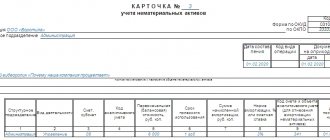

Intangible assets accounting card: form NMA-1

Being a primary document, an intangible asset registration card is drawn up upon receipt of an object. The standard form approved by Goskomstat is universal and until recently was mandatory, but since 2013 business entities have been allowed to develop their own documents, maintaining all the necessary details. Note that the intangible asset form - 1 is very convenient; it was developed by analogy with the asset accounting card, and companies use it, including additional sections only when they are necessary due to the specifics of production.

Sample of filling out an intangible assets accounting card

NMA-1 is drawn up in 1 copy. The basis for entering data into it is a document that may indicate receipt of the asset. A separate card should be created and filled out for each intangible asset.

The header of the form provides information about the enterprise and its structural division. After this, the date of registration and the name of the intangible asset are indicated.

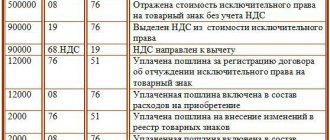

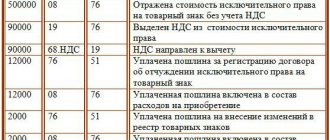

In general, IMA-1 is a table consisting of 17 columns that reflect the main characteristics of the asset:

- accounting account (column 3);

- initial cost (column 5);

- useful life (column 6);

- depreciation amount (column 7);

- depreciation rate (column 8);

- document on the basis of which the intangible asset was accepted for accounting (column 12);

- information about the disposal of the object (columns 13-17);

- other information.

When filling out information about disposal, you must indicate the reason for writing off the asset, as well as the amount of proceeds if it is sold. After the table the amount of depreciation is entered.

For information on determining the value of intangible assets, see the material “The initial cost of intangible assets is...”.

The last stage in document preparation is to reflect brief information about the intangible asset. When the basic information is entered into the form, the person in charge signs the card, indicating the date of completion and position.

On our website you can form NMA-1:

Filling out form No. NMA-1

Drawing up a document is a simple operation, but there are rules that guide it:

Each registration card is assigned a registration number in the line “Card No.”, the date of drawing up the document and the acceptance certificate, the full name of the company, OKPO code, as well as the division (shop/department) where the facility is operated are indicated. However, based on the intangibility of property, it is usually used in the activities of an entire enterprise, for example, a brand or trademark of a company, and then there is no need to fill out the line “Structural unit”.

For enterprises using a coding system, the transaction code for the receipt of the asset is entered on the card, and then the date and number of the corresponding document are specified. Subsequently, information is entered about the type of activity for which the asset was acquired, the department responsible for operating the asset, and the balance sheet account (subaccount) in which it will be recorded.

All object parameters are indicated:

- the initial cost, which consists of the costs of purchasing and bringing it to usable formats;

- the period required for full depreciation of property (SPI). Often, SPI is determined by expert means, since a special classifier has not been created, and the specifics of these assets are not always amenable to traditional methods of calculating depreciation. For intangible assets whose useful life is not determined, depreciation rates are set for ten years;

- depreciation rate in % or estimated rate;

- monthly depreciation amount;

- an account in which accrued depreciation amounts are accumulated.

For objects for which depreciation is not accrued (for example, received under donation agreements), dashes are placed in the corresponding columns.

The column “Acquisition method” provides information on how the company acquired the assets. Column 12 “Registration document” contains information about the document confirming the right to use intangible assets.

The last block of the table is devoted to information about the disposal/relocation of an object: document number and date, reason for disposal, amount from the sale of the object.

In the lower right corner of the form, in the “Depreciation amount” detail, the amount of monthly deductions is indicated.

The reverse side of the card is devoted to a brief description of the main qualities of the object.

Intangible assets accounting card: features

All kinds of intangible assets in any enterprise are always values that are not expressed physically and materially. These include the following values, which are expressed intangibly:

- single right to authorship;

- program;

- any intellectual property;

- other benefits.

Such a card has characteristic similarities with a card that is created and filled out to record various goods considered material, that is, for inventory. But in the second case, the card tracks records of precisely the benefits that the company has and are considered only material. At the same time, such cards have their own differences when they are constantly maintained and filled out.

Form NMA-1: sample filling

We present an example of the design of the NMA-1 card - a sample of filling out for a license that allows you to improve the technical aspects of the operating fleet of locomotives.

Form NMA-1 (form below) is filled out in one copy, on the reverse side notes are made about the characteristics of the property. The document is signed by the accountant who issued the card.

So, the intangible asset registration card-1, a sample of which is presented in the publication, is used in companies that record the corresponding property on the balance sheet.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What is an intangible asset registration card?

The intangible assets card -1 or the intangible assets card differs from the card that is created for inventory in that it contains data that is not related to material assets, but represents intangible values. It is extremely important that the intangible asset accounting card is filled out as correctly as possible. For this purpose, you should pay attention to the sample, which reflects the correctness of the form being filled out.

The card in accordance with the appropriate form of intangible asset -1 is filled out after it is accepted for accounting for an intangible asset. The form is filled out on one side and the other. The transfer and acceptance certificate, on the platform of which it is accepted for accounting, contains all the data that is required for the form.

Card for recording intangible assets NMA-1

Accounting for intangible assets for enterprises is carried out by filling out a standard form NMA-1, which provides basic information on the received object. In the article we also offer a sample of filling out the intangible asset registration card NMA-1.

An accounting card in the form of intangible assets NMA-1 is used when a new asset is received and is filled out for each object separately.

Important: it is impossible to document everything with one document; if there are several assets, each one must have a separate card, taking into account the specifics.

The basis for filling out the card is the act of acceptance and transfer of the asset; it can be drawn up either in free form or using standard forms developed for fixed assets. No separate forms have been developed for intangible assets.

Samples of standard forms for fixed assets can be viewed here.

The procedure for classifying objects as intangible assets is regulated by law through various regulations. Objects of an intangible nature include values that do not have a physical basis.

In particular, these objects include:

- Property, in the form of intellectual labor;

- Computer programs;

- A collection of rights that have claims to a piece of property.

An inventory card OS-6 is filled out for OS objects - download the form and sample OS-6.

Rules for filling out an intangible asset registration card

This form contains a standard form that reflects all the necessary data.

The NMA-1 form on the card reads:

- Name and OKPO of the organization;

- If the intangible asset is planned to be used in a separate division, its name is indicated;

- Date of document preparation;

- If the company uses a coding system, the operation code is indicated;

- The number and date of posting of the registration card NMA-1 is indicated;

- Full name and purpose of the intangible asset.

After the title data, information is entered into the table.

From lines 1 to 17 the relevant information is recorded:

- The name and type of employment of the department where the asset is located;

- The account and sub-account in which the intangible asset is registered;

- Analytical subaccount number, if this is practiced at the enterprise;

- The nominal price of an intangible asset, taking into account all the resulting costs of its acquisition;

- Useful life;

- The amount and rate of monthly depreciation;

- Account for depreciation;

- The date from which the asset began to be taken into account;

- Method of acquiring the asset;

- The document indicates the basis for the operation of the facility.

The last 5 lines of the intangible asset form are filled in at the time of disposal of the intangible asset from the organization:

- Number of the document that became the basis for disposal of the object;

- Date of preparation of such paper;

- Reasons and code of disposal;

- Revenue from product sales.

Important: in addition to these points, on the back of the intangible asset registration card-1 there is a brief description of the intangible asset and its properties.

This card is signed by the employee who compiled it, usually an accountant plays this role.

Features of filling NMA-1

- All items on the form must reflect the main properties, data and information about the asset for which the accounting card is issued;

- It is important to indicate the filling procedure and enter all the required data so that the card has legal force;

- Form NMA-1 refers to the supporting documents that every organization must have in order to conduct business operations;

- The document must be drawn up at the time of the reception operation, if this is not possible immediately after it, since the timely preparation of documents and the inclusion of truthful information in them is ensured by the persons performing the event;

- The registration card is accompanied by documents that ensure the transfer and availability of intellectual property rights;

- If it is impossible to determine the useful life of a certain object, then the document must contain a justification for this fact.

Conclusion

This system of accounting for intangible assets, together with the accompanying documentation, was developed taking into account the legislation and allows us to fully take into account the specifics of the asset.

Intangible assets accounting card form NMA-1 form - download.

Sample of filling out the NMA-1 card - download.

Source: //9doc.ru/kartochka-ucheta-nematerialnyx-aktivov-nma-1/

Reverse side of the intangible assets accounting card

There are no tables on the second page of the document. On it, the filler is provided with lines for a brief written description. Moreover, the purpose of the asset is not stated in it, since it should already be contained on the front side of the document.

You can specify here the specific parameters and capabilities of the computer program, terms, and rights. A list of functionality will also be useful. They often list the company whose intellectual property the product was. But too lengthy a description is not welcome.

Important! Information on the brief characteristics should not duplicate or quote technical documentation (instructions, operating rules) for the described object, which is located in the organization. The final touch on the paper will be the indication of the position of the person filling it out, his personal signature and transcript

It is placed after a comprehensive analysis of the intangible asset

The final touch on the paper will be the indication of the position of the person filling it out, his personal signature and transcript. It is placed after a comprehensive analysis of the intangible asset.

Procedure for filling out NMA 1

The form is filled out in one copy based on the document for registration, acceptance and transfer (movement) of intangible assets and other documentation.

Column 7 indicates the amount of depreciation, which is calculated monthly at rates calculated based on the original cost and useful life.

In chapter

“Brief description of the object of intangible assets”

Only the main indicators of the object are recorded, excluding duplication of data from the technical documentation available in the organization for this object.

For accounting of intangible assets, only one unified document is provided: an intangible asset accounting card (form No. NMA-1), approved by the Resolution of the State Statistics Committee of Russia dated October 30, 1997. No. 71a. An enterprise can independently develop the form of an acceptance and transfer certificate for intangible assets and approve it in its accounting policies.

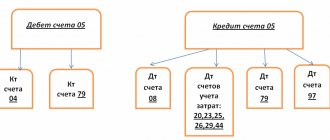

37) Analytical and synthetic accounting of settlements with personnel for other operations: documentation. Accounting for settlements with personnel for other operations is kept on account 73 (asset).

Features of filling out primary documents for accounting for intangible assets

According to the Accounting Regulations “Accounting for Intangible Assets” PBU 14/2000, approved by Order of the Ministry of Finance of the Russian Federation of October 16, 2000 No. 91n, intangible assets for accounting purposes include: · the exclusive right of the patent holder to an invention, industrial design, utility model; · exclusive copyright for computer programs, databases; · property right of the author or other copyright holder to the topology of integrated circuits; · the exclusive right of the owner to a trademark and service mark, the name of the place of origin of goods; · exclusive right of the patent holder to selection achievements.

Intangible assets accounting card

All kinds of intangible assets in any enterprise are always values that are not expressed physically and materially.

These include the following values, which are expressed intangibly:

- single right to authorship;

- program;

- any intellectual property;

- other benefits.

1\Temp\msohtmlclip1\01\clip_image002.jpg" />

On the front side of the card you must enter the name of the asset (intangible).

The table columns contain the following data:

Intangible assets accounting card: form NMA-1

Using NMA-1 cards, all types of intangible assets received are recorded, and information is provided on how the company received the assets.

In column 12 “Registration document”

Sample filling

To avoid mistakes and fill out the intangible asset form correctly, you should pay attention to the example of filling out the card. The name of the company that owns the intangible assets should be indicated on the front side. You also need to indicate the name of the unit that accepted the object. Further actions: you must enter the date corresponding to the date when the form was filled out, as well as the number.

On the front side of the card you must enter the name of the asset (intangible). The table columns contain the following data:

- name of the relevant division (structural);

- type of activity carried out;

- accounting (accounting) number;

- when conducting analytics - the corresponding accounting code;

- the amount of all relevant financial expenses in the process of acquiring assets;

- if there is a certain period of the asset, it must be indicated;

- depreciation is determined depending on the type of accrual;

- the rate of such depreciation is determined according to the chosen method;

- indication of an account reflecting depreciation charges every thirty days;

- the date when exactly the existing asset was taken into account;

- an indication of how the asset was received;

- indication of the date and number of documents regarding the right to a particular asset.

Attention! After the asset leaves the company, it is necessary to fill out all remaining lines in the existing form. At the same time, the document on the platform of which the asset is transferred is noted. You will need to indicate the reason why this asset was lost. If a sale takes place, the amount of funds that went into the company's treasury should be indicated.

To fill out the back of the intangible asset card, you need to pay attention to the sample, which will be the best way to prevent the most serious mistakes. On this side, it is necessary to briefly describe the asset, provide data such as position, surname, first name and patronymic of the citizen who fills out the form. You must also indicate the exact date, month and year of its completion.

Post Views: 301