After registering an individual entrepreneur with the tax office, you not only receive the right to conduct business, i.e. engage in entrepreneurial activity, but also have responsibilities, the first of which are to submit reports and pay insurance premiums for yourself. In addition to these key responsibilities of each individual entrepreneur, there are a number of nuances that you should know about so as not to run into fines in the first month of your official activity. Especially for this article, we have selected seven important issues that an IT freelancer needs to solve immediately after state registration.

And for those who have opened an LLC, we have prepared: 10 things that must be done after registering an LLC

Choose the right tax system

If, when you registered as an individual entrepreneur, you did not submit notifications about the transition to a simplified taxation system, then you will need to decide on the taxation system within the specified period of time after the date of registration.

The taxation system is the procedure for calculating and paying taxes. Each system has its own rate and tax base, but the main thing is that the amount of tax payable differs significantly. One such illustrative example is in the article “How much does a programmer earn in Moscow according to the Federal Tax Service.”

There are five taxation systems in total, but one of them (Unified Agricultural Tax) is intended only for agricultural producers. You can choose between the main one (OSNO) and special systems (USN, UTII, PSN). In principle, calculating the tax burden is an accounting topic, so if you know a competent specialist, then it makes sense to contact him.

You can also calculate something on your knee:

- for OSNO you have to pay 13% of the difference between income and expenses plus VAT;

- under the simplified tax system, income tax will be 6% of income (in some regions the rate can reach 1%);

- under the simplified tax system Income minus expenses - from 5% to 15% of the difference between income and expenses (in some regions the rate can reach up to 1%);

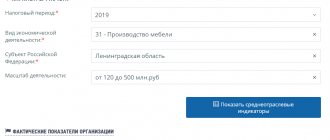

- the cost of the patent is given by the Federal Tax Service calculator;

- Calculating UTII is a little more complicated, but you can really do it on your own.

If you don’t want to delve into the calculations, and you can’t get to an accountant, we recommend that you apply for the simplified tax system for Income, because This is the most common tax system. Plus, it is the simplest reporting system with a fairly low tax burden. It can also be combined with any other systems except OSNO.

(!) There is an exception to our recommendation to immediately switch to the simplified tax system - if your main customers are budget organizations or large businesses, then they just need an individual entrepreneur working on OSNO.

Why is this important : special (aka preferential) tax regimes allow you to reduce payments to the budget to a minimum. This right is enshrined in Article 21 of the Tax Code of the Russian Federation. But if you yourself do not submit an application to switch to the simplified tax system, UTII, PSN, then no one will persuade you. By default, you will have to work on a common system (OSNO). It is not advisable to forget about the reporting deadlines of your system; tax authorities will very quickly block the current account of an individual entrepreneur for failure to submit a declaration.

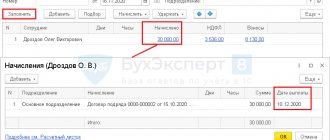

Another reason to submit tax reports on time is the risk of receiving a payment from the Pension Fund in the amount of 154,852 rubles. The logic is this: since you have not reported your income to the Federal Tax Service, then its size is simply immodest. This means that contributions will be calculated at the maximum (8 minimum wage * 26% * 12). This is not a fine, the money will go to your pension account and will be taken into account when calculating your pension (if everything has not changed again by then), but still the surprise is not the most pleasant.