Step-by-step instruction

Attention! The VAT rate has been changed from 01/01/2019 from 18% to 20% and from 18/118 to 20/120.

July 03 Mikhailov P.A. sent on a business trip to Samara for 4 days. On the same day, the employee received funds from the cash register for the report in the amount of 12,000 rubles.

On July 10, the employee submitted an advance report, to which he attached:

- railway ticket (Moscow-Samara) in the amount of 2,988 rubles. (including VAT 18% - 67.15 rubles);

- railway ticket (Samara-Moscow) in the amount of 2,240 rubles. (including VAT 18% - 67.15 rubles);

- receipt and SF for hotel accommodation in the amount of 2,950 rubles. (including VAT 18%).

Daily allowances in the Organization in accordance with the Regulations on Business Travel are paid at the rate of 700 rubles/day. — 2,800 rub.

The employee returned the unused funds to the cashier.

Let's look at step-by-step instructions for creating an example. PDF

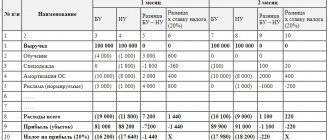

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Issuance to an accountable person from the cash register | |||||||

| July 03 | 71.01 | 50.01 | 12 000 | 12 000 | Issuance to an accountable person | Cash withdrawal - Issue to accountable person | |

| Employee's advance report on business trip | |||||||

| July 10 | 26 | 71.01 | 10 393,70 | 10 393,70 | 10 393,70 | Acceptance of travel expenses for accounting | Advance report - Other tab |

| 19.04 | 71.01 | 584,30 | 584,30 | Acceptance for VAT accounting | |||

| Registration of SF supplier | |||||||

| July 10 | — | — | 2 950 | Registration of SF supplier | Invoice received for receipt | ||

| 68.02 | 19.04 | 450 | Acceptance of VAT for deduction | ||||

| — | — | 450 | Reflection of VAT deduction in the Purchase Book | Purchase Book report | |||

| Registration of carrier railway tickets | |||||||

| July 10 | — | — | 5 228 | Registration of supplier BSO | Invoice (strict reporting form) | ||

| 68.02 | 19.04 | 134,30 | Acceptance of VAT for deduction | ||||

| — | — | 134,30 | Reflection of VAT deduction in the Purchase Book | Purchase Book report | |||

| Return of unused accountable funds | |||||||

| July 10 | 50.01 | 71.01 | 1 022 | 1 022 | Return of accountable funds | Cash receipt - Return from accountable person | |

Issuance to an accountable person from the cash register

Funds can be issued on account based on any administrative document or employee application. Repayment of debt on previously issued accountable amounts is not necessary (clause 6.3 of the Directive of the Central Bank of the Russian Federation dated March 11, 2014 N 3210-U).

More information about issuing funds against a report

The issuance of funds to an accountable person is documented in the document Cash issuance transaction type Issuance to an accountable person in the Bank and cash desk - Cash desk - Cash documents - Issuance button.

the Cash Issue document using our example.

- The recipient is the employee to whom the funds are issued on account.

- The basis is the needs for which the accountable amount is issued: for travel expenses.

- Application - data from an administrative document or an employee’s application for the issuance of funds.

To automatically fill out the line According to the document the Printed form details section in the Individuals of the Cash Withdrawal document must be filled in .

Postings according to the document

The document generates the posting:

- Dt 71.01 Kt 50.01 - issuance of an advance to an employee on account.

Documenting

To document the issuance of funds from the cash register, it is necessary to use the unified form Cash receipt order (KO-2) , approved by Resolution of the State Statistics Committee of the Russian Federation dated August 18, 1998 N 88.

The form can be printed by clicking the Cash receipt order (KO-2) from the Cash issuance . PDF

Settlements with accountable persons in 1C:ERP

Let's consider settlements with accountable persons

in two sections: issuing funds and accepting advance reports.

What documents can be used to formalize the issuance of funds to an accountable?

The issuance of funds is formalized either by a cash receipt order

(RKO), or

by writing off non-cash funds

. Both documents for issuing funds contain a special type of operation:

1. In the cash receipt order

(Treasury / Cash Office / Expenditure cash orders) - operation

Issue to accountant

.

Figure 1 - Operation Issue to accountant in cash receipt order

In the cash register we indicate the accountable person, the amount and cash desk, and the reporting period.

Figure 2 - Filling out the cash register for issuance to the accountable

2. In non-cash payments

(Treasury / Bank / Non-cash payments) - operation

Issue to accountant

.

Figure 3 - Creating a non-cash write-off for the operation Issue to an accountant

In Write-off of non-cash funds

For the operation

Issue to the accountable,

we also indicate the accountable person, the amount of transfer, the organization's current account from which funds will be written off, and the accountable's current account for receiving funds.

Figure 4 - Filling out a non-cash write-off for the operation Issue to an accountant

On the Payment Details

the DDS article

both in RKO and in non-cash write-offs .

Figure 5 - Filling out the DDS article when issuing to an accountable

Also in both documents there are details for setting the reporting period: on the Main

in the

Report

, select the time period after which we want to receive a report, and the system will automatically fill in the cut-off date for the sub-report.

Figure 6 — Filling in the details Report when issuing funds

In which workplace can you check settlements with accountable persons that are not covered by reports?

In the Treasury

in the

Accountants

there is a workplace

Advance reports for registration

.

Figure 7 — Location of the workplace Advance reports for registration

In the workplace, you can conduct operational control of funds issued to an accountable person, but not closed by reports, as well as purchases made by an accountable person, but not closed by payment. To report for the above operations, click on the button Create an advance report.

or

Process payment

accordingly.

Figure 8 — Workplace Advance reports for registration

The journal reflects data on the accountable person, whether there is an advance or purchase amount, whether the report is overdue, or if there is an overrun.

What documents can be used to accept reports from an accountant?

In the Treasury

in the

Accountants

there is a workplace

Advance reports

.

Figure 9 — Location of the workplace Advance reports

In the workplace Advance reports

shows all the documents used to prepare all reports with accountants: advance report, receipt of monetary documents, purchase of goods and services.

Figure 10 — Types of documents for settlements with accountants

In the document Advance report

We can reflect purchase transactions, expenses and payments to the supplier.

Purchasing goods and services

in the workplace Advance reports are the usual registration of purchases, but with the type of business transaction

Purchase through an accountable person

.

Receipt of cash documents

in the workplace Advance reports exist for the purpose of posting monetary documents through an accountant.

How to arrange the issuance of funds to an accountable through an expense cash order

To register the issue to the accountant, go to the Treasury

-

Cash desk

-

Expenditure cash orders

and create a new

cash register

with the type of operation

Issuance to the accountable

.

In RKO

on the

Basic

, fill in the date of issue, transaction (Issue to the accountable), cash desk, full name of the accountable person (from the directory of individuals), department, amount and when it is necessary to report.

Figure 11 — Creating and filling out a cash receipt order for the transaction issued to an accountant

Next on the Payment Details

We fill out the DDS article and the application for the expense of the DDS (if records are kept of the issuance of funds based on applications).

Figure 12 — Filling out the DDS article in RKO

We post cash receipts and create regulated accounting entries.

Figure 13 — Formation of regulated accounting entries for cash and cash management services

Because issuance to the accountable person in our example is issued in rubles, then a debit account is generated 71.01 (Settlements with accountable persons).

Similarly, the debit division is filled with data from cash register.

Figure 14 — Filling out regulated debit accounting entries

Check

and

Loan

Division Cash

.

Figure 15 — Filling out regulated loan accounting entries

After our RKO

the Advance reports for registration

workplace , where the issued amount of funds is reflected in the

Advance

, and that the advance issued should be reported.

Because the date filled in in cash register in the “Report” detail exceeds the current date, then in the workplace the system prompts and indicates the amount in red in the Overdue report

.

Figure 16 — Advance reports for registration after the issuance of funds to the accountable

How to prepare an advance report

The system has a report Control of funds from accountable persons

, which we access from the Advance reports workplace using the hyperlink of the same name.

Figure 17 — Opening a report Control of funds from accountable persons

As you can see, in the report for our accountant from the example, the amount issued is recorded in the Advances issued

,

Unfinished transactions at the end of the period

and the presence

of arrears

in the report. The status of the operation is also recorded as “not completed” and recommendations are shown on what to do for this accountable person.

There are several options for generating a report on issued funds.

1. In the workplace Advance reports for registration

go to the line with the data for the accountant for which you want to create an expense report and click on

Create expense report

.

The system creates a pre-filled document Advance report

.

Figure 18 - Creating an expense report, option No. 1

2. In the workplace Advance reports

.

Figure 19 — Creating an expense report, option No. 2

In the document Advance report

We can reflect transactions according to three types of transactions:

- procurement

- to select already created ones or create new ones and reflect in the tabular part of documents on the purchase of inventory items by an accountable person (Purchase of goods and services), the document Purchase of monetary documents and documents for booking electronic tickets; - business trip expenses

(food, accommodation, travel, etc.); - payment to the supplier

- to reflect the fact of payment by the accountable person to the supplier for previously provided services or goods supplied.

Figure 20 - Creation of purchasing documents from the Advance report form

How to register a purchase from a supplier for reporting purposes

We can document the purchase of inventory items by an accountable person with the document Purchase of goods and services

3 ways:

- from the workplace Advance reports

(Fig. 10); - from the document Advance report

(Fig. 20); - from the Purchasing

-

Purchasing documents (all)

, create a document

Purchase of goods and services

with the type

Purchase through an accountable person

.

Figure 21 — Creating a document Purchase of goods and services with the type Purchase through an accountable person

This document will differ from a regular purchase in that in the household field. transaction will be reflected in the transaction Purchase through an accountable entity

.

In the document we fill in the following fields: accountable person, warehouse, item, quantity, price, division.

Figure 22 — Filling out the document Purchase of goods and services with the type Purchase through an accountable person

We post the document and reflect the accounting entries.

Figure 23 — Reflection of transactions of regulated accounting of the document Purchase of goods and services

Let's see that the account is debited 10.05

filled in from the item financial accounting settings groups: the financial group is configured for the “Battery” item. accounting “Spare parts”, for which an item cost account is set

10.05

.

Figure 24 — Filling out the Dt account in regulated accounting transactions

Loan account 71.01

closes settlements with accountable persons and is filled in in accordance with the selected operation under the document

Purchase through an accountable person

.

Division Kt

is a division from the document Purchase of goods and services.

To close the report, it is important that the division for which the funds were issued is identical to that indicated with the Purchase of goods and services.

If the division is different, then we will get the following display of discrepancies in the system, when the issuance of DS took place in one division, and the purchase in another.

Figure 25 — Reflection of discrepancies between departments in Advance reports for registration

How to print an advance report after completing the Purchase of goods and services

In the document Purchasing goods and services

Using the hyperlink

Include in advance report,

we create an advance report for the purchase amount.

Figure 26 - Creation of an advance report based on the Purchase of goods and services

After successfully linking the expense report to the Purchase of goods and services, the hyperlink Include in the expense report

will be replaced with a hyperlink

Included in the Advance report _No. from _

, which can be used to get into the advance report itself.

Figure 27 — Linking the expense report to the Purchase of goods and services

To print the expense report, click the Print

.

Figure 28 - Printing an expense report

Registration of payment to the supplier by an accountable person

the Advance reports for registration workplace

, go to the line with our accountable and click

Create an advance report

.

By default, the system will reflect the entire balance of the accountable debt on the Expenses

.

To transfer the amount to the Payment to suppliers

in the tabular section on the line with the amount, double-click to display the command bar, where we select

Transfer line to payments to suppliers

.

Figure 29 — Creating payments to suppliers through an expense report

On the Payment to suppliers

fill in the name of the supplier, adjust the amount (amount of payment to the supplier), select the object of payment (purchase document), number, date.

Figure 30 - Filling out Payment to the supplier according to the Advance report

We process the document and reflect it in regulated accounting. Accordingly, debit account 60.01 is taken from the groups of settings for financial accounting of settlement objects (invoice, agreement, etc.).

Figure 31 — Postings of regulated accounting of the Advance report

Go to the workplace Advance reports for registration

and we see the reflection of payment to the supplier in reducing the balance of outstanding debt on funds issued.

Figure 32 — Updating the amount of outstanding debt after conducting an advance report for payment to the supplier

How to apply for a refund from an accountant

For the remaining debt, we will issue a refund to the organization's cash desk. To do this, in the workplace Advance reports for registration

Click on

Make a payment

and select

Cash refund

.

a Cash Receipt Order already pre-filled for the unspent balance of funds.

for the operation

Return from the accountable

.

Figure 33 — Creation of a Cash Receipt Order for the “Return from Accountable” operation

We carry out

document and reflected in regulated accounting.

Figure 34 - Reflection in regulated accounting of the Receipt Cash Order for the operation “Return from Accountant”

Checking the closure of mutual settlements by accountant

To check the closure of a sub-report for a given accountable entity, we can go to the Control of cash transactions

.

There are no pending transactions at the end of the period for our accountant and no actions are expected for the accountant.

Figure 35 — Checking the status of an accountant in the Cash Transactions Control report

Also, for verification, we will create a balance sheet for account 71

(Regulated Accounting/Standard Accounting Reports). There are no open mutual settlements for the accountable account.

Figure 36 - Formation of the balance sheet for account 71

Do you need advice on accounting in 1C:ERP?

Our specialists are ready to provide advice or conduct corporate training!

Employee's advance report on business trip

Travel expenses in accounting are included in expenses for ordinary activities if the conditions of paragraphs 5, 16 of PBU 10/99 are met and are recognized on the date of approval of the advance report. Until this moment, the issued funds are taken into account as part of the accounts receivable of the reporting entity (clause 16 of PBU 10/99).

In NU, travel expenses are recognized on the date of approval of the advance report as part of other expenses associated with production and sales (clause 12, clause 1, article 264 of the Tax Code of the Russian Federation, clause 5, clause 7, article 272 of the Tax Code of the Russian Federation).

More information about issuing funds against a report

To register an employee's advance report on a business trip, an Advance report document is generated in the Bank and cash desk - Cash desk - Advance reports section.

The header of the document states:

- Accountable person - an employee is selected from the Individuals who reports for the funds issued to him on account.

On the Advance Add button to select advance payment documents.

Learn more about filling out the Advances tab

Other tab provides information about travel expenses.

Learn more about filling out the Other tab

Other expenses associated with production and sales include expenses for business trips, in particular for (clause 12, clause 1, article 264 of the Tax Code of the Russian Federation):

- Travel of the employee to the place of business trip and back to the place of permanent work.

- Renting residential premises, including the employee’s expenses for paying for additional services provided in hotels (with the exception of expenses for service in bars and restaurants, room service, expenses for the use of recreational and health facilities).

- Daily allowance or field allowance.

- Other

To be able to accept business trip expenses, they must be justified and confirmed by correctly executed documents (Clause 1, Article 252 of the Tax Code of the Russian Federation).

Read more about the basic requirements for documents confirming a business trip

To confirm travel to the place of business trip and back, you must have a paper ticket, and if the ticket is electronic, an itinerary receipt. When traveling by air, in addition to the above documents, the ticket or boarding pass must have a pre-flight inspection mark (Letters of the Ministry of Finance of the Russian Federation dated 05.28.2018 N 03-07-07/36077, dated 10.09.2017 N 03-03-06/1/65743, dated 06.06.2017 N 03-03-06/1/35214).

Services for hotel accommodation can be confirmed by a strict reporting form (SRF) or another document that has the necessary details of the primary accounting document (PUD). Based on the BSO, you can deduct VAT, highlighted in it as a separate line (clause 18 of the Rules for maintaining the Purchase Book, approved by Decree of the Government of the Russian Federation of December 26, 2011 N 1137).

Data on daily allowances are entered on the basis of a local regulatory act of the organization approving their amount, or a business trip order, a copy of which can be attached to the advance report.

There is no need to confirm the daily allowance with expenditure documents (Letter of the Ministry of Finance of the Russian Federation dated November 11, 2011 N 03-03-06/1/741).

Postings according to the document

The document generates transactions:

- Dt Kt 71.01 - taking into account business trip expenses.

- Dt 19.04 Kt 71.01 - acceptance of VAT on travel expenses for accounting.

In order to deduct VAT presented by the ticket supplier, it is necessary that the VAT on the ticket be highlighted on a separate line (Letters of the Ministry of Finance of the Russian Federation dated 02/26/2016 N 03‑07‑11/11033, dated 01/30/2015 N 03‑07‑11/ 3522, dated July 30, 2014 N 03‑07‑11/37594).

In order for VAT allocated on tickets and SF presented by counterparties to be deducted, it is necessary in the columns:

- SF - check the boxes.

- BSO — check the boxes for BSO documents.

- Invoice details - fill in the number and date of the invoice, the BSO details will be filled in in this column automatically from the Document (expense) .

As a result of registration, the BSO and SF will automatically be created:

- Invoice (strict reporting form).

- Invoice received.

The documents can be found in the Invoices received through the section Purchases – Purchases – Invoices received.

Documenting

The organization must approve the forms of primary documents, including the form of an advance report in the Accounting Policy. In 1C, an Advance report is used in form AO-1 . The form can be printed by clicking the Print button - Advance report (AO-1) of the document Advance report . PDF

What is the procedure for reporting by an accountable person on amounts issued?

Persons who have received cash on account are obliged, within a period not exceeding three working days after the expiration date of the period for which they were issued, to present to the chief accountant or accountant (in their absence, to the manager) a report on the amounts spent and make a final settlement on them.

Note:

an advance report (f. 0504505) is submitted by the employee (freelance employee) with supporting documents attached (

clause 6.3, clause 6 of Instruction No. 3210-U

,

clause 216 of Instruction No. 157n

).

The procedure for filling out an advance report by an accountable person (f. 0504505) is established by Order of the Ministry of Finance of the Russian Federation dated March 30, 2015 No. 52n.

The reporting person provides information in the advance report (f. 0504505):

– on the front side – about yourself; – on the reverse side – fills out columns 1 – 6 regarding the amounts actually spent by him, indicating documents confirming the expenses incurred.

The documents attached to the advance report (f. 0504505) are numbered by the accountable person in the order they are recorded in the report. Subsequently, the advance report (f. 0504505) is approved by the head of the institution or his authorized person.

In addition, by virtue of clause 26 of the FSBU “Conceptual Fundamentals”, the primary accounting document is accepted for accounting provided that it reflects all the details provided for in the unified form of the document, and if the document is signed by the head of the accounting entity or a person authorized by him.

The unspent balance of the accountable amount is subject to return.

Registration of SF supplier

The invoice received is created automatically after registration of the invoice in the document Advance report . Operation type code: “Receipt of goods, works, services.”

If the document has the Reflect VAT deduction in the purchase book by date of receipt checkbox , then when it is posted, entries will be made to accept VAT for deduction.

Read more about Options for deducting VAT

Postings according to the document

The document generates the posting:

- Dt 68.02 Kt 19.04 - acceptance of VAT for deduction on the service.

Registration of carrier railway tickets

The Invoice document (strict reporting form) was created automatically based on the Advance report .

If the document has the Reflect VAT deduction in the purchase book , then when it is posted, entries will be made to accept VAT for deduction.

When posting the document Invoice (strict reporting form) in the Purchase Book, in column 2 “Operation type code” the code “Travelling expenses on a strict reporting form, clause 7 of Art. 171 of the Tax Code of the Russian Federation.”

Postings according to the document

The document generates the posting:

- Dt 68.02 Kt 19.04 - acceptance of VAT for deduction on the service.

The document generates movements in the VAT Purchases :

- registration entry for the Type of value Travel expenses with the transaction type code "" Travel expenses on a strict reporting form ..." for the amount of VAT accepted for deduction.

Purchase Book report can be generated from the Reports – VAT – Purchase Book section. PDF

Reporting

The VAT return reflects the amount of VAT deducted:

In Section 3 page 120 “Amount of VAT to be deducted”: PDF

- the amount of VAT accepted for deduction.

In Section 8 “Information from the purchase book”:

- invoice with transaction type code "";

- BSO with transaction type code “23”.

VAT write-off

The Ministry of Finance believes that VAT can be deducted only on an invoice, the exception is if this is provided for in clauses 3, 6-8 of Art. 171 Tax Code of the Russian Federation. The Code does not provide for the specifics of deducting VAT on retail purchases.

Also, the specified VAT cannot be accepted as expenses for income tax purposes, since clause 2 of Art. 170 of the Tax Code of the Russian Federation does not provide for the possibility of taking into account in the cost of goods (work, services) VAT presented due to the lack of an invoice (Letter of the Ministry of Finance of the Russian Federation dated January 24, 2017 N 03-07-11/3094).

Since the goods were purchased at retail and no invoice was issued, VAT is not deductible. Based on the Receipts document (acts, invoices), you need to create a VAT write-off .

Postings according to the document

Return of unused accountable funds

The return of unused accountable funds is documented in the document Cash Receipt type of operation Return from an accountable person by clicking the Create button based on the Cash Receipt document Advance Report . Cash Receipt document created in this way is filled in automatically.

You just have to fill it out manually:

- Income item - Return from an accountable person .

Postings according to the document

The document generates the posting:

- Dt 50.01 Kt 71.01 - return of unused funds by the accountable person.

Documenting

To document the receipt of cash at the organization's cash desk, it is necessary to use the unified form Cash receipt order (KO-1), approved. Resolution of the State Statistics Committee of the Russian Federation dated August 18, 1998 N 88.

The form can be printed using the Cash receipt order (KO-1) the Cash receipt document . PDF

See also:

- The procedure for settlements with accountable persons

- Advance report on the purchase of fuels and lubricants

- Advance report on payment for services

- Advance report on the purchase of materials through the company. map

- Advance report on business trip. Issued tickets (cash documents)

- Advance report on payment for electronic services to a foreign counterparty using a corporate card

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Payment for a share in the authorized capital in cash Payment for a share in cash is one of the permitted methods of forming...

- Test No. 6. Payment of a share in the authorized capital in cash...

- Business trip: trip abroad, payments in foreign currency Business trips abroad have their own characteristics - most expenses are carried out...

- Purchase of inventories in kind in accounting...

Regulatory regulation

Settlements with accountable persons are regulated by the following regulations:

- Federal Law “On Accounting” No. 402 dated February 6, 2011.

- Accounting Regulations (Part 10/99 “Expenses”).

- Chart of accounts and instructions for its use.

- Local acts of the organization itself.

The main document on the basis of which calculations are made is the Procedure for conducting cash transactions No. 40, established by the Decision of the Board of Directors of the Central Bank dated September 22, 1993.

How to issue money on account and reflect settlements with accountable persons in accounting ?