How much insurance premiums will individual entrepreneurs need to pay “for themselves” in 2022? What has changed in the calculation of the amount? What are the features of paying fixed insurance premiums for individual entrepreneurs without employees? What is the amount of contributions in 2022 if the income of an individual entrepreneur is less than 300,000 rubles? Is it necessary to pay a fee if the individual entrepreneur does not conduct business and does not have turnover on the current account? How to get exemption from paying insurance premiums in 2022? Which BCCs should I use for payment in 2022? We will answer your questions.

What are fixed contributions and why are they no longer fixed?

Fixed contributions were insurance contributions for compulsory pension insurance and compulsory health insurance paid by individual entrepreneurs, lawyers, notaries and other persons engaged in private practice.

Until 2014, defined contributions were truly fixed (set for the year) and the same for all persons paying them. Then amendments to the legislation came into force, changing the procedure for calculating contributions and, in fact, contributions ceased to be fixed.

And from 2022, this name has been removed from regulatory documents. We will continue to call these contributions fixed for convenience and because the name is familiar to entrepreneurs.

Since 2022, the procedure for paying fixed insurance premiums is regulated by Chapter 34 of the Tax Code and contributions are paid not to extra-budgetary funds, but to the territorial tax inspectorates at the place of registration of the individual entrepreneur.

Fixed payments for individual entrepreneurs 2022: payment terms

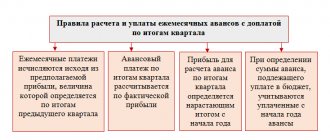

Fixed contributions must be paid by the individual entrepreneur before December 31 of the current year, i.e. for 2022, they must be listed by December 31, 2019 inclusive. Additional deductions if income exceeds 300 thousand rubles. must be made before July 1 of the following year, i.e. no later than 07/01/2020. Contributions can be transferred at a time, or by breaking them into parts.

Let us remind you that fixed contributions for 2022 must be paid no later than 01/09/2019 (due to the postponement of the pre-New Year weekend), and 1% of additional “pension” contributions must be paid no later than 07/01/2019.

The calculation of payments is directly proportional to the time of activity in the status of individual entrepreneur. Fixed contribution amounts are their value for a full year. If a businessman registered or officially closed down his activities in the middle of the year, then the amounts of deductions are calculated in proportion to the time he worked as an individual entrepreneur.

Here are examples of calculating contributions in various circumstances.

Example 1: fixed payments for individual entrepreneurs in 2022 for less than a full year of work

The individual entrepreneur was registered on May 18, 2022. Income was received for 2022. in the amount of 280 thousand rubles.

Calculation:

- Amount of contributions for 7 full months of work (from June to December 2019):

To the Pension Fund of the Russian Federation – 17,123.17 rubles. (29,354 / 12 x 7);

In the Federal Compulsory Medical Insurance Fund - 4015.67 rubles. (6884 / 12 x 7);

- Individual entrepreneur status was received on May 18, therefore, it is necessary to include 14 days of May in the calculation (from the 18th to the 31st). Amount of deductions for 14 days:

In the Pension Fund of Russia – 1104.72 rubles. (29,354 / 12 / 31 x 14);

In the Federal Compulsory Medical Insurance Fund – 259.08 rubles. (6884 / 12 / 31 x 14).

- Amount of contributions for 2022:

To the Pension Fund of Russia – 18,227.89 rubles. (17,123.17 + 1104.72);

In the Federal Compulsory Medical Insurance Fund - 4274.75 rubles. (4015.67 + 259.08).

- The total amount of contributions is 22,502.64 rubles. (18227.89 + 4274.75).

In the same way (in proportion to the number of months of work and days in an incompletely worked month), deductions are calculated if the businessman finished his activity in the middle of the year. They must be paid within 15 days (calendar) from the date of official deregistration with the Federal Tax Service.

Example 2: calculation of contributions for income over 300 thousand rubles.

For 2022, the individual entrepreneur received income in the amount of 960 thousand rubles. Let's calculate the amount of contributions:

- Amount of fixed payment for individual entrepreneurs 2022. in the Pension Fund of the Russian Federation – 29,354 rubles, the Compulsory Medical Insurance Fund – 6,884 rubles.

- The amount for additional taxation is 660,000 rubles. (960000 – 300000);

- The amount of the additional contribution to the Pension Fund is 6,600 rubles. (660000 x 1%);

- The total amount of contributions is 42,838 rubles, of which:

— 36238 rub. with payment no later than December 31, 2019;

— 6600 rub. must be paid by 07/01/2020 inclusive.

Who pays fixed fees

Contributions in a fixed amount are required to be paid by all individual entrepreneurs, regardless of the taxation system for individual entrepreneurs, business activities and the availability of income. In particular, if an individual entrepreneur works somewhere under an employment contract, and insurance premiums are paid for him by the employer, this is not a basis for exemption from paying contributions calculated in a fixed amount.

Please note that since 2010, contributions are also paid by those individual entrepreneurs who in previous years enjoyed benefits: military pensioners pay contributions on the same basis as all other entrepreneurs. Since 2013, you can avoid paying fixed contributions for the following periods:

- conscription service in the army;

- the period of care of one of the parents for each child until he reaches the age of one and a half years, but not more than three years in total;

- the period of care provided by an able-bodied person for a group I disabled person, a disabled child or a person who has reached the age of 80 years;

- the period of residence of spouses of military personnel serving under contract with their spouses in areas where they could not work due to lack of employment opportunities, but not more than five years in total;

- the period of residence abroad of spouses of employees sent to diplomatic missions and consular offices of the Russian Federation, permanent missions of the Russian Federation to international organizations, trade missions of the Russian Federation in foreign countries, representative offices of federal executive authorities, state bodies under federal executive authorities or as representatives these bodies abroad, as well as to representative offices of state institutions of the Russian Federation (state bodies and state institutions of the USSR) abroad and international organizations, the list of which is approved by the Government of the Russian Federation, but not more than five years in total.

However, if entrepreneurial activity was carried out during the above periods, then contributions will have to be paid (clause 7 of Article 430 of the Tax Code of the Russian Federation).

Individual entrepreneur: fixed payment 2022

In 2022, contributions are not tied to the minimum wage; their amount is established by law. With an annual income not exceeding 300 thousand rubles, contributions will be:

- RUB 29,354 to the Pension Fund of Russia;

- 6884 rub. to the Compulsory Medical Insurance Fund

For comparison: in 2018 contributions are:

- RUB 26,545 to the Pension Fund;

- 5840 rub. and the MHIF.

If a businessman’s annual income exceeds 300 thousand rubles, in addition to the fixed payment, he will have to pay an additional 1% of the excess amount to the Pension Fund. The maximum amount of contributions for income received during the year has also been established - 234,832 rubles. (an eightfold increase in the fixed payment to the Pension Fund).

For information! Individual entrepreneurs are exempt from insurance premiums for temporary disability and maternity, but have the right to pay them on their own initiative. But a businessman should not make contributions to the Social Insurance Fund for industrial injuries, even on a voluntary basis.

What determines the size of contributions?

Until January 1, 2022, the amount of individual entrepreneur contributions depended on the minimum wage.

However, due to the fact that the minimum wage is going to be increased to the subsistence level, individual entrepreneurs’ contributions were decided to be “delinked” from it, and starting from 2022, the fixed amount of contributions paid per year is indicated in the Tax Code.

Since 2014, the amount of fixed contributions also depends on the annual income of the individual entrepreneur, since if the income exceeds 300 thousand rubles during the year. it is necessary to charge another 1% contribution on the amount of income exceeding 300 thousand rubles.

Income is calculated as follows:

- Under OSNO - income accounted for in accordance with Article 210 of the Tax Code of the Russian Federation. i.e. those incomes that are subject to personal income tax (applies only to income received from business activities). When determining these incomes, expenses are taken into account (Resolution of the Constitutional Court of November 30, 2016 No. 27-P);

- Under the simplified tax system with the object of taxation, “income” is income taken into account in accordance with Article 346.15 of the Tax Code of the Russian Federation. Those. those incomes that are taxed under the simplified tax system (such income is indicated in column 4 of the book of income and expenses and is indicated in line 113 of the tax return under the simplified tax system);

- Under the simplified tax system with the object of taxation “income reduced by the amount of expenses” - income taken into account in accordance with Article 346.15 of the Tax Code of the Russian Federation. Those. those incomes that are taxed under the simplified tax system (such income is indicated in column 4 of the book of income and expenses and is indicated in line 213 of the tax return under the simplified tax system). However, there are decisions of courts, including the Supreme Court, that expenses can be taken into account. However, the Ministry of Finance still maintains that all income is taken to calculate contributions.

- Under the Unified Agricultural Tax - income accounted for in accordance with paragraph 1 of Article 346.5 of the Tax Code of the Russian Federation. Those. those incomes that are taxed under the Unified Agricultural Tax (such income is indicated in column 4 of the book of income and expenses and is indicated in line 010 of the tax return under the Unified Agricultural Tax). Expenses are not taken into account when determining income for calculating contributions;

- For UTII - the taxpayer's imputed UTII income, calculated according to the rules of Article 346.26 of the Tax Code of the Russian Federation. Imputed income is indicated in line 100 of section 2 of the UTII declaration. If there are several sections 2, then the income is summed up across all sections. When determining annual income, imputed income from declarations for the 1st-4th quarter is added up.

- With PSN - potential income, calculated according to the rules of Article 346.47 of the Tax Code of the Russian Federation and Article 346.51 of the Tax Code of the Russian Federation. Those. the income from which the cost of the patent is calculated.

- If an individual entrepreneur applies several taxation systems simultaneously, then the income from them is added up

Taxes

The main news in the field of taxation is the increase in VAT from January 1, 2022. The maximum value added tax rate will increase from 18% to 20%. The increase in VAT will affect even those entrepreneurs who do not pay it because they work under special regimes.

Most individual entrepreneurs are built into a chain of counterparties working on a common system, so the increased VAT rate will be reflected in the price of purchased goods and services. Many experts believe that real price increases will exceed 2%, and ultimately this will negatively affect consumer demand.

As for tax rates under special regimes, the situation here is more even. For payers of the simplified tax system and unified agricultural tax, nothing has changed. A slight increase in tax payments is expected on UTII due to the annual increase in the K1 coefficient, in this case from 1.868 to 1.915.

The cost of an individual entrepreneur’s patent may also increase in certain regions, but here everything depends on the decisions of municipal authorities. If they exercise their right to change the potential annual income for certain activities, the patent will cost more.

But the real innovation in the taxation of individual entrepreneurs can be called a new type of tax - on professional income. This tax is designed specifically for the so-called self-employed who are engaged in small businesses without registering with the Federal Tax Service.

Starting from 2022, individual entrepreneurs who operate in Moscow, the Moscow and Kaluga regions, and the Republic of Tatarstan can also become NAP payers.

The tax rate on professional income depends on the category of clients or buyers. If these are ordinary individuals, then the tax will be only 4% of the income received, and if they are individual entrepreneurs or organizations, then 6%. NAP payers do not pay insurance premiums for themselves.

To work under this new regime in one of the above regions, a number of restrictions must be observed:

- have no employees;

- receive an annual income of no more than 2.4 million rubles;

- not engage in resale of goods, as well as trade in excisable and marked goods.

All other conditions for NAP payers can be found out from the primary source.

Calculation of contributions for incomes over 300 thousand rubles

If the income of the payer of insurance premiums for the billing period exceeds 300,000 rubles, in addition to the fixed pension contributions indicated above (29,354 rubles), contributions are paid in the amount of 1% of the income exceeding 300,000 rubles. Note! Health insurance premiums for incomes over 300 thousand rubles are not paid

! Those. The amount of contributions to the FFOMS is fixed for all individual entrepreneurs, regardless of the amount of annual income.

Example:

The income of an individual entrepreneur in 2022 was: 350,000 rubles. for activities subject to the simplified tax system and 100,000 rubles. for activities for which UTII is applied (how income is calculated is indicated above). Total 450,000 rub. The amount of contributions to the Pension Fund for 2022 will be 29,354 + (450,000 − 300,000) × 1% = 30,854 rubles. The amount of contributions to the FFOMS is 6,884 rubles.

The total amount of fixed insurance contributions to the Pension Fund for the year cannot be more than eight times the fixed amount of insurance contributions established for the year. Those. no more than 29354 x 8 = 234,832 rubles.

Example:

The income of an individual entrepreneur using the simplified tax system in 2022 was: 30,000,000 rubles. The amount of contributions for 2022 would be 29,354 + (30,000,000 − 300,000) × 1% = 326,354 rubles, however, since it is greater than the maximum possible contributions of 234,832 rubles, 234,832 rubles are paid. contributions to the Pension Fund and contributions to the Federal Compulsory Medical Insurance Fund in the amount of 6,884 rubles.

What fees do individual entrepreneurs need to pay in 2019?

Individual entrepreneurs are required to pay insurance premiums on payments and remunerations accrued in favor of individuals within the framework of labor relations and civil contracts for the performance of work and provision of services (Clause 1 of Article 419 of the Tax Code of the Russian Federation). But individual entrepreneurs must also transfer mandatory insurance premiums “for themselves” (Article 430 of the Tax Code of the Russian Federation):

- for pension insurance;

- for health insurance.

In 2022, individual entrepreneurs are required to pay insurance premiums “for themselves” in any case. That is, regardless of whether they are actually conducting business activities or are simply registered as individual entrepreneurs and are not engaged in business. This follows Article 430 of the Tax Code of the Russian Federation.

There are also insurance premiums in case of temporary disability and in connection with maternity. Individual entrepreneurs, as a general rule, do not pay this type of insurance premiums (clause 6 of Article 430 of the Tax Code of the Russian Federation). However, payment of these contributions can be made on a voluntary basis. This is provided for in Article 4.5 of the Federal Law of December 29, 2006 No. 255-FZ. Why pay these contributions voluntarily? This is done so that in the event of, for example, illness, the individual entrepreneur can receive an appropriate sickness benefit at the expense of the Social Insurance Fund.

Individual entrepreneurs do not pay insurance premiums for injuries at all. Payment of this type of insurance premiums by individual entrepreneurs is not provided even on a voluntary basis.

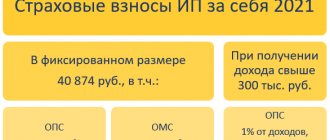

Mandatory fixed contributions for individual entrepreneurs in 2022

Individual entrepreneur contributions for 2022 are in no way tied to the minimum wage. They are established by law dated November 27, 2017 No. 335-FZ:

· to the Pension Fund of the Russian Federation - 29,354 rubles. + 1% on individual entrepreneur income over 300,000 rubles. (the total payment is limited to a limit of RUB 234,832);

· In the Federal Compulsory Medical Insurance Fund - 6,884 rubles.

The table below shows the amounts of all contribution payments, as well as the due dates for their payment:

| Where to pay | Size (amount) | Payment due date |

| For pension insurance in the Federal Tax Service (fixed amount) | RUB 29,354 | 31/12/2019 |

| For medical insurance in the Federal Tax Service (fixed amount) | RUB 6,884 | 31/12/2019 |

| For pension insurance in the Pension Fund of the Russian Federation with income exceeding 300,000 rubles for 2022 | 1% of the amount of income exceeding 300,000 rubles. At the same time, the amount of all payments of individual entrepreneurs for themselves is limited to the amount of 234,832 rubles. | 01/07/2020 |

Due date for payment of contributions

Insurance premiums for the billing period are paid by individual entrepreneurs no later than December 31 of the current calendar year, with the exception of contributions in the amount of 1% on income exceeding 300 thousand rubles.

Insurance premiums calculated on the amount of income of the payer of insurance premiums exceeding 300,000 rubles for the billing period are paid by the payer of insurance premiums no later than July 1 of the year following the expired billing period.

Contributions (including contributions for compulsory health insurance) are paid from January 1, 2022 not to the Pension Fund, but to the tax office. Including contributions for previous years.

Result..Total you need to pay:

| To the Pension Fund: 32448 To the Federal Compulsory Medical Insurance Fund: 8426 Total amount: 40874 You chose 2022 or 2022: Contribution for the full year - 2022 (minimum wage does not matter). The fixed payment to the pension fund in 2022 for individual entrepreneurs amounted to ( a total of 12 full months ): for the insurance part of the pension: = Since 2014, the Pension Fund of Russia has been paying only the insurance portion in one payment (regardless of age). Also, since 2014, when accumulating income exceeding 300,000 (since the beginning of the year), the individual entrepreneur pays 1% to the Pension Fund of the Russian Federation on the amount of income exceeding 300,000 rubles (per year)... That is. if the income is 400,000 rubles. then you need to pay 400,000 -300,000 rubles = 100,000 *1% = 1000 rubles. |