Which section of the declaration does line 170 include and what is its meaning?

Line 170 in the VAT return is included in the 2nd part of section 3, i.e., part of the deductions.

It should reflect deductions for advances received by the seller, from which he accrued tax payable at the time of receipt. The VAT declaration for reports for the 3rd quarter of 2022 and further applies as amended by Order of the Federal Tax Service of Russia dated March 26, 2021 No. ED-7-3/ [email protected]

You will find a line-by-line algorithm with examples of filling out all twelve sections of the report in ConsultantPlus. Trial access to the system can be obtained for free.

Since accruals as a result of the update should be described in a larger number of transactions than in the previous edition of the document, the total number of descriptions of transactions and deductions in the section has increased. This led to line 170 changing the deduction serial number, but the description and line code itself did not change.

To learn about the form in which an advance payment can be made, read the material “VAT on advance payments: examples, postings, complex situations .

What is shown in line 070 in the VAT return

When filling out section 3 of the value added tax return, sometimes difficulties arise with calculating the amount of tax to be paid.

In particular, the tax on the prepayment received during the reporting period should be correctly calculated. IMPORTANT!

Please note that starting with reporting for the 3rd quarter of 2021, an updated VAT declaration form is used, approved by Federal Tax Service Order No. ED-7-3 / [email protected] dated March 26, 2021. The electronic format and procedure for filling out the report have also changed.

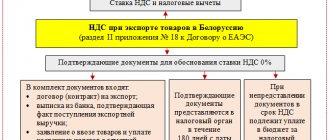

The obligation to pay value added tax upon receipt of advance payment is enshrined in paragraphs. 2 p. 1 art. 167 Tax Code of the Russian Federation. Exceptions when tax is not paid:

- the duration of the product manufacturing cycle is more than 6 months;

- goods are sold for export;

- the place of sale is not the territory of the Russian Federation;

- goods are not subject to value added tax.

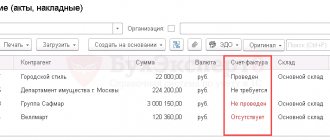

To understand how line 070 of section 03 of the VAT return is filled out, create a balance sheet for account 62.02 for the reporting quarter.

When an advance payment is received, the following accounting entry is made:

Dt 50 (51) Kt 62.02.

Thus, if the question arises which account in the value added tax report for line 070 should be used, generate one of the reports for 62.02:

- OSV;

- account analysis;

- account card.

Page 070 consists of two fields. The field on the left indicates the amount of advances received, on the right - the calculated tax. To correctly determine the tax rate, check the payment document for which the advance payment was received and the product cards, where the correct rate is indicated. If an advance is received for work or services, tax is calculated at a rate of 20%.

This is what filling out line 070 in the VAT return looks like (section 3):

As for prepayments in foreign currency, when amounts are received into the account, a tax base arises, calculated in rubles at the exchange rate for the current date. Such advances are reflected in account 62.22 and must be included in line 070.

There is another line in the report with the same number - in section 2. It is filled out only by tax agents specified in Art. 161 Tax Code of the Russian Federation. If your organization is one of such tax agents and you do not know which transaction code to put in the VAT return in section 2 (line 070), please refer to Appendix No. 1 of the Procedure for filling out the declaration.

Please note that line 070 should reflect all advances received, including those for which accrual and offset were made in the reporting period. It follows from this that the total amount of tax calculated for payment 070 is VAT on all prepayment received in the reporting period.

What determines the emergence of the right to deduct advances received?

Receipt of payment (in full or partial) on account of a later shipment subject to tax obliges the seller to allocate tax from the amount of this payment (subclause 2, clause 1, article 167 of the Tax Code of the Russian Federation). This procedure is accompanied by the creation of an advance invoice (clause 3 of Article 168 of the Tax Code of the Russian Federation), which gives the buyer the opportunity to apply a deduction during the period of transfer of funds. The seller also acquires the right to use the deduction (clause 8 of Article 171 of the Tax Code of the Russian Federation), but only at a different time. This moment will occur during the period of shipment of what was sold with the condition of prepayment (clause 6 of Article 172 of the Tax Code of the Russian Federation) or during the period of cancellation of the agreement on future shipment, which will result in the return of the advance (clause 5 of Article 171 of the Tax Code of the Russian Federation).

What is the reason for the possibility of such a deduction from the seller? With the fact that there is an obligation to create an invoice at the time of shipment (clause 1 of Article 168 of the Tax Code of the Russian Federation). The use of this deduction eliminates double taxation of income received upon sale.

For details on the specifics of creating an advance invoice and entering it into the purchase/sales books, read the article “Acceptance for deduction of VAT on advances received .

Line 170 is also in section 6 of the VAT return. ConsultantPlus experts explained how to fill out this section correctly using an example. To do everything right, get trial access to the system and upgrade to the Ready Solution for free. There you will also find explanations for filling out each line of the report.

Line 170 of the VAT return: explanation

This position is included in the 2nd part of the 3rd section of the declaration, i.e. it is located in the deductions block. It records the amount of tax refund due to the seller, accrued on advance receipts on account of future deliveries and indicated in a specially issued advance invoice (clause 1 of Article 167, clause 3 of Article 168 of the Tax Code of the Russian Federation). The supplier's right to a VAT refund arises during the shipment of the goods or upon cancellation of the transaction and the return of the advance payment. Deductions for VAT paid on prepayment are indicated in line 170.

How to fill out line 170

The rules for filling out line 170 (clause 38.19 of appendix 2 to the order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3 / [email protected] ) require correspondence between the data in section 3 falling into lines 070 and 170. This means that in deductions Only those amounts of tax can be taken that were accrued for payment from advances and were reflected, accordingly, in line 070. The amount of the deduction depends on the ratio of the amounts of prepayment and shipment:

- if the shipment amount is equal to or exceeds the amount of the advance payment, then the deduction is taken in the amount accrued from the advance payment;

- if the shipment is made for an amount less than the advance payment received, then the tax to be deducted will correspond to the amount of the shipment.

Do I need to enter data in lines 070 and 170 when receiving an advance payment and making shipments in the same quarter? The Ministry of Finance (letter dated October 12, 2011 No. 03-07-14/99) and the Federal Tax Service of Russia (letter dated July 20, 2011 No. ED-4-3/11684 and earlier) insist on the obligation to reflect these transactions if they fall within the same period.

To learn how to deal with the tax accrued on an advance payment that is among the overdue debts, read the material “VAT when writing off accounts payable: problematic situations .

VAT return, line 170: filling procedure

The rules for the formation of this position provide for the equality of its data with the information in line 070. This means that only VAT amounts accrued from advances and recorded in line 070 can be claimed for reimbursement.

Thus, filling out line 170 of the VAT return is possible only after the seller has carried out a sequential set of actions:

- receiving an advance on future supplies;

- issuing an invoice specifying the amount of VAT on the prepayment received;

- the emergence of the right to receive a tax refund upon shipment.

Accordingly, suppliers who do not work on a prepayment basis do not generate line 170 of section 3 of the VAT return.

Let us remind you that in 2022, the VAT return is prepared using an updated form, approved. By Order of the Federal Tax Service of the Russian Federation dated October 29, 2014 No. ММВ-7-3/ [email protected] (as amended on December 28, 2018).

Results

Line 170, located in section 3 of the VAT return, includes those amounts of tax from advances received by the seller, which he has the right to submit for deduction at the time of shipment or return of the advance payment.

The basis for the deduction is the advance invoice issued to the buyer upon receipt of the advance payment. The advance and shipment amounts may not coincide, and then the deduction amount will correspond to the lower of these amounts. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Location of line 170 in the VAT return and its interpretation

Line 170 of the VAT return is located in the second part of section 3 “Tax deductions” (Federal Tax Service order No. ММВ-7-3 dated 10/29/2014/ [email protected] as amended by Russian Federal Tax Service order No. ED-7-3/ dated 08/19/2020 [email protected] ), this line reflects one of the deductions due to the seller.

Note! The updated declaration form is valid from reporting for the 4th quarter of 2022. However, the indicators in line 170 of section 3 are identical in both editions.

The explanation of page 170 of the VAT declaration is expressed in its name: “The amount of tax calculated by the seller from the amounts of payment, partial payment, subject to deduction from the seller from the date of shipment of the relevant goods (performance of work, provision of services).”

From the specified name the following algorithm of actions of the seller is formed:

- The seller receives advance payment from the buyer, either in full or in part (this is a condition of their contract).

- He allocates the amount of VAT from this advance (subclause 2, clause 1, article 167 of the Tax Code of the Russian Federation).

- Within five days after receiving the advance payment, the seller provides the buyer with the right to a deduction by providing him with an advance invoice for the amount received with the amount of tax indicated therein (clause 3 of Article 168 of the Tax Code of the Russian Federation) and pays this amount of tax to the budget.

- After this, the company has the right to receive a deduction in this amount (clause 8 of Article 171 of the Tax Code of the Russian Federation) later, when it ships goods, performs work or provides services (clause 6 of Article 172 of the Tax Code of the Russian Federation), thereby creating invoice at the time of shipment (subclause 2, clause 1, article 168 of the Tax Code of the Russian Federation).

- Only after completing all the listed procedures, the seller has the right to fill out page 170 in the VAT return.

How to fill out and check lines 070 and 170 in the VAT return

The procedure for filling out a value added tax return is regulated by Order No. ММВ-7-3/ [email protected] dated October 29, 2014. As the Federal Tax Service has decided, in the third section of the declaration, employees must reflect the following things:

- VAT deductions claimed after goods have been shipped;

- advances received;

- tax paid on advances.

To reflect VAT deductions in the third section, lines 070 and 170 were prepared. In this article we will analyze their content and other nuances in detail.

Line 070

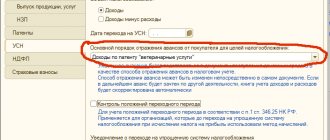

When a company receives an advance VAT, it calculates and pays it at the following calculated rates: 10/110 and 20/120. Moreover, accrual occurs even if shipment is expected in the same quarter. Such data is taken from paragraph 4 of article 164 of the Tax Code of the Russian Federation.

VAT accrued on advances received is shown regardless of the date of shipment. They rely only on the quarter in which the advance was received. Therefore, according to clause 38.1 of the Procedure, this must be filled out as follows:

- In line 070 of section 3 we indicate the total amount of advances received for the quarter. We indicate this data in column 3, and the value added tax on them in column 5. These numbers should not be reflected anywhere else in the section.

- Information from the sales book about invoices for advances is routinely entered into section 9.

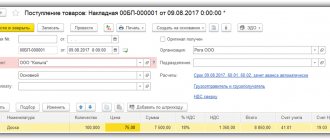

The amount of tax paid for the advance will be reflected in the following accounting entries:

Debit 68.02 Credit 76 AB

When calculating, please note that the tax on invoices must correspond to the credit turnover on account 76 AB. It is reflected in line 170 of the third section of the VAT return.

Line 170

To receive a deduction, you must ship the goods and accept them for accounting. Otherwise, the advance must be returned. Therefore, VAT is deducted in one reporting period along with the shipment of goods.

Therefore, in line 170 from the third section, indicate the total amount of advance VAT, which is claimed for deduction. And the eighth section of the declaration contains information about invoices registered after shipment.

Important!

Before determining the amount of the deduction, pay attention to the amount of the shipment.

If it is equal to or even greater than the advance payment received, then the entire accrued VAT is deducted. If the shipment is less than the advance payment, then VAT deduction is equal to the shipment amount. As Article 171 of the Tax Code of the Russian Federation states, a deduction from an advance payment can only be obtained for a quarter. The three-year period does not apply to deductions received from an advance payment. But if the advance is returned, then you can apply for a deduction within up to one year. This is written in the fourth paragraph of Article 171 of the Tax Code of the Russian Federation.

Communication 070 and 171 lines

The meaning of lines 070 and 170 will be the same if the shipment occurs in the same quarter with the receipt of an advance. And if the amount in line 170 is greater than in line 70, then this situation arises if value added tax is deducted from those advances that the company received in earlier periods.

If tax officials have a question about the legality of applying the deduction, the company may be required to provide documents that will confirm the legal right to the deduction.

Although shipment and prepayment do not take place on the same day and are even reflected in different documents, inspectors look not at dates and declarations, but at lines 070 and 171 in the reporting period. Although if everything is in order with your documentation, then there is nothing to worry about.

And to avoid a case that requires clarification, you can immediately draw up an explanation for the declaration if the amount in line 170 is more than in line 070. The explanation must indicate when VAT on the advance was calculated and reflected. And also when it was accepted for deduction. Then tax officials will be able to check your data on previous declarations and make sure that the deduction requirements are legal.

[email protected] dated March 23, 2015 , there are special benchmarks that help verify that the data is entered without errors. In this letter you can find instructions on how to check that line 170 is filled out correctly. According to the records, the value of line 170 must be less than or equal to the sum of lines 010-040 of section three, column 5. This means the deduction for advances cannot exceed the amount of tax on shipment for the quarter.

If the figures are exceeded, this means that the tax base is underestimated or the tax deductions themselves are not justified.

Relationship between lines 070 and 170 of the VAT return - example

Let’s assume that in June 2022, Tandem LLC received an advance payment from the buyer (50% of the future shipment) in the amount of 300,000 rubles, including 20% VAT on the amount of 50,000 rubles. The company issued an advance invoice and paid VAT to the budget in the amount of 50,000 rubles. This operation is reflected in the declaration for the 2nd quarter. 2022:

- 300,000 – according to gr. 3 page 070.

- 50000 – according to gr. 5 page 070. Wiring D 76.AB K 68.2.

In September, a batch of products was shipped for a total amount of 600,000 rubles, including 20% VAT of 100,000 rubles. Previously paid tax is deducted and reflected in the declaration for the 3rd quarter. 2022:

- 50000 - according to page 170. Wiring D 68.2 K 76.AB.

Thus, the accrual of tax on prepayment is reflected in the report for one period (2nd quarter), and the deduction - for another (3rd quarter). There are differences, but they are legitimate.

Read: VAT return form