After registration, the entrepreneur receives a special document - a USRIP entry sheet. It replaced the certificate of registration of an individual entrepreneur. Let's figure out in what cases and in what form such sheets are issued.

Issuance of a sheet when registering an individual entrepreneur

When the Federal Tax Service registers a citizen as an individual entrepreneur, it enters data about him into the Unified State Register of Individual Entrepreneurs (USRIP). Until 2022, confirmation of registration was a corresponding certificate. It was printed on a printed form containing a unique number and a hologram. The same forms were issued after registration of changes, for example, a change of activity.

From the beginning of 2022, in order to save money, certificates are no longer printed on printed forms. Instead, the individual entrepreneur receives a USRIP record sheet in form P60009, approved by order of the Federal Tax Service dated September 12, 2016 No. ММВ-7-14 / [email protected] However, previously issued certificates are still considered valid.

From mid-2022, the tax service will send registration documents only electronically. You will not have to visit the inspection after state registration as an individual entrepreneur. In the application on form P21001, the future entrepreneur must indicate his email address. The Federal Tax Service registers the individual entrepreneur within 3 working days, and the next day sends him the Unified State Register of Entrepreneurs record sheet on state registration by email.

The electronic sheet is digitally signed by the Federal Tax Service and has legal force. If necessary, you can obtain a record sheet of the Unified State Register of Individual Entrepreneurs on paper. To do this, you will have to make a request to the tax authority. It should indicate the full name, INN, OGRNIP, address, as well as the entry number and date of entry into the register.

Receipt upon registration

First, what is the significance of the recording sheet for individual entrepreneurs and where to get it. Entrepreneurs who started their business before 2022 received a certificate of registration of individual entrepreneurs. This is a document printed on a special secure form with a hologram. Each such form had a unique series and number. If lost, you had to contact the Federal Tax Service and get a duplicate. The certificate was issued not only after registration, but also after making any changes to the data about the entrepreneur or his activities, which are reflected in the register.

However, several years ago the Federal Tax Service set a course for electronic document management. It was decided to abandon printing the certificate on expensive unique forms. On September 12, 2016, the Federal Tax Service approved a new document - in form P60009 (order No. ММВ-7-14/ [email protected] ). At the same time, it has been established that certificates issued before this cannot be replaced - they are still valid to this day.

The registration sheet for individual entrepreneurs is the main document confirming registration after 2022. It is sent to the citizen in electronic form to the address specified in application P21001. That is, a document confirming the registration of an individual entrepreneur can be obtained online. It arrives on the fourth day from the date of transfer to the Federal Tax Service of the set of papers for registration and indicates that it was successful.

The document is generated electronically by the Federal Tax Service and certified by a digital signature of a specialist. It has the force of the original, and there is no need to further confirm its authenticity. However, if an entrepreneur wants to receive a paper document indicating his new status, he can request it from the Federal Tax Service. Previously, a request is sent there to issue a sheet of entry in the Unified State Register of Individual Entrepreneurs on paper. You can write it in free form, indicating the basic data - full name, address, INN, OGRNIP, address, as well as the number and date of the register entry on the registration of the individual entrepreneur.

Free consultation on individual entrepreneur registration

When else is the registration sheet issued?

The rules described above are relevant not only when entering information about state registration of individual entrepreneurs into the register. In the same order, an entry from the register is issued if changes have been made to it. This usually concerns the list of OKVED codes. If an entrepreneur wants to add or, conversely, exclude some activity codes or change the main OKVED, he must transfer this information to the Unified State Register of Individual Entrepreneurs (form P24001). This information will be reflected in the register, about which the individual entrepreneur will receive a new record sheet.

If an entrepreneur decides to close a business, he submits to the tax authority an application for state registration of termination of activity (form P26001). An entry is made in the register that the citizen is no longer an individual entrepreneur, and the corresponding entry sheet is sent to him.

Other reasons for issuance

All basic information about the entrepreneur is entered into the state register (USRIP). It must be relevant and reliable. Therefore, individual entrepreneurs are required to report some changes to the tax authority. Typical examples are the addition of new types of activities according to OKVED.

Changes in information in the register are made by application on form P24001. It is submitted to the registering Federal Tax Service, after which new information is entered into the register, and a new sheet of the Unified State Register of Individual Entrepreneurs is sent to the individual entrepreneur’s mail.

Another case when such a document is sent is the end of an activity. The individual entrepreneur draws up and submits application P26001 to the registration authority. In response to this, the Federal Tax Service receives a record sheet for the Unified State Register of Individual Entrepreneurs. He confirms that a record of termination of business activity has been made in the Unified State Register of Entrepreneurs.

What is contained in the document

The USRIP record sheet for state registration contains the following data:

- last name, first name and patronymic of the individual entrepreneur;

- OGRNIP - the number that the Federal Tax Service assigned to the entrepreneur upon registration;

- number and date of entry in the register;

- date of preparation of the document and signature of the official.

Free consultation on business registration

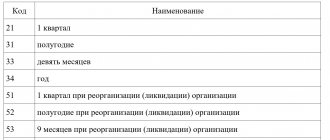

The content of the record is presented in the form of tables. Depending on what was recorded, they may reflect different information. For example, in the tabular part of the record sheet for the state registration of a new individual entrepreneur, the following is reflected:

- information about the registration authority;

- Full name of the entrepreneur and his gender;

- citizenship;

- address;

- number of types of activities and their OKVED;

- list of documents submitted for registration.

A sample entry sheet for individual entrepreneur registration can be downloaded here

.

Data Composition

The USRIP record sheet reflects the following information:

- Full name of the entrepreneur;

- unique registration number - OGRNIP;

- number and date of entry in the register indicating that the individual entrepreneur is registered;

- date of compilation of the USRIP record sheet;

- signature of the responsible person.

In addition to this information, the entry sheet of the Unified State Register of Individual Entrepreneurs contains a table that presents the contents of the register entry. That is, the information that was entered into the register. When a new individual entrepreneur is registered, in addition to personal information about him, the record contains data about the registering Federal Tax Service, the types of activities of the entrepreneur, as well as a list of documents submitted for registration.

How to get

The register entry sheet is a document confirming the registration of an individual entrepreneur. It is necessary when contacting, for example, a bank to open a current account or various government agencies. Sometimes entrepreneurs have a question: if there is no such document, is it needed and where can I get it? This sheet may be missing for two reasons:

- It was not received, since the individual entrepreneur was registered when the certificate was issued.

- It was received, but then lost (lost).

In the first case, there is no need to receive a sheet. A certificate of registration of individual entrepreneurs issued before the beginning of 2022 is a valid document. It can be presented wherever its successor, the registry entry sheet, is required.

In the second case, you should get a duplicate sheet. To do this, you need to contact the registering Federal Tax Service with a request in any form. You must first pay 200 rubles for each copy of the duplicate. You can generate a receipt with the correct details on the tax service website. The sheet will be issued within 5 working days. For urgent production, a fee of 400 rubles is charged.

There is no USRIP entry sheet - what to do

The entry sheet appears in the list of documents that the entrepreneur must submit as part of the package of documents confirming the activity. For example, to open a bank account or obtain an electronic signature key certificate. Usually it is additionally indicated that instead of it, you can submit a certificate of registration of an individual entrepreneur (if it was issued). But sometimes the requirement for a record sheet confuses entrepreneurs. We explain how to get a recording sheet, and also figure out when it is needed and when it is not.

Most often, a recording sheet is missing because it was not issued. In this case, instead, the individual entrepreneur has in his hands a certificate confirming registration until 2022. If it exists, there is no need to obtain a Unified State Register of Individual Entrepreneurs (USRIP) sheet from the tax office - it can easily be replaced by this certificate.

Another situation is that the sheet was issued (sent by mail) and then lost. If you need to restore it, you will have to contact the Federal Tax Service. A message is sent there in any form with a request to issue a duplicate sheet. For re-issuance you need to pay 200 rubles. A receipt for payment can be generated on the tax service website.

Prepare documents for individual entrepreneur registration (free)

Difference from the extract from the Unified State Register of Individual Entrepreneurs

The entry sheet differs from an extract from the state register. It contains information only about a specific entry and confirms the fact that it was made. For example, if an individual entrepreneur made changes to types of activities, then the entry sheet will only contain information about his new OKVED codes.

An extract from the register contains all the information about the entrepreneur from the moment of his registration and has a broader purpose. It is requested, for example, by a bank, a certification center for issuing an electronic signature, or business partners of an individual entrepreneur. Any person can obtain an online extract from the register in relation to the subject of interest through a special service of the Federal Tax Service.

Legal acts regulating changes

For business entities, in its letter No. 03-07-09/25676 dated 04/27/2017, the Ministry of Finance of Russia explained that an analogue of the details of the State Registration Certificate from 01/01/2017 is information about the date of entry in the Unified State Register, specified in USRIP record sheet. From the clarifications it follows that a business entity – individual entrepreneur, registered after January 1, 2017, is authorized to carry out its activities on the basis of the Unified State Register of Entrepreneurs.

The termination of the issuance of the Individual Entrepreneur Registration Certificate is established by the provisions of the Order of the Federal Tax Service of the Russian Federation No. ММВ-7-14 / [email protected] dated September 12, 2016, according to which:

- previously in force orders of the Federal Tax Service of Russia No. ММВ-7-6/ [email protected] dated 11/13/2012 (part 1, clause 2 of the order), and No. ММВ-7-6/ [email protected] dated 08/11/2011 (part 3 clause 2 of the order) were declared invalid;

- the form and content of the new document have been approved, which is put into circulation from 01/01/2017 and confirms the registration of individual entrepreneurs in the Unified State Register of Individual Entrepreneurs (part 2, clause 1 of the order).

Select OKVED codes

A person planning to open an individual entrepreneur already has an idea of what he will do. Now you need to correctly select the main and additional activity codes according to OKVED in order to avoid fines and unnecessary expenses in the future.

OKVED is a classifier of types of business activities, in which each type of activity has its own numerical code. With the help of codes, the state understands what a particular entrepreneur does. Here are some tips for choosing codes:

Tip 1.

As the main business activity code, choose the activity from which you plan to receive the most income. If the inspection authorities find out that the main activity of the enterprise is not carried out according to the main selected code, the businessman faces a fine under Art. 14.25 Code of Administrative Offenses from five thousand rubles. And it’s very easy to check: find out in what areas of activity the entrepreneur enters into transactions. And if transactions do not correspond to the selected activities, a fine is possible. Plus, doubts may arise about the trustworthiness of the individual entrepreneur, which means additional checks by tax authorities, counterparties and the bank that services the individual entrepreneur’s current account.

Tip 2.

The main code determines the danger of work, therefore, the amount of insurance premiums for injuries is calculated. And the more dangerous the activity, the more contributions employees will have to pay.

Tip 3.

According to the rule, there is one main code, and there can be as many additional ones as you like. But this does not mean that you need to enter as many additional codes as possible into the application. The possibility of using special tax regimes depends on the selected codes: it may happen that an entrepreneur indicated more codes “just in case”, but because of these codes he will not be able to switch to more profitable regimes - patent or imputation. Or another story, when I added more codes, but it turned out that one of the types of activities required a license. But in fact, the businessman is not even involved in this activity.

In order not to create unnecessary problems for yourself, indicate only the activities that you really plan to do. And be sure to check whether it is allowed to use a preferential tax regime and whether a license is required.

Important.

Select codes according to the new OKVED-2, otherwise the application will not be accepted. On the third page of the application for registration as an individual entrepreneur (more about it later), you need to indicate one main code and several additional ones, consisting of at least four digits. If, after creating an individual entrepreneur, you decide to engage in new types of activities, you will need to fill out form P24001, entering new codes into it, and submit it to the tax office.

When and where to get it

The USRIP entry sheet is requested from the Federal Tax Service. A citizen can request the original document only in three cases:

- After three days from the moment of successful completion of the enterprise creation process.

- Upon change of information about a merchant in the Unified State Register database (issued instead of the old one).

- In connection with the completion of commercial affairs (the individual entrepreneur receives an official document indicating the date of liquidation of the business).

If the original is lost, it is possible to purchase an official duplicate. To do this, the entrepreneur applies to the Federal Tax Service. A completed application form and fee receipt will be required. The request completion time is five working days. After this, you can pick up a duplicate, officially certified by the tax authority. When filling out an application, a citizen or his representative can indicate one of the convenient ways to receive a response: by personal contact, by letter via Russian Post or by email.

The state duty today is 200 rubles. If a duplicate document is needed urgently, the amount doubles: 400 rubles. In this case, the Record Sheet can be picked up the very next day.

The extract can be obtained electronically on the official website of the Tax Service. To do this, you need to log in, enter your TIN and full name, and make a request.

Note! On the Tax Service page on the Internet, it is possible to request an Extract from the Unified State Register of Individual Entrepreneurs, but not a Record Sheet.

in the latest edition

The new application form for opening an individual entrepreneur has been used since November 2022.

You can download the form P21001 for free in PDF, as well as other formats convenient for you: Excel, Word (the application is valid in 2022):

We have also prepared for you examples of filling out an application:

- Sample of filling out form P21001 – download in PDF format (pdf).

- Sample of filling out form P21001 – download in Excel (xls) format.

Step-by-step procedure for registering changes in the Unified State Register of Individual Entrepreneurs

In order for a businessman to register new data in the Unified Register of Individual Entrepreneurs, he must do the following:

- Prepare a package of documents for submission to the inspectorate at the place of registration (see list of documents below).

- Fill out an application for amendments in form No. P24001, approved by Order of the Federal Tax Service dated August 31, 2020 No. ED-7-14/ [email protected] Please note that the applicant’s signature is approved by a notary.

form No. P24001 for free by clicking on the picture below:

- Submit an application and documents to the interdistrict inspectorate of the Federal Tax Service. Papers can be presented in person (by courier), through a representative acting under a notarized power of attorney, by sending a postal item with an inventory of the attachment and the declared value of the letter, or through the MFC. It is also permissible to issue an electronic signature and interact with the Federal Tax Service through the State Services portal or the tax website.

- The documents will be checked by the tax office within 5 working days. If everything is correct, the tax authority will issue a sheet with new data entered into the Unified State Register of Individual Entrepreneurs.

Check whether you have correctly prepared the documents for making changes to the Unified State Register of Individual Entrepreneurs using reference information from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

The service may not be provided if:

- the application was submitted by an unauthorized person, for example your representative without a power of attorney;

- documents are not certified by a notary;

- not all necessary documents have been submitted;

- the application was submitted to the wrong tax authority.