The Federal Tax Service of the Russian Federation invites organizations to partially switch to automatic budget recalculation online by creating an account on the official portal of the Federal Tax Service of the Russian Federation. The personal account of a taxpayer of a legal entity or individual entrepreneur allows you to receive detailed information about available tax deductions and payments made. You can also make a request for the issuance of relevant settlement data from the Federal Tax Service remotely, that is, remotely.

Official website of the Federal Tax Service of the Russian Federation for legal entities lkul nalog ru

The personal account of a taxpayer of a legal entity, registered as a legal entity, presented on the official portal of the Federal Tax Service of the Russian Federation is a universal virtual platform where you can manage the personal account of any taxpayer. Using your personal legal account. individuals can obtain accurate information on current debts or on payments already made. Companies have publicly available information about existing counterparties and other persons. Legal here. individuals can generate the documents they need, receive certificates, and so on.

Personal account of a taxpayer of a legal entity

When working with a legal entity’s personal account, only secure system tools are used. Any user information on the site can count on the security and confidentiality of personal information. Since everything is under an electronic signature key, which only the owner of the personal account knows. To gain access to the KSKPEP, which is confirmation of the authority of the owner of the personal account, there may be a limited list of people established by the accredited Ministry of Communications of the Russian Federation, these are:

- company manager;

- representative.

You can find suitable accredited institutions using the portal of the Ministry of Telecom and Mass Communications.

Possibilities

Legal entities can connect to a registered personal account in order to further use the services of the tax service remotely. Thanks to the personal account, users can receive an extract from the USRN department, an extract for their organization, and make the necessary changes with or without the help of special documents. You can only get up-to-date information, information related to tax debts, the possibility of paying off debts, sending notifications, penalties and other data.

The Federal Tax Service branch offers the opportunity to use a personal account with different functions. A personal account of a legal entity is registered with the Federal Tax Service.

Functional Features

The functions available in each service allow you to fully use the personal account of a taxpayer of a legal entity:

- accounting for any accruals and paying taxes;

- ordering a full extract of the Unified State Register for your company;

- request for an extract, which will confirm the fulfillment of the main obligations;

- entering personal information about departments into the organization’s personal account;

- debt verification;

- sending an application for further deduction or return of the withheld amount and viewing the final decision from the tax authority;

- preparing or sending the necessary web files;

- uploading information in csv format.

What can you get from your personal account as an individual entrepreneur or head of an organization:

- receive a virtual extract from the Unified State Register of Individual Entrepreneurs or the Unified State Register of Legal Entities;

- selection of a suitable tax system;

- connecting an alert about the presence of debt in payments;

- sending important messages, filing a complaint, filing an application with the tax office;

- editing information, obtaining qualified reference information;

- submitting an electronic application to determine the availability of payments;

- viewing the main actions for calculating your personal budget and obtaining the necessary statement.

Using an electronic signature

As noted earlier, gaining access to the service implies the presence of an electronic signature key, the issuance of which is carried out in a specialized certification center that has received accreditation at the state level, corresponding to the norms of Federal Law No. 63 of April 6, 2011.

Along with this, you will need to go through a simple registration procedure, which does not imply a personal visit by a representative of the organization to the Federal Tax Service. An important role is played by the signing of an agreement related to the provision of access to your personal account. It is issued directly by the head of the company or by a person authorized to act on his behalf. Also, this issue can be resolved by a participant who has a power of attorney.

In the future, all these persons can connect additional participants to their personal user account, the number of which is not limited . There are only two conditions :

- presence of an electronic signature;

- TIN.

The functionality of your personal account does not imply the possibility of generating reports electronically and using a free program developed by the Federal Tax Service. It is called “Taxpayer Legal Entity”. On the website you can find the program and read the instructions for use.

Registration of a personal account of a taxpayer of a legal entity

To fully work with the personal account of the Federal Tax Service, both a legal entity and an individual entrepreneur will have to:

- Have a certificate of an entrepreneur or legal entity on hand to verify the document.

- Check the full compliance of the software on a personal computer, from where the user will be able to fully open their personal account and follow all the necessary requirements and conditions listed on the official website.

- Install all necessary application components on your PC.

An individual entrepreneur can log into a taxpayer’s personal account using an INN, a personal password, which is issued strictly by the Federal Tax Service, or by using an electronic signature, which significantly expands all the existing functionality of the convenient service. To renew your password, you can use your passport data and documentation issued for opening an individual business.

What should be the digital signature for the Federal Tax Service?

Each application has its own basic formalities that allow you to enter basic information about yourself and your business. Legal entities are allowed to formalize their data based on the listed possibilities only thanks to long-studied rules and conditions. Each specific user can open a personal account in any version for him. Now you can do this using a regular personal computer or using a mobile device.

How to register a personal account of a legal entity remotely?

Authorization in your personal legal account. persons are offered on the official portal nalog.ru using Rutoken EDS 2.0. But this option can only be joined with the Windows operating system. To enter the application, just download it to your device and receive a PIN code. By default, a single PIN code is issued for the Rutoken program - 12345678, it is better to change it in case such a PIN code is known to everyone. This way you can protect your personal information. All entered keys and a virtual signature are automatically saved on Rutoken.

How to log into another account on the same device

- You need to log out of your personal account using the button located in the upper right corner.

- Connect the correct USB drive to the computer to change the personal computer.

- Clear browser cache files. To do this, you can use the settings or the shortcut key combination “Ctrl+Shift+Delete”.

- Restart the program and re-enter the website lkul.nalog.ru.

- If all technical parameters are met, a window for entering a security code will appear, and then authorization will be performed.

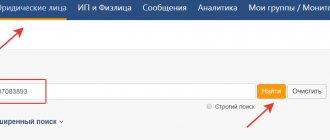

Login to the LKUL.NALOG.RU account (legal entities)

To open a personal account, you must use several methods. It is necessary to open a window to log into your account through popular browsers that have never let users down. Afterwards you need to log in:

- Switch to the official website https://www.nalog.ru;

- In the Federal Tax Service portal, select the “legal entities” category;

- in this category, find “Personal Account”. The page “Personal Legal Account” will automatically appear there. faces."

Another option is to connect Rutoken to a personal computer.

- Enter Rutoken EDS 2.0 into the USB port of your personal computer and select the button “Checking connection conditions with Rutoken EDS 2.0 using a document issued by EGAIS.”

- A browser window will appear in the browser tab, displaying a complete list of details required for authorization in LUK.

Now all that remains is to select a certificate and go to the personal account of the legal entity.

- If certain elements are not in the system, go to the “Setting up a PC to enter your personal legal account” category. faces."

- If some elements are missing from the system, a window for selecting a certificate will appear in the browser tab.

- Certificates that are not available for selection are located in the “Unavailable Certificates” tab; accordingly, the available ones will be located in the “Available Certificates” section.

To select a certificate, you must go through the next step.

- In the “Available Certificates” category, in the item with the certificate required for users, select the “Select” button.

- Enter Rutoven’s PIN code and press the “ok” key. As a result, a window is displayed on the screen with the stages of a thorough check perfectly completed.

Go to the personal account intended for the legal entity. persons.

- Go to the tab “Go to the “Personal Account of a Legal Entity””.

- On the new tab, find the category “Login to the site using a certificate.”

- Switch by the name of the selected category from a specific certificate.

- Enter the Rutoken PIN code and press the “Login” button. So the legal entity lic tab will appear on the screen.

Setting up a PC to log into your personal legal account. faces

On the main tab “Personal Legal Account” persons" in the category "Checking the conditions for connecting to the "Personal Legal Account". persons"" several statuses will be displayed for verification actions.

Basic rules for values:

- A green circle with a check mark means that this part is available in the operating system or browser running on the computer.

- A red circle with a minus sign means that this component is in the OS and browser.

- A question mark means that the component did not pass the test, so the following actions will be rejected.

As soon as a notification appears on the monitor that it is impossible to find Rutoken Connect in the OS. As a result, you can make instant setup.

In any other case, you need to go to the instruction category “Manually setting up a PC to log into the legal account. faces." Instant setup of a personal computer to log into the legal account. faces.

For faster setup, select the Rutoken Connect program from trusted sources. Together with this application, the following drivers will be installed: Rutoken Plugin, an important software extension used with the browser Adapter “Rutoken Plugin”. As well as a certificate installed by the necessary documentation in the head certification center and the Ministry of Telecom and Mass Communications.

Now all that remains is to install the program itself.

- On the main page of the “Personal Legal Account” faces" in the list of features there are all the necessary components, where you should find the "Download" category and click on it. Afterwards the “Rutoken Connect” item will appear.

- In the window that appears, find the link that allows you to install the program for Windows.

- The provided software must be downloaded.

- You should first run the downloaded program; install it by pressing the “Run” button.

- In the Rutoken Connect category, select the convenient “Install” button.

- If the Main Center certification has not been previously downloaded, a page will appear on the monitor confirming the pre-installation of the certification. You will have to select the “Yes” button.

- If the certificate received to confirm the legal entity of the Ministry of Telecom and Mass Communications was not downloaded and installed, the category for registering the certificate will be displayed on the monitor. Now click on the “Yes” button.

- After completing the installation process, you must select the “Close” button.

- In one of the browser lines with additional extensions, select the icon with an exclamation mark.

- Select the "New Extension Added" category.

- Click on the “Enable extension” button.

- Go to the “Add” tab for the installed plugin.

- Enable the "Enable Extension" category.

- Now restart your browser.

Legislative standards

The concept of “electronic signature”, valid on the territory of the Russian Federation, is described in detail in 63-FZ, paragraph 2. Its use is regulated by acts 44 and 222 of the Federal Law.

Accordingly, they are used in regulating electronic document management. The above legislative standards apply to absolutely all areas where an electronic signature can be used, including tax. But EDS comes in several varieties. Which of them will provide the opportunity to submit reports remotely or request extracts from the Federal Tax Service?

The primary variation of the law on electronic signatures was published and adopted back in 2002, the latest current version was in 2015. Starting in 2022, the functionality of digital signatures has been significantly expanded. For example, the owner of an electronic key was given the opportunity to interact with Rosreestr, including conducting real estate transactions, even on a commercial basis.

In 2000, a law was signed allowing businesses to begin using electronic digital signatures throughout their operations. In 2011, a regulatory legal act was adopted regulating civil legal relations when concluding transactions.

Contacts of the Federal Tax Service of Russia

More than a million people contact the tax inspectorate every day, concerned about issues of various formats. They often complain that they cannot decide how convenient it is to use the application. Therefore, to obtain the necessary information, just contact the support service. 24-hour support for the population is provided through a convenient contact center.

The Federal Tax Service of the Russian Federation is openly available to people of any category, regardless of whether they are a legal entity or an individual. It is not necessary to call or visit the tax office; it is enough to send your own notification or question online. Some of the requests sent over the network are only increasing every day, so precise modernization and improvement of the current channel when talking with specialists will be required.

Citizens are offered the following forms of communication via chat:

- It is possible to send a written message by email

- You can make an official request through the convenient portal https://www.nalog.ru/rn77/service/obr_fts/.

- Write a notification on social networks.

In most cases, users can send their messages through a special portal. It all depends on which category a person belongs to. Now users, regardless of the form will be different. You must provide personal information by attaching a subject and a detailed description of the issue or problem of interest to the notification. Using a special form, anyone can make an appointment with the company's professionals. And only by filling out the questionnaire with an answer, you can get a decent answer.

The support service operates during business hours and accepts any messages from the local population via email in order to adhere to the appropriate form, where you must provide only reliable information.

Federal Tax Service hotline

Most questions from the public are received at the contact center. For some time now, a hotline has been operating in Russia, where any requests from users of any category are processed. The hotline number is the same for all regions, so you can reach it from any region by calling: 8. This number is free, even when calling from mobile devices. Additionally for physical and legal a single auxiliary call center is being created for individuals to communicate with other countries. The cost of tariffication will depend on the established conditions of the operator.

Regional tax management

In different regions with huge populations, the tax service network is maximally developed, so any representative has his own contact information to consider the application. Information about telephone numbers, emails, as well as the work schedule of the capital’s Federal Tax Service employees can be found on the website: https://www.nalog.ru/rn77/apply_fts/.

Head center

The main tax center is located in Moscow; citizens can contact them via a hotline.

Helpline

In any specific region, the telephone number for contacting, sending complaints, claims, as well as reviews, can be called by calling the main telephone line or +7 (495) 400 63 67.

Information for the media

Information intended for representatives of the information service can be transmitted via telephone or online resource. Contacts for information services in the regions have distinctive features, which can be further clarified on the official portal. Head office service telephone number.