Pay taxes in a few clicks!

Pay taxes, fees and submit reports without leaving your home!

The service will remind you of all reports. Try for free

Under the simplified taxation system, taxpayers make a quarterly “prepayment” to the budget for a single tax - an advance payment. At the end of the tax period - one year - you need to draw up a declaration and pay the remaining amount of tax. In this article we will tell you how to calculate advance payments during the year and calculate the annual payment. Let's consider the objects of taxation “Income” and “Income minus expenses”.

Advances under the simplified tax system in 2022

On the simplified tax system, a single tax must be paid annually. At the same time, it is important to make advance payments every quarter during the year. The Federal Tax Service expects payments from organizations and individual entrepreneurs by the 25th of the month following the reporting period. In 2022 the deadlines are as follows:

| Reporting period | 2022 |

| 1st quarter | 25th of April |

| half year | July 25 |

| 9 months | the 25th of October |

If the 25th falls on a weekend or non-working holiday, the due date is postponed to the next working day.

There is formally no advance payment for the 4th quarter. It represents the final payment for the year. Organizations and individual entrepreneurs calculate tax according to the simplified tax system, taking into account all previously paid advance payments. Simplifiers at the object “Income minus expenses” calculate a single or minimum tax. You need to transfer taxes to the budget:

| for 2022 | |

| IP | May 4, 2022 |

| OOO | March 31, 2022 |

Don't ignore down payments. If an entrepreneur decides to calculate and transfer the tax only after the end of the calendar year, he will have to respond in rubles: for each day the advance payment is late, the Federal Tax Service charges penalties - use our free penalty calculator to calculate their amount. If a businessman fails to pay tax for the year, in addition to penalties, he faces a fine of 20% or 40% of the unpaid amount.

Pay taxes in the Kontur.Accounting web service! The system itself will calculate the amount, prepare a payment invoice and remind you of payment. Get free access for 14 days

Payment of advance payments under the simplified tax system: KBK

If the BCC is correctly indicated, the advance payment of the simplified tax system will be correctly credited to the budget of the Russian Federation. The payer should carefully fill out this field in the payment order.

Here are the BCCs for tax transfers in force in 2022:

- 182 1 0500 110 — KBK tax calculated by “simplified people” with the object of taxation “income”;

- 182 1 0500 110 - BCC of tax calculated by taxpayers operating on the simplified tax system with the object of taxation “income minus expenses”, and from 2022 this BCC is also applied when paying the minimum tax.

Let us remind you that the lists of KBK are approved by the Ministry of Finance.

Read more about the KBK used under the simplified tax system in the material “KBK under the simplified tax system “income” for 2022-2023.”

Advance payment for 1st quarter

Calculation of the advance payment for the 1st quarter using the “income” base

Step 1. To calculate the tax, we determine the tax base: we sum up all income from the beginning of the year. This indicator is taken from the 1st section of the Book of Income and Expenses. Organizations and individual entrepreneurs on a simplified basis take into account revenue from sales as income, as well as non-operating income, which are listed in Art. 249 and 250 of the Tax Code of the Russian Federation.

Step 2. The tax amount is calculated using the formula: Income × Tax rate. Check the tax rate for your type of activity and your region - it can range from 1 to 6%. From January 1, 2021, an increased rate of 8% also appeared for those taxpayers who violated the basic limits. We will explain below how to calculate the tax if the limits are exceeded.

Step 3. Simplified workers on the “income” basis have the right to apply a tax deduction and reduce the tax by the amount of insurance premiums paid for employees, as well as sick leave paid by the employer.

- LLCs and individual entrepreneurs with employees can reduce tax by no more than 50%.

- An individual entrepreneur without employees has the right to reduce tax without restrictions by the amount of insurance premiums that he pays for himself.

The trade tax deduction is applied without restrictions.

Now we deduct from the tax amount all paid contributions, fees and sick leave. If the amount of the tax deduction exceeds 50% of the tax (for organizations and individual entrepreneurs with employees), then the tax is reduced only by half.

An example of calculating an advance payment for Kopyto LLC for the 1st quarter of 2022

Tax base “income”, rate 6%.

The enterprise's income from the beginning of the year to the end of March amounted to 150,000 rubles.

- Advance payment for the 1st quarter: 150,000 × 6% = 9,000 rubles.

We may reduce this amount by the amount of fees paid. The organization has two employees, the salary of each of them is 30,000 rubles. Insurance contributions are paid from the salary in the amount of 30%, that is, 18,000 rubles per month. Over the past quarter, the organization transferred insurance premiums in the amount of 54,000 rubles (18,000 × 3). Sick leave was not paid.

We see that the amount of contributions is greater than the amount of tax, but we can still only reduce the tax by half:

- 9,000 × 50% = 4,500 rubles.

Thus, the organization must pay 4,500 rubles by April 25.

Calculation of the advance payment for the 1st quarter using the “Income minus expenses” base

Step 1. Determine the tax base. The amount of income is taken from section 1 KUDIR - the total amount for the reporting period, column 4. Simplified people must take into account income in the tax base in accordance with Art. 249 and 250 of the Tax Code of the Russian Federation. The amount of expenses that we will deduct from income is taken from column 5 of section 1 KUDIR. Under the simplified tax system, economically justified and documented costs are recognized as expenses, which are listed in paragraph 1 of Art. 346.16 Tax Code of the Russian Federation. You can read about how to keep track of expenses under the simplified tax system in our article.

Step 2. The tax amount is calculated using the formula: (Income – Expenses) × 15%. Check the tax rate for your region and type of activity, it may be less than 15%.

A separate question: what to do with insurance premiums? In accordance with clause 1.7 of Art. 346.16 of the Tax Code of the Russian Federation, simplified versions include paid insurance premiums as expenses. This applies to contributions for employees and contributions from entrepreneurs “for themselves.” Paid insurance premiums reduce the tax base and the tax itself.

An example of calculating an advance payment for an individual entrepreneur A.V. Petrov for 1st quarter.

Tax base “income minus expenses”, rate 15%.

The income of the individual entrepreneur from January to the end of March amounted to 120,000 rubles. The individual entrepreneur's expenses for 3 months amounted to 40,000 rubles. Individual entrepreneur Petrov pays insurance premiums for himself in each quarter of 10,220 rubles, he included this amount in expenses.

- Advance payment amount: (120,000 – 40,000) × 15% = 12,000 rubles.

Thus, the individual entrepreneur must pay 12,000 rubles by April 25.

The Kontur.Accounting web service will calculate the tax itself, prepare a payment invoice and remind you of the payment deadlines:

Calculation of the advance payment for the simplified tax system “income”

The procedure for calculating advance payments under the simplified tax system “income” has not changed for several years. The most important change, which came into force in 2022, will not affect all payers of the simplified tax system. It is associated with the introduction of a transition period, during which the tax rate increases to 8% and the calculation procedure changes. Let's look at the rules for calculating advances for standard and increased rates.

Algorithm for calculating payment at a standard rate of 1–6%

Step 1. To calculate the tax base, we sum up all the company’s income from the beginning of the year to the end of the quarter for which we calculate the advance payment. These numbers are taken from column 4 of section 1 KUDiR. Revenue from sales and other income, the list of which is given in Art. 249 and art. 250 Tax Code of the Russian Federation.

We calculate the tax amount using the formula: Income (rubles) × Tax rate (%)

Check the tax rate for your type of activity in your region - it can be reduced even to 1%. Also note that after exceeding the amount of revenue of 164.4 million rubles or the average headcount of 130 people, the tax rate rises to 8%.

Step 2. Payers of the 6% simplified tax system have the right to apply a tax deduction and reduce the amount of tax. The tax can be reduced by the amount of insurance premiums for yourself and your employees and by the amount of sick leave paid at the expense of the employer.

- LLCs and entrepreneurs with employees reduce tax by no more than 50%.

- An individual entrepreneur without employees has the right to reduce the tax by the amount of all insurance premiums that he pays for himself.

Companies that pay a trade tax include the amount of the fee in their tax deduction. The levy reduces the tax without the above limitations.

Step 3. From the resulting amount, you need to subtract advance payments that were made in previous periods of the current calendar year.

An example of calculating an advance payment for the 2nd quarter according to the simplified tax system 6%

Fire and Ice LLC received income in the amount of 660,000 rubles for the first half of the year. Of these, in the 1st quarter 310,000 rubles and in the 2nd quarter 350,000 rubles. Advance payment for the 1st quarter - 9,300 rubles.

We calculate the tax for six months : 660,000 × 6% = 39,600 rubles.

We do tax deductions. The organization has 2 employees, they pay contributions of 20,000 per month, there were no sick days for six months, the company does not pay a trading fee. So, for 6 months, contributions of 20,000 × 6 = 120,000 rubles were paid. We see that the amount of the tax deduction is greater than the amount of tax, which means we can reduce the tax by only 50%. 39,600 × 50% = 19,800 rubles.

We reduce the amount of tax by deduction and advance payment for the 1st quarter : 39,600 – 19,800 – 9,300 = 10,500 rubles.

So, at the end of the six months, you need to make an advance payment of 10,500 rubles.

The Kontur.Accounting web service will calculate the tax amount, prepare a payment slip and remind you of the payment date:

Algorithm for calculating payment at an increased rate of 8%

Step 1: Calculate your down payment for the year-to-date period in which you were within the limits and applied the standard tax rate. To do this, use the standard formula: Income for the reporting period × Tax rate (6% if there is no right to a reduced rate).

Step 2. Calculate the down payment for the period in which you are required to apply the increased rate. To do this, you will need the amount obtained in the first step. Use the formula:

Advance payment at the increased rate = Advance payment for the period before the excess, calculated in step 1 + (Revenue for the reporting period with excess - Revenue for the reporting period in which the limits were met) × 8%.

Step 3 . Reduce the calculated payment at the increased rate by tax deductions and advance payments based on the results of previous periods.

An example of calculating an advance payment for 9 months at an increased rate of 8%

Based on the results of 9 months of 2022, Woodpecker LLC earned 170 million rubles. At the end of the 1st quarter, revenue amounted to 75 million rubles, and at the end of the half year - 120 million rubles. Having exceeded the limit of 164.4 million rubles, the organization did not lose the right to the simplified tax system, but received the obligation to calculate tax at an increased rate of 8%.

Calculate advance payments for the 1st quarter and half of the year in the usual manner:

- Advance payment for the 1st quarter: 75,000,000 × 6% = 4,500,000 rubles.

- Advance payment for six months: 120,000,000 × 6% – 4,500,000 = 2,700,000 rubles.

Advance payment for 9 months is calculated at an increased rate:

- Advance payment for 9 months: (120,000,000 × 6%) + ((170,000,000 - 120,000,000) × 8%) = 11,200,000 rubles.

The received payment amount must be reduced by advances for the 1st quarter and half of the year, as well as tax deductions (600,000 rubles in insurance premiums for 9 months).

- Advance payment for 9 months due: 11,200,000 - 4,500,000 - 2,700,000 - 600,000 = 3,400,000 rubles.

The payment based on the results of 9 months will be 3,400,000 rubles.

Pay taxes in the Kontur.Accounting web service! The system itself will calculate the amount, prepare a payment invoice and remind you of payment. Get free access for 14 days

Advance payment for 2nd quarter

Calculation of the advance payment for the 2nd quarter using the “income” base

The procedure for calculating the advance payment for the second quarter is similar to the first. It is important to keep in mind that advance payments paid in the last quarter must first be subtracted from the calculated tax amount.

An example of calculating an advance payment for LLC “Kopyto” for the 2nd quarter

The enterprise's income from the beginning of the year to the end of June amounted to 270,000 rubles. Of these, 150,000 rubles for the 1st quarter and 120,000 rubles for the 2nd quarter. Advance payment for the 1st quarter - 4,500 rubles.

- Tax amount for the half year: 270,000 × 6% = 16,200 rubles

We can reduce this amount by the amount of contributions paid, which for the first six months amounted to, say, 108,000 rubles. Sick leave was not paid. We see that the amount of contributions is greater than the amount of tax, but the tax can still only be reduced by half:

- Tax amount for half a year with deduction: 16,200 × 50% = 8,100 rubles

Now from this amount we must subtract the advance payment of the 1st quarter: 8,100 – 4,500 = 3,600 rubles.

Thus, the organization must pay 3,600 rubles by July 25.

Calculation of the advance payment for the 2nd quarter using the “Income minus expenses” base

The procedure for calculating the advance payment for the taxable base “Income minus expenses” is also similar to the first quarter. But the advance paid in the first quarter must first be deducted from the amount of tax calculated in the second quarter.

An example of calculating an advance payment for an individual entrepreneur A.V. Petrov for the 2nd quarter.

The income of the individual entrepreneur from January to the end of June amounted to 230,000 rubles. Of these, 120,000 were for the 1st quarter, 110,000 were for the 2nd quarter. The individual entrepreneur's expenses for 6 months amounted to 85,000 rubles. Of these, 40,000 for the 1st quarter, 45,000 for the 2nd quarter. Advance payment in the 1st quarter - 12,000 rubles. Individual entrepreneur Petrov pays insurance premiums for himself in each quarter of 10,200 rubles, he included these amounts in expenses.

- Tax amount for half a year: (230,000 – 85,000) × 15% = 21,750 rubles

Now we subtract the advance payment for the 1st quarter from this amount: 21,750 - 12,000 = 9,750 rubles.

Thus, the individual entrepreneur must pay 9,750 rubles by July 25.

Advance payment for 3rd quarter

Calculation of the advance payment for the 3rd quarter using the “income” base

The procedure for calculating the advance payment for the third quarter is similar to the first. It is important to keep in mind that advance payments paid in the first and second quarter must first be subtracted from the calculated tax amount.

An example of calculating an advance payment for LLC “Kopyto” for the 3rd quarter

Tax base “income”, rate 6%

The enterprise's income from the beginning of the year to the end of September amounted to 420,000 rubles. Of these, 150,000 rubles for the 1st quarter, 120,000 rubles for the 2nd quarter and 150,000 for the 3rd quarter. Advance payments for the 1st quarter - 4,500 rubles, for the 2nd quarter - 3,600 rubles.

- Tax amount for 9 months: 420,000 × 6% = 25,200 rubles.

We can reduce this amount by the amount of contributions paid, which over the past 9 months amounted to 162,000 rubles. Sick leave was not paid. The amount of contributions is greater than the amount of tax, but we can still only reduce the tax by half:

- Tax amount for 9 months with deduction: 25,200 × 50% = 12,600 rubles

Now from this amount we must subtract the advance payments of the 1st and 2nd quarters: 12,600 - (4,500 + 3,600) = 4,500 rubles.

Thus, the organization must pay 4,500 rubles by October 25.

Calculation of the advance payment for the 3rd quarter on the basis of “income minus expenses”

The procedure for calculating the advance payment for the taxable base “Income minus expenses” is also similar to the first quarter. But advances paid in the first and second quarters must first be deducted from the tax amount calculated in the third quarter.

An example of calculating an advance payment for an individual entrepreneur A.V. Petrov for the 3rd quarter

Tax base “Income minus expenses”, rate 15%

The income of the individual entrepreneur from January to the end of September amounted to 380,000 rubles. Of these, 120,000 were for the 1st quarter, 110,000 for the 2nd quarter and 150,000 for the 3rd quarter.

The individual entrepreneur's expenses for 9 months amounted to 125,000 rubles. Of these, 40,000 for the 1st quarter, 45,000 for the 2nd quarter and 40,000 for the 3rd quarter.

Advance payments in the 1st quarter - 12,000 rubles, in the 2nd quarter - 9,750 rubles.

Individual entrepreneur Petrov pays insurance premiums for himself in each quarter of 10,200 rubles, he included these amounts in expenses.

- Tax amount for 9 months: (380,000 – 125,000) × 15% = 38,250 rubles.

Now we subtract from this amount the advance payments of the 1st and 2nd quarters: 38,250 – (12,000 + 9,750) = 16,500 rubles.

Thus, the individual entrepreneur must pay 16,500 rubles by October 25.

Pay taxes in the Kontur.Accounting web service! The system itself will calculate the amount, prepare a payment invoice and remind you of payment. Get free access for 14 days

Calculation of the advance payment for the simplified tax system “income minus expenses”

The rules for calculating advance payments and tax under the simplified tax system “income minus expenses” have also not changed. The only change is the appearance of a transition period with increased rates. Let's look at the calculation procedure for both cases.

Algorithm for calculating payment at a standard rate of 5–15%

Step 1. We sum up all the company’s income from the beginning of the year to the end of the desired quarter. We take the numbers from column 4 of section 1 KUDiR. Income for the simplified tax system includes proceeds from sales and other income that are listed in Art. 249 and Art. 250 Tax Code of the Russian Federation.

Step 2. We sum up the business expenses from the beginning of the year to the end of the required period, we take the numbers from column 5 of section 1 of KUDiR. A complete list of costs that can be taken into account as enterprise expenses is given in Art. 346.16 Tax Code of the Russian Federation. It is also important to follow the procedure for accounting for expenses: expenses must be directly related to the activities of the enterprise, must be paid and recorded in the accounting department. We talked about how to correctly account for the costs of the simplified tax system. Insurance premiums for the simplified tax system of 15% are considered expenses and are taken into account as part of them.

We calculate the tax amount using the formula: (Income – Expenses) × 15%.

Check the tax rate for the type of activity of your enterprise in your region. Since 2016, the region can set a differentiated rate from 5 to 15%.

Step 3. Now we subtract from the tax amount the advance payments that were made in previous periods of the current calendar year.

An example of calculating an advance payment for the 3rd quarter according to the simplified tax system 15%

IP Myshkin A.V. Since the beginning of the year, I received an income of 450,000 rubles. Of these, for the 1st quarter 120,000 rubles, for the 2nd quarter 140,000 rubles and for the 3rd quarter 190,000 rubles.

Expenses since the beginning of the year amounted to 120,000 rubles. Of these, 30,000 rubles - in the 1st quarter, 40,000 rubles in the 2nd quarter and 50,000 rubles in the 3rd quarter.

Advance payments amounted to: 13,500 rubles in the 1st quarter and 15,000 rubles in the 2nd quarter.

Let's calculate the amount payable in the 3rd quarter: (450,000 – 120,000) × 15% = 49,500 rubles.

Let us subtract payments from previous quarters from this amount: 49,500 – 13,500 – 15,000 = 21,000 rubles.

So, according to the results of the 3rd quarter, individual entrepreneur Myshkin must pay 21,000 rubles.

Algorithm for calculating payment at an increased rate of 20%

Step 1 . Calculate the accrued advance payment for periods in which the limits were not exceeded. To do this, use the standard formula: (Income for the reporting period – Expenses for the reporting period) × Tax rate (15%, if there is no right to reduced rates).

Step 2 . Calculate the down payment for the period of exceeding the limits. To do this, you will need the amount obtained in Step 1. Use the following formula:

Advance payment at an increased rate = Advance payment for the period before the excess, calculated in step 1 + (Tax base for the reporting period with excess - Tax base for the reporting period in which the limits were met) × 20%.

Step 3. Calculate the advance payment for additional payment or reduction by subtracting advance payments for previous periods from the amount received in Step 2.

An example of calculating an advance payment on the simplified tax system “income - expenses” at a rate of 20%

Based on the results of 9 months of 2022, Snegir LLC earned 170 million rubles. In this regard, the advance payment for 9 months must be calculated at an increased rate of 20%. At the end of the half year, revenues amounted to 125 million rubles.

The tax base at the end of the six months amounted to 25 million rubles, at the end of 9 months - 50 million rubles.

Let's calculate the advance payment for 9 months of 2022:

(25,000,000 × 15%) + ((500,000) × 20%) = 8,750,000 rubles.

The accrued advance payment for 9 months can be reduced by advance payments paid during the year (4 million rubles). In this case, the amount of the advance payment for additional payment will be 4,750,000 rubles (8,750,000 - 4,000,000 rubles).

Pay taxes in the Kontur.Accounting web service! The system itself will calculate the amount, prepare a payment invoice and remind you of payment. Get free access for 14 days

What to do if you are late with your quarterly advance payment

Sometimes an entrepreneur does not have available funds to pay an advance payment and makes the payment later - closer to the end of the year or together with the payment of tax calculated at the end of the year. This means that the businessman will have to pay a penalty for each day of delay. If the advance had to be transferred before April 25 inclusive, then the first day for accrual of penalties for non-payment is April 26. The last day for accrual of penalties is the day on which you paid the advance payment.

Penalties are calculated differently for organizations and individual entrepreneurs. Entrepreneurs charge penalties as follows:

1/300 of the refinancing rate × amount of non-payment × number of days of delay.

The amount of penalties for organizations depends on the number of days of delay. If the delay is less than 30 days, then the formula is similar to the formula for individual entrepreneurs. But if the delay is more than 30 days, the formula becomes more complicated:

(1/300 of the refinancing rate × amount of non-payment × 30) + (1/150 of the refinancing rate × amount of non-payment × number of days of delay from 31 days)

Pay attention to the refinancing rate. Recently, the Central Bank of the Russian Federation has been actively raising its key rate. To avoid errors in calculations, use our free online penalty calculator.

An example of calculating penalties for non-payment of an advance payment in the 3rd quarter

The individual entrepreneur was supposed to pay 12,000 rubles in advance payment by October 25, 2022, but he was able to transfer these funds only on December 11. The delay is 47 days. The key rate of the Central Bank of the Russian Federation during this period was stable - 7.5%.

- 1/300 × 7.5% × 12,000 × 47 = 141 rubles.

Thus, the penalty will be 141 rubles. The individual entrepreneur will have to pay this amount along with the advance payment.

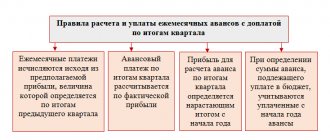

Single tax according to the simplified tax system for the year (payment for the 4th quarter)

There is no advance payment under the simplified tax system for the 4th quarter. The fact is that the tax is paid in installments at the end of each reporting period, and 4 quarters of the year are the tax period. Therefore, for the 4th quarter, it is not an advance payment that is paid, but a tax based on the results of the year or all quarters. When calculating it, all advance payments made during the year are taken into account. Tax payment deadlines in 2021 differ for organizations and entrepreneurs:

| IP | April 30, 2022 |

| OOO | March 31, 2022 |

Calculation of the single tax according to the simplified tax system for the year using the “Income” base

The rules for calculating the single tax according to the simplified tax system are established by Article 346.21 of the Tax Code of the Russian Federation. The tax is calculated using the formula:

TAX = Tax base × 6% – Advance payments for the year

Step 1. Determine income for the period. Let's sum up the income received for the 1st, 2nd, 3rd and 4th quarters on a cumulative basis. This indicator can be found in the first section of the Income and Expense Accounting Book. Organizations and individual entrepreneurs using the simplified tax system take into account revenue from sales as income, as well as non-operating income, which are listed in Art. 249 and 250 of the Tax Code of the Russian Federation.

Step 2. Determine the amount of insurance premiums . The calculated tax is reduced by the amount of insurance premiums paid for the period.

- LLCs and individual entrepreneurs with employees can reduce tax by no more than 50%;

- An individual entrepreneur without employees has the right to reduce tax without restrictions by the amount of insurance premiums that he pays for himself.

Step 3. Determine the tax base. From the amount of income received for the year, we subtract the amount of insurance premiums paid for the year. If the amount of the tax deduction exceeds 50% of the tax (for organizations and individual entrepreneurs with employees), then the tax is reduced only by half.

Step 4. Calculate tax according to the simplified tax system . We multiply the resulting tax base by the tax rate and subtract all advance payments transferred to the budget during the year.

An example of calculating a tax payment for Kopyto LLC for 2021.

Tax base “Income”, rate 6%

LLC "Kopyto" works on a simplified basis with the object of taxation "income". The organization has two employees, the salary of each of them is 30,000 rubles. The company's income for the entire year amounted to 580,000 rubles:

- 1st quarter - 150,000 rubles;

- 2nd quarter - 120,000 rubles;

- 3rd quarter - 150,000 rubles;

- 4th quarter - 160,000 rubles.

During the year, advance payments were transferred for the 1st quarter - 4,500 rubles, for the 2nd quarter - 3,600 rubles, for the 3rd quarter - 4,500 rubles.

- Tax amount for the year: 580,000 × 6% = 34,800 rubles

We may reduce this amount by the amount of fees paid. From the salaries of two employees (30,000 rubles each), insurance premiums are paid monthly in the amount of 30% - 60,000 × 30% = 18,000 rubles per month. Over the past year, the organization transferred insurance premiums in the amount of 18,000 × 12 = 216,000 rubles. Sick leave was not paid.

We see that the amount of contributions is greater than the amount of tax, but we can still only reduce the tax by half.

- Tax amount for the year with deduction: 34,800 × 50% = 17,400 rubles

Now from this amount we must subtract advance payments for three quarters:

- 17,400 – (4,500 + 3,600 + 4,500) = 4,800 rubles.

Thus, the organization must pay 4,800 rubles by March 31, 2022.

Calculation of the single tax according to the simplified tax system for the year using the “Income minus expenses” base

Step 1. Determine the tax base. We take income and expenses from the Income and Expense Accounting Book. Income is recorded in the first section of KUDIR in column 4. “Simplified” must take into account income in the tax base in accordance with Art. 249 and 250 of the Tax Code of the Russian Federation. Expenses are indicated in column 5 of the first section of KUDIR. Economically justified and documented costs, which are listed in clause 1 of Art. 346.16 Tax Code of the Russian Federation.

Unlike the simplified taxation system “Income”, under the “Income minus expenses” system, insurance premiums cannot be deducted. They are immediately included in expenses and reduce the tax base and the tax itself.

Step 2. Determine the tax amount. The tax is calculated using the formula:

Tax = (Income - Expenses) × 15%.

Check the tax rate for your region and type of activity, it may be less than 15%.

Step 3. Calculate the amount of tax payable for the year. From the calculated tax amount, we subtract advance payments that were made in the 1st, 2nd and 3rd quarters.

An example of calculating a tax payment for an individual entrepreneur A.V. Petrov. for 2021

Object of taxation “income minus expenses”, rate 15%

IP income for 2022 amounted to 470,000 rubles, and expenses amounted to 160,000 rubles. Of them:

Quarter Income Expenses 1st quarter 120,000 rubles 40,000 rubles 2nd quarter 110,000 rubles 45,000 rubles 3rd quarter 150,000 rubles 40,000 rubles 4th quarter 90,000 rubles 35,000 rubles Petrov pays quarterly insurance premiums for himself of 10,200 rubles, he included these amounts in expenses.

Advance payments during the year amounted to: 1st quarter - 12,000 rubles, 2nd quarter - 9,750 rubles, 3rd quarter - 16,500 rubles.

- Tax amount for the year: (470,000 - 160,000) × 15% = 46,500 rubles.

Now we subtract advance payments for the year from this amount:

- Tax amount for the year minus advance payments: 46,500 – (12,000 + 9,750 + 16,500) = 8,250 rubles.

Thus, the individual entrepreneur must pay 8,250 rubles by May 4, 2022.

Pay taxes in the Kontur.Accounting web service! The system itself will calculate the amount, prepare a payment invoice and remind you of payment. Get free access for 14 days

Results

Persons who have chosen this tax regime will pay a single tax according to the simplified tax system based on the results of 2022. The tax must be paid by legal entities until 03/31/2022, and by individual entrepreneurs until 05/04/2022 (taking into account the transfer). The tax base and the tax itself are calculated in the declaration submitted to controllers at the end of the year. If taxpayers fail to pay the simplified tax system for the year within the allotted time frame, they face sanctions imposed by the tax authorities in the form of penalties and fines.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Calculation of the minimum tax according to the simplified tax system 15%

It is not always possible to make a business profitable. At the end of the year, expenses may exceed income or differ only slightly. In this case, the tax base will be very tiny or even negative. In this case, the state will not pay you any compensation, but will oblige you to pay a minimum tax. The minimum tax is calculated based on all income received during the tax period at a rate of 1%.

Therefore, at the end of the year it is necessary to calculate the tax in the standard way and the minimum tax. The amount that turns out to be greater is subject to payment to the budget.

An example of calculating the minimum tax for Tea House LLC.

In 2022, income amounted to 180,000 rubles, and expenses amounted to 170,000 rubles.

- Tax amount for the year = (180,000 - 170,000) × 15% = 1,500 rubles per year.

- Minimum tax = 180,000 × 1% = 1,800 rubles.

With a slight difference in income and expenses, the amount of the minimum tax was 300 rubles higher than the amount of tax calculated in the usual way. In this case, Tea House LLC will pay the minimum tax for the year - 1,800 rubles.

The difference between the minimum tax and the tax you would have paid under the standard rules can be taken into account when calculating your tax for subsequent tax periods.

Calculation of advance payments and tax for the year at an increased rate

From January 1, 2022, increased rates began to apply for the simplified tax system. They must be used when basic limits are violated. In 2022 this happens when:

- Income since the beginning of the tax period exceeded 164.4 million rubles, but did not reach 219.2 million rubles;

- The average number of employees in the reporting period exceeded 100 people, but remains less than 130 people.

The increased rate for the simplified tax system “income” is 8%, for the simplified tax system “income minus expenses” - 20%. The size of the increased rates is fixed; they must be applied if the limits are violated, even if there are reduced rates in your region or you are on a tax holiday.

The increased rate applies to the portion of the tax base that falls on the period from the beginning of the quarter in which the excesses occurred.

Calculation procedure

Step 1. Calculate the down payment for the period before exceeding the limits. To do this, determine the advance payment without taking into account deductions by multiplying the tax base by the standard tax rate.

Step 2 . Calculate the advance payment for the period in which the limits were violated. To do this, take the amount calculated in step 1 and add to it the difference between the tax base for the period with excess and the tax base for previous periods, multiplied by 8%. Use the following formula:

Advance payment for the period in which the limits were exceeded = Tax base for the reporting period preceding the quarter in which the limits were exceeded × Tax rate + (Tax base for the reporting period in excess - Tax base for the previous reporting period in which the limits were met) × Increased tax rate

Step 3. If you are calculating the payment for the simplified tax system “income”, additionally reduce the accrued advance payment or additional tax by tax deduction.

An example of calculating an advance payment at a rate of 8% for the simplified tax system “income”

LLC "Bashmachok" on the simplified tax system "income" exceeded the income limit for 9 months and was forced to apply an increased rate of 8%. At the end of the 1st quarter, revenue amounted to 50 million rubles, at the end of the half year 110 million rubles, and at the end of 9 months - 167 million rubles. Advance payments for the 1st quarter and half of the year are calculated in the standard manner:

- Advance payment for the 1st quarter: 50,000,000 × 6% = 3,000,000 rubles.

- Advance payment for half a year: 110,000,000 × 6% – 3,000,000 = 3,600,000 rubles.

The accrued advance payment for 9 months of 2022 must be calculated at an increased rate.

- Advance payment for 9 months: (110,000,000 × 6%) + ((167,000,000 - 110,000,000) × 8%) = 11,160,000 rubles.

The advance payment accrued at the end of 9 months can be reduced by tax deductions (450,000 rubles in insurance premiums for 9 months) and previously paid advance payments.

- Advance payment for 9 months for additional payment: 11,160,000 - 450,000 - 3,000,000 - 3,600,000 = 4,110,000 rubles.

Based on the results of 9 months, Bashmachok LLC must pay an additional 4,110,000 rubles to the budget.