amounts on purchased assets, set the value By counterparties, invoices received and accounting methods. To do this, you need to click on the appropriate hyperlink and check the box for the value By accounting methods.

After making the settings in the tabular part of the accounting system documents Receipt (act, invoice) with the type of transaction Goods (invoice), as well as with the type of operation Goods, services, commission, a column for VAT accounting method will appear on the Goods tab. This column displays information about the selected method of accounting for input VAT, which can take the following values:

- Accepted for deduction;

- Included in the price;

- Blocked until confirmation 0%;

- Distributed.

For accounting system documents Receipt (act, invoice) with transaction type Services (act), information about the method of accounting for input VAT will be reflected in the Accounting Invoices column.

In order for the value VAT Accounting Method to be filled in automatically in the Receipt (act, invoice) document, you need to use the settings for the information register of the Item Accounting Account (section Directories - subsection Goods and Services - Nomenclature directory).

To automatically fill out Section 7 of the VAT return in the program and create a register of documents confirming the validity of the application of tax benefits in accordance with the letter of the Federal Tax Service of Russia dated January 26, 2017 No. ED-4-15 / [email protected] (hereinafter referred to as the Register of Supporting Documents), in the settings items (section Directories - subsection Goods and services - directory Nomenclature) for the corresponding item item in the % VAT field, you must set the value Without VAT (Fig. 1).

Rice. 1. Indication of the transaction code not subject to VAT

After this, in the Transaction Code field that opens, you must indicate the code of the exempt transaction in accordance with Appendix No. 1 to the procedure for filling out the VAT tax return, approved. by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/ [email protected] (as amended on December 20, 2016).

Since the Register of Supporting Documents provides for the indication of not only the transaction code, but also the type (group, direction) of a non-taxable transaction, the required value of the type (group, direction) can be entered by opening the appropriate form for the selected transaction code (Fig. 1). Let us recall that the indication of the group (type, direction) in the absence of regulatory clarifications is established by the taxpayer independently, based on his own ideas and ease of use.

The procedure for filling out Section 7 of the VAT tax return and the need to submit the Register of supporting documents depends on whether the transaction is:

- exempt from taxation in accordance with Article 149 of the Tax Code of the Russian Federation;

- not recognized as an object of taxation in accordance with paragraph 2 of Article 146 of the Tax Code of the Russian Federation;

- The territory of the Russian Federation is not recognized as a place of sale of goods (works, services) in accordance with Articles 147 and 148 of the Tax Code of the Russian Federation.

In this regard, it is necessary to put the following flags in the form that opens for the corresponding operation code:

- in the line Operation is not subject to taxation (Article 149 of the Tax Code of the Russian Federation) - if this operation is not subject to taxation (exempt from taxation) in accordance with Article 149 of the Tax Code of the Russian Federation. In this case, in accordance with clause 44.2 of the Procedure for filling out Section 7 of the declaration, indicators in columns 3 and 4 will be generated;

- in the line Included in the register of supporting documents - if a transaction that is not subject to taxation (exempt from taxation) in accordance with paragraph 2 or paragraph 3 of Article 149 of the Tax Code of the Russian Federation falls under the concept of a tax benefit, taking into account paragraph 1 of Article 56 of the Tax Code of the Russian Federation and paragraph 14 of the Resolution of the Plenum Supreme Arbitration Court of the Russian Federation dated May 30, 2014 No. 33. If the flag is checked, this operation is included in the Register of supporting documents.

If the transaction being carried out is not subject to VAT due to the fact that the place of sale of goods (work, services, property rights) is not recognized as the territory of the Russian Federation in accordance with Articles 147 and 148 of the Tax Code of the Russian Federation, then it is necessary to indicate the transaction code in accordance with Appendix No. 1 to the procedure for filling out the tax VAT declarations, approved. by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/ [email protected] (as amended on December 20, 2016) in the relevant agreement with the counterparty (section Directories - subsection Purchases and sales - directory Contracts).

Accounting for non-taxable transactions

The shipment of frames for corrective glasses to the buyer of Trading House LLC (operations: 2.1 “Shipment of frames for corrective glasses to the buyer of Trading House LLC ” ; 2.2 “Write-off of the cost of goods sold”) is registered in the program using the document Sales (act, invoice) with type of operation Goods (invoice) (section Sales - subsection Sales).

In accordance with subparagraph 1 of paragraph 3 of Article 169 of the Tax Code of the Russian Federation, when performing transactions that are not subject to taxation (exempt from taxation), invoices are not drawn up. Therefore, the accounting system document Invoice issued is not generated, and, therefore, the Issue an invoice button under the tabular part of the Sales document (act, invoice) is not used.

After posting the document, the following accounting entries are entered into the accounting register:

Debit 90.02.1 Credit 41.01 - for the cost of sold frames for corrective glasses for each product item; Debit 62.01 Credit 90.01.1 - for the selling price of frames for corrective glasses for each item.

Since imported frames for glasses are sold, entries on the number of frames indicating the country of origin and the customs declaration number are entered in the debit of the auxiliary off-balance sheet account of the customs declaration.

To registers:

- Sales VAT - a record is entered about the cost of goods exempt from taxation;

- Non-VAT-taxable transactions - a record is made with the type of movement Receipt for subsequent entry of information into Section 7 of the VAT declaration;

- Separate accounting of VAT - entries with the type of movement Expense are entered.

- Documents for non-taxable transactions - data on documents for this transaction is entered to create a Register of supporting documents.

The shipment of frames for corrective glasses to the buyer of LLC "Style" (operations: 2.3 "Shipment of frames for corrective glasses to the buyer of LLC "Style""; 2.2 "Write-off of the cost of goods sold") is registered in the program using the document Sales (act, invoice) with the type of operation Goods (invoice) in a manner similar to that given for the sale of goods by Trading House LLC (operations 2.1 and 2.2).

The provision of advertising services to a foreign customer “Honka” (operation 2.5 “Provision of advertising services to a foreign customer “Honka””) is registered in the program using the document Sales (acts, invoices) with the transaction type Services (act) (section Sales - subsection Sales).

When performing transactions, the place of implementation of which is not recognized as the territory of the Russian Federation, invoices are not drawn up (letters of the Ministry of Finance of Russia dated 04/16/2012 No. 03-07-08/107, dated 02/17/2009 No. 03-07-08/36). Therefore, the accounting system document Invoice issued is not generated, and, therefore, the Issue an invoice button under the tabular part of the Sales document (act, invoice) is not used.

After posting the document, the following accounting entry is entered into the accounting register:

Debit 62.21 Credit 90.01.1 - for the cost of advertising services in the amount of RUB 127,570.40. (2,000.00 EUR x 63.7852, where 63.7852 is the EUR exchange rate established by the Central Bank of the Russian Federation on the date of service provision, i.e. as of 06/10/2017).

To registers:

- Sales VAT—a record is entered about the cost of the advertising service provided to the foreign partner.

- Non-VAT-taxable transactions - an entry is made with the type of movement Receipt for subsequent entry into Section 7 of the VAT return.

- Separate accounting of VAT - a record with the type of movement Expense is entered.

- Ruble amounts of documents in foreign currency - a record is entered about the ruble equivalent of the amount reflected in the Sales document (act, invoice) in EUR, both for determining the proceeds from sales in accounting and tax accounting (BU and NU), and for calculating the tax base according to VAT.

Since in relation to transactions the place of implementation of which is not recognized as the territory of the Russian Federation, the Register of supporting documents is not formed, no entry is made into the Documents register for non-taxable transactions.

Accounting for rental services

The organization TF-Mega LLC rented office space from Delta LLC in the second quarter of 2022.

The provision of services for renting premises for the second quarter of 2022 (operations: 3.1 “Service for renting premises for the second quarter of 2017”; 3.2 “Accounting for input VAT on rent for the second quarter of 2022”) is registered using the document Receipt (act, invoice) with the transaction type Services (act) (Purchases section - Purchases subsection).

Since the service for renting office space relates to the entire activity of the organization, i.e., both operations subject to VAT and operations not subject to taxation, the amount of VAT claimed by the lessor must be distributed (clause 4 and clause 4.1 of Article 170 of the Tax Code of the Russian Federation ). To do this, in the document Receipt (act, invoice) in the Accounts column of the tabular section, set the VAT accounting method to Distributed.

After posting the document, accounting entries will be generated:

Debit 26 Credit 60.01 - for the cost of the service excluding VAT; Debit 19.04 Credit 60.01 - for the amount of VAT presented by the lessor. At the same time, account 19.04 has a third sub-account, reflecting the method of accounting for VAT - Distributed.

Entries with the type of movement Receipt with the event Presented by VAT by the Supplier and with the type of movement Expense with the event VAT are subject to distribution to the amount of VAT presented by the lessor and subject to distribution are entered into the VAT register presented.

At the same time, for the tax amount written off in the VAT register, an entry is made in the Separate VAT accounting register with the type of movement Receipt.

To register an invoice received from the lessor (operation 3.3 “Registration of the lessor’s invoice for the second quarter of 2017”), you must enter, respectively, the number and date of the incoming invoice in the Invoice No. and from the Receipt document (act, invoice) fields. invoices and click the Register button. In this case, the document Invoice received will be automatically created, and a hyperlink to the created invoice will appear in the form of the basis document.

As a result of posting the document Invoice received, an entry will be made in the information register Invoice Journal to store the necessary information about the received invoice.

Distribution of the presented amount of VAT on rental services (operations: 3.4 “Accounting for the amount of input VAT on rent subject to deduction”; 3.5 “Accounting for the amount of input VAT on rent included in the price”) is carried out by the VAT Distribution document (section Operations - subsection Closing of the period - hyperlink Regulatory operations of VAT) (Fig. 2).

Rice. 2. VAT distribution. Calculation of sales revenue

To calculate the proportion of VAT distribution, you must execute the Fill command.

After executing this command in the program on the Sales Revenue tab, the amount of revenue (the cost of shipped goods (work, services, property rights)) from activities subject to VAT and from activities not subject to taxation (both exempt from taxation and from one, the place of sale of which is not recognized as the territory of the Russian Federation).

In the program, the proportion indicators for the second quarter of 2022 will be calculated as follows:

- revenue from taxable activities (cost of shipped sunglasses) for the second quarter of 2022, excluding VAT - RUB 387,500.00. (see Example condition);

- revenue from activities not subject to VAT - RUB 293,270.40. (RUB 96,900.00 + RUB 68,800.00 + RUB 127,570.40).

The automatic distribution of the amount of input VAT according to the calculated proportion will be reflected on the Distribution tab of the VAT Distribution document (Fig. 3).

Using the VAT Distribution Analysis button in the VAT Distribution document, you can generate a report and, if necessary, print it.

After posting the VAT Distribution document, the following entries will be made in the accounting register.

The amount of input VAT for the office space rental service will be transferred from the credit of account 19.04 with the third subaccount. Distributed to the debit of account 19.04 with the third subaccount:

- Accepted for deduction - in the appropriate share;

- It is taken into account in the cost - in the corresponding share.

To registers:

- VAT presented - a record will be entered with the movement type Receipt with the VAT event distributed for the amount of VAT presented by the supplier and subject to deduction after distribution.

- savings VAT-free transactions - a record is made with the type of movement Receipt, reflecting the amount of VAT related to transactions that are not subject to taxation and, therefore, not accepted for tax deduction.

- Separate accounting of VAT - a record will be made with the type of movement Expense for the amount of VAT presented by the supplier.

Registration in the purchase book of the received invoice for premises rental services for the second quarter of 2022 (operation 3.6 “Presentation for deduction of the amount of input VAT”) is carried out by the document Formation of purchase book entries (section Operations - subsection Closing the period - hyperlink Regular VAT operations) using Create commands.

Data for the purchase book on the amounts of tax to be deducted in the current tax period are reflected on the Purchased assets tab.

To fill out a document using accounting system data, it is advisable to use the Fill command.

The tabular part of the document will contain information about the purchased service for renting office space for the second quarter of 2017, for which the amount of input VAT presented by the lessor is claimed for deduction in the share calculated on the basis of the generated distribution proportion (Fig. 3).

Rice. 3. VAT distribution

After posting the document, an accounting entry is generated:

Debit 68.02 Credit 19.04 with the third subaccount “Accepted for deduction” - for the amount of VAT subject to deduction for the purchased premises rental service.

To registers:

- VAT claimed - for the amount of VAT accepted for deduction, a record with the type of movement Expense is entered.

- VAT Purchases - an entry is entered for the purchase book, reflecting the acceptance of VAT for deduction on the premises rental service for the second quarter of 2017.

Based on the VAT Purchases register entry, the purchases book for the second quarter of 2022 is filled out (Purchases section - VAT subsection).

Accounting in 1C

On March 1, the Organization sold a plot of land at a price of 600,000 rubles. (without VAT).

On the same day, an act was received for legal services to support the transaction in the amount of 12,000 rubles. (including VAT 20%).

The book value of the plot is RUB 500,000.

In the 1st quarter the Organization:

- incurred general business expenses distributed between taxable and non-VAT-taxable activities in the amount of 120,000 (including 20% VAT);

- provided services in the amount of RUB 2,400,000. (including VAT 20%).

According to the VAT accounting policy, the Organization does not apply the 5% rule.

Separate accounting settings

If you regularly carry out transactions that are not subject to VAT, you need to set separate accounting settings in the program.

More details:

- How to keep separate accounting of incoming VAT in 1C if there are transactions subject to VAT and non-taxable transactions?

- Transition to separate VAT accounting

- What needs to be done in 1C so that it is considered that separate VAT accounting is carried out?

The legislation does not define the procedure for maintaining separate accounting, so if the operation is one-time, then the calculations can be performed outside the program using your own methodology, so as not to complicate further work in the program by connecting separate accounting in the settings.

Then you need to take it for deduction, include VAT in the price and fill out section 7 manually.

More details:

- VAT

- Input VAT on goods used for VAT-exempt activities

Both with automatic and manual separate accounting, the calculation of 5% of expenses is carried out manually (if provided for by the accounting policy).

Read more 5 percent rule for maintaining separate accounting of incoming VAT