The amount of annual fixed insurance premiums paid by an individual entrepreneur is affected by the minimum wage that will be in effect on January 1 of the calendar year. The last change in the minimum wage on 07/01/2017 increased it to 7,800 rubles, and from 01/01/2018 it may become even higher. Although it is possible that soon the minimum wage will not be taken into account at all when determining the amount of fixed contributions of individual entrepreneurs. Let's consider all the listed options for the development of events in more detail in this article.

What are fixed contributions and why are they no longer fixed?

Fixed contributions were insurance contributions for compulsory pension insurance and compulsory health insurance paid by individual entrepreneurs, lawyers, notaries and other persons engaged in private practice.

Until 2014, defined contributions were truly fixed (set for the year) and the same for all persons paying them. Then amendments to the legislation came into force, changing the procedure for calculating contributions and, in fact, contributions ceased to be fixed.

And from 2022, this name has been removed from regulatory documents. We will continue to call these contributions fixed for convenience and because the name is familiar to entrepreneurs.

Since 2022, the procedure for paying fixed insurance premiums is regulated by Chapter 34 of the Tax Code and contributions are paid not to extra-budgetary funds, but to the territorial tax inspectorates at the place of registration of the individual entrepreneur.

Justification of the term and types of deductions

Fixed payments for individual entrepreneurs 2022 - there is literally no such term in the legislation. But this expression has become part of everyday business language. They received this name because their size is clearly defined by law. Previously, contributions to compulsory insurance depended on the minimum wage. Now they are recorded directly in the Tax Code of the Russian Federation.

There are two types of such payments:

- for mandatory pension insurance (OPI);

- for compulsory health insurance (CHI).

A fixed payment for individual entrepreneurs in 2022 in the event of temporary disability or maternity has not been established. The entrepreneur pays such contributions only voluntarily on the basis of a separately concluded agreement. Individual entrepreneurs do not pay deductions “for injuries” for themselves at all; this is not provided for by law.

A fixed payment to the Pension Fund in 2022 for individual entrepreneurs, as well as to the Medical Insurance Fund, is established in Art. 430 Tax Code of the Russian Federation. The amounts of contributions for these purposes have also been established for 2022 and 2022. It is further assumed that the fees will be increased annually by separate legislation.

Who pays fixed fees

Contributions in a fixed amount are required to be paid by all individual entrepreneurs, regardless of the taxation system for individual entrepreneurs, business activities and the availability of income. In particular, if an individual entrepreneur works somewhere under an employment contract, and insurance premiums are paid for him by the employer, this is not a basis for exemption from paying contributions calculated in a fixed amount.

Please note that since 2010, contributions are also paid by those individual entrepreneurs who in previous years enjoyed benefits: military pensioners pay contributions on the same basis as all other entrepreneurs. Since 2013, you can avoid paying fixed contributions for the following periods:

- conscription service in the army;

- the period of care of one of the parents for each child until he reaches the age of one and a half years, but not more than three years in total;

- the period of care provided by an able-bodied person for a group I disabled person, a disabled child or a person who has reached the age of 80 years;

- the period of residence of spouses of military personnel serving under contract with their spouses in areas where they could not work due to lack of employment opportunities, but not more than five years in total;

- the period of residence abroad of spouses of employees sent to diplomatic missions and consular offices of the Russian Federation, permanent missions of the Russian Federation to international organizations, trade missions of the Russian Federation in foreign countries, representative offices of federal executive authorities, state bodies under federal executive authorities or as representatives these bodies abroad, as well as to representative offices of state institutions of the Russian Federation (state bodies and state institutions of the USSR) abroad and international organizations, the list of which is approved by the Government of the Russian Federation, but not more than five years in total.

However, if entrepreneurial activity was carried out during the above periods, then contributions will have to be paid (clause 7 of Article 430 of the Tax Code of the Russian Federation).

What determines the size of contributions?

Until January 1, 2022, the amount of individual entrepreneur contributions depended on the minimum wage.

However, due to the fact that the minimum wage is going to be increased to the subsistence level, individual entrepreneurs’ contributions were decided to be “delinked” from it, and starting from 2022, the fixed amount of contributions paid per year is indicated in the Tax Code.

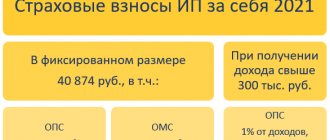

Since 2014, the amount of fixed contributions also depends on the annual income of the individual entrepreneur, since if the income exceeds 300 thousand rubles during the year. it is necessary to charge another 1% contribution on the amount of income exceeding 300 thousand rubles.

Income is calculated as follows:

- Under OSNO - income accounted for in accordance with Article 210 of the Tax Code of the Russian Federation. i.e. those incomes that are subject to personal income tax (applies only to income received from business activities). When determining these incomes, expenses are taken into account (Resolution of the Constitutional Court of November 30, 2016 No. 27-P);

- Under the simplified tax system with the object of taxation, “income” is income taken into account in accordance with Article 346.15 of the Tax Code of the Russian Federation. Those. those incomes that are taxed under the simplified tax system (such income is indicated in column 4 of the book of income and expenses and is indicated in line 113 of the tax return under the simplified tax system);

- Under the simplified tax system with the object of taxation “income reduced by the amount of expenses” - income taken into account in accordance with Article 346.15 of the Tax Code of the Russian Federation. Those. those incomes that are taxed under the simplified tax system (such income is indicated in column 4 of the book of income and expenses and is indicated in line 213 of the tax return under the simplified tax system). However, there are decisions of courts, including the Supreme Court, that expenses can be taken into account. The Federal Tax Service also agreed with this, details can be found in the material Good news: individual entrepreneurs using the simplified tax system can count contributions taking into account expenses;

- Under the Unified Agricultural Tax - income accounted for in accordance with paragraph 1 of Article 346.5 of the Tax Code of the Russian Federation. Those. those incomes that are taxed under the Unified Agricultural Tax (such income is indicated in column 4 of the book of income and expenses and is indicated in line 010 of the tax return under the Unified Agricultural Tax). Expenses are not taken into account when determining income for calculating contributions;

- For UTII - the taxpayer's imputed UTII income, calculated according to the rules of Article 346.26 of the Tax Code of the Russian Federation. Imputed income is indicated in line 100 of section 2 of the UTII declaration. If there are several sections 2, then the income is summed up across all sections. When determining annual income, imputed income from declarations for the 1st-4th quarter is added up.

- With PSN - potential income, calculated according to the rules of Article 346.47 of the Tax Code of the Russian Federation and Article 346.51 of the Tax Code of the Russian Federation. Those. the income from which the cost of the patent is calculated.

- If an individual entrepreneur applies several taxation systems simultaneously, then the income from them is added up

Calculation of contributions for incomes over 300 thousand rubles

If the income of the payer of insurance premiums for the billing period exceeds 300,000 rubles, in addition to the fixed pension contributions indicated above (26,545 rubles), contributions are paid in the amount of 1% of the income exceeding 300,000 rubles. Note! Health insurance premiums for incomes over 300 thousand rubles are not paid

! Those. The amount of contributions to the FFOMS is fixed for all individual entrepreneurs, regardless of the amount of annual income.

Example:

The income of an individual entrepreneur in 2022 was: 350,000 rubles. for activities subject to the simplified tax system and 100,000 rubles. for activities for which UTII is applied (how income is calculated is indicated above). Total 450,000 rub. The amount of contributions to the Pension Fund for 2022 will be 26,545 + (450,000 − 300,000) × 1% = 28,045 rubles. The amount of contributions to the FFOMS is 5,840 rubles.

The total amount of fixed insurance contributions to the Pension Fund for the year cannot be more than eight times the fixed amount of insurance contributions established for the year. Those. no more than 26545 x 8 = 212,360 rubles.

Example:

The income of an individual entrepreneur using the simplified tax system in 2022 was: 20,000,000 rubles. The amount of contributions for 2022 would be 26,545 + (20,000,000 − 300,000) × 1% = 223,545 rubles, however, since it is greater than the maximum possible contributions of 212,360 rubles, 212,360 rubles are paid. contributions to the Pension Fund and contributions to the FFOMS in the amount of 5,840 rubles.

Patent taxation system: insurance premiums

The taxation system used by an entrepreneur is important when determining the amount of contributions to be paid on income over 300 thousand rubles. Under different tax regimes, the amount of income of an individual entrepreneur is derived using different algorithms:

- if an entrepreneur works on OSNO terms, when calculating the final value of insurance premiums, he is guided by the amount of income received, determined in accordance with the provisions of Art. 210 Tax Code of the Russian Federation.

- if an individual entrepreneur applies a simplified special regime (regardless of the chosen object of taxation), one must focus on actual income, without taking into account costs (Article 346. 15 of the Tax Code of the Russian Federation);

- In relation to UTII, the principle of linking to the indicator of imputed profitability, which is determined in accordance with the provisions of Art. 346.29 Tax Code of the Russian Federation;

- Insurance premiums for a patent depend on the potential annual income for the relevant type of activity (Articles 346.47, 346.51 of the Tax Code of the Russian Federation).

Read also: Reducing the single tax on insurance premiums for individual entrepreneurs

The peculiarity of the patent taxation regime is that, unlike the simplified tax system and UTII, an entrepreneur is deprived of the opportunity to reduce the obligation to repay the cost of a patent at the expense of paid insurance premiums both for himself and for hired personnel. Insurance premiums of an individual entrepreneur on a patent directly depend on the potential profitability of the business line chosen by the businessman. This indicator is influenced by regional legislation in force in relation to a specific type of business.

Example

The individual entrepreneur is registered in the Republic of Tatarstan. The entrepreneur's field of activity is vehicle maintenance. The potential annual income for this line of business in 2022, provided that the company works on a patent, is equal to 540 thousand rubles. (Law of the Republic of Tatarstan dated September 29, 2012 No. 65-ZRT, Appendix 1). The individual entrepreneur must pay the following amounts of insurance premiums for himself:

- Fixed payment for pension insurance in the amount of 26,545 rubles.

- Fixed payment for health insurance – 5840 rubles.

- For the amount exceeding the income limit, 1% of contributions within the pension insurance system is charged. The calculation base will be equal to 240,000 rubles. (540,000 – 300,000). The amount of the additional payment will be 2400 rubles. (240,000 x 1%).

- The total amount of transfers for all mandatory types of contributions is RUB 34,785. (26,545 + 5840 + 2400).

Individual entrepreneurs must transfer the main fixed contributions no later than 01/09/2019 (December 31 in 2022 is a non-working day), and contributions from the amount exceeding the income limit (2400 rubles) - no later than 07/01/2019.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Due date for payment of contributions

Insurance premiums for the billing period are paid by individual entrepreneurs no later than December 31 of the current calendar year, with the exception of contributions in the amount of 1% on income exceeding 300 thousand rubles.

But since in 2022 December 31 will be a day off (due to the postponement of holidays), the deadline for paying contributions is postponed to the next working day, most likely it will be January 9, 2019.

Insurance premiums calculated on the amount of income of the payer of insurance premiums exceeding 300,000 rubles for the billing period are paid by the payer of insurance premiums no later than July 1 of the year following the expired billing period.

Contributions (including contributions for compulsory health insurance) are paid from January 1, 2022 not to the Pension Fund, but to the tax office. Including contributions for previous years.

Reduced insurance premium rates

In 2022, the preferential categories of policyholders who are entitled to pay premiums at reduced rates will not change.

| Conditions for applying the reduced tariff | Insurance premium rates, % | ||

| pension insurance | social insurance | health insurance | |

| Business entities and partnerships that practically apply (implement) the results of intellectual activity, the exclusive rights to which belong to their founders (participants): - budgetary or autonomous scientific institutions; – budgetary or autonomous educational organizations of higher education | 8,0 | 2,0 | 4,0 |

| Organizations and entrepreneurs who have entered into agreements on the implementation of technology-innovation activities and who make payments to employees working: – in technology-innovation special economic zones; – in industrial and production special economic zones | |||

| Organizations and entrepreneurs who have entered into agreements on the implementation of tourism and recreational activities and who make payments to employees working in tourist and recreational special economic zones, united by a decision of the Government of the Russian Federation into a cluster | |||

| Russian organizations that work in the field of information technology and are engaged in: – development and implementation of computer programs and databases; – provision of services for the development, adaptation, modification of computer programs, databases (software and information products of computer technology); – installation, testing and maintenance of computer programs and databases | |||

| Organizations and entrepreneurs with payments and remunerations for the performance of labor duties to crew members of ships registered in the Russian International Register of Ships (except for ships for storage and transshipment of oil and petroleum products in Russian seaports) | 0 | 0 | 0 |

| Organizations and entrepreneurs on the simplified tax system engaged in certain types of activities and if their cumulative income for the calendar year does not exceed 79 million rubles. | 20,0 | 0 | 0 |

| Payers of UTII: pharmacy organizations and entrepreneurs with a license for pharmaceutical activities, with payments to citizens who have the right or are admitted to pharmaceutical activities | |||

| Non-profit organizations that use simplified legislation and operate in the field of: – social services for the population; – scientific research and development; – education; – healthcare; – culture and art (the activities of theaters, libraries, museums and archives); – mass sports (except professional). Exception – state and municipal institutions | |||

| Charitable organizations simplified | |||

| Entrepreneurs who apply the patent taxation system, except for: – those leasing (renting) residential and non-residential premises; – working in the retail and catering industry | |||

| Organizations participating in the Skolkovo project | 14,0 | 0 | 0 |

| Commercial organizations and entrepreneurs with the status of residents of the territory of rapid socio-economic development in accordance with the Law of December 29, 2014 No. 473-FZ8 | 6,0 | 1,5 | 0,1 |

| Commercial organizations and entrepreneurs with the status of residents of the free port of Vladivostok in accordance with the Law of July 13, 2015 No. 212-FZ | 6,0 | 1,5 | 0,1 |

All of the above reduced rates can also be summarized into a single table with rates. As a result, we get the following:

| Rate | Who has the right to apply |

| 20% | Small businesses using simplified rules, patents, pharmacies using special regimes, charitable and socially oriented non-profit organizations using simplified rules |

| 14% | Economic companies and partnerships that are engaged in technical innovation activities and tourism and recreational activities in the territory of special economic zones |

| Participants of the Skolkovo project | |

| IT companies | |

| 7,6% | Payers who received the status of a participant in a free economic zone in the territory of Crimea and Sevastopol, the status of a resident of the territory of rapid socio-economic development, the status of a resident of the free port of Vladivostok |

| 0% | Payers in relation to payments to crew members of ships from the Russian International Register of Ships |

What “simplified” people need to know about the new OKVED classifier

In 2022, the new OKVED2 classifier came into force (approved by order of Rosstandart dated January 31, 2014 No. 14-st). Because of this, the codes for some preferential activities have changed. This does not affect the reduced tariff in any way. A change in OKVED cannot deprive you of benefits. This is provided for by Federal Law No. 335-FZ of November 27, 2017. For more details, see “New preferential activities under the simplified tax system”