Example

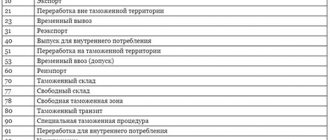

The current form of the customs declaration for goods is approved by Appendix No. 2 of the decision of the Customs Union Commission dated May 20, 2010 No. 257:

Let us say right away that the registration number of the cargo customs declaration must be understood as the number of the declaration indicated above. After all, as such, customs declarations are no longer valid due to the development of EAEU legislation.

According to clause 43 of the rules for filling out this document, the registration number of the customs declaration in 2022 and in the future is affixed to it exclusively by an official of the relevant customs office.

The same paragraph says what the registration number of the customs declaration looks like and gives its interpretation.

Here is a typical example of a customs declaration registration number. For each country participating in the Customs Union and each declaration it is different, although the format is the same:

| Russia: 10226010/090617/0003344 Armenia: 11/141117/0004455 Belarus: 06532/030217/0001122 Kazakhstan: 50208/290617/0002233 Kyrgyzstan: 10302/240817/0005566 |

Please note that each sample customs declaration registration number has the following format:

| XXXXXXX/XXXXXX/XXXXXXX |

Where:

- the left part is the code of the customs office that registered the declaration in accordance with its classification;

- the middle part is the day on which the declaration was registered (DDMMYY);

- the right part is the serial number of the declaration, which is given to it according to the customs journal on registration of declarations (starts with one for each calendar year).

As you can see, the number in question is always indicated through a slash “/”. There should be no spaces between elements.

Thus, an organization (individual entrepreneur, individual) should not have the question of how to fill out the registration number of the customs declaration. This is done exclusively by a customs official. It is only important to know where the registration number of the customs declaration is indicated in order to quickly find it.

Sometimes the registration number of the customs declaration (full customs declaration) is necessary to confirm zero VAT on actually sold goods exported (clause 1 of Article 165 of the Tax Code of the Russian Federation).

At the same time, the Ministry of Finance believes that the registration number of the customs declaration for export should be taken from the full declaration (letter dated October 23, 2015 No. 03-07-08/60952), and the Federal Tax Service believes that it is quite temporary (letter dated July 28, 2017 No. SD-4- 3/14879).

Also see “Full list of customs codes: table”.

Where can I get the customs declaration number for an invoice? – all about taxes

> commodity documents > How and when to fill in the customs declaration number in the invoice

To indicate VAT on goods, the seller is required to generate an invoice, but since such operations are quite often used in the process of moving cargo from country to country, that is, when performing import and export operations, the seller, if there is reason, indicates the customs declaration number in the invoice . What is it, how is it deciphered, how is it filled out in the new form from 10/01/2021?

| Dear readers! The article describes typical situations, but each case is unique. If you want to find out how to solve your particular problem , use the online consultant in the lower right corner of the site or call direct numbers: +7 (499) 653-60-72 ext.445 — Moscow — CALL +7 ext.394 — St. Petersburg — CALL here — if you live in another region. It's fast and free! |

In 2022, under the influence of significant changes in legislation, this issue and the topic as a whole have undergone many changes.

Please note: as of October 1, 2021, the form of the invoice, both regular and adjustment, has changed. The form has not changed significantly, but the innovations affected the order of indicating the customs declaration number in column 11 of this form.

In 2022 - 2022, the customs declaration number is an integral part of the invoice for the import or production of imported materials, raw materials, products and other things; it should be indicated in compliance with all legal requirements and remember the exceptions when entering information is not required.

What is it - gas turbine engine (decoding)

A customs declaration is a cargo customs declaration that must be filled out if goods are moved between countries, no matter in which direction (export and import operations).

The customs declaration contains basic information about:

- Cost of goods, identification data;

- The transport used in this operation;

- Participants of the event - the sender and recipient of the cargo.

The number assigned to the customs declaration must be transferred to column 11 of the invoice. Moreover, the update of this form, which occurred from 10/01/2021, affected exactly this column 11 - its name changed, the word “registration” was added at the beginning.

The importance of the gas turbine engine cannot be underestimated, since it:

- Provides the opportunity to perform an after-the-fact inspection of cargo by customs officers;

- On its basis, border crossing is carried out;

- It makes it possible to assess the fact of correct implementation of customs legislation;

- Is a confirmation of actions on the part of participants within the framework of the law;

- It is a source of indicators for entering them into the invoice and subsequently charging VAT.

Since this cargo customs declaration ensures the legalization of the transportation of goods, its formation is important:

- When importing/exporting taxable products;

- When moving it using an individual economic approach;

- Import/export of assets worth more than 100 euros.

If all of the above goods are not accompanied by a declaration, then their import is regarded as contraband.

The customs declaration form is drawn up on 4 identical sheets, each of them is used:

- For storage at customs in the archive;

- For the purpose of filing in the customs statistics folder;

- Transfer to the person declaring the cargo;

- For the purpose of accompanying transport transportation.

A customs declaration for cargo can be generated in any convenient way, but without errors or corrections.

When is it necessary to include a customs declaration number on an invoice?

According to the law, the customs declaration number is required to be indicated in the invoice for the goods, but it is not always indicated, but only if there are grounds. Information about the customs declaration must be indicated in column 11. The name of this column from 10/01/2021 is the registration number of the customs declaration.

Please note that this number must be entered before the goods are shipped to the buyer.

To enter a customs declaration into a document, perform the following operations:

- Transport imports into the territory of the Russian state - the registration number is indicated on the invoice during the process of sales and transfer of goods to the buyer.

- Processing of imported raw materials - to justify the inclusion of a number in the invoice, it is necessary to establish that the manufactured products fully correspond in quality to the purchased raw materials, otherwise, they are recognized as manufactured in Russia and there is no need to carry out the entry in accordance with the law.

- The raw materials are of imported origin, but have already been purchased on the territory of the Russian Federation - in this case, you should proceed similarly to the previous case and establish that the finished products correspond in quality to the imported raw materials.

Step-by-step steps for filling out column 11 in the invoice:

If it becomes clear that the invoice should be filled out indicating the customs declaration number, proceed as follows:

- Enter a set of numbers into the corresponding column of the invoice;

- The indicators are rechecked with the primary document - column 1 of the customs declaration;

- In the 10th column you should indicate the country of the manufacturer - this indicator is in the 16th column of the declaration;

- Moreover, if several batches of the same type of goods were used to import raw materials, each of which was accompanied by a separate declaration, upon sale it is necessary to enter the numbers of all customs declarations into the invoice.

When invoices are issued without a customs declaration number

There are cases when the importing organization should not use the declaration number:

- The object is transferred by a VAT non-payer - such a supplier has the right not to generate an invoice, which means there is no reason to enter a number;

- The import of goods was not declared - the law does not prohibit certain groups of imports from being imported into Russia without declarations, which means that there is nothing to bring in.

Also, the customs declaration number is not indicated in the invoice:

- When selling domestic products;

- Cargo received from the EASF countries or transported through their territories.

Customs declaration number in the invoice from 10/01/2021 - what has changed

From October 1, 2022, a number of changes have been introduced to the current invoice form. One of them concerned the name of column 11. The word “registration” was added to the wording.

In general, the essence of the purpose of this column has not changed. It is still necessary to enter the number of the customs declaration from column A of the declaration for goods, issued when carrying out import operations with the issuance of an invoice.

That is, the customs declaration number consists of a registration number (three digital blocks separated by a fraction) and the serial number of the goods. The registration component is assigned to the declaration when it is accepted by customs.

Questions and answers

Question 1: A company purchases imported goods from an organization that works on the simplified tax system and does not issue invoices, and therefore does not indicate the customs declaration number. The buyer will sell the purchased imported goods with VAT; does the buyer need to fill in the customs declaration number in the invoice for the buyer when reselling?

Answer: There is no need to indicate a customs declaration, this is not a violation of filling out invoices, and the tax office has no right to refuse a deduction.

Question 2: An organization buys imported goods in several batches, each with a customs declaration issued. The product is subject to resale in its entirety. Do all declaration numbers need to be included in the invoice?

Answer: Yes, you need to enter in column 11 all the numbers of customs declarations under which the imported cargo was received and is subject to resale.

Question 3: The foreign supplier of imported products did not indicate the cargo customs declaration number on the invoice. When reselling this product, is it necessary to indicate this number in the s/f? Is registration correct without a registration number?

Answer: If the supplier did not indicate the customs declaration in the c/f, then the buyer during resale may also not fill out field 11, since he fills out the invoice based on the data he has. If the customs declaration is missing, then he cannot fill out this field.

Question 4: When filling out the declaration registration number from 10/01/2021, the supplier indicated this number along with the product code. Is this correct, or should I request a reissue of the invoice to claim the deduction?

Answer: In column 11 of the invoice you must indicate the registration number (three digital blocks separated by a fraction). However, if the supplier supplemented this number with a product code, this will not lead to a refusal to deduct VAT.

Even if this is accepted by the tax authorities as an error in the preparation of the invoice, this will not prevent the correct identification of the required information about the buyer, supplier, product, tax, so the right to deduction will not be lost.

| Didn't find the answer to your question in the article? Get instructions on how to solve your specific problem. Call right now: +7 ext.445 - Moscow - CALL +7 ext.394 - St. Petersburg - CALL here - if you live in another region. It's fast and free! |

Source:

Registration number of customs declaration example

In the practical work of an accountant, problems often arise when filling out the form. 11 on the invoice. The registration number of the customs declaration is entered into it. Where can an accountant get the necessary information about him, and what can be encoded in such an endless combination of numbers? It is useful to clarify the specifics of recording the correct data in the document so that it is filled out correctly.

What information is contained in the gr. 11 invoices

How to correctly fill out invoices (ICF) is explained in the regulatory documents. The rules must be followed unquestioningly. SSF – documents, the formation of which is necessary for the calculation of VAT, and subsequent requirements for tax deductions on it.

https://www..com/watch?v=kVlA0A3itWc

Often such operations involve the movement of a huge range of goods across state borders. Therefore, in the SSF, which are issued by selling companies to buying companies, it is impossible to do without recording the No. of the cargo customs declaration (CCD).

The second paragraph of the rules for forming the SSF states that the registration number of the customs declaration on the invoice is indicated in a separate column under number 11. The TD is filled out only in relation to those products that were not produced in the Russian Federation; their state of origin is different.

This refers to the registration number of goods imported into the Russian Federation by importers and intended for consumption within the country.

This number is a domestic detail and is generated by the relevant customs authority. This procedure is established by law. According to the current Instructions, the registration number of the customs declaration for 2022, as in all previous time periods, consists of three elements separated by the corresponding “/” sign.

Composition of the TD number

The code contains a certain number of digits. Its individual components are clear and logical. the numbers are:

Part 1. Consists of 8 digits. They mean the code of the customs authority where the TD was registered. The registration number of the customs declaration has an incorrect value if the initial digits differ from the number “10”. All customs codes in the Russian Federation are strictly eight-digit. Its two starting digits are always “10”.

Part 2. The six-digit number is even easier to decipher. It contains the date of registration of the goods by customs. The format is standard - day, month and year (last 2 digits of the year). The registration number of the customs declaration, an example of which is given below, means that the document was registered on September 12, 2022 (09/12/17).

Part 3. The code consists of seven digital characters or more. It encrypts the serial number of the document (TD) for commodity resources in the customs authority where registration took place.

It also has its own characteristics and rules that determine what the registration number of the customs declaration looks like as a whole. It must start with one in each new calendar year.

It turns out that the first declaration that falls into the hands of customs officers in the new year will receive a sequential number in the following form: “0000001”.

Tax authorities have their most “favorite” details, which they check especially carefully. Among them are TD registration numbers. Therefore, when filling out the SSF, their authenticity must be checked. The registration number of the customs declaration, a sample of which is presented below, consists of a total of 21 digits and two delimiters:

10012000/120917/0129451

Number decoding:

Kaliningrad Regional Customs/September 12, 2022/number of the registered declaration that passed through the specified customs.

The number of numbers in the third part will increase if more goods pass through customs. Then the registration number of the cargo customs declaration (CCD) will increase by one or two digits.

Source: https://nalogmak.ru/transportnyj-nalog/gde-vzyat-nomer-gtd-dlya-scheta-faktury-vse-o-nalogah.html

Where to get

Where to get the registration number of the customs declaration is stated in the same paragraph 43 of the rules for filling out the declaration for goods.

There is no need to search for a long time to find the registration number of the customs declaration. It is located immediately in the first line of column “A” of the first and each additional sheet of the declaration.

To clearly understand where to look at the customs declaration registration number, refer to the figure above and below. We have highlighted column “A” in red.

That's not all. Another source where the registration number of the customs declaration is indicated is the upper corner of each copy of the addendum, if one is used.

Filling out a customs declaration

A manual for filling out a customs declaration for goods was developed on the basis of the Alta-GTD program at the Rostov branch of the Russian Customs Academy in 2015 and updated in 2022 by foreign trade experts taking into account changes in customs legislation.

The manual is recommended by the RTA Educational Institution for use in teaching students in the specialty 38.05.02 “Customs Affairs”.

Filling out a customs declaration for goods is one of the most important stages when moving goods across the border of the Eurasian Economic Union. Correct filling of all columns ensures unimpeded placement of the transported cargo under the customs procedure, which is actually the first stage of declaration.

The procedure for filling out a customs declaration is determined by the Customs Code of the Eurasian Economic Union, which came into force in 2018, the Federal Law “On Customs Regulation in the Russian Federation”, Decisions of the EEC, individual normative acts, regulations and the Decision of the Customs Union Commission dated 05.20.2010. No. 257 (Instructions for filling out a customs declaration). Filling out individual fields of the declaration is also regulated by special documents.

For correct declaration, many factors must be taken into account. In these instructions for filling out a customs declaration, we have tried to provide detailed explanations on how to fill out complex fields. Despite the fact that most columns of the goods declaration have the same rules when filling out for the import and export procedures, some columns in these cases are radically different. For such DT columns, we gave the most detailed explanations, providing examples of filling.

Source

Invalid value

Sometimes an accounting program may display a message that the registration number of the customs declaration has an incorrect value. It is important that the customs officer through whom the declaration passed is initially responsible for affixing the correct number. After all, he certifies the assigned number with his signature and personal number stamp.

It also happens that when following the chain of counterparties, the registration number of the customs declaration when transferred from one document to another has lost its correctness. This means you need to clarify it with your business partners.

Difference from declaration number

As was said, the main difference between the registration number of the customs declaration and other details of this document is its writing format.

In addition, Decree of the Government of the Russian Federation dated August 19, 2017 No. 981 actually abolished the term “customs declaration number” from the main VAT documents. On this basis, we can say that the difference between the customs declaration number and the registration number of this declaration is no longer relevant. Take line 150 of the VAT declaration, which is now called “Registration number of the customs declaration”:

On the invoice

It is necessary to indicate the registration number of the customs declaration in the invoice in column 11. From October 1, 2022, it received the same name as this detail:

Column 11 is filled in for goods that:

- do not come from Russia;

- released for domestic consumption upon completion of the free customs zone procedure in the Kaliningrad region.

Also see “New invoice form from 10/01/2017: form and sample filling”.

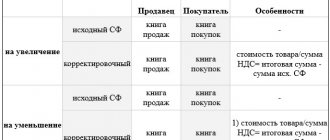

Customs declaration number on the invoice

Column 11 of the invoice (SF) indicates the registration number of the customs declaration (CD) (clause l, clause 2 of the Rules for filling out the invoice, approved by Decree of the Government of the Russian Federation of December 26, 2011 N 1137).

At the same time, the Ministry of Finance explained that indicating in this column the full number of the customs declaration (4 blocks), and not the registration number (3 blocks), does not deprive the taxpayer of the right to deduct VAT (Letter of the Ministry of Finance of the Russian Federation dated January 18, 2018 N 03-07-09/ 2213).

What is the difference between the full and registration number of a TD?

The TD registration number is assigned by Russian customs and must contain 23 characters, and also consist of three parts (clause 1, clause 43 of the Instructions on the procedure for filling out a declaration for goods, approved by Decision of the Customs Union Commission dated May 20, 2010 N 257):

Get clear tutorials 2022 on 1C for free:

The full TD number consists of 4 blocks. For example, TD number 10129052/140520/0010690/14.

The first three blocks are as in the TD Registration Number , and the 4th block is information about the commodity item number on the main or additional sheet of the TD from column 32 (clause 30 of the Instructions on the procedure for filling out a declaration for goods, approved by the decision of the Customs Union Commission dated 05/20/2010 N 257).

Where do “unformatted” TD numbers come from?

An “unformatted” number is a TD registration number assigned by a non-Russian customs authority. It consists of fewer characters - 17 or 20, in contrast to the Russian TD registration number of 23 characters.

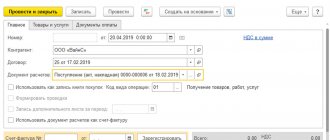

The procedure for filling out information about the TD number in 1C

Attention! The VAT rate has been changed from 01/01/2019 from 18% to 20% and from 18/118 to 20/120.

The organization entered into a contract with the supplier Aurora LLC for the supply of goods in the amount of 200,600 rubles. (including VAT 18%).

On March 01, the goods were shipped and delivered to the Organization’s warehouse:

Settings for accounting for imported goods

Features of specifying the TD number when purchasing goods

The direct importer can find the TD registration number in column A of the customs declaration (top right). PDF

When purchasing imported goods on the domestic market, in the column Customs declaration number, enter the customs declaration number indicated in the supplier’s invoice in column 11 “Registration number of the customs declaration” (Letter of the Ministry of Finance of the Russian Federation dated August 16, 2017 N 03-07-09/52531). PDF

If column 11 in the supplier’s SF:

More information about filling out the column Customs declaration number

The customs declaration number can be entered into the Customs Declaration Numbers in two ways:

As you enter the TD number into the Customs Declaration Numbers in the TD Number stating that:

At the same time, the registration number of the customs declaration, for example, consisting of 20 characters, will not be displayed in the purchase book and in the VAT declaration, because The electronic format of the declaration limits the number of characters in the TD number - no shorter than 23 characters and no longer than 27 (Appendix 4, approved by Order of the Federal Tax Service of the Russian Federation dated October 29, 2014 N ММВ-7-3 / [email protected] ).

Registration number of 20 characters, assigned by the customs authority of Belarus. The country of origin of the goods is Germany, but the import into the Russian Federation was from the EAEU, on whose territory the goods were previously released into circulation for domestic consumption.

At the same time, such a “special” TD registration number will not be recorded or displayed anywhere.

It is not required to indicate in column 11 of the invoice the number of the customs declaration assigned by the customs authority from the EAEU countries (Letter of the Ministry of Finance of the Russian Federation dated September 15, 2016 N 03-07-13/1/53940).

At the same time, indicating an “unformatted” TD number does not make the SF defective and does not lead to a refusal to deduct VAT from the buyer (paragraph 2, paragraph 2, article 169 of the Tax Code of the Russian Federation, Letter of the Federal Tax Service of the Russian Federation dated August 30, 2013 N AS-4-3/15798 ).

Correcting errors in the TD number

You need to open the directory and correct the TD number.

In the tabular part of the Receipt document (act, invoice) from the Customs Declaration Numbers , you can select the full TD number because it corresponds to the format of 23-27 characters, provided that all blocks are entered correctly according to the number of characters in the first three blocks - ХХХХХХХХ/ХХХХХХ/ХХХХХХХ (8 characters / 6 characters / 7 characters).

Reflection of the TD number in the purchase book

Column 13 “Registration number of the customs declaration” of the purchase book reflects the registration numbers of the Trade House of the Russian Federation. The fourth block in the customs declaration number is cut off automatically and is not displayed in the purchase book; the registration number of the customs declaration of the Republic of Belarus (“unformatted” number) is also not filled in.

The VAT declaration Section 8 line 150 “Registration number of the customs declaration” is filled out in the same way - only the 23-character registration number of the Trade House of the Russian Federation is displayed.

Registration numbers of customs declarations according to the electronic format of the VAT declaration must be no shorter than 23 characters and no longer than 27 (Appendix 4, approved by Order of the Federal Tax Service of the Russian Federation dated October 29, 2014 N ММВ-7-3 / [email protected] ).

For this reason, a short number of 20 characters is not uploaded to the VAT return.

The fourth block of TD is not unloaded, because from 10/01/2017 the TD registration number (3 blocks, 23 characters) is indicated in the Northern Fleet, and not the full TD number (4 blocks, up to 27 characters) (paragraphs and clause 6 of the Filling Rules invoices approved by Decree of the Government of the Russian Federation dated December 26, 2011 N 1137).

The columns of the purchase book and VAT declaration are named accordingly “ Registration number of the customs declaration...”.

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

Publication card

( 15 ratings, average: 4.93 out of 5)

Add a comment Cancel reply

You must be logged in to post a comment.

You can ask more questions

Access to the “Ask a Question” form is only possible if you have fully subscribed to BukhExpert8

By clicking the “Ask a Question” button, I agree with the BukhExpert8.ru regulations >>

Good afternoon I would like to express my deep gratitude to BUKHEKSPERT for making life at work easier :), providing invaluable material and sharing professional experience. Seminars are conducted in a clear, accessible language, there is an opportunity to ask questions and get answers, very useful and necessary additional information. material. Thanks to you, I have experienced positive changes in my work, and even in my life. I won my dream trip (the first time I won anything in my life) to Italy. I received a lot of positive emotions and impressions. Thank you very much for your work.

Source

In the sales book

Due to the changes introduced by Decree of the Government of the Russian Federation dated August 19, 2017 No. 981, from October 1, 2022, the registration number of the customs declaration in the sales book received its own separate column 3a:

The registration number of the customs declaration, which is issued upon the release of goods for domestic consumption upon completion of the free customs zone procedure in the Kaliningrad region, is entered in this column.

This indicator is filled in when selling goods for which VAT is calculated during customs declaration:

- was not paid according to paragraph 1 sub. 1.1 clause 1 art. 151 Tax Code of the Russian Federation;

- paid in accordance with paragraph 3 sub. 1.1 clause 1 art. 151 of the Code.

In the shopping book

From October 1, 2022, in the purchase book, the registration number of the customs declaration received its own column of the same name. Previously, it was called simply “Customs Declaration Number” (Resolution of the Government of the Russian Federation dated August 19, 2017 No. 981):

In this column, one or several registration numbers of the customs declaration are given, separated by a semicolon, when selling goods imported into Russia, when their customs declaration is provided for by the laws of the Eurasian Economic Union.

Column 13 is not filled in when reflecting data on an adjustment (corrected adjustment) invoice in the purchase book.

When reflecting in the purchase book the VAT paid when importing goods into the Russian Federation, in column 3 indicate one or several registration numbers of the customs declaration, separated by a semicolon

When reflecting VAT in the purchase book (clause 14 of Article 171 of the Tax Code of the Russian Federation), in column 3, provide the registration number of the customs declaration issued upon the release of goods for domestic consumption upon completion of the free customs zone procedure in the Kaliningrad region. In this case, columns 4 – 9 and 11 – 15 are not filled in.

Also see “Book of purchases and sales from October 1, 2022: new VAT forms.”

Customs declaration number - decoding for import and export, examples

Any transactions related to the import or export of goods, as well as subsequent payment for such transactions, are subject to taxes, and in order to make the correct deduction, separate procedures are carried out with the total amount used.

Each customs declaration is assigned a separate tax number, which makes it easier for the Federal Tax Service to verify and control all transactions.

Basically, such numbers are used exclusively by tax services, however, declaration owners can also check the status of their own document at the time of its verification, and the correct completion of the information base.

How and when to fill in the customs declaration number in the invoice

To indicate VAT on goods, the seller is required to generate an invoice, but since such operations are quite often used in the process of moving cargo from country to country, that is, when performing import and export operations, the seller, if there is reason, indicates the customs declaration number in the invoice . What is it, how is it decrypted, where can I get the import decryption, how is it filled out in the new form from 10/01/2021?

In 2022, under the influence of significant changes in legislation, this issue and the topic as a whole have undergone many changes.

In 2022 - 2022, the customs declaration number is an integral part of the invoice for the import or production of imported materials, raw materials, products and other things; it should be indicated in compliance with all legal requirements and remember the exceptions when entering information is not required.

Customs declaration number in the invoice, how to check the customs declaration by code number online?

This article will discuss the features of filling out the customs declaration number in 1C.

Let's look at an example:

- what is the difference between the full and registration number of the customs declaration;

- where do the “unformatted” customs declaration numbers come from;

- how to enter the customs declaration number specified in the supplier’s invoice in 1C;

- how to correct a customs declaration number entered incorrectly in the program;

- in what format the numbers are reflected in the purchase book and in the VAT return.

Column 11 of the invoice (SF) indicates the registration number of the customs declaration (CD) (clause l, clause 2 of the Rules for filling out the invoice, approved by Decree of the Government of the Russian Federation of December 26, 2011 N 1137).

Source: https://buhvopros.com/nomer-tamozhennoj-deklaratsii/