Property of a liquidated legal entity

Property after liquidation of a legal entity can also be distributed.

The general procedure for terminating activities and dividing property between participants (shareholders) of an organization is disclosed in Article 63 of the Civil Code of the Russian Federation. According to paragraph 1 of this article, the main body authorized to carry out liquidation is the liquidation commission. It is she who, by virtue of paragraph 4 of Article 62 and paragraph 1 of Article 63 of the Civil Code of the Russian Federation, manages the organization, takes measures to identify creditors and seeks ways to collect receivables.

However, the liquidation commission acts before an entry is made in the Unified State Register of Legal Entities about the liquidation of the company. But what to do if the company no longer exists, and an essentially absurd situation has arisen - there is property, but its owner is absent. More on this later.

In practice, there are situations when, after making an entry in the Unified State Register of Legal Entities, an organization may discover undistributed property that, for various reasons, was not included in the liquidation balance sheet. A similar situation may arise when a company is excluded from the Unified State Register of Legal Entities if it does not file reports on taxes and insurance contributions within 1 year, and also does not conduct banking transactions on its accounts, in accordance with the requirements of Articles 64.2 of the Civil Code of the Russian Federation, 21.1 of the Federal Law “On State ..." dated 08.08.2001 No. 129-FZ, or if the organization was liquidated due to bankruptcy.

The mechanism for the distribution of such property is established in clause 5.2 of Art. 64 Civil Code of the Russian Federation. It can be used by both creditors and participants of the liquidated company. An application for assignment of property distribution can be submitted within 5 years after the company is excluded from the Unified State Register of Legal Entities.

Targeted payments and subsidies are not subject to distribution and are not included in the distributed property. Also, such property does not include things and property rights that have been terminated, for example, the right to lease under a contract that was not renewed in a timely manner.

You need to understand that the company will not be restored; this is not necessary for the distribution of property.

How does the procedure work?

After an application for appointment of distribution of the discovered property is submitted, an arbitration manager is appointed. The court does this. It is the arbitration manager who manages the distribution. The costs may be borne by the submitting creditor or a participant in the liquidated company.

The procedure itself follows the rules that are established for the liquidation of a company, but with certain specifics, because the property can be sold in order to then distribute the proceeds from its sale. The arbitration manager determines the list of creditors, the property is assessed to determine the market value, the assets are put up for auction, and the proceeds are distributed among the creditors in the order of priority, which is prescribed in Art. 64 of the Civil Code of the Russian Federation, in proportion to the size of the requirements.

If there are no creditors

If there are no creditors, then the property will be distributed among the participants of the liquidated company in proportions, according to shares or by virtue of an agreement between them. All disputes and issues of the distribution process are resolved by arbitration courts. Since there are no special distribution rules, the application is subject to consideration according to the general rules of claim proceedings.

The fate of the organization’s material assets during liquidation

Issues related to the division of company property between the founders and the liquidation procedure of the enterprise are regulated in accordance with the norms of the following legislative acts:

- Civil Code, section 4, art. 92 – regulation of the procedure for reorganization and liquidation of the company; paragraph 2 of section 4 of the Civil Code of the Russian Federation - provisions on partnerships, including limited liability companies.

- Federal Law No. 14-FZ of February 8, 1998 (hereinafter referred to as Law 14-FZ), Art. 57, 58 – liquidation of the LLC and division of the company’s property between its members.

The norms of the above legislative acts can be specified in the charter of the enterprise (statutory documents), which will also be used to resolve the issue of division of property between members of the company.

According to Art. 58 of Law 14-FZ, the founders can begin the process of distributing shares after satisfying the claims of creditors. This procedure is carried out during the period established for filing claims.

The liquidation of an organization is associated with the cessation of the operation of the enterprise, which means that the participants have the right to receive their share, which was invested when the company was formed. Also, a member of the organization has the right to receive more than the initial contribution if, during its existence, the organization has succeeded in its activities and replenished its assets.

The procedure for distributing property between members of the enterprise is carried out in a clear sequence. There are two key rules for separating assets :

- The first payments are made from the organization's income that has not yet been distributed among the participants.

- Next, the residues are divided. In this case, the proportions corresponding to the size of the share in the authorized capital are taken into account.

The distribution of shares is made after an independent assessment of the value of the company's property. The liquidation procedure is often accompanied by a tax audit and is always associated with the payment of taxes.

Possibility and procedure for distribution of property

As an analysis of the provisions of Article 63 of the Civil Code of the Russian Federation shows, the possibility of dividing property after the liquidation of a legal entity between participants and the procedure for its implementation depend on 2 main factors:

- method of liquidation of the organization;

- its organizational form.

Speaking about methods of liquidation, it is important to emphasize that Article 63 of the Civil Code describes the procedure for voluntary termination of a company’s activities, while in practice forced termination is also possible - within the framework of bankruptcy or by court decision, as well as in the case when the organization does not actually conduct business activities, according to the provisions Article 64.2 of the Civil Code of the Russian Federation.

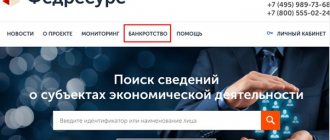

Bankruptcy

If insufficient property is discovered during liquidation, the liquidation commission, by virtue of paragraph 4 of Article 63 of the Civil Code, is obliged to apply to the court to declare the organization bankrupt. Moreover, according to Article 3 of the Law “On Insolvency...” dated October 26, 2002 No. 127-FZ, an operating organization can also be declared bankrupt by claims of creditors, employees or tax authorities if it is unable to repay the debt within 3 months. This allows us to conclude that the fact that there is insufficient property to pay off accounts payable already indicates the absence of property that can be distributed among its participants.

Forced liquidation by court decision

In case of liquidation of a company on the basis of a court decision (in the absence of a license, violations during registration, conduct of illegal activities and on other grounds specified in paragraph 3 of Article 61 of the Civil Code), the court, in view of the provisions of paragraph 5 of Article 61 of the Civil Code, obliges the founders to fulfill the requirements provided for in Article 63 Civil Code procedures provided for voluntary liquidation. In this situation, the distribution of the property remaining after liquidation will be carried out in accordance with the general procedure, in accordance with paragraph 8 of Article 63 of the Civil Code.

If the founders evade the liquidation procedure, then the court appoints an arbitration manager to liquidate the company, who will act according to the general rules of Article 63 of the Civil Code of the Russian Federation. If there is insufficient property to pay for the manager’s services and finance other expenses related to the liquidation, the difference, by virtue of paragraph 5 of Article 61 of the Civil Code, is subject to recovery from the company’s participants.

Distribution of property after liquidation of a legal entity - judicial practice

An example of resolving a situation similar to those described above can be found in the decision of the Moscow Arbitration Court dated December 14, 2015 in case No. A40-160054/15, which indicates the need to apply in this case the rules of paragraph 5.2 of Article 64 of the Civil Code of the Russian Federation. According to the designated norm, an interested person (creditor, founder) has the right to apply to the court within 5 years with a request to appoint a procedure for the distribution of discovered property. In this case, we can talk about both actual movable or immovable things, and about the rights of claim of the liquidated organization to other entities.

The peculiarity of such cases, as can be seen from the indicated arbitration decision, is the absence of a defendant. However, this fact does not affect the general procedure for considering the case, which is resolved according to the general rules of litigation.

In case of a positive decision, the court, by virtue of clause 5.2 of Article 64 of the Civil Code of the Russian Federation, must approve the proposed arbitration manager or appoint one, since all actions for the distribution of discovered property are exclusively within its competence. In this case, the distribution itself must take place in the order in which the division of the organization’s property was carried out earlier, as is expressly stated in paragraph 3 of clause 5.2 of Article 64 of the Civil Code of the Russian Federation.

How to distribute property during liquidation: procedure

After repaying the debts, the commission balances the remaining real estate and other material assets of the company for their subsequent division among the LLC participants. When performing this work, the following points should be taken into account:

- According to the law, all property that remains at the disposal of the company after settlement with creditors must be divided between the participants. But here it is important to comply with two important requirements - publish an announcement about the launch of the LLC liquidation process, and then wait the 60 days necessary to identify all available creditors. In addition, the liquidation balance sheet should reflect the calculations made with creditors.

- In practice, only part of the organization’s property is transferred, which remains after full repayment of the debt. It is these funds that are reflected in the liquidation balance sheet and are taken as the basis in the distribution process.

- If after settlement there is no property left, its distribution is also not made. This information must also be included in the balance sheet by commission representatives.

Taking into account the above, we can conclude that the LLC liquidation commission takes on two tasks:

- Get the balance right.

- Enter the necessary information into it.

Distribution of property upon liquidation of LLC and PJSC (comparative analysis)

The procedure for dividing the remaining property is determined by the organizational and legal form of the company (LLC, JSC, etc.) taking into account the provisions of paragraph 8 of Article 63 of the Civil Code of the Russian Federation and relevant Federal Laws (for example, “On Companies...” dated 02/08/1998 No. 14-FZ, “ About joint stock..." dated December 26, 1995 No. 208-FZ). As an example, consider this issue in relation to LLCs and PJSCs.

Distribution procedure for LLC

According to paragraph 1 of Article 58 of Federal Law No. 14, LLC has the right to begin distribution of property only after final settlement with creditors. After this condition is met, the property is subject to division between the participants, which involves 2 stages:

- Transfer of profits that have already been distributed but not yet paid.

- Division of the remaining property according to the shares of participants in the authorized capital of the company.

Paragraph 2 of Article 58 of Federal Law No. 14 obliges participants to first fully repay the debt on unpaid profits (both from cash and from other property of the LLC) and only then proceed to the second stage of dividing the remaining property (if any). If it is not enough even to make a full calculation of the profit, then the actual property must be distributed among the participants in proportion to their shares.

If, after payment of profits, there is undistributed property left, it is subject to transfer to the participants on the basis of a transfer act, which is signed on the one hand by the head of the liquidation commission, on the other - by the LLC participant (or by all participants, if there are several of them).

It is important to remember that all calculations must be completed before the entry on the liquidation of the organization is made in the Unified State Register of Legal Entities, since by virtue of paragraph 9 of Article 63 of the Civil Code of the Russian Federation, it is from this moment that the organization is considered liquidated, after which the liquidation commission loses its authority to sign any documents.

What does the law say about the distribution of property?

There is no specific plan of action on how exactly the distribution of LLC property should be carried out in legislative acts. Clause 8 art. 63 of the Civil Code of the Russian Federation states that the property that remains after settlements with creditors must be transferred to the founders who have real rights to it or obligations in relation to the LLC, unless otherwise provided by other legal acts or the company’s constituent documents.

Law on LLC (Federal Law No. 14 dated 02/08/1998), more precisely its Art. 58, states that first of all, the distributed but unpaid profit (if any remains) should be paid to the participants, and then the property should be distributed in proportion to the shares of the founders in the authorized capital of the Company.

That is, the LC or the liquidator divides only the property that remains unclaimed after completion of all settlements with creditors.

There is no specific algorithm for how property is transferred. As a rule, the LC draws up an act of distribution of property or an act of acceptance and transfer of property in order to avoid future claims from former LLC participants.

Distribution of authorized capital upon closure of an LLC

- The distribution of any property of the company occurs strictly in accordance with the norms of the law, according to the established rules of priority. Participants take and withdraw funds only after settlements with all creditors.

- If an organization does not have the ability to pay off all external debts due to insufficient own funds, then its own property must be sold, which in turn is accountable and cannot go anywhere in violation of the liquidation procedure.

- The authorized capital is also the property of the LLC; it should be withdrawn to pay off and repay the company’s debts.

- As such, there is no mandatory return of the authorized capital. The founders are not recognized as creditors of the company and take assets only after the distribution of property according to the company’s obligations.

- The authorized capital may go to the participants in a smaller amount than was contributed due to insufficient funds during liquidation.

- Distribution always occurs in proportion to the contributions of the founders, since the original ratio of shares does not go away.