Many business owners could pay less taxes, but do not do so: they are let down by ignorance of the Tax Code and the intricacies of financial planning. We explain with examples how small businesses can optimize their tax burden and earn more profit.

From this article you will learn:

- About the optimal taxation scheme

- How to apply a reduced social security contribution rate

- How to minimize management salary costs

- How to organize outsourcing of consultants

- How to take inventory of personnel costs

- How to reduce income tax and insurance premiums through voluntary health insurance (VHI)

- How to reduce the risk of an on-site tax audit

Choosing the optimal tax scheme

A competent approach already at the stage of organizing a business and comparative calculations when choosing a tax system will help you save. First of all, you need to analyze several factors: type of activity, number of employees, region of location, planned expenses and property that will be used for the business. Based on this, you need to choose a taxation system.

After working for 7 years in a large salon, Olga decided to open her own hairdressing salon in the Moscow region.

She registered an individual entrepreneur, equipped a small hall and hired 2 employees. The owner of the previous salon said that she works under the simplified taxation system (STS) “Income” 6%, and Olga did the same.

Average financial indicators for the month:

- Revenue per month - 350,000 rubles;

- Employees’ salary - 50,000 rubles (25,000 × 2);

- Insurance premiums for employees - 15,100 rubles (50,000 rubles × 30.2%).

Financial indicators for the year:

- Annual revenue: 12 × 350,000 = 4,200,000 rubles;

- Insurance premiums for employees: 12 × 15,100 = 181,200 rubles;

- Individual entrepreneur contributions for themselves: 26,545 + (4,200,000 − 300,000) × 1% = 65,545 rubles, where:

- 26,545 - the amount of the minimum fixed part of contributions to the Pension Fund;

- (4,200,000 − 300,000) × 1% = 39,000 rubles - contributions to social funds for the amount of individual entrepreneur’s income that exceeds 300,000 rubles.

The total amount of insurance premiums paid is 246,745 rubles.

STS tax for the year: 4,200,000 × 6% = 252,000 rubles.

Under the simplified tax system “Income”, it is allowed to reduce the amount of tax on insurance premiums paid. The amount of the deduction should not exceed half of the payment (clause 3.1 of Article 346.21 of the Tax Code of the Russian Federation).

Since the amount of contributions (246,745 rubles) is more than 50% of the amount of tax paid (252,000 rubles), Olga transfers only half to the budget - 126,000 rubles.

The total annual costs will be:

126,000 (tax) + 181,200 (employee contributions) + 65,545 (IP contributions) = 372,745 rubles.

Not a bad result for a beginner entrepreneur. But it could have been better if Olga had known about other tax options.

How could you save money?

Under the patent system (PSN), Olga would buy a patent for a hairdressing salon with two employees for 26,601 rubles.

Financial indicators for the year on PSN

181,200 (contributions for employees) + 65,545 (contributions of individual entrepreneurs for themselves) + 26,601 (cost of the patent) = 273,346 rubles.

It turns out that the entrepreneur could save: 372,745 − 273,346 = 99,399 rubles.

We apply a reduced rate of social insurance contributions

Standard tariffs for insurance contributions to extra-budgetary funds are established by Art. 426 Tax Code of the Russian Federation.

Standard premium rates

But there are also reduced rates, at which only 20% needs to be contributed to the Pension Fund, and nothing needs to be paid to the medical and social insurance funds (clause 3, clause 2, article 427 of the Tax Code of the Russian Federation).

The benefit can be used by LLCs or individual entrepreneurs that are on the simplified taxation system (STS) (clause 5, clause 1, article 427 of the Tax Code of the Russian Federation), if the annual income of the enterprise does not exceed 79 million rubles (clause 3, clause 2, article 427 of the Tax Code) RF).

Another mandatory condition is that profits from activities that are subject to tax benefits must exceed 70% of the total income of the organization or individual entrepreneur.

For example, an enterprise sells bottled water wholesale using the simplified tax system. This activity is included in the preferential list. The company's annual income is 54 million rubles. Therefore, she pays social insurance contributions at a reduced rate of 20%.

The company begins to sell related products - coolers, plastic cups, etc. Total income grows to 70 million rubles. But the share of profit from bottling and selling water falls from 100% to 69%. Therefore, the company must pay insurance premiums in full.

The size of the tariff depends on the type of activity of the taxpayer; the following receive a discount:

List of preferential activities

The list is significant - check if your type of activity is on it. If you find out that you are entitled to a benefit, but you did not use it, you can recalculate the tariffs, return or offset the overpayment.

To do this, you must submit an updated calculation of insurance premiums to the tax office and attach an explanatory note explaining the reasons for its submission.

In the report, include sections from the original report, but with the correct data. Section 3 “Personal Data” does not need to be added to the new document.

An example of filling out the first page of an adjustment calculation for insurance premiums

An example of an explanatory note for an updated calculation of insurance premiums

You can receive an overpayment only after submitting a written application in accordance with Art. 79 Tax Code of the Russian Federation. If you owe arrears of penalties or fines, the entire amount will not be returned - part of the money will be used to pay off the debt (Article 78 of the Tax Code of the Russian Federation).

The dental clinic operates under the simplified tax system according to the “Income - Expenses” system. The clinic has 12 employees. Annual income does not exceed 19 million rubles. The company may pay insurance premiums at reduced rates, but the manager does not know about it.

The wage fund for the year is 7.2 million rubles.

The amount of insurance premiums is 2.16 million rubles (7.2 million rubles × 30%).

The clinic hires a new accountant who knows about benefits. The specialist submits updated reports with reduced rates (20%) and submits an application for a refund of the overpayment.

For late payment of insurance premiums, the clinic was charged a penalty of 15 thousand rubles, so only 705,000 rubles (7.2 million rubles × 10% - 15 thousand rubles) are returned to the current account.

We minimize management salary costs

Executive salaries make up a significant portion of the wage fund. Someone follows the legal path and pays all taxes, while others take risks and use salaries “in envelopes”.

But instead of using “shadow” schemes, you can save money legally - replace top management with a management company (Article 42 of the Federal Law No. 14-FZ of 02/08/1998). The solution is only suitable for enterprises operating on the generally accepted taxation system (OSNO).

Management Company

- this is a group of professional managers; if there is only one manager, then the manager may have the status of an individual entrepreneur (clause 2, clause 2.1, article 32 of the Federal Law No. 14-FZ of 02/08/1998). It is more profitable for a management company to use a simplified taxation system at a rate of 6% “Income”.

Then social insurance contributions are reduced from 30% to 6% (USN rate) or to 13% (personal income tax rate).

Let's look at this optimization method in more detail using an example.

The logistics company was engaged in the transportation of goods in Russia and abroad. The company included two large departments. The highest salaries were among 5 top managers: the general director, financial director, deputy director for development and 2 heads of departments. Their total salary was 720,000 rubles.

The company transferred social contributions 720,000 × 30.2% (total insurance premium rate) = 217,440 rubles per month.

How to save money

To reduce tax payments, five managers established a management company and chose the simplified “Income” tax system at a rate of 6%. Neither the functionality nor the volume of work of managers has changed.

After the reorganization, the income of top managers remained the same, but began to be divided into 2 parts:

- The official salary of an employee of the management company is 250,000 rubles per month;

- dividends of the founder of the management company - 470,000 rubles per month.

The total is still 720,000 rubles.

The management company pays social insurance contributions and the simplified tax system at a rate of 6%. Let us carry out comparative calculations of tax costs under the old and new taxation systems.

Comparative tax cost calculations

Under the new management scheme through the management company, the amount of contributions decreased to 97,100 rubles.

The total savings per month in the second option amounted to 217,440 − 97,100 = 120,340 rubles.

Over the year, the logistics company reduced tax payments by 120,340 × 12 months = 1,444,080 rubles.

We organize outsourcing of consultants

Small firms need legal, accounting and technical support. But it is not always possible to keep such specialists busy with full-time work. Typically, one employee combines the functions of a secretary, personnel officer, lawyer, accountant and other specialists. Sometimes the entrepreneur himself tries to understand all the issues.

Neither one nor the other option will protect you from mistakes. The risk of making the wrong decision due to lack of knowledge is high. You are wasting time trying to figure things out instead of making money.

If the constant presence of an accountant, HR specialist, lawyer or programmer is not required, outsource them. This way, specialists will resolve the issues, and you will save on insurance premiums. Another plus is that the outsourcer will not suddenly get sick while submitting reports and will not go on vacation before an important deal.

The veterinary clinic, in addition to its main activities, sells medicines and accessories for animals. Accounting is carried out in the 1C accounting program. Taxation system: for veterinary services - a single tax on imputed income (UTI), for trade - a simplified taxation system (STS). In addition to the director, the company employed 4 veterinarians, 2 medical assistants, 2 cleaners, an accountant and a lawyer. Neither the lawyer nor the accountant had a full workload, and the cleaning staff changed frequently.

The veterinary clinic's monthly revenue is 540,000 rubles.

Let's calculate the monthly expenses for workers who do not take part in receiving animals and do not make a profit.

- Accountant's salary - 35,000 rubles per month;

- A lawyer’s salary is 35,000 rubles per month;

- The salary of cleaners is 2 × 20,000 = 40,000 rubles per month.

Total: 35,000 + 35,000 + 40,000 = 110,000 rubles.

Monthly insurance premiums from salary: 110,000 × 30.2% = 33,220 rubles.

Total costs for remuneration of support staff:

110,000 + 33,220 = 143,220 rubles, that is, 26% of revenue (remember, monthly revenue is 540,000 rubles). This suited the management quite well.

How to save money

After the audit, the business owner outsourced the support staff by concluding agreements with companies to provide accounting, legal and cleaning services.

At the end of the month, expenses were:

- accounting services - 23,000 rubles;

- legal services - 15,000 rubles;

- cleaning services - 40,000 rubles.

Total expenses: 23,000 + 15,000 + 40,000 = 78,000 rubles.

Outsourcing saved the veterinary clinic: 143,220 − 78,000 = 65,220 rubles per month.

Savings per year: 65,220 rubles × 12 months = 782,640 rubles.

The owner of the hospital found a use for this money - he hired another veterinarian and an assistant, who increased the volume of services and began to bring more basic income to the clinic.

Form reserves

An organization can create reserves for vacation pay, repairs and warranty service, repair of fixed assets, and reimbursement of outstanding debts. They are useful in work: they help to repair a broken machine on time or not to go to a loss without receiving payment from customers. Bonus reserves allow you to reduce advance payments for income taxes.

Savings from the formation of reserves depend on the method of recognition of income and expenses: cash or accrual. Basically, organizations on OSNO use the accrual method, since the cash method is available only to those whose revenue for each of the four previous quarters did not exceed 1 million rubles. Under the accrual method, income and expenses are recognized for tax purposes in the period in which they are accrued, regardless of the actual receipt and expenditure of money.

Example. Rozetka LLC shipped goods worth 500,000 rubles, but did not receive payment on time. The company uses the accrual method, therefore, on the date of shipment, income of 500,000 has already been accrued, which is subject to income tax. Rozetka LLC has not yet received the money, but must already pay 20% or 100,000 rubles.

If you create a reserve for doubtful debts, then at the end of the quarter you can write off the entire amount of the debt if it is overdue for 90 days or more, or half of it if it is overdue for 45 days or more.

After you receive the debt, you will have to pay the tax in full, but from the money received, and not from your own pocket. Therefore, reserves can be used as a tax deferral rather than a complete exemption.

Keep records of exports and imports in the Kontur.Accounting web service. Simple accounting, payroll and reporting in one service

We take inventory of personnel costs

Let's look at two more ways to minimize labor taxes. We are talking about the payment of compensation, which is not subject to insurance contributions, and the use of student contracts.

Employee compensation benefits

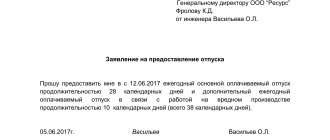

The Tax Code allows you not to pay insurance premiums for certain types of employee benefits (clause 2, clause 1, article 422 of the Tax Code of the Russian Federation). By replacing part of the salary with compensation, the company reduces costs.

It is important to remember that all compensation and social payments must be enshrined in a collective labor agreement, which regulates the relationship between employees and the employer. Usually it is concluded in large companies - where there is staff turnover, difficult working conditions, etc. A collective agreement helps to simplify the resolution of issues, including tax disputes.

But it is rarely used in small businesses. If there is no such agreement, then the provision on payments is fixed in individual employment contracts and job descriptions of employees. This will eliminate disputes with tax authorities during audits.

Let's look at what compensation small businesses use.

Compensations that small businesses use

A company selling office equipment hired a sales manager with a salary of 60,000 rubles per month. That is, after deducting personal income tax, the employee will receive 52,200 rubles.

With such a salary, insurance premiums per month will be:

60,000 × 30.2% = 18,120 rubles.

How to save money

The director found out that the new employee pays a mortgage - 15,000 rubles per month and is receiving a second higher education - 5,000 rubles per month. The manager's work involves the use of a personal car - 3,000 rubles per month - and a mobile phone - 1,000 rubles per month.

The company replaced these expenses with compensation. Instead of a salary of 60,000 rubles, the manager receives 36,000 rubles. Compensation from the employer amounts to 24,000 rubles. They are not subject to social security contributions and personal income tax.

The employer saves monthly on insurance premiums:

24,000 × 30.2% = 7,248 rubles.

Savings per year: 7,248 × 12 months = 86,976 rubles.

In turn, the employee saves on personal income tax. His salary is 36,000, which means he receives 31,320 rubles “in hand.”

31,320 + 24,000 = 55,320 rubles.

An employee receives more every month: 55,320 − 52,200 = 3,120 rubles.

For a year it turns out: 24,000 × 13% × 12 months = 37,440 rubles.

Use of apprenticeship agreements

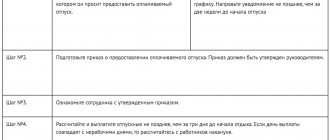

Often employees without education or experience are hired for blue-collar jobs. To save money in trade, construction, repairs and similar activities, use apprenticeship contracts. According to them, a new employee studies for a certain time under the guidance of experienced colleagues, and his salary is paid in the form of a scholarship, which is not subject to insurance contributions.

The legality of this method is confirmed by the letter of the FSS (No. 15-03-11/08-16893 dated December 18, 2012) and the resolution of the Presidium of the Supreme Arbitration Court (No. 10905/13 dated December 3, 2013).

When concluding an apprenticeship agreement, indicate the period during which the employee undertakes to undergo training. The amount of the scholarship should not be lower than the official minimum wage (minimum wage) in the region.

Federal Law No. 82-FZ of June 19, 2000 establishes the procedure for determining the minimum amount of labor. Depending on the level of the cost of living, the regional government may change the minimum wage. The amount can be found on the regional government website or in statistical publications. In St. Petersburg, from May 1, 2018, the minimum wage was established in the amount of 17,000 rubles.

The construction company carried out work from April to October. During this time, she additionally hired masons, plasterers, roofers - 35 people, each receiving 42,000 rubles.

Every month the accounting department transferred insurance premiums for new employees:

(42,000 rubles × 35 people) × 30.2% = 441,000 rubles.

How to save money

Now let’s imagine that initially the company entered into apprenticeship agreements. This means that for the first three months, new employees would undergo training and perform practical work under the guidance of foremen.

The company could legally save: 441,000 rubles × 3 months = 1,323,000 rubles.

VAT schemes

Scheme No. 1.

Redistribution of costs and turnover with and without VAT involves the division of costs with VAT for a company operating under the general taxation regime, and without VAT - under a simplified one. Buyers are divided according to the same principle. It will be possible to prove your case in court if companies operate independently, not subordinate to a single center in different territories, with different products, etc.

Scheme No. 2.

Replacing part of the proceeds with payments not related to sales involves providing the buyer with a discount and then reimbursing it from other payments. Such a scheme will not arouse suspicion if it is used rarely and the correct basis for payment is chosen (penalty, fine, security deposit, etc.).

Scheme No. 3.

An advance from the buyer under the guise of a loan, which is not subject to VAT. And after the goods are shipped, the loan debt is counted towards its payment. Such transactions are not typical business practices and are therefore considered dangerous.

Scheme No. 4.

Purchasing and selling through a chain of resellers allows you to significantly increase input VAT. But if the tax authorities are able to prove that the chain of sellers is formal, the company will be fined a substantial amount.

Scheme No. 5.

Paper VAT. Its sellers purchase deductions from other suppliers, and those from someone else, and so on. In this scheme, the company at the end of the chain will have to try hard to prove the absence of intent. But if you fail to do this, you may face criminal liability.

We reduce the risk of an on-site tax audit

According to the Federal Tax Service website, information technologies help to conduct on-site inspections less frequently. Over the nine months of 2022, 10.9 thousand inspections were carried out, which is a third less than last year.

But inspector visits are now more expensive for entrepreneurs. For example, in St. Petersburg, the average amount of fines and arrears accrued based on the results of one inspection increased from 5 to 60 million rubles. It seems that inspectors know in advance where to go and where to look for violations.

This is true - before an enterprise is included in the on-site inspection plan, its activities are carefully studied by the analytical department of the Federal Tax Service. Using the Concept of a planning system for on-site tax audits (Federal Tax Service order No. MM-3-06/ [email protected] ), specialists calculate whether the company pays all taxes and how transparently it operates.

You can reduce the risk of inspections if you know the criteria by which a business comes to the attention of auditors:

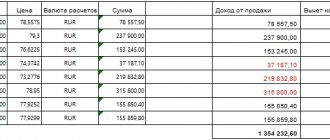

- Losses.

Tax authorities may order an audit if a company shows losses in its financial or accounting statements for more than two years. A business is created in order to make a profit. Making a profit means paying taxes. If everything goes the other way around, you need good reasons. Such reasons may include seasonal declines in sales, the purchase of expensive equipment, major overhauls of industrial buildings, the development of new markets, and others; - Employee salaries are below the regional average.

To determine this indicator, data is taken from reports: the amount of the wage fund for the year is divided by the average number of employees. The numbers are compared with the average statistical result, which is published on the region’s statistics website or in printed analytical materials. If the figure is below average, this is an alarming sign for the taxpayer. For example, a private kindergarten in the Leningrad region submitted personal income tax returns. Part of the salary was paid in envelopes, so in the calculation the average monthly salary of one employee was underestimated to 25,000 rubles. From statistical data it is known that the average salary in the industry is 41,019 rubles. A company that pays an official salary 1.5 times less than the industry average will attract the attention of inspectors. Sometimes the prosecutor's office or the tax service receive complaints from the employees themselves about “salaries in envelopes.” This also becomes a reason for an on-site inspection; - The company pays less taxes than other companies doing the same thing.

Every year, experts, using statistical data, calculate the average tax burden for each field of activity. The calculation formula is specified in paragraph 1 of Appendix No. 2 to the Order of the Federal Tax Service of Russia dated May 30, 2007 No. MM-3-06 / [email protected] : Tax burden = Total amount of taxes paid for the year / Revenue for the year Comparing the results of a particular enterprise with average indicators , the inspector makes a conclusion. If the company pays little, the manager is called in for a conversation or sent a written request for clarification - this is the first signal that an audit is just around the corner; - Submitting significant amounts of VAT deductions for deduction.

This indicator is used for enterprises and individual entrepreneurs using the generally accepted taxation system (OSNO). The share of VAT deductions should not exceed 89% of the tax base. Let's illustrate this. The company submitted its declaration for the last quarter of 2022. The accountant assessed 100,000 rubles in value added tax. During the same period, the company paid suppliers 75,000 rubles as VAT for raw materials. You can make a deduction for this amount: 100,000 − 75,000 = 25,000 rubles - all that remains is to pay the tax service. In this example, the VAT deduction share is 75%: 100,000 × 75% = 75,000 rubles. This does not exceed the permissible parameter, and the company will not be subject to an unscheduled inspection; - Inconsistency between the growth rates of expenses and income.

The indicator is checked by the ratio of income and expenses of the enterprise. Data is taken from financial statements for several years. If expenses grow faster than revenues, controllers will take note of the company; - An entrepreneur's expenses are close to his income.

This indicator is used to control taxes on personal income. The risk zone includes individual entrepreneurs who claim professional deductions for personal income tax if their amount for the year is 83% or more. Professional deductions for personal income tax are provided only to entrepreneurs using the generally accepted taxation system (OSNO). They help reduce taxes on income that a businessman received for work and services performed personally. A prerequisite for receiving a deduction is the conclusion of an agreement for the performance of work or the provision of services not through intermediaries, but directly with the customer. This applies to those who are engaged in tailoring, producing design projects, and developing Internet sites. Artists, composers, inventors, patent owners, manufacturers of industrial designs, lawyers, privately practicing consultants and others can also use deductions (Article 221 of the Tax Code of the Russian Federation). The amount of the deduction is equal to the expenses incurred to complete the work, which are confirmed by documents. If you cannot document your expenses, use a special cost standard (Article 221 of the Tax Code of the Russian Federation). In this case, the professional deduction will depend on the type of activity of the individual entrepreneur (from 20% - 40% of income). For example, an entrepreneur produced a design project for 20,000 rubles. A printout of the calculations and the project was done in a professional studio for 4,000 rubles. Net income - 16,000 rubles. Taking into account the OSNO rate of 13%, the individual entrepreneur will pay: 16,000 × 13% = 2,080 rubles of personal income tax. If the individual entrepreneur did not have documents confirming the amount of expenses, he could apply a professional deduction in the amount of 30% (clause 3 of Article 221 of the Tax Code of the Russian Federation). Then the personal income tax calculation would look like this: 20,000 × 30% = 6,000 rubles (professional tax deduction). 20,000 − 6,000 = 14,000 rubles (tax base). 14,000 x 13% = 1,820 rubles personal income tax amount. In our example, it is more profitable for an individual entrepreneur to take advantage of the professional deduction at the rate of 30%, rather than document expenses; - Change of legal address.

If the tax office changes along with the company's address, the likelihood of an on-site audit increases significantly. Those companies that have changed inspections 2 times or more are at risk; - Ignoring requests from the tax inspectorate.

To avoid being shortlisted for review, do not ignore requests or challenges related to errors in reporting or providing explanations. It is better to make contact and correct the shortcomings, rather than avoid meeting with the inspector; - High tax risk in transactions.

This is the name given to the risk of dealing with shell companies. A company falls under this criterion if it makes transactions with organizations about which there is no information on the Internet (for example, advertising or a website), there are no statutory documents, and the registration address is recognized as “mass”. A special service from the Federal Tax Service will help you check your legal address for widespread availability. In addition, the attention of controllers will be drawn to transactions with unusual payment terms and situations where the client does not pay for goods or services for a long time, and the businessman does not try to collect debts. Transactions with intermediaries are also at risk if the company cannot explain why it did not work directly with partners.

How to reduce the tax burden on a digital agency and generate additional income

Let’s figure out which taxation system is more profitable for digital agencies to work on, how to reduce the tax burden and generate additional income. The text will help you get a general idea of the topic, but in any case you cannot do without consulting an accountant.

Do you advertise to clients?

Join the eLama affiliate program and receive agent commissions.

More details

Understanding the concepts: OSN and simplified tax system

OSN (or OSNO) is the main taxation system. Legal entities and individual entrepreneurs pay VAT, income tax and property tax on the OSN. Any legal entity or individual entrepreneur can work on OCH; there are no restrictions on income and the number of employees in the organization. Read more about OCH in the “General Ledger”.

system is a simplified taxation system. Legal entities and individual entrepreneurs using the simplified tax system do not pay VAT, income tax and property tax; they are replaced by a single tax. Not everyone can work for the simplified tax system; there are a number of requirements:

Conditions for applying the simplified tax system. Source: Federal Tax Service website.

The amount of the single tax on the simplified tax system depends on the object of taxation - what exactly you will pay tax on. The object of taxation is chosen by the taxpayer himself, with the exception of the case provided for in paragraph 3 of Article 346.14 of the Tax Code of the Russian Federation.

There are two options for an object of taxation on the simplified tax system:

- STS “Income” - tax must be paid on all income. The rate is 6%, in some regions it can be reduced to 1%.

- STS “Income minus expenses” (or “Income reduced by the amount of expenses”) - tax must be paid on the difference between income and expenses. The rate is 15%, while in some regions the rate can be in the range of 5–15%.

You can find out the tax rate for a specific region on the official website of the Federal Tax Service. For example, in St. Petersburg it will be like this:

As we indicated above, individual entrepreneurs and legal entities using the simplified tax system are exempt from paying VAT. But if a large client who is a VAT payer approaches a company using the simplified tax system, you need to look for a convenient work scheme. Next, we will use examples to analyze how companies and individual entrepreneurs should act on the simplified tax system and the special tax system when a client asks or does not ask for an invoice.

Let's imagine: we work on the simplified tax system, a large client contacts us

And he wants us to launch advertising for him in Yandex.Direct. Let’s say his advertising budget is 100 ₽ (we’ll take a smaller amount to make it easier to count).

To spend 100 ₽ on advertising, we must transfer 120 ₽ to Yandex.Direct (since we also need to pay 20% VAT). Why do we have to pay VAT when paying for advertising if we work on the simplified tax system: we purchase services from a company that works on the simplified tax system, so we pay VAT included in the cost of services.

Let's not forget about additional costs that will affect the final invoice issued to the client. For example:

- Office rent: 10 ₽.

- Salary: 30 ₽.

- Taxes from the employee payroll: 10 ₽.

Let's calculate the invoice amount for the client: 120 + 10 + 30 + 10 = 170 rubles. Let's add another 2 rubles here for additional services and issue the client an invoice for 172 rubles. The possibility of reducing the tax payment depends on whether the client requires an invoice.

USN: the client does not ask for an invoice

Let's remember how much the client will pay us and how much we will spend:

If we follow this scheme, then our income is: 172 − 170 = 2 rubles.

It would seem that everything is fine if you take the real amounts. But we should not forget that under the simplified tax system we still have to pay a single tax.

Let us remind you that the single tax depends on the object of taxation:

- USN “Income” . Let us remind you that the tax rate is 6%, in some regions it can be reduced to 1%. If you operate as an LLC or individual entrepreneur with employees, you can reduce your tax payment by the amount of insurance premiums for payroll (by no more than 50% of the tax amount).

- USN “Income minus expenses” . Let us remind you that the tax rate is 15%, while in some regions the rate can be in the range of 5–15%. Tax legislation also provides for a minimum tax of 1%:

Source: Federal Tax Service website

How can you reduce the amount of tax under the simplified tax system “Income minus expenses”

If last year you paid the minimum tax (1%), then this year when paying the single tax you can take into account the amount by which the minimum tax exceeded the single tax. But that’s not all: a detailed list can be found in Article 346.16 of the Tax Code of the Russian Federation.

Now let's consider a situation when you work for the simplified tax system and your client asks for an invoice.

USN: client asks for an invoice

Let's imagine that a large client who is a VAT payer contacts us and will need an invoice. In this case, we will have to transfer the VAT amount to the budget. The basis is paragraph 5 of Article 173 of the Tax Code of the Russian Federation.

We return to the table we are already familiar with and see what has changed:

We count: 143 − (120 + 10 + 30 + 10) = −27. As a result, we have a loss of 27 ₽. And at the same time, we cannot refund VAT on the transfer to the advertising system. The basis is the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated May 30, 2014 N 33.

Now let's consider the situation when we are working on OSN.

Let's imagine: we work for OSN, a large client contacts us

Now we have a basic taxation system, which means that we are VAT payers. As in the case of the simplified tax system, we will consider two situations: when the client asks and does not ask for an invoice.

OSN: the client does not ask for an invoice

In this case, the client can pay money to us directly, and we will independently transfer it to advertising systems and activate it. Our table will look like this:

We calculate the profit: 172 − (120 + 10 + 30 + 10) + 20 = 22 rubles.

Since we work on OSN, we can apply a VAT deduction (in the example above this is already taken into account).

Now let's look at a case when we are working on OSN and our client asks for an invoice.

OSN: client asks for an invoice

In this case, our table will look like this:

We count: 143 − (120 + 10 + 30 + 10) + 20 = −7. As a result, we received a loss of 7 rubles, even taking into account the fact that we can reimburse VAT (20 rubles).

Where does the loss come from? Let's figure it out.

There is a concept - tax deduction . This is an amount that can reduce your tax base. In our case, it turns out that the agency can apply a tax deduction for the VAT paid when transferring money to the advertising system. Agency clients who work with VAT will also be able to apply the tax deduction.

There is also incoming and outgoing VAT:

- Input VAT is the tax we pay as a customer when we buy something from a VAT taxpayer.

- Output VAT is a tax that our customers are required to pay to us if we are VAT payers.

Read more about incoming and outgoing VAT in the “General Ledger”.

Let's return to our example. Output VAT − incoming VAT = (172 − 172 ÷ 1.2) − (120 − 120 ÷ 1.2) = 28 − 20 = 8 ₽.

Let's consider the case:

- We work for OSN.

- The client pays the money to us directly, we activate it ourselves.

- We ourselves transfer money to the advertising system.

- The client wants to transfer us 120 ₽, this entire amount will be used to pay for advertising.

In this case:

- We issue an invoice to the client for 120 ₽ (it already includes 20% VAT).

- We are obliged to pay 20 rubles to the state.

- The VAT return is submitted at the end of the quarter, the tax amount is paid during the next quarter.

What's the result:

- We transfer 120 ₽ for advertising in Yandex.Direct and receive an invoice with VAT included.

- Thanks to the tax deduction, we will compensate 20 ₽.

But it's not that simple:

- Typically, in one reporting period, 80–90% of all the money that the client pays to the agency is spent.

- The amount of expenses for tax deduction is reduced.

- In practice, during the reporting period it is possible to return not 20% of expenses, but 14–16%.

The story goes something like this:

As a result: 20 − 19.2 = 0.8 ₽ (this amount is our debt to the state). We will be able to reimburse 0.8 ₽ only when we spend the remaining 24 ₽ that the client paid us on advertising.

It turns out:

- While our agency is actively growing and starting to work with new clients, 2–4% of turnover will constantly “hang in advance” from the state.

- We will be able to fully reimburse this money only when we fully spend all the money that clients paid us on advertising.

Let's summarize everything that was discussed above.

OSN or simplified tax system: final comparison

Judging by this table, working on the simplified tax system is more profitable. But there are problems: if a large client who is a VAT payer contacts us, we may agree to work with him, but at the same time we must pay VAT without the possibility of refunding it.

And there is a third option - to work with such clients through eLama.

Agency on the simplified tax system and a large client: scheme of work through eLama

The scheme is like this:

- Your client independently transfers money for advertising in eLama.

- You work on a client’s account in eLama: transfer money to advertising systems, run ads, and so on.

- eLama independently provides your client with the necessary closing documents, including the invoice that is needed to apply for VAT deduction.

Why is this beneficial for an agency using the simplified tax system?

- You can work perfectly with a client who is a VAT payer, and all issues with documents will be resolved by eLama.

- The agency receives a convenient account for work: a single wallet with which you can distribute money to advertising systems, as well as access to 15+ tools for all stages of working with advertising.

- eLama has an affiliate program for agencies and freelancers. Its members can receive a monthly agency fee. Read more about the affiliate program below.

eLama Affiliate Program for Agencies and Freelancers

Legal entities and individual entrepreneurs from the Russian Federation on OSN and STS, as well as individuals, can participate in the eLama affiliate program.

Why is the eLama affiliate program interesting?

- One office for work and a single budget, from which it is convenient to distribute money to different systems and services.

- eLama provides closing documents for each of your clients. You can receive a monthly agent commission.

- A credit line is available to legal entities and individual entrepreneurs. This is an opportunity to pay advertising expenses on a deferred basis. You can receive a credit line after verification by eLama finance specialists.

To receive a monthly agent fee, you need:

- Advertise independently through eLama to at least 3 clients.

- The total turnover of clients in advertising systems must be at least 30,000 rubles/month excluding VAT.

The maximum monthly remuneration is 10% of customer turnover in advertising systems.

All information about the affiliate program and monthly remuneration can be found in the detailed conditions →

eLama Affiliate Program

The material was prepared based on the eLama webinar “How to reduce the tax burden on an agency.”

Remember

- Study tax systems and make comparative tax calculations. The simplified tax system is not a panacea;

- If you have chosen the simplified tax system, then you may be entitled to a benefit in paying social insurance contributions - clause 2 of Art. 427 of the Tax Code of the Russian Federation on the possibility of using a reduced tariff of insurance premiums;

- If you work for OSNO, you can minimize the cost of management salaries by transferring management to a management company and establishing it on a more favorable tax system. This is possible on the basis of Art. 42 Federal Law No. 14-FZ dated 02/08/1998 on the transfer of powers of the sole executive body of the company to the manager;

- Outsource some of your tasks: accounting, lawyers, system administrators, cleaning services, HR and others. Sometimes it is cheaper to simply pay for their services, without taxes and fees;

- Take an inventory of personnel costs: you can save on taxes and contributions by paying part of the salary to employees in the form of compensation or scholarships - paragraphs. 2 p. 1 art. 422 of the Tax Code of the Russian Federation on amounts not subject to insurance premiums;

- Optimize income taxes and insurance premiums through VHI - this way you can reduce the amount of taxes and contributions to 6% of labor costs - clause 16 of Art. 255 of the Tax Code of the Russian Federation on the specifics of determining the tax base for insurance contracts;

- Study the Concept of the planning system for on-site tax audits (Order of the Federal Tax Service dated May 30, 2007 No. MM-3-06/ [email protected] ) and reduce the risk of an on-site tax audit;

- If you are a starting individual entrepreneur, read our article about tax holidays for individual entrepreneurs.

Use of tax regimes

This method is the most popular among all possible ones. It is effective when the company has buyers who do not need VAT - individuals or organizations or individual entrepreneurs using the simplified tax system.

How can taxes be optimized in this case? Distribute sales flows: either create a company that will apply the simplified tax system or UTII, or use the services of an individual entrepreneur with a patent. Then all contracts with buyers who do not need VAT will be transferred to another legal entity or individual entrepreneur, and contracts with large wholesalers or buyers who need VAT will remain on the main legal entity. As a result, it is possible to minimize both VAT paid on the markup and income tax.

It is worth considering that the constituent entities of the Russian Federation annually pass laws in accordance with which they provide reduced rates for certain types of activities to organizations and individual entrepreneurs on the simplified tax system.

Read more articles on this topic:

Simplified tax system and patent: how to combine correctly

STS and UTII: how to combine correctly