What is a TIN and what is it for?

People may have heard about the Taxpayer Identification Number many times, but a large number of citizens do not understand why it is needed. This is a typical situation, because in everyday life people rarely remember it. TIN

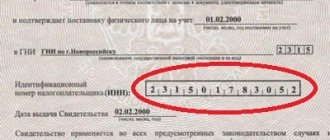

is a code issued by the state to a citizen for identification in the taxpayer database. It consists of 12 characters (numbers) and has been issued to all Russians since the beginning of the new century. If a person decides to change his passport data, last name, first name, then there is no need to change this code. Thus, this identifier is issued once.

The identifier helps tax inspectors identify people's debts to the government, if any. The numbers in the code are divided by purpose. The first two digits indicate where the citizen is registered, in what region. The next two numbers will tell you the tax office where the TIN was created. The rest are an identifier; all numbers in the code are unique. This term means that it is impossible to find the same identifier for two Russians.

This is interesting: what is the tax number in the passport.

TIN decoding

If there is an identification number, citizens do not know its meaning. In Russia the following combination decoding is accepted:

- The initial 2 digits correspond to the code of the region (territorial unit) of the country;

- 3.4 digits - indicate the division of the Federal Tax Service that issued the document;

- 5-8 digits - indicate the taxpayer’s record number in the tax service database;

- The last 2 digits are the control identifier used during verification.

All assigned numbers are individual, which allows you to find information about tax deductions and payments of a citizen, individual entrepreneur, or organization.

Many citizens do not attach much importance to the document and keep it at home. There are also known cases of the absence of a paper copy. Although there may be situations where data is entered according to information received by the tax authorities from notaries, social workers, and government services

. This often happens when purchasing property for which you need to pay tax. Therefore, when situations arise where an identification number is required, the question arises of quickly requesting information via the Internet.

How to print a TIN on State Services

On the website for receiving government services, a person can look up his TIN, but nothing more. The site does not offer tools to download this data. For this reason, visit another federal website - nalog.ru. Log in using your details. To do this, select one of the available account types on the main page - for individuals, individual entrepreneur or legal entity.

If you have already received a TIN from the service earlier, you can find it on the website as follows:

- Open the main page of the site;

- Click on the profile name, last name and owner's first name;

- Next, on the next screen, select the “Personal Data” tab;

- Scroll the page all the way down and select the “Download” button in the “TIN Certificate” block;

- A copy of the certificate with an identifier and other data will be downloaded to your device. This form is provided in PDF format. Each such document in its interface offers to print a copy.

You can print a document on the website page where you opened it or after downloading it to your device. The owner can store it digitally on a portable disk in the device’s memory. A TIN number may be necessary in different situations. Without it, a citizen may be denied a loan when applying for it at a bank. Using the code, employees of banks and other organizations can check a citizen’s debts to the state or other financial institutions.

This is interesting: how long does it take to receive a tax refund after filing an application?

TIN certificate

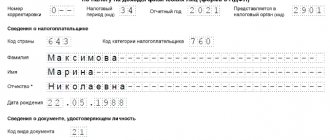

Information about the taxpayer and the TIN assigned to him is applied by the tax authority to the certificate form approved by the Order of the Federal Tax Service dated November 23, 2004 in the prescribed form N 2-1-Accounting. Such forms are classified as secure printing products. All of them have a series and number and are subject to accounting.

Form N 2-1-Accounting involves not only entering information about the taxpayer, but also indicating the name of the official of the tax authority who issued the certificate with his signature. In addition, according to the above-mentioned order, a protective holographic mark is applied to the form.

How to open and print PDF

Nowadays, special applications are not required to work with PDF files. Browsers allow you to view them and use basic functions. Once you download the document, you can print it from any navigator even if there is no Internet connection.

- Launch the file from the folder by selecting a browser from the list of programs to open;

- Next, find the button in the form of a printer on the toolbar and click on it;

- If the printer is connected and ready to go, you will need to set up printing and start this process.

There are other programs for working with PDF files, which have additional capabilities for managing printing.

If the user is unable to find the TIN on the State Services website, it is possible that his account does not contain sufficient information. In this case, you need to try to log into the nalog.ru portal and find this data. Users who have an ID but cannot find it on government portals can seek help on the website or at the Federal Tax Service branch.

How to use State Services?

Citizens who have registered on the e-government portal can receive many government services via the Internet. Among them are those provided by the Federal Tax Service.

After logging into the EPGU portal and loading the “Services” section, for easier searching, click on the “Authorities” tab. Here all products are sorted into categories depending on which department provides them. To open a list of services related to the tax service, you need to click on its coat of arms.

Select the item marked in the screenshot below from the list. To complete the application, the system will ask you to enter the login and password for your user account or register. After successful authorization, you should fill out the form, indicating the data from your passport. Information is provided free of charge and quickly.

Important! If they have an account on the portal, users can receive a response to their request in a matter of seconds.

If you need to print the TIN from the State Services website, the combination can be copied to a file, copied onto a piece of paper, or taken a screenshot of the screen.

Nalog.ru and State Services support contacts

If during the operation of the sites you are unable to receive a certain service, you do not see the necessary data, use a dedicated service support line. There are contacts for the nalog.ru portal:

- Phone number – 8-800-222-2222;

- Group on VKontakte with the ability to write to the administrator;

- On nalog.ru, use the chat icon to get help from a bot.

There are other social networks available that have tax service groups. Citizens can find them in the “Contacts” section of the online service. To solve problems related to the State Services portal, you will need contacts of social networks, links to which you will find at the bottom of the site.

For users who do not understand modern devices, multifunctional centers can provide assistance. They are an analogue of the State Services portal for helping citizens in different regions of Russia.

Recommendations

Absolutely everyone needs a TIN. It is recommended to do it immediately after receiving a passport at the age of 14. Why at this moment? Because, starting from the age of 14, a person can officially get a job. Of course, you can issue a certificate earlier if necessary. For example, when entering into an inheritance or registering property for a minor.

How to make a TIN through State Services? Even if you are just learning to use a computer, mastering the Internet and social networks, the procedure described above will help in obtaining and obtaining a certificate. Visual instructions can be seen in the video.

On the website gosuslugi.ru, all information is described in clear and simple language, and the necessary services are located in special categories. There is also a search on the portal, which you can use if you cannot find the required function in the catalog. In addition, the State Services website is equipped with various tips. Also, if you have any questions, you can contact technical support. The required button can be found at the top of the site. In addition, you can turn to relatives or directly to the tax office for help.

How to find out the TIN from your passport

The taxpayer code is publicly available. If you want to know it, the Tax website will be happy to provide it. Before accessing this tool, the user agrees to the processing of data that will be entered in the form on the next page.

The rules of this form also indicate that the user can only request his TIN code. But there are no technical means to prevent a third party from obtaining this data.

To request a TIN bypassing the State Services:

- Follow the link to the service https://service.nalog.ru/static/personal-data.html;

- Agree to the terms of information provision and click on the “Next” button;

- Fill in all blank fields with your personal information. Each line next to which there is a red asterisk must be used;

- If you accidentally made a mistake or changed your mind about filling out the form, below there is a “Clear form” button, which will erase all data;

- To complete the request procedure, click the “Send request” button below.

If the user has entered their information correctly, after a few seconds the required code will appear on the screen. The result is also influenced by whether the person is registered with the TIN. What makes it difficult for someone else to receive the code is that it requires them to have virtually all the information required on the form. Which is no easy task. In the personal account of the State Services, only the real owner can view his tax identification number. For others, this data is hidden and inaccessible.

How to apply for an unassigned TIN?

Finding out your taxpayer number is not at all difficult, but it is much more difficult to apply for a TIN, and, in fact, to obtain it without personally visiting the federal tax office. To do this, you need to follow the following plan:

- Log in to the service www.nalog.ru.

- Open the “TIN” section and click on the “I want to register with the tax authority” icon.

- Next, everything you need to know about this process, all the necessary documents, deadlines, etc. will appear in a new window.

How to get a TIN

The website has a separate service where you can register with the tax service. A citizen himself can apply to any tax office at his place of residence. Registration is also carried out offline and online.

The user is asked to register on the Tax website. Then, with an application, come to one of the service departments at your place of residence. It is permissible to set a date on which it is convenient for a citizen to submit an application to the service. You will need to take your passport with you.

A registration document will be issued within five days after consideration of the application. Can only be issued personally to a person by a tax officer. In urgent situations, a temporary copy may be issued. This type of document is issued within the first 2 days after sending the application.

A child can receive his own TIN in Russia before he receives a Russian passport. This must be done by a legal guardian - parents or guardians. The application procedure is the same as for adults.

Getting a duplicate

You can obtain a TIN from your passport by personally contacting the authorized body. If you only need to look at his number or submit an application, you should use an activated account for this.

Following the system prompts, fill out the form with personal and passport data.

To restore a lost document (no matter for what reason), a citizen must pay a state fee of three hundred rubles through his personal account on the tax service website. The initial issuance of a certificate is free.

After the application is received and processed, you will receive a notification where to get your TIN and at what address the Federal Tax Service is located. Bring with you a passport, an application for a duplicate document, and a receipt for payment of the fee. In just 5 working days, a citizen will be able to receive a certificate.

How to make a note about the TIN in the passport?

To make a note about the TIN in your passport, select the tax office that is convenient for you and make an appointment online. You will need a passport and TIN certificate. The mark will be made in your presence within 15 minutes.

Is it possible to find out tax debt using the TIN?

On the State Services website there is a function for taxpayers to receive information on debt through the Taxpayer Identification Number (TIN). To do this, first of all, you need to log in to the system. Next, fill out an application, which includes your TIN. After processing the application, you will be able to receive information on debts, if any. The State Services website also offers its users to immediately pay debts in any way. This can be done using a bank card, as well as through some electronic payment systems. If it’s easier for you to make a payment at a bank, you can print out a receipt and take it to the cashier. Applications are processed quickly. This service is free.

Registration of a certificate for children

As for obtaining a certificate for a child under 14 years of age, it can be issued by legal representatives - usually parents.

This is done in the same way with adults, with the exception of one nuance - a child should be indicated as an applicant, not a representative .

On the tax service website, fill out exactly the same application as described above. There is also a service for tracking the request.

Required documents

To switch to the State Services service, the user will need to enter the details of their documents:

- passports;

- SNILS;

When registering a number, a child, in addition to a birth certificate, will need the parents’ passports, an application from them, as well as an extract confirming the child’s registration at the place of residence (certificate No. 8).

To pick up a paper form with information about the assignment of a TIN to the Federal Tax Service, you must present the original documents.

A person with a temporary residence permit or residence permit can obtain an identification number.

How to print your tax identification number via the Internet using your passport

Several websites allow you to print the TIN of an individual, indicating the passport number. Via the Internet, you can also generate a request for the issuance of a document initially or again, for example, in case of loss.

Let's talk in detail about how to print your TIN from the tax website and the Unified e-Government Portal. Citizens who have registered on the e-government portal can receive many government services via the Internet.

Among them are those provided by the Federal Tax Service.

The law does not oblige a citizen to have a TIN certificate in hand; it is enough to be registered with the Federal Tax Service and know his unique identification number.

Find out the Inn from your passport and print a copy

To do this you need:

- in the upper left corner of the site find the category Individuals;

- Scroll the mouse wheel down until the TIN button appears (Get or find out the code);

- on the next page you can familiarize yourself with the conditions for assigning a unique 12-digit code to a citizen; at the end of the sheet, select the service I want to find out the TIN.

Next, you will be asked to fill out an electronic form, which should display the following information:

- your full name;

- Date of Birth;

- type of document that can be used to confirm identity;

- information about this document (series, number, date of issue).

To send a request, you must enter the numbers indicated on the captcha at the bottom of the electronic form, and at the end click on the Send request button.

After this, the tax payer number will be displayed on the screen.

If desired, you can copy it and save it on your computer.

How to order a TIN via the Internet

Ordering a TIN via the Internet is perhaps the most convenient way. But first you should make sure that the tax payer number has not been assigned previously.

This is possible when a taxpayer gets a job, makes transactions with real estate, or applies for social support from the state.

Personal data is sent to the Federal Tax Service by other departments, and the inspectorate assigns a unique TIN to the citizen. It is subsequently used to identify it in the system of tax relations.

To begin with, it is worth determining whether a person has an assigned number or not. There are several ways to find out. Two resources provide this opportunity via the Internet: the “Find out TIN” services of the official website of the tax service and the State Services portal.

In both cases, you will need to enter your passport details and send a request to the department. If there is a number, it will be displayed on the screen. Often this is enough to use the TIN. For example, if you do not need to present a certificate on paper. If you cannot do without a physical document, and you did not receive one, then you will have to issue it.

The most convenient way to do this is online through Internet services. This service is provided by the tax department exclusively on its official website (this cannot be done through the government services portal).

To do this, registration on the resource is required. After registration and authorization in your personal account, on the main page of the site, select the “individuals” section. Among the topics of possible requests and life situations, you should choose an INN.

According to SNILS

There is no service as such to find out the TIN from SNILS. In order to find out if I have a TIN online, you need to enter data about the document, but SNILS is not a document. However, if you know SNILS, you can also know f. And. O. person, which means you can try to find out the TIN from this data.

Let's sum it up

Any person can be asked for an INN, for example, when applying for a new job. The tax registration certificate is not always at hand. To be honest, they often lose it because they don’t see much value in it.

Of course, few people would want to apply for the coveted number to the tax service on a personal visit.

However, this is not necessary: today you can find out the identification code quickly and without any difficulties - by using the Internet, namely the State Services portal or the Federal Tax Service.

Sources

- https://urist.club/administrative/oformlenie-dokumentov/inn/v-internete.html

- https://mfc-list.info/kak-uznat-ili-poluchit-inn-cherez-gosuslugi.html

- https://gosusluga24.ru/inn/raspechatat-inn.html

- https://OGosUsluge.ru/inn/mozhno-li-raspechatat-inn.html

- https://gidgosuslugi.ru/kak-raspechatat-inn-cherez-sajt-gosuslug-i-fns/

- https://infoyslugi.ru/kak-raspechatat-svoj-inn.html

- https://woodartist.ru/kak-raspechatat-svoj-inn-cherez-sajt-gosuslug-i-fns

- https://gosuslugi.in/mozhno-li-raspechatat-inn-cherez-internet/

- https://www.mos.ru/otvet-dokumenti/kak-poluchit-inn/

- https://teoriprava.ru/kak-raspechatat-svoj-inn-s-sajta-nalogovoj-po-nomeru.html

Similar articles:

- Why the TIN was not found in the Federal Tax Service database on State Services and what to do Often the State Services portal produces an unexpected result - the entered TIN was not found in the database. Let's talk about the reasons and possible solution to the problem of why the State Services does not see the TIN....

- Step-by-step instructions for changing your registration through State Services. Pros and cons of this method How to register for State Services? This article provides step-by-step instructions on how to register in an apartment through State Services!…

- Step-by-step application for a tax deduction through State Services How to apply for a tax deduction? Detailed instructions for working with the State Services portal for electronic and paper declarations...

- How to replace a passport via the Internet on the government services portal? Passport production deadline is 2022. Step-by-step instructions for replacing a passport through State Services. When is this possible, what documents are required, deadlines for completing the application….

Previous entry How to enter an electronic diary and view a student’s grades through the Public Services Portal

Next entry How to file a complaint against a bailiff through State Services?

What is the difference between a paper copy of the TIN and an electronic medium?

For several years now, the bulk of interaction between citizens and government departments has been transferred to remote operation. The provision of electronic services required the development of serious tools that would make it possible to give online certificates and other documents legal significance.

An enhanced qualified signature was developed for these purposes. It is affixed on electronic media and sealed. All papers of this type have the same legal force as paper copies. The same applies to an electronic copy of the TIN. It is certified by an official of the territorial department of the Federal Tax Service and certified with a seal.

Important! A copy of the TIN in electronic form has the same legal force as a document received on paper in the department of the Federal Tax Service.

All taxpayers have a unique TIN assigned. If you have previously drawn up this document, it is stored in the Unified State Register of Taxpayers. From there you can download it yourself. As a result, you will have a copy of the TIN that has legal force.

Obtaining a certificate

At the moment, there are several options for obtaining a certificate via the Internet.

- You, or your authorized representative, have the opportunity to receive a paper TIN registration document at the inpatient department of the Federal Tax Service. Upon receipt, you only need to provide an identification document. In the case of a proxy, you must present the passport of the proxy, as well as the person for whom the TIN was issued.

By mail. The certificate is sent to the address specified during registration by registered mail.- By email. In this case, you can receive a TIN registration document in PDF format by e-mail or download from the website. The document must have your signature in electronic digital format.

You can receive the document in the form most convenient for you. It all depends on your personal preferences and capabilities.

TIN: definition

The first step is to familiarize yourself with the document you are studying. What is an individual taxpayer number?

This is a document printed on an A4 sheet. It contains information about the taxpayer, as well as his individual account number. Using the latter, you can quickly search for information about a citizen in the database. A TIN is also required to use government and some municipal services.

How can citizens obtain a TIN? Through “GosGosGosuslugi” it is not difficult. But do you need to pay for this operation?

It all depends on the circumstances. The first order of study paper is free. There is no need to pay for issuing a TIN.

But there are exceptions. If a citizen orders a duplicate document, his responsibilities include paying the state fee for the operation. In 2022, requesting a copy of the TIN will cost 300 rubles. Money must be deposited into the state treasury in advance.