Description and use of account 26

Account 26 “General business expenses” is used to collect information about costs for management needs not directly related to the production of products, performance of work, or provision of services.

Agents, brokers, dealers, forwarders, that is, organizations not related to production, use account 26 as the main one in conducting their activities, summarizing information on all their expenses on it and writing them off to the sales account.

Trading companies do not use account 26 in their activities and all expenses, without exception, are attributed directly to account 44 “Sales expenses”.

For information on the main components of costs accounted for in account 44 “Sales expenses”, read the article “Accounting entries for business expenses”.

Analytical accounting for account 26 is carried out directly by expense items and places of their occurrence.

https://youtu.be/https://www.youtube.com/watch?v=RBmpFnH0uco

Analytical accounting

Accounting for general business expenses is required, first of all, in order to calculate the adequate cost of products produced or work or services provided.

The analytical accounting system involves accounting for expenses by sections and cost items.

The organization approves the method of maintaining analytical accounting in its accounting policy.

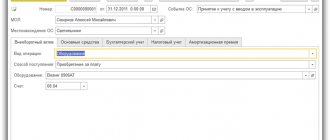

In accounting programs, account analytics. 26 is maintained by department and cost item. Based on the articles, to the account. 26 the corresponding sub-account will be opened.

Cost divisions are the object in respect of which these costs were incurred; a cost item is a decoding of the expense sections.

Analytical accounting can be maintained in the following sections:

- Administrative expenses containing the following items:

- travel expenses;

- expenses for paying salaries to management personnel;

- the amount of insurance premiums paid;

- entertainment expenses;

- Household expenses containing items:

- salaries of general business personnel;

- the amount of insurance premiums paid ;

- depreciation;

- protection costs ;

- personnel costs - training and retraining of personnel.

- Other expenses. They include:

- stationery ;

- postage ;

- electricity;

- sewerage;

- water supply.

Main components of general business expenses

The main general operating expenses include the following:

- Remuneration for management staff, directorate, accounting, office (including bonuses, vacation pay, benefits at the expense of the employer).

- Amounts of insurance payments to extra-budgetary funds related to the remuneration of employees of the administrative and economic apparatus of the organization.

Information about accounting entries when calculating and paying insurance premiums can be found in the material “Insurance premiums accrued (accounting entry)” .

- Accrued depreciation on fixed assets and intangible assets that were acquired to serve administrative and business personnel.

- Expenses for repairs of fixed assets not related to production.

- Expenses for renting premises used for management staff and other non-production purposes.

- Expenses for information and consulting services.

- Expenses for materials used for administrative needs.

- Entertainment expenses.

- Expenses for retraining of personnel.

- Expenses for paying for the services of security organizations.

- Recruitment costs.

- Expenses for subscription to periodicals.

- Software costs.

- Expenses for telephone calls and Internet services.

- Travel expenses.

ConsultantPlus experts explained in detail how to take into account administrative expenses when calculating taxable profit. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

You can familiarize yourself with all the nuances of documenting travel expenses in the article “Procedure for accounting for travel expenses in 2020-2021”.

Accounting for general business expenses based on an example

Synthetic accounting of general business expenses during the month is carried out in correspondence with the accounts:

| Dt 26 Kt 02 | Depreciation of equipment used for administrative and economic needs has been calculated. |

| Dt 26 Kt 05 | Depreciation was calculated on intangible assets used in the administrative and economic sphere |

| Dt 26 Kt 10 | Raw materials, supplies, and household equipment used in the administrative and economic sphere have been consumed |

| Dt 26 Kt 21 | Semi-finished products of our own production were released for administrative and economic purposes. |

| Dt 26 Kt 43 | Part of the finished products is used for our own administrative and economic needs |

| Dt 26 Kt 60 (76) | Costs for the services of suppliers and contractors are reflected on the basis of acts for the general economic needs of the enterprise |

| D 26 Kt 70 | Accrued wages for general business personnel |

| Dt 26 Kt 69 | The amounts of insurance payments to extra-budgetary funds related to the remuneration of general business personnel were included in expenses. |

| Dt 26 Kt 71 | In accordance with the advance report of the accountable person, entertainment expenses were written off |

| Dt 26 Kt 97 | A share of deferred expenses is written off to general business expenses |

Example

During the month, the architectural and design bureau incurred the following expenses.

The salary of employees performing design work amounted to 500,000 rubles.

The salary of the administration - the director of the organization and the accountant - amounted to 120,000 rubles.

The amount of insurance payments to funds related to administration salaries amounted to 36,240 rubles.

Depreciation of equipment for geological exploration amounted to 25,000 rubles, depreciation of a laptop and multifunctional device, which the accountant uses in his work, amounted to 5,000 rubles.

The cost of consumables for the multifunctional device purchased for the administration amounted to 6,000 rubles.

During the month, the following transactions are generated on account 26:

- Dt 26 Kt 70 - 120,000 rub. — salaries of the director and accountant were calculated.

- Dt 26 Kt 69 - 36,240 rub. — the amounts of contributions to the director’s and accountant’s remuneration funds are expensed.

- Dt 26 Kt 02 — 5,000 rub. — depreciation of the laptop and multifunctional device has been calculated.

- Dt 26 Kt 10 - 6,000 rub. — consumables for a multifunctional device were used for the needs of the administration.

Write-off and distribution of general business expenses

Account 26 does not have a balance, so everything that has accumulated on it must be written off to other accounts at the end of the month.

The choice of cost write-off option depends on the method of generating product costs:

- Full production cost.

- Reduced cost (method called direct costing).

Which method of cost formation the accountant will choose must be indicated in the accounting policy, otherwise the organization is obliged to form the full production cost of the product.

When an accountant chooses the accounting method at full production cost, general business expenses are written off as a debit to account 20 “Main production”.

If an organization uses account 23 “Auxiliary production” to register auxiliary costs, or if the organization’s balance sheet has servicing facilities (dormitories, kindergartens, sanatoriums, etc.) and account 29 “Service production” is used, then general business expenses can also be written off to the debit of account 29 expenses.

Expenses can be written off to the debit of these accounts only if the servicing industries and farms performed work and services outsourced.

The entries that form the reflection of such transactions in accounting will look like this:

Dt 20 (23, 29) Kt 26

Find out how to reflect the distribution of general business expenses in the accounting of a production organization in ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

The choice of the order of distribution of general business expenses between the above accounts remains with the accountant: general business expenses can be distributed among production in proportion to wages, the amount of direct costs or revenue. Which option the accountant chooses must be indicated in the accounting policy.

Example

A construction company has a fleet of vehicles on its balance sheet, the vehicles of which are used to deliver building materials to the company’s facilities and to provide services to third parties.

The company's accountant provided in its accounting policy that the expenses accumulated on account 26 are distributed in proportion to the amount of direct costs for maintaining the main and auxiliary production.

The company's costs associated with providing construction and installation services to clients amounted to RUB 1,800,000.

The construction company's expenses for the vehicle fleet amounted to 200,000 rubles.

2,000,000 rub. (1,800,000 + 200,000) is the total amount of expenses.

The amount of general business expenses is equivalent to 500,000 rubles.

The calculation of the distribution coefficient will look like this: 500,000 / 2,000,000 = 0.25.

The accountant needs to make the following entries:

- Dt 20 Kt 26 - 450,000 (1,800,000 × 0.25) - the estimated share of general business expenses is included in the cost of construction and installation work.

- Dt 23 Kt 26 - 50,000 (200,000 × 0.25) - the cost of providing motor transport services to third-party organizations includes the share of expenses from account 26.

When an accountant chooses the method of accounting for products at reduced cost, the contents of account 26 are written off directly to account 90-2 “Cost of sales”. This creates the following wiring:

D 90-2 Kt 26

You can learn more about accounting for account 90 by reading the material “Account 90 in accounting (nuances).”

Subscription to electronic publications

Situation: how to reflect in accounting the costs associated with subscriptions to electronic periodicals?

Accounting for expenses for periodical electronic publications depends on the type of contract.

Subscription to electronic periodicals can be issued:

- an agreement for the provision of paid information services for the provision of a copy of a periodical in electronic form (clause 2 of Article 779 of the Civil Code of the Russian Federation);

- a license agreement under which non-exclusive rights to use the electronic resources of the publishing house are transferred (Article 1367 of the Civil Code of the Russian Federation).

In the first case, pay for the subscription to the electronic publication in accounting as an advance payment (clause 3 of PBU 10/99). Reflect the advance payment using the following entries:

Debit 60 subaccount “Settlements for advances issued” Credit 51 – advance payment for subscription to an electronic magazine (newspaper) is transferred.

After receiving the issue of the magazine (newspaper) in electronic form, make the following entries:

Debit 26 (44) Credit 60 subaccount “Settlements with publishing houses” – the cost of the next issue of an electronic magazine (newspaper) is written off as expenses;

Debit 60 subaccount “Settlements with the publishing house” Credit 60 subaccount “Settlements for advances issued” - the amount of the advance is offset against repayment of accounts payable.

This procedure is based on the provisions of the Instructions for the chart of accounts (accounts 60, 44, 26), paragraphs 3, 18 and 19 of PBU 10/99.

In the second case, for accounting purposes, intangible assets received for use are accounted for on an off-balance sheet account in the valuation established by the agreement (clause 39 of PBU 14/2007). The chart of accounts does not provide for a separate off-balance sheet account for accounting for intangible assets received for use. Therefore, the organization needs to independently open an off-balance sheet account and consolidate this in its accounting policies for accounting purposes. For example, account 012 “Electronic subscription publications”.

The one-time payment for the granted right to use the electronic publication should be reflected in accounting in account 97 “Deferred expenses” and included monthly in expenses for ordinary activities during the validity period of the license agreement (paragraph 2, clause 39 of PBU 14/2007).

In accounting, reflect the prepayment by posting:

Debit 60 Credit 51 – the cost of the right to use the electronic publication has been paid.

After gaining access to the electronic publication, make notes:

Debit 012 “ Electronic subscription publications ” – the cost of the right to access an electronic publication is taken into account;

Debit 97 Credit 60 – the cost of the right to access the electronic publication is charged to deferred expenses.

Determine the mechanism for transferring future expenses to cost yourself. The following expenses can be written off:

- evenly;

- in proportion to the income received from sales;

- in other ways.

Determine the period for writing off expenses by the period for which access to the electronic subscription publication was provided. The beginning of this period (the beginning of the period of use of the subscription publication) is determined by the format of the software provided. For example, for the Internet version - from the moment the code is activated.

The period of use of the subscription publication is specified in the contract.

The established procedure for writing off future expenses should be fixed in the accounting policy for accounting purposes (clause 4, 8 of PBU 1/2008, letter of the Ministry of Finance of Russia dated January 12, 2012 No. 07-02-06/5).

Monthly during the period of access to the electronic subscription publication, make the following entries:

Debit 26 (44) Credit 97 – part of the payment for using the electronic publication has been written off.

This procedure is based on the provisions of the Instructions for the chart of accounts (accounts 97, 60, 44, 26), paragraphs 18 and 19 of PBU 10/99.

Attention: many write off deferred expenses at a time. They want to understate large profits of the current period or simply out of ignorance. Officials will be fined for this. In some cases, the organization will also suffer. However, you can avoid trouble.

In accounting, reverse the entry that was written off by the RBP at a time. Remember, this can only be done within the year in which the mistake was made.

r />

For example, the Alpha organization received a certificate of conformity for its products valid for five years. The cost of the certificate was 50,000 rubles. According to the accounting policy at Alfa, RBP is written off evenly.

Error!

Debit 20 Credit 76 – 50,000 rub. – the fee for the certificate is taken into account as part of expenses for ordinary activities.

Correctly like this:

Debit 97 Credit 76 – 50,000 rub. – the fee for the certificate is included in deferred expenses.

Monthly:

Debit 20 Credit 97 – 833 rub. (RUB 50,000: (5 years × 12 months)) – deferred expenses are written off.

Here's how to fix the error in this situation:

Debit 20 Credit 76 – 50,000 rub. – the amount previously erroneously included as expenses for ordinary activities is reversed;

Debit 97 Credit 76 – 50,000 rub. – the fee for the certificate is included in deferred expenses.

At the same time, expense the amounts written off for the past months. For example, if three months have passed since costs were accepted for accounting:

Debit 20 Credit 97 – 2500 rub. (3 months × (50,000 rubles: (5 years × 12 months))) – deferred expenses are written off.