From time to time, organizations have to part with employees. They can leave their place of work at their own request, at the request of the employer, or for other reasons. Regardless of the reasons, upon dismissal, the employee is paid monetary compensation for all unused vacations (Article 127 of the Labor Code of the Russian Federation). In the article we will look at what the specified compensation consists of, how it is regulated and how the calculation is made and when it should be paid. We will also answer the question whether this payment is subject to personal income tax and insurance premiums

So, compensation upon dismissal for unused vacation is a monetary payment due to dismissed employees upon termination of an employment contract to compensate them for unused vacation days during the period of work.

How compensation upon dismissal is regulated

The main documents governing the calculation of compensation upon dismissal are:

- Labor Code of the Russian Federation;

- Regulations on the specifics of the procedure for calculating the average salary (approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922) - hereinafter referred to as the Regulations on the average salary;

- Rules on regular and additional vacations (approved by the NKT of the USSR on April 30, 1930 No. 169) - hereinafter Rules on vacations

What taxes are imposed on compensation payments upon dismissal?

In the event that a worker leaves his position this year immediately after vacation, compensation for unused vacation days will not be accrued to him. Accordingly, there is no need to pay taxes. In all other situations, the accounting department calculates not only the main type of paid leave, but also the additional one provided to employees working in certain positions. These include, for example, workers working in hazardous industries. They are entitled to additional days of paid leave. In accordance with this, upon dismissal, compensation is also accrued.

If an employee is transferred to another branch through dismissal, he is also required to receive compensation for vacation pay with the withholding of all necessary taxes and fees.

An example of calculating compensation for unused vacation

Input data for calculation:

— Antoshkin A.A. hired on May 12, 2016, dismissed on July 13, 2017

— The duration of annual paid leave in the organization is 28 days. During the period of his working life Antoshkin A.A. I was on vacation for 14 days from 09/04/2016 to 09/17/2016, and on sick leave from 01/11/2017 to 01/13/2017.

— For the billing period from 07/01/2016 to 06/30/2017, the following were accrued: wages in the amount of 150,000 rubles, vacation pay in the amount of 12,000 rubles, as well as temporary disability benefits in the amount of 1,500 rubles.

Vacation period and vacation days

Full working years - 1 year (period from 05/12/2016 to 05/11/2017). A full year corresponds to a full vacation of 28 days.

The remaining months worked are accounted for as follows:

- the period from 05/12/2017 to 07/11/2017 is included in the calculation of the vacation period and is calculated as: 2 months x 28 days ÷ 12 = 4.67;

- the period from 07/12/2017 to 07/13/2017 is not included in the calculation of vacation experience, because less than half a month worked (clause 35 of the Leave Rules).

Important! Rounding the result to whole days is possible only in favor of the employee. (Letter of the Ministry of Health and Social Development of the Russian Federation dated December 7, 2005 No. 4334-17 “On the procedure for determining the number of calendar days of unused vacation”)

Total Antoshkin A.A. for the period of work, according to the conditions of our example, it is necessary: 28 + 4.67 = 32.67 days of vacation.

The number of unused vacation days for which the employee is entitled to compensation upon dismissal will be: 32.67 – 14 (was on vacation) = 18.67 days.

Note! If an employee has worked for an organization for less than a year, then the calculation of unused vacation days is carried out in a special manner (Rostrud Letter No. 1133-6 dated July 26, 2006, Rostrud Letter No. 1519-6-1 dated December 18, 2012).

Average daily earnings of an employee

The calculation period for calculating compensation (clause 4 of the Regulations on the average salary) is usually 12 months preceding the month of dismissal (for example, for dismissal in February 2022, this is the period from February 2022 to January 2022). An exception is the case when an employee quits on the last day of the calendar month (for example, January 31, February 28 (29), March 31, etc.) - then the month of dismissal is included in the billing period (Letter of Rostrud dated July 22, 2010 No. 2184- 6-1). Let's return to our example. Because Antoshkin A.A. resigns on July 13, 2017 (not the last day of July), the calculation period for calculating average daily earnings will be the period from July 2016 to June 2022 .

Number of days worked (Article 139 of the Labor Code of the Russian Federation, clause 10 of the Regulations on the average salary). Days worked are all calendar days (working days, weekends, holidays) when the employee was registered in the organization, minus days not worked. Unworked days are days when the employee:

- was on any leave (annual, at your own expense, for child care, etc.);

- was ill or was sent on a business trip;

- for other reasons, he did not work while maintaining the average salary (clause 5 of the Regulations on the average salary, Letter of the Ministry of Labor dated April 15, 2016 No. 14-1/B-351).

Antoshkin A.A. was on vacation from 09/04/2016 to 09/17/2016, and on sick leave from 01/11/2017 to 01/13/2017. In the billing period (from 07/01/2016 to 06/30/2017) Antoshkin A.A. worked completely for 10 months. Each of these months is recognized as equal to 29.3 days. The total number of days for fully worked months will be: 10 x 29.3 = 293 days. The number of days in months not fully worked is calculated as follows:

- for September 2016: 16 days. (actually worked: 30 days (total in September) – 14 days (was on vacation)) ÷ 30 days. (total in September) × 29.3 = 15.63 days;

- Let’s calculate the same for January 2022: 28 days. ÷ 31 days × 29.3 = 26.46 days.

The total number of days worked during the billing period will be (clause 3.2.1 + clause 3.2.2): 293 days. + 15.63 days + 26.46 days = 335.09 days.

Basis for calculating compensation for unused vacation

The base for calculating compensation for unused vacation includes wages and other payments accrued to the employee for days worked (clause 2 of the Regulations on the average salary). Vacation pay, benefits, payment for business trips, financial assistance, etc. are excluded from the calculation. Bonuses and salary increases are taken into account in a special manner (clause 15, clause 16 of the Regulations on the average salary).

Let's return to our example. Antoshkin A.A. for the billing period from 07/01/2016 to 06/30/2017 the following were accrued: wages in the amount of 150,000 rubles, vacation pay in the amount of 12,000 rubles, as well as temporary disability benefits in the amount of 1,500 rubles. The basis for calculating compensation will be 150,000 rubles , because Vacation pay and benefits are not included in it.

We calculate the average daily earnings - 150,000 rubles. ÷ 335.09 days = 447.64 rubles/day

Calculation of compensation upon dismissal for unused vacation

Compensation upon dismissal will be: 18.67 days. × 447.64 rub./day = 8,357.44 rub.

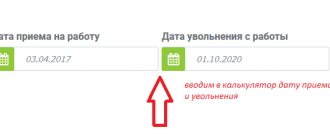

Recommendation: You can use an online calculator to check your calculations.

Dismissal by agreement of the parties and calculation of severance pay: legal aspect

An employment contract can be terminated on the basis of Art. 78 of the Labor Code of the Russian Federation at any time during the period of its validity (clause 1, part 1, article 77). The grounds for its termination are contained in Art. 77 Labor Code of the Russian Federation.

Among other things, the features of termination of a contract by agreement of the parties are:

- the ability to fire an employee who is on vacation or sick leave;

- no restrictions on the amount of severance pay. The amount of compensation paid by the Labor Code of the Russian Federation is not limited, therefore, before dismissal, it is necessary to discuss the specific amount of money due to the employee;

- the ability to choose the date of dismissal without complying with the requirement of two weeks of service, which is typical for the dismissal of a person on his own initiative (you can either increase or shorten the period of service, and even completely eliminate it);

- the impossibility of revoking the dismissal agreement unilaterally without compelling reasons (such as pregnancy of the dismissed woman).

The representative of an LLC or individual entrepreneur and the resigning employee have the right to agree on the accrual of severance pay in an increased amount (for example, twice the average monthly salary), as well as determine the amount of additional compensation. The amount, dates and procedure for payments must be fixed in an agreement on termination of the labor contract, a collective or employment contract.

An agreement “in words” is not provided for by law. The employer can say whatever he wants, and after dismissal, evade the verbal obligation, citing the fact that such an “option” is not provided for in the collective agreement/employment agreement. Therefore, you should not be fooled by such promises from the employer.

CONSULTATION WITH A LAWYER ON LABOR LAW

Taxes upon payment of compensation for unused vacation

Compensation upon dismissal for unused vacation is subject to personal income tax (13%) and insurance contributions in the full amount - usually about 30.2% (Article 217 of the Tax Code of the Russian Federation, Article 422 of the Tax Code of the Russian Federation). For example, for our example, when paying 8,357.44 rubles. it is necessary to withhold personal income tax (1,086 rubles) and accordingly issue (or transfer) 7,271.44 rubles to the employee. The personal income tax amount must be withheld upon actual payment of compensation and transferred to the budget no later than the day following the day of payment to the employee. Also, according to our example, from the amount of 8,357.44 rubles. it is necessary to calculate insurance premiums for compulsory types of insurance: pension, medical, social. Thus, the employer is obliged to additionally accrue and transfer 2,523.95 rubles to the budget.

Example

Initial data:

The employee resigns voluntarily on June 14, 2022. On his last working day, he was paid a salary and compensation for unused vacation in the amount of 24,500 rubles.

The employer is obliged to withhold personal income tax from this income and charge contributions.

Calculation:

Personal income tax = 13% * 24,500 = 3,185 – payment due until June 15, 2022 inclusive.

Compensation to be issued = 24,500 – 3,185 = 21,315.

Insurance deductions:

Pension = 22% * 24,500 = 5,390.

Medical = 5.1% * 24,500 = 1,249.50

VNiM = 2.9% * 24,500 = 710.50.

Injuries = 0.2% * 24,500 = 49.

In total, the employer needs to transfer contributions in the amount of 5390 + 1249.5 + 710.5 + 49 = 7,399 - no later than July 15, 2022 inclusive.

Terms of payment of compensation upon dismissal

Compensation upon dismissal must be paid to the employee on the day of termination of the employment relationship (Article 140 of the Labor Code of the Russian Federation). If a dispute arises between the employer and the employee about the amount of amounts due to the employee upon dismissal, the employer is obliged to pay the amount not disputed by him. If the employee is absent on the day of dismissal, payments are made no later than the day following the day on which he submits a request for payment. If, instead of paying compensation, the employee was granted leave with subsequent dismissal, then compensation is not paid and the employee receives vacation pay in the usual manner.

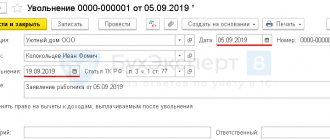

How are compensation payments for unused vacation days documented?

When calculating days to determine the amount of compensation, the accountant must take into account all types of vacations not taken by the employee. As a rule, payment for them is made:

- without an application, special instructions from management, on the basis of an order confirming the fact of dismissal of an employee, and the Labor Code of the Russian Federation;

- when making a payment using form T61. A special form is filled out by personnel officers and accounting department indicating a detailed calculation of the amount to be paid and the accrual of personal income tax;

- minus income taxes withheld from the worker's income.

The final settlement with the employee upon his dismissal is carried out on the last day of work. When calculating accounting, it is necessary to correctly determine the amount of tax and Social Insurance contributions based on the tax base.

Results

In the article, we talked about a situation where an employee did not have time to take all the vacation days allotted to him before being fired. In this case, the employer, regardless of the reasons for dismissal, must pay the employee monetary compensation on the day of dismissal. We have indicated all the necessary indicators for calculating compensation upon dismissal for unused vacation and examined them with an example. For violation of payment terms, the employer bears various legally established types of liability - from financial to criminal. In addition, he is obliged to withhold personal income tax on the day of actual payment of compensation upon dismissal, transfer personal income tax to the budget, and also charge insurance premiums for the entire amount of compensation.

Firmmaker, November 2022 (monitor the relevance) Irina Bazyleva When using the material, a link is required

What holiday payments are not subject to contributions?

The legislation of the Russian Federation provides for the following payments in connection with an annual long vacation, for which payments for insurance purposes are not accrued:

- payment in connection with being on additional leave for citizens exposed to radiation during the accident at the Chernobyl nuclear power plant (clarified in the Letter of the Social Insurance Fund dated November 17, 2011 No. 14-03-11/08-13985). These payments are not compensation in connection with injury to health and are transferred from budgetary funds;

- payment for time spent in sanatorium-resort treatment institutions if the employee suffered as a result of an accident at work or developed an occupational disease (Letter of the Ministry of Labor dated October 27, 2015). This is effectively social security.

Now let’s answer the question: are insurance premiums calculated on the premium?