Why is count 41 needed?

Account 41 “Goods” is used to record the movement of goods for resale. 41 accounts record their value and movement: purchase, sale or write-off. Purchased packaging is also taken into account on this account.

Account 41 is active. The debit indicates an increase in the cost of goods, for example, when purchasing a new batch for a warehouse. And for a loan - a decrease, for example, when selling to a buyer. The debit balance of account 41 is entered into the balance sheet in the “Inventories” line.

The procedure for accounting for goods, as well as other inventory items, is regulated by PBU 5/01.

Accounting for goods receipt

Goods are inventories purchased from other parties and intended for sale in the ordinary course of business without additional processing (clause 3 of FSBU 5/2019).

Since 2022, the accounting of goods is regulated by the new FSBU 5/2019 “Inventories”. The new procedure for accounting for goods is discussed in detail in the Ready-made solution from ConsultantPlus. Trial access to the system can be obtained for free.

Receipt of inventory items is reflected in the debit of account 41 in correspondence with mutual settlement accounts: 60, 71, 75, 86, etc. (chart of accounts approved by order of the Ministry of Finance dated October 31, 2000 No. 94n).

Goods are accepted for accounting at actual cost (clause 9 of FSBU 5/2019), which includes all costs incurred during the acquisition of goods and materials, including (clause 11 of FSBU 5/2019):

- payment for goods to the supplier;

- costs of procurement and delivery of goods to the place of their sale;

- pre-sale preparation costs (sorting, packaging, etc.);

- other expenses.

Accounting for goods in wholesale and retail trade has some differences. Companies that sell goods wholesale record them at cost of acquisition. Retail companies are given the right to choose to record the cost of inventory items: either at the purchase price or at the sales price, with separate consideration of markups and discounts (clause 21 of FSBU 5/2019). The selected accounting option must be secured as an element of the enterprise's accounting policy.

Read more about how to account for goods in wholesale and retail trade in ConsultantPlus. Get trial access to the system for free and go to the Typical situation.

Let's look at the main transactions when goods arrive.

| Wholesale | Retail | Content | ||

| Dt | CT | Dt | CT | |

| 41 | 60 | 41 | 60 | Goods received from supplier |

| 19 | 60 | 19 | 60 | VAT allocated |

| 41 | 60 | 41 | 60 | Related expenses reflected |

| 19 | 60 | 19 | 60 | VAT allocated on related expenses |

| 41 | 42 | Markup reflected | ||

Analytical accounting of account 41 is organized in the context of warehouses, financially responsible persons, names of inventory items, etc.

An example of accounting for trade margins from K+ An organization purchased for retail sale: 500 kg of carrots at a price of 10 rubles/kg. Trade margin 50%, i.e. 2,500 rub. (10 rub/kg x 500 kg x 50%); 300 kg of apples at a price of 30 rubles/kg. Trade margin 150%, i.e. 13,500 rub. (30 rub/kg x 300 kg x 150%). During the month, 100 kg of carrots were sold at 15 rubles/kg (10 rubles/kg + 10 rubles/kg x 50%) and 30 kg of apples at 75 rubles/kg (30 rubles/kg + 30 rubles/kg x 150%). Revenue - 3,750 rubles. (15 RUR/kg x 100 kg + 75 RUR/kg x 30 kg). There is no natural loss or other disposal of goods other than sales. We calculate the average markup percentage. You can view the calculation in K+ by getting free trial access.

Who uses count 41

The account is mainly used by trading companies and catering companies. Manufacturing companies for the most part are engaged in the sale of finished products, that is, those that they have produced themselves. For this purpose, in their chart of accounts there is account 43 “Finished products”. They use account 41 if they bought something for resale, for example, raw materials or materials.

Goods accepted for storage or intended for resale under a commission agreement are not taken into account in 41 accounts. To do this, enter off-balance sheet accounts 002 and 004, respectively.

Accounting for goods and materials

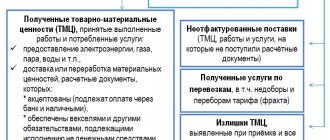

Goods and materials are often combined into one accounting group and given a general name - inventory assets, abbreviated as goods and materials.

Inventory materials in finished form intended for further sale are goods. And materials are goods and materials that are purchased for use in the manufacture of the company’s products, or for their own needs that affect the overall production process, provision of services or performance of work.

Inventory and materials are taken into account at the actual cost, which consists of the amounts of funds transferred or paid (in cash) to the supplier and other expenses associated with transportation, commission costs, etc.

At what cost are goods written off from 41 accounts?

Goods are written off from account 41 when they are damaged, lost, or sold. There are three permitted options for writing off goods.

1. By average cost - when we buy goods at different prices, and when writing off we calculate the average - we divide the cost of all goods by their quantity.

For example, the first batch of 10 kg of sugar was bought for 700 rubles, and the second batch of 10 kg for 800 rubles. We calculate the average cost:

(700 + 800) / (10+10) = 750 rub. — writes off the goods at this price upon sale.

2. At the cost of each unit - each batch is written off at its actual cost.

3. According to the FIFO method , the goods that were purchased earlier are written off first. For example, sugar was purchased in three batches:

- 1st batch - 10 kg at a price of 70 rubles/kg;

- 2nd batch - 10 kg at a price of 80 rubles/kg;

- 3rd batch - 10 kg at a price of 90 rubles/kg.

The company sold 23 kg of sugar. This means that the cost of the item being written off will be:

10 * 70 + 10 * 80 + 3 * 90 = 1770 rub. — amount to be debited from account 41

Accounting by sales price

If an organization registers goods at the subsequent sale price, then it becomes necessary to use account 42. Account. “Trade margin” takes into account income from the sale of goods and VAT.

The accountant makes the following quotes with the correspondence of accounts 41 and 42:

- Dt 41 Kt 42 – reflects the markup on the goods received.

- Dt 90.2 Kt 42 - the amount of the markup was deducted when making a sale.

- Dt 41 Kt 42 – write-off of the discounted value of goods due to the previously made markup.

- Dt 91.2 Kt 41 – the difference between the markup and the discounted value is written off (in cases where the markdown exceeds the amount of the markup).

- Dt 44 Kt 41, Dt 44 Kt 42 – goods and their trade margins are written off for the needs of the enterprise.

- Dt 94 Kt 41, Dt 94 Kt 42 – the amount of shortage/damage to the goods and its trade margin are written off.

What subaccounts are opened for account 41

To add detail to account 41, you can open subaccounts. We have collected them in a table.

| Subaccount | Characteristic |

| 41.1 “Goods in warehouses” | Here they keep records of all goods located in warehouses and wholesale centers. Catering uses this account to account for goods in pantries. |

| 41.2 “Goods in retail trade” | For accounting of goods at retail outlets and buffets. |

| 41.3 “Containers under the goods and empty” | A separate sub-account for accounting for containers for goods. |

| 41.4 “Purchased products” | Special sub-account for industrial companies conducting trading activities. |

Consolidation of knowledge

Having carefully studied all the information presented and summed up, we can outline the key points about the characteristics and accounting of accounts. 41:

- goods are among the assets of the enterprise;

- account 41 - active, inventory;

- upon receipt of goods, the account is debited excluding VAT;

- the sale of goods results in the debiting of amounts from account 41;

- The trade margin is reflected by posting Dt 41 Kt 42.

Regardless of how accounting is kept at the enterprise (in 1C or in writing), knowledge of the properties of account 41 will simplify the work of a novice accountant.

Main entries for account 41

We have collected the main accounting entries where account 41 is used in a table.

| Debit | Credit | The essence of the operation |

| 41 | 60 | Purchasing goods from a supplier |

| 62 | 90.1 | Selling goods |

| 90.2 | 41 | Cost of goods sold written off as expenses |

| 90 | 62 | Received a return from the buyer |

| 60 | 41 | Goods returned to supplier |

| 41 | 91.1 | During inventory, unaccounted surpluses were discovered |

| 94 | 41 | The shortage discovered during the inventory was written off |

| 41 | 94 | The amount of losses was written off within the limits of the loss stipulated by the supply agreement |

| 41 | 42 | Trade margin reflected |

We recommend you the cloud service Kontur.Accounting. In our program, you can keep track of goods by item groups, batches, responsible persons, warehouses, and so on. The service has a salary block, online reporting and other tools for an accountant. We give all newbies a free trial period of 14 days.

Account 41 “Goods” in accounting

In accounting, goods are recorded in 41 accounts.

Basically, account 41 “Goods” is used by organizations that conduct trading activities, as well as organizations that provide services in the field of public catering.

The corresponding sub-accounts shown in the figure can be opened for account 41 “Goods”:

Typical transactions and examples of transactions for 41 accounts

In accounting, goods are accounted for at actual cost, including the following costs:

- Amount of payment for the goods;

- Expenses for services related to the purchase of goods (information and others);

- Remunerations to intermediaries and other expenses associated with the purchase of goods.

Account 41 is used to reflect the cost of goods and record their quantity.

For enterprises using the simplified tax system, the cost of goods includes VAT if reflected in the supplier’s documents. For companies on OSNO, the purchased VAT will not be included in the price.

Let's look at typical transactions for 41 accounts in the tables.

Table 1. Reflection of warehouse operations on account 41:

| Account Dt | Kt account | Wiring Description | A document base |

| 41 | 60/76 | Receipt of goods and materials to the warehouse from the supplier/other contractors | Packing list |

| 41.01 | 41.11(12) | Moving goods from a wholesale warehouse to an automated (manual accounting) retail outlet. When returning goods to the main warehouse, a reverse entry is generated, for example, if the goods were not sold | Invoice certified by the signatures of the persons issuing and receiving goods and materials (TORG-28, MX-10) |

| 45.01 | 41.01 | Goods and finished products have been shipped from the warehouse | Sales Invoice |

| 45.02 | 41.01 | Containers for shipped goods are written off from the warehouse | Sales Invoice |

| 45.05 | 41.01 | Write-off of the cost of goods under a commission agreement | Sales Invoice |

| 94 | 41 | Write-off of the cost of damage or shortage of goods | Write-off act, inventory sheet |

Example 1. Accounting for goods on account 41 at the purchase price

Xenopolis LLC took out a loan in the amount of RUB 100,000.00. to purchase goods. Monthly loan expenses amounted to RUB 1,250.00. Xenopolis LLC purchased goods from Zhuravl LLC (RUB 100,00.00, VAT RUB 15,254.00) and received it into the warehouse. Upon the sale of goods to Ptichka LLC, inventory and materials were written off from the warehouse (RUB 169,000.00, VAT RUB 25,780.00)

According to the accounting policy, Xenopolis LLC reflects inventory items in the warehouse at the purchase price.

Table 2. Postings to account 41 for accounting for goods at the purchase price:

| Account Dt | Kt account | Transaction amount, rub. | Wiring Description | A document base |

| 51 | 66 | 100 000,00 | Bank loan credited | Bank statement |

| 41.1 | 60 | 84 746,00 | Purchased goods are included in the warehouse (excluding VAT) | Packing list |

| 19 | 60 | 15 254,00 | VAT amount reflected | Packing list |

| 68 VAT | 19 | 15 254,00 | Tax deduction reflected | Invoice |

| 91.2 | 66 | 1 250,00 | Loan costs taken into account | Banking agreement |

| 90.2 | 41.1 | 84 746,00 | Write-off from warehouse due to sales | Sales Invoice |

| 62 | 90.1 | 169 000,00 | Reflection of revenue from the sale of inventory items | Sales Invoice |

| 90.3 | 68 VAT | 25 780,00 | VAT reflected | Invoice |

| 51 | 62 | 169 000,00 | The goods were paid for by Ptichka LLC | Bank statement |

Example 2. Accounting for goods on account 41 at the selling price

Solntse LLC purchased goods (components for split systems) at a price of RUB 145,000.00, VAT RUB 22,119.00. for the purpose of subsequent sale. Trade margin - 29% (RUB 35,635.00). VAT on sales - RUB 28,533.00. The total markup including VAT is RUB 50,652.00. The product was sold to Gavan LLC.

Table 3. Accounting for goods at sales price - postings to account 41.01:

| Account Dt | Kt account | Transaction amount, rub. | Wiring Description | A document base |

| 41.1 | 60 | 122 881,00 | The components are included in the warehouse (excluding VAT) | Packing list |

| 19 | 60 | 22 119,00 | VAT amount reflected | Packing list |

| 68 VAT | 19 | 22 119,00 | Tax deduction reflected | Invoice |

| 60 | 51 | 122 881,00 | Payment for components has been made | Payment order |

| 41.1 | 42 | 50 652,00 | Trade margin taken into account | Calculation of markup |

| 90.2 | 41.1 | 173 533,00 | The goods are written off from the warehouse due to sale (122,881.00 + 50,652.00) | Sales Invoice |

| 90.2 | 42 | 50 652,00 | Reversal of trade margin | Sales Invoice |

| 62 | 90.1 | 173 533,00 | Reflection of revenue from the sale of inventory items | Sales Invoice |

| 90.3 | 68 VAT | 28 533,00 | VAT reflected | Invoice |

| 51 | 62 | 173 533,00 | The goods were paid for by Gavan LLC | Bank statement |

Legislative regulation and write-off features

During the inventory, goods that are subject to spoilage and expired are identified, as well as those on which an expiration date should be indicated, but in fact it is not. All these goods are classified as unusable and withdrawn from trade.

Write-off of goods that have become unusable is carried out on the basis of:

- Civil Code of the Russian Federation, art. 469, 470, 472;

- Federal Law-2300-1 dated 07/02/92

According to the norms of the Civil Code, the seller is obliged to offer the buyer only high-quality, usable goods. The sale of goods with an expired expiration date is prohibited, and this period must be set in such a way that the consumer can use the product before its expiration.

The Federal Law “On the Protection of Consumer Rights” requires the transfer to the buyer of goods that meet the mandatory requirements for it (Article 4), and also names goods on which the manufacturer must indicate an expiration date: medicines, household chemicals, cosmetics, perfumes, products (Article . 5).

Goods that are expired or do not have an expiration date indicated on the packaging are returned by the trading establishment to the supplier, destroyed or disposed of.

Federal Law No. 446 dated November 28, 2018 introduced a ban on the return of perishable goods of good quality (with a shelf life of less than a month). Requests for refunds or replacements for items subject to perishable deterioration have also been prohibited since the end of last year.

If the unusable product is not returned to the supplier, it is destroyed or disposed of. Without the participation of third parties, this can be done in relation to spoiled products or goods whose exact origin is unknown. In other cases, an expert assessment from a supervisory government agency (veterinary, merchandising, etc., depending on the type of product) is required.

Composition of non-current assets

The property rights of this group include fixed assets and intangible assets that are planned to be used by the enterprise for more than a year. It consists of:

- OS owned by the enterprise and involved in the production process. At the same time, over a long period of time, the property does not lose its natural and material form.

- Investments of a long-term nature and in the form of capital.

- Any forms of intangible assets.

- Other noncurrent assets.

The property of an enterprise belonging to this category of funds occupies a leading place in the activities of the enterprise, especially in production cycles. During the period of its use, the cost is gradually transferred to the finished product in the form of depreciation charges.

There are active and passive parts of non-current assets. The first category includes the most mobile and dynamic means. For example, industrial equipment, company vehicles. The second group includes real estate objects: structures and buildings that create the initial conditions for the work of enterprise employees.

Receipt of non-current assets

Most often, a company acquires property through a purchase and sale agreement. In this case, the algorithm for registering it is clear: you need to collect all expenses on account 08, and then write them off during commissioning to the main accounts. But there are other ways in which assets are transferred to the ownership of a business. This is mainly the result of barter or a contribution to the initial capital; gratuitous receipts are not uncommon.

For each method of obtaining property, a method for registering 08 accounts and a method for calculating the initial cost are determined. When making an act of donation, a corresponding agreement is drawn up, which indicates the market value of the transferred objects. This will be the amount that should be reflected by posting Dt 08 Kt 98 “Gratuitous receipts”.

Account 08 08 and its purpose

We have sorted out the concept of non-current assets, but it remains unclear: why do we need a separate account for them if 01 and 04 have already been created? To understand the essence of the issue, let us recall the rules for accepting fixed assets and intangible assets for accounting.

According to the requirements of PBU, the accountant must reflect fixed assets and intangible assets on the account at their original cost, which includes all the actual costs of their acquisition. It often happens that information about all amounts is not received immediately. This is where the need arises to open accounting account 08, which will collect data on items of expenses for the acquisition of property. As soon as the accounting department has taken into account all the amounts and the property is ready for commissioning, the information can be written off to the main account 01 or 04.

Account structure

08 accounting account is active, because information about the company’s funds is collected on it. All related costs for the acquisition of property are reflected in a debit. When written off, the amounts are shown in the account credit. At the end of the reporting month, a debit balance may appear. As a rule, these are the amounts of expenses for unfinished construction projects and fixed assets that have not been put into operation. If there is no balance, the account is closed.

The debit balance, if any, should be reflected in the financial statements. Account 08 in the balance sheet is included in line 1190, which characterizes the amount of other non-current assets.

Analytical accounting

To combine expenses of a similar nature into groups and systematize accounting, first-level subaccounts are additionally opened, which reflect information about the costs of:

- 08.1 – acquisition of land plots;

- 08.2 – purchase of environmental management facilities;

- 08.3 – construction of environmental facilities;

- 08.4 – purchase of individual OS by category;

- 08.5 – acquisition of intangible assets;

- 08.6 – transfer of livestock from one herd to another;

- 08.7 - purchase of adult livestock;

- 08.8 – carrying out scientific research, conducting experiments, the results of which will be used in the future at the enterprise.

If necessary, other analytical accounts of a similar nature may be opened.