A number of specialties are directly related to negotiations, including over the telephone. Since a mobile phone is a tool needed to support work activities, cellular communication services are paid for by the employer. Compensation involves a partial or full refund to the employee for communication services. Only expenses for calls on work matters are reimbursed. Associated costs must be properly accounted for.

Is it necessary to use CCT when deducting from an employee’s salary for overspending on cellular communications and fuel standards?

What documents must an employee provide?

To receive compensation, each employee provides:

- a copy of the agreement with the mobile operator;

- details of calls made on behalf of the organization.

ATTENTION! For those who doubt whether an employee is required to provide details of calls made on a personal SIM card, we inform you that by law an employee is not required to provide such a report. But asking an employee to do this voluntarily to justify the costs economically is not prohibited.

Purchasing a mobile phone at the expense of the organization

Situation: is it possible to take into account the costs of purchasing a mobile phone for the director of an organization when calculating income tax? The cost of the phone is less than 40,000 rubles. The director will pay for telephone conversations from his own funds.

Answer: no, you can't.

In order to take expenses into account when calculating income tax, they must be economically justified and documented (Clause 1, Article 252 of the Tax Code of the Russian Federation).

Paying for telephone calls from the employee's (director's) own funds means that the telephone itself was purchased for his personal use. Such a telephone cannot be recognized as property that is used in activities aimed at generating income. Consequently, the costs of its acquisition are not economically justified (clause 1 of Article 252 of the Tax Code of the Russian Federation).

How to properly reimburse expenses

Expenses are reimbursed if they were incurred during the performance of work duties. This could be payment:

- for the use of the employee’s own property (cell phone, laptop);

- wear and tear of technical equipment;

- Internet or mobile operator services.

IMPORTANT!

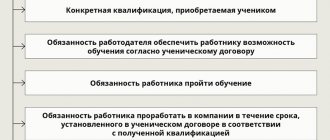

The amount of payment is fixed in writing in the employment contract or in an additional agreement, if the need for this arose after registration of employment.

How to apply for reimbursement of employee expenses for mobile communications

If a SIM card is issued to an enterprise and it independently pays for the services of a mobile operator, a certain limit is set for each employee and employee expenses for cellular communications and their registration are recorded. The format is as follows:

- The head of the enterprise issues an order indicating a list of positions for which reimbursement of expenses will apply.

- An agreement is signed with a mobile operator.

- An agreement is signed with the employee to allocate him a work cell phone or SIM card, and the established limit is separately specified.

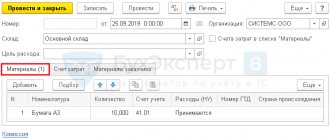

- Monthly provision by the mobile operator of documents for accounting expenses: invoices, acts, call details for each number.

To answer the question whether just an order for compensation for cellular communications is sufficient, let us turn to the letter of the Federal Tax Service of Russia for Moscow dated October 5, 2010 No. 16-15/ [email protected] It states that the need to use a cell phone to perform work duties should be recorded and in the employee’s job description.

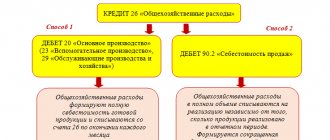

Accounting

Expenses for communication services are expenses for ordinary activities (PBU10/99 R.2 p.5), they are associated with the production, acquisition, sale of goods, work, services. From the above it follows that they will be taken into account in accounting in “cost” accounts by department.

Standard wiring:

- Dt 20, 25, 26, 44 Kt 60 – mobile communications costs are taken into account (excluding VAT).

- Dt 19 Kt 60 – VAT on mobile communication services is taken into account.

- Dt 68 Kt 19 – VAT deductible.

- Dt 60 Kt 51 – payment for mobile communications has been completed.

If overspending is detected, settlements are carried out through account 73, using the corresponding subaccounts:

- Dt 73 Kt 60 – above-limit communication expenses were recorded (in the context of analytical accounting, by name).

- Dt 50 Kt 73 – expenses were repaid in cash by an employee who exceeded the limit.

- Dt 91 Kt 73 - expenses of the employee who committed overspending were written off as losses due to the inability to withhold the amount. This situation may arise if the employee managed to quit.

Compensations for the use of personal phones for business purposes (mentioned above) are also taken into account through account 73:

- Dt 20, 25, 26, etc. Kt 73 – compensation payment to the employee has been accrued.

- Dt 73 Kt 50, 51 – the company paid the employee.

Sample order

| State budgetary educational institution for additional education of children, specialized children's and youth sports school of Olympic reserve "Allur" ORDER Moscow |

About corporate cellular communications

In order to improve performance

I ORDER:

- To improve the results of educational activities and effective interaction, from December 1, 2022, establish compensation for the use of mobile phones according to the position held.

- Compensation for communication services is paid

- to the director

- chief accountant

- Head of HR Department

- Each person receives a monthly payment in the amount of:

- director - 1500.00 rub.

- chief accountant - 500.00 rub.

- to the head of the HR department - 500.00 rubles.

- An employee receiving compensation must be available to call during working hours.

- Chief Accountant V.V. Viktorova conclude agreements on reimbursement of expenses with each employee and ensure their accounting.

- The director monitors the implementation of the order.

Director Ivanov I.I.

BASIC: income tax

When calculating income tax, include the costs of paying for mobile communication services as other expenses (subclause 25, clause 1, article 264 of the Tax Code of the Russian Federation). At the same time, the organization must have documents confirming the production nature of telephone conversations. This is the requirement of paragraph 1 of Article 252 of the Tax Code of the Russian Federation.

Situation: what documents confirm the production nature of an employee’s conversations on a mobile phone? The organization independently entered into an agreement with a cellular operator.

The list of documents confirming the production nature of telephone conversations is not defined by law. Despite this, the courts are inclined to believe that the organization is obliged to prove the connection between the costs of paying for communication services and its production activities (see, for example, resolutions of the Federal Antimonopoly Service of the Moscow District dated January 19, 2009 No. KA-A40/12732-08, Western Siberian District dated May 4, 2005 No. F04-2733/2005 (10928-A27-40) and East Siberian District dated May 27, 2005 No. A58-1983/03-F02-2300/05-S1).

Controlling agencies recommend confirming the production nature of telephone conversations:

- contracts with a mobile operator for the provision of services;

- detailed accounts of mobile operators;

- job descriptions that state when performing what duties an employee can use mobile communications;

- orders of the head of the organization on approval of the list of employees who, due to the duties they perform, require mobile communications.

The listed documents are given in letters of the Ministry of Finance of Russia dated June 23, 2011 No. 03-03-06/1/378, dated June 5, 2008 No. 03-03-06/1/350, dated July 27, 2006 No. 03- 03-04/3/15. The above list is also referred to by some arbitration courts (see, for example, decisions of the FAS Moscow District dated September 2, 2008 No. KA-A40/8318-08, Volga District dated September 22, 2005 No. A65-23196/2004-CA1 -32).

Advice: there are arguments that allow organizations to take into account the costs of paying for mobile communication services for tax purposes without detailed invoices. They are as follows.

The Tax Code of the Russian Federation does not contain a list of mandatory documents that can be used to confirm expenses incurred. Moreover, the fact of expenses can be confirmed by any document, even indirectly indicating this (clause 1 of Article 252 of the Tax Code of the Russian Federation). Neither tax legislation, nor communications legislation, nor accounting legislation contain requirements for mandatory decoding of conversations made, receiving detailed invoices and drawing up a report on each call. In addition, the content of the negotiations constitutes a communication secret protected by law (Article 63 of the Law of July 7, 2003 No. 126-FZ). This means that the organization is not obliged to confirm the production nature of these expenses by detailing the accounts.

Thus, the organization has the right to justify the costs of paying for mobile communication services, in particular, by the concluded agreement with the mobile communication operator, payment documents, organizational and administrative documents of the head of the organization, etc. This conclusion is confirmed by judicial practice (see, for example, the definition of the Supreme Arbitration Court RF dated September 3, 2008 No. 11211/08, resolution of the Federal Antimonopoly Service of the West Siberian District dated July 2, 2008 No. F04-3910/2008(7317-A81-14), Moscow District dated June 3, 2009 No. KA-A40 /4697-09-2, dated February 24, 2009 No. KA-A40/12268-08, dated July 9, 2008 No. KA-A40/5861-08 and dated July 19, 2007 No. KA-A40/5441- 07, Ural District dated December 8, 2008 No. Ф09-9153/08-С3, Northwestern District dated January 15, 2009 No. A56-6560/2008, Volga District dated May 23, 2008 No. A55-10554/07 , dated May 16, 2008 No. A55-13148/07, Central District dated March 6, 2009 No. A35-4080/07-C8).

The tax inspector may ask who exactly and for what production purpose this or that employee spoke on a mobile phone. Therefore, prepare in advance additional information confirming the production nature of the negotiations. This could be contracts with counterparties, business correspondence, certificates on the status of mutual settlements, etc.

Tax inspectors have no right to demand reports on the content of telephone conversations (paragraph 8 of the letter of the Ministry of Taxes and Taxes of Russia dated May 22, 2000 No. VG-9-02/174).

Advice: in the internal documents of the organization, stipulate the obligation of employees to prepare reports on business calls made during the month using the provided mobile connection.

Such reports can be compiled based on transcripts provided by the telecom operator. The employee must justify each call indicated in the transcript. In this case, the tax inspectorate will not be able to accuse the organization of not confirming the production nature of the expenses.

If the organization uses the accrual method, then reduce the tax base as bills for payment for telecom operator services are presented or on the last day of the month (subclause 3, clause 7, article 272 of the Tax Code of the Russian Federation). If the organization uses the cash method, write off expenses only after they are actually paid to the operator (clause 3 of Article 273 of the Tax Code of the Russian Federation).

Do not take into account the cost of personal conversations between employees when calculating income tax (with the exception of cases when an employee compensates for the organization’s expenses for paying for his personal telephone conversations). They are not related to the activities of the organization and are not economically justified (see, for example, letter of the Federal Tax Service of Russia for Moscow dated October 19, 2005 No. 20-12/75319).

An example of how expenses for mobile communication services are reflected in accounting and taxation. The organization applies a general taxation system

In March, Alpha LLC entered into an agreement with a mobile operator for the provision of services on a 100% prepayment basis. The operator provided the organization with 2 subscriber numbers. By order of the head of Alpha, the following have the right to use mobile communications:

- Commercial Director;

- Chief Accountant.

The organization determines income and expenses using the accrual method. In March, Alpha transferred an advance payment of 5,000 rubles to the operator’s current account. In April, the operator issued an itemized invoice and invoice to the organization. The total cost of telephone conversations in April was 4,720 rubles. (including VAT - 720 rubles). Based on the decryption of the invoice, the organization’s accountant determined that the cost of personal telephone conversations amounted to 590 rubles. (including VAT - 90 rubles). Of them:

- for the commercial director - 236 rubles. (including VAT - 36 rubles);

- for the chief accountant - 354 rubles. (including VAT - 54 rubles).

Employees do not reimburse the cost of personal telephone conversations.

Alpha calculates contributions for insurance against accidents and occupational diseases at a rate of 0.2 percent. The organization charges insurance premiums for compulsory pension (social, medical) insurance at general rates.

The following entries were made in the organization's records.

In March:

Debit 60 subaccount “Settlements for advances issued” Credit 51 – 5000 rub. – prepayment for the provision of mobile communication services for April is listed.

In April:

Debit 26 Credit 60 – 3500 rub. (4720 rub. – 720 rub. – (590 rub. – 90 rub.)) – reflects the cost of office telephone conversations for April;

Debit 19 Credit 60 – 630 rub. (720 rub. – 90 rub.) – VAT on mobile communication services is taken into account;

Debit 68 subaccount “Calculations for VAT” Credit 19 – 630 rub. (720 rubles – 90 rubles) – accepted for deduction of VAT on the cost of business telephone conversations;

Debit 73 Credit 60 – 590 rub. – the cost of personal telephone conversations is reflected, which is not subject to reimbursement at the expense of employees;

Debit 19 Credit 73 – 90 rub. – VAT on mobile communication services is taken into account;

Debit 91-2 Credit 73 – 500 rub. – reflects the cost of personal telephone conversations that are not reimbursed by employees;

Debit 91-2 Credit 19 – 90 rub. – VAT is written off from the cost of personal telephone conversations;

Debit 60 Credit 60 subaccount “Settlements for advances issued” – 4720 rubles. – the prepayment amount has been credited;

Debit 70 Credit 68 subaccount “Personal Income Tax Payments” – 77 rubles. (RUB 590 × 13%) – personal income tax is charged on the cost of personal calls from employees;

Debit 91-2 Credit 69 subaccount “Settlements with the Pension Fund” – 129.80 rubles. (590 rubles × 22%) – pension contributions are accrued;

Debit 91-2 Credit 69 subaccount “Settlements with the Social Insurance Fund for social insurance contributions” – 17.11 rubles. (590 rubles × 2.9%) – social insurance contributions in case of temporary disability and in connection with maternity in the Federal Social Insurance Fund of Russia are calculated from the cost of personal negotiations of employees;

Debit 91-2 Credit 69 subaccount “Settlements with FFOMS” – 30.09 rubles. (590 rubles × 5.1%) – contributions for health insurance to the Federal Compulsory Medical Insurance Fund are calculated from the cost of personal conversations between employees;

Debit 91-2 Credit 69 subaccount “Settlements with the Social Insurance Fund for contributions to insurance against accidents and occupational diseases” - 1.18 rubles. (590 rubles × 0.2%) – contributions for insurance against accidents and occupational diseases are calculated from the cost of personal conversations between employees.

When calculating profit tax for April, Alpha’s accountant included 3,677 rubles in other expenses. (4000 rub. – (590 rub. – 90 rub.) + 177 rub.). The accounting reflects a permanent tax liability:

Debit 99 subaccount “Continuous tax liabilities” Credit 68 subaccount “Calculations for income tax” - 118 rubles. (RUB 590 × 20%) – reflects a permanent tax liability for expenses that do not reduce taxable profit.

Unspent advance amount of 280 rubles. (5000 rubles - 4720 rubles) is counted towards payment for mobile communication services in the next month.