Who are tax residents

These are legal entities and individuals who are required to pay tax on income received in Russia. These include:

- companies registered on the territory of the Russian Federation;

- foreign companies that are required to pay tax according to the provisions of an international treaty;

- companies whose management body is located in Russia.

The following rule applies to individuals: residents are those who spend 183 calendar days throughout the year on Russian territory. Short trips for study or training purposes are not taken into account.

If the employee is a non-resident, then the employer must correctly calculate the personal income tax (the amount will be increased). In addition, such an employee cannot take advantage of child and property deductions.

The determination of the status of an individual for calculating personal income tax is described in Letter of the Ministry of Finance dated February 15, 2017 No. 03-04-05/8334.

Tax resident status

Determining your tax residence status is necessary for the correct calculation and withholding of income tax (NDFL).

The personal income tax rate for a tax resident is 13% (there are exceptions to this rule, for more details see paragraph 2 of Article 224 of the Tax Code of the Russian Federation). Non-residents pay a tax of 30% (clause 3 of Article 224 of the Tax Code of the Russian Federation). At the same time, non-residents do not have the right to tax deductions for personal income tax. Find out more about taxes for non-residents from the following materials:

- “Personal income tax from non-residents of the Russian Federation in 2022”;

- “Insurance premiums from foreigners in 2020-2021.”

Legislation and regulatory authorities have established time frames for obtaining residency. Thus, the minimum required period for approval of tax resident status is 183 (not less) calendar days for 12 consecutive months of stay in the territory of the Russian Federation (clause 2 of Article 207 of the Tax Code of the Russian Federation). The day of entry and the day of departure are taken into account (letters of the Federal Tax Service of Russia dated April 24, 2015 No. OA-3-17 / [email protected] , Ministry of Finance of Russia dated February 15, 2017 No. 03-04-05/8334).

EXAMPLE of calculating the time of stay in Russia from ConsultantPlus: On March 20, 2022, the organization paid employee I. I. Ivanov income (anniversary bonus). For tax purposes, it determines the employee's tax status. The 12 months preceding this date are the period from 20 March 2022 to 19 March 2022 (inclusive). At this time, I. I. Ivanov was on the territory of the Russian Federation in the following days... See the example in “ConsultantPlus” . Trial access to K+ is free.

Departure for a short period of time (up to six months) for training or treatment for a tax resident is not a reason to break the residence calculation period. In addition, military personnel and employees of state authorities and local self-government are recognized as residents of the Russian Federation, regardless of the time spent in Russia.

Can a citizen of the Russian Federation lose his resident status by spending less than a specified period in Russia? The Federal Tax Service of Russia believes that if an individual stays in Russia for less than 183 days, then for such a tax resident this is not critical for a similar reason, and does not lead to automatic loss of the status of a tax resident of the Russian Federation, unless otherwise determined by an international agreement (letter of the Federal Tax Service of the Russian Federation dated October 29. 2015 No. OA-3-17/ [email protected] ). For example, an international treaty of the Russian Federation on the avoidance of double taxation, including with the Republic of Cyprus, may provide that if there is a permanent place of residence, personal or work interests (family, work, business) in the Russian Federation, the status of a tax resident is maintained.

ATTENTION! According to the new rules, individuals who, during the period from January 1 to December 31, 2022, were in the territory of the Russian Federation from 90 to 182 days inclusive, were able to be considered tax residents of the Russian Federation. See details here.

How to confirm your status

You need to obtain a tax residence certificate. To do this, you will have to contact the interregional inspectorate of the Federal Tax Service, which is responsible for centralized processing of information, with an application (you can download the application template file at the end of the article).

The application must be accompanied by documents indicating that the company receives income abroad: contracts with partners, a decision of the board of directors on the payment of dividends. The certificates must bear the signature of the director and the seal of the company.

To confirm your status for a long time (more than three years), you need information about paying taxes abroad.

Inspectors first examine the submitted papers. If there are no complaints, a certificate of residence of the Russian Federation is issued in the form KND 1120008.

Tax residents of the Russian Federation

To avoid paying the same taxes twice, you need a certificate from the country in which the tax will actually be paid. In Russia, the document is issued by the Interregional Inspectorate of the Federal Tax Service for Data Processing (DPC). This division of the tax authority is located in Moscow.

It is also important to know that a confirming certificate is needed for each piece of property, source of income, etc. This means that if an organization has several contracts with foreign counterparties, then this status (tax resident) must be confirmed for each contract.

Additional Information.

In regulations, the certificate we are talking about is called a document confirming tax resident status. A tax resident is someone who is subject to taxation in a particular state (in our case, in the Russian Federation).

Who can be a tax resident in Russia?

The list of Russian tax residents is established by the Tax Code of the Russian Federation. It states that residents are:

- local companies;

- foreign companies that are managed from the Russian Federation;

- foreign companies in cases provided for by international agreements on double taxation (on its avoidance);

- foreign companies that conduct business in the Russian Federation through their branches and representative offices and recognize themselves as local tax residents;

- individuals who stay in the Russian Federation for 183 days or more per year.

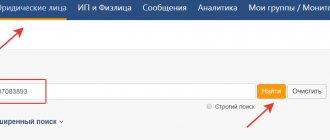

How to submit an application to the tax office

Choose a convenient method of contact:

- through the tax office website;

- hand over documents in person;

- make a postal item.

In the contact form, specify the code:

- write the numbers “0000” if you submit documents to the office yourself;

- indicate “9965” when sending by post.

Inspectors, as you know, check everything carefully and only then give an answer. Therefore, it is important to protect yourself and confirm where you were:

- make copies of the pages of your international passport about crossing the border;

- obtain certificates of presence in Russia for the required period of time;

- evidence of the location of property abroad.

For example, documents on ownership of real estate and a lease agreement. Foreign papers must be translated and notarized. Then the inspectors will be able to accept them.

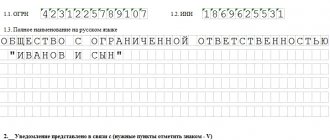

The application form for companies was approved by Order No. ММВ-7-17 dated November 7, 2017/ [email protected]

Confirmation of tax resident status online

In 2022, tax resident status can be confirmed online by going to the Tax Service website. The website offers a special service “Confirmation of tax resident status of the Russian Federation”, which can be used by individuals and legal entities. This service allows both organizations and individuals to quickly fill out an application and send it to the tax office, as well as receive the necessary document in PDF format, or a refusal to issue it. One of the advantages of this service is that you do not need to send additional supporting documents to the tax office. It will be sufficient to simply formulate an application. Moreover, if a residence certificate is needed on paper, then the corresponding note should be made when filling out the application, that is, “Submit the document on paper.” Using the service, the applicant can also monitor the processing status of his application at the tax authority. It should be remembered that the period for reviewing the document in this case does not change and is also 40 calendar days. In addition, tax agents and foreign authorities can also check a person's tax resident status online. They can also use the service presented on the tax website. Moreover, any interested person can do this and there is no need for special registration or entering any codes.

How to get an answer

Choose the most convenient way to obtain a certificate of residence of a legal entity:

- on the inspection website;

- by mail to the address specified in the application.

The information provided in the document is valid for 12 months. Issued exactly for the year that you indicate in the application. You can receive several copies at once. But this must be noted in the application.

It happens that the fiscal department does not issue a certificate. In such a situation, the applicant is sent a justified refusal. You can try to eliminate the shortcomings - collect evidence and ask for an answer again. The period for studying papers is 40 days.

If you need to confirm your tax status, take care of this in advance. Collect documents and send them to MIFTS in a convenient way.

How to get a certificate?

To obtain the specified residence certificate, you need to send an application to the Federal Tax Service MI for the data center. It must be accompanied by a set of documents confirming receipt of income abroad, in particular:

- contract;

- copies of payments and/or checks;

- accounting documents;

- decisions of the legal entity’s governing bodies, etc.

Also, legal entities must provide copies of registration documents, and individuals must provide a copy of their passport/international passport and a handwritten calculation of the time spent in Russia.

All documents written in a foreign language will need to be translated into Russian. The completed translation must be certified by a notary or the Russian consulate.

Documents are sent by mail, through the online services of the Federal Tax Service, or submitted in person to the Russian tax service. The period during which tax officials review the application and issue a certificate is up to 40 calendar days.

Tax resident of the Russian Federation - individual

For the purpose of calculating personal income tax, tax residents are citizens who are actually in the Russian Federation for at least 183 calendar days over the next 12 consecutive months.

If a citizen has traveled abroad for short-term (less than six months) treatment or training, as well as to perform labor or other duties related to the performance of work (provision of services) in offshore hydrocarbon fields, then the period of his stay in the Russian Federation is not interrupted.

Also, regardless of the actual time spent in the Russian Federation, Russian military personnel serving abroad and employees of state authorities and local governments sent to work outside the Russian Federation are recognized as tax residents.

The countdown of 183 days begins from the date of crossing the border of the Russian Federation.

Consequently, persons who stay in the Russian Federation for less than 183 calendar days over the next 12 consecutive months are not tax residents of the Russian Federation. These could be, for example, foreign tourists coming to Russia on vacation and excursions, students coming to study, people coming to work in the Russian Federation, etc. At the same time, whether an individual has Russian citizenship or not does not matter when determining his status as a tax resident of the Russian Federation.

In other words, both a foreign citizen and a stateless person can be recognized as tax residents of the Russian Federation.

In turn, a Russian citizen may not be a tax resident of the Russian Federation.

Tax resident status of the Russian Federation for personal income tax purposes

Assigning resident (non-resident) status to each taxpayer establishes his obligations to pay tax to the budget on his income and affects the types and methods of deductions.

In general, the income of individuals, regardless of their size, is taxed at a rate of 13%.

Income from sources in the Russian Federation received by an individual who is not recognized as a tax resident of the Russian Federation is subject to taxation at a rate of 30%.

In respect of income in the form of dividends from equity participation in the activities of Russian organizations received by such an individual, a tax rate of 15% is applied.

For income for which tax rates other than 13% are provided when determining the tax base, tax deductions, including standard deductions, are not applied. That is, the income of an individual who is not recognized as a tax resident of the Russian Federation is taxed at a higher rate and is not reduced by tax deductions.